PMETAL (8869) and PMETAL-C7 [The Aluminium Price Chart Speaks for Itself] - Super Bullish

ChloeTai

Publish date: Thu, 19 Apr 2018, 05:15 PM

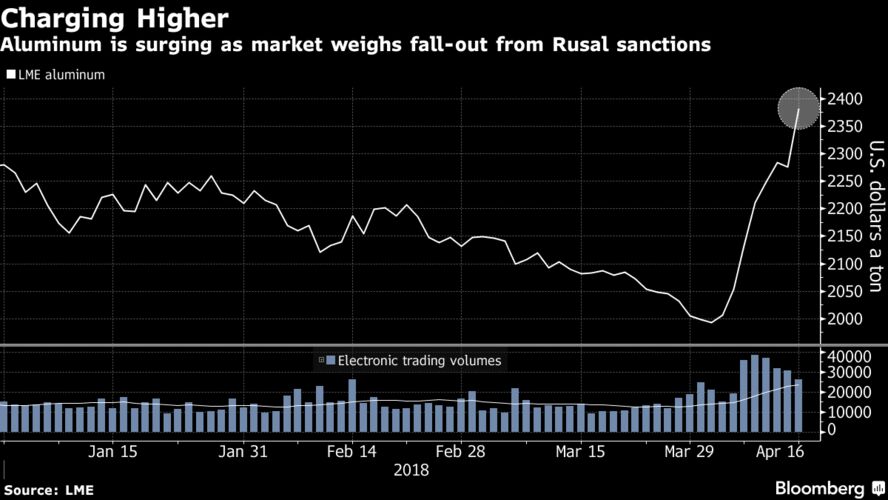

(Bloomberg) -- Aluminum surged to a six-year high as the impact of U.S. sanctions against United Co. Rusal continued to reverberate through the global market more than a week after they were announced, with buyers rushing to secure supplies amid forecasts that the price may hit $3,000 a metric ton.

The metal, used to make everything from cans and cars to airplanes, reversed an early drop to gain as much as 1.5 percent to $2,435 a ton on the London Metal Exchange, the highest intraday price since September 2011. It traded at $2,429 at 7:52 a.m. in London, extending Monday’s 5 percent jump.

The aluminum market is in turmoil following the U.S. action against Russia’s Rusal, which has unleashed a supply shock that’s still unfolding as the company accounts for about 17 percent of worldwide production outside China. The Russian supplier has been shut out of the Western financial system, lacerating its share price while boosting rivals. Rio Tinto Group, South32 Ltd. and Alumina Ltd. are among the potential beneficiaries, according to UBS Group AG.

“The market is looking at $2,800, $3,000,” Jackie Wang, an analyst at CRU Group, said from Beijing. There are concerns about possible production cuts by Rusal, either because its sales are blocked or the raw material supply chain is affected, according to Wang. LME prices last topped $3,000 in 2008.

When Aluminium price was at USD2,200 per metric ton, PMETAL and PMETAL-C7 prices were at around RM5.80 and RM0.20 respectively. Now that aluminium price has surged to around USD2660, PMETAL and PMETAL-C7 prices are ONLY at RM5.23 and RM0.11 respectively (truly UNDERVALUED). Judge for yourselves. Happy trading!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-09-20

PMETAL2024-09-20

PMETAL2024-09-19

PMETAL2024-09-19

PMETAL2024-09-19

PMETAL2024-09-19

PMETAL2024-09-19

PMETAL2024-09-19

PMETAL2024-09-19

PMETAL2024-09-19

PMETAL2024-09-13

PMETAL2024-09-13

PMETAL2024-09-12

PMETAL2024-09-12

PMETAL2024-09-12

PMETAL2024-09-12

PMETAL2024-09-11

PMETAL2024-09-11

PMETAL2024-09-11

PMETAL2024-09-11

PMETAL2024-09-11

PMETAL2024-09-11

PMETAL2024-09-11

PMETAL2024-09-11

PMETAL2024-09-10

PMETAL2024-09-10

PMETAL2024-09-10

PMETAL2024-09-10

PMETAL2024-09-10

PMETALMore articles on Chloe Tai Blog

Created by ChloeTai | Jul 31, 2024

Created by ChloeTai | Jul 29, 2024

The NDWT at Kuantan Port is making huge amount of profit at present (for IJM) while the Smart AI Container port at Port Dickson (a plan by TANCO) can only be materialised in the year 2030.

Created by ChloeTai | Jul 18, 2024

NATGATE is a multi-bagger AI technology gem.

Created by ChloeTai | Jul 16, 2024

IJM new Target Price is RM4.40 forecasted by CGSI.

Created by ChloeTai | Jul 14, 2024

GAMUDA is the king of construction throughout the world (not only in Malaysia).

Created by ChloeTai | Jul 12, 2024

SUNCON TP of RM5.46.

Created by ChloeTai | Jul 12, 2024

Gamuda TP of RM9.50.

Discussions

In a research note last month, UOB Kay Hian said every US$100 per tonne increase to its forecast all-in aluminium prices could raise Press Metal’s earnings by about RM170 million annually.

2018-04-20 00:39

By far c7 has the highest risk out of so many warrant. The exercise price is high and the title seems so misleading. Anyhow, trade at your own risk.

2018-04-20 08:29

360Capitalist

http://www.theedgemarkets.com/article/cover-story-press-metal-makes-its-mark

2018-04-20 00:38