Tong's value investing portfolio added positions in several attractive stocks (The Edge)

david68

Publish date: Thu, 02 Mar 2017, 09:02 PM

Capitalising on global rally

Equity markets globally are performing very well.

The closely watched Dow Jones Industrial Average and the broader S&P 500 have been notching successive record highs. Investors remain sanguine that the boost from Trump’s fiscal stimulus, tax reforms and deregulations are forthcoming and that corporate profits are on the cusp of a turnaround.

The US Federal Reserve too has been upbeat on the underlying strength of the world’s largest economy, laying the foundation for an imminent rate hike, perhaps even as soon as March.

That positive sentiment has spilled over to the rest of the world. Case in point, relevant bellwether indices in Singapore, Japan, Thailand, Indonesia, Hong Kong and China are all hovering around their highest levels since 2015.

Our local bourse too has been faring well, though still lagging by comparison.

Notably, trading volume has gained traction this month. The average number of shares traded daily in January rose to 1.92 billion compared with 1.44 billion in December. So far this month, the daily volume has been averaging at over 2.4 billion shares.

An even better indicator of investor optimism is the Chartist Picks on www.absolutelystocks.com, which has seen a sharp spike in the number of positive momentum stocks in January compared with December 2016, and an even higher one this month.

Foreign funds inflow too has been positive year to date, totalling over RM1.1 billion.

Followers of this column will notice that I’ve been actively reducing my huge cash balance since late-November. And the portfolio has been doing well, capitalising on this positive turn in sentiment.

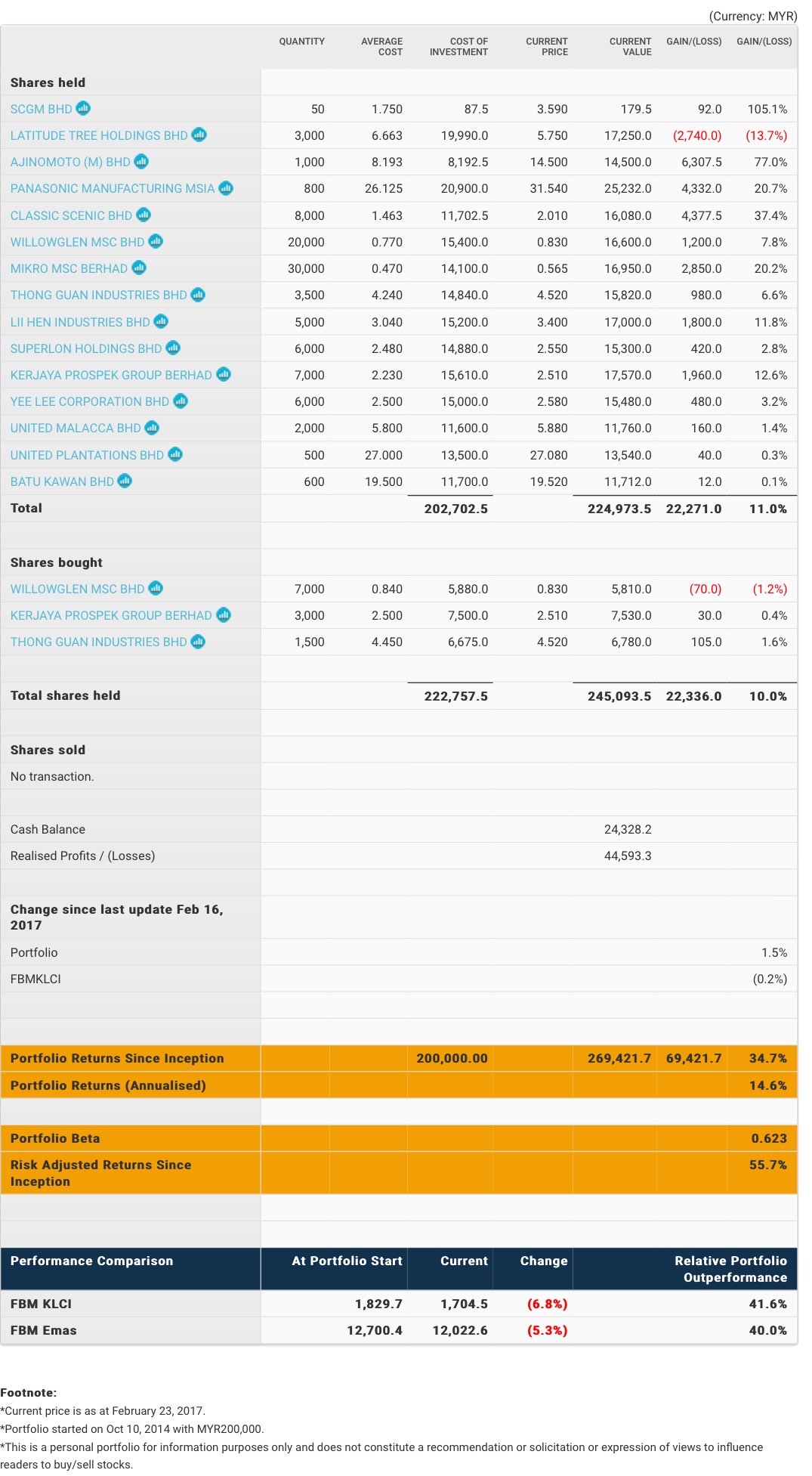

Total portfolio returns now stand at 34.7% since inception. I continue to outperform the FBM KLCI, which is down 6.8% over the same period, by some distance.

This week I added to my positions in several stocks that are still looking attractive, valuation-wise.

I acquired 1,500 shares in Thong Guan (Fundamental: 2.8/3; Valuation: 2/3) and 7,000 shares in Willowglen (Fundamental: 2.55/3; Valuation: 1.8/3) and 3,000 shares in Kerjaya Prospek (Fundamental: 2.6/3; Valuation: 1.8/3).

Source: The Edge

More articles on David68

Created by david68 | Dec 26, 2016

Discussions

same like me. We dont like to speculate. Speculating is no different than gambling.

2017-03-02 22:44

赞同,但道理人人懂,能坚持做到的有几个?所以一旦我看不清局势的时候就会拿起冷眼的股票投资正道来充电和沉淀一下,自我鼓励一番 :)

-------------------------------------------------

gohkimhock 堅持投資正道. 腳踏實地, 一步一腳印, 是致富的不二法門.

02/03/2017 22:51

2017-03-02 23:06

moneySIFU

The selection is quite safe & conservative

2017-03-02 22:17