Tong's value investing portfolio (The Edge weekly)

david68

Publish date: Sat, 07 Jan 2017, 02:54 PM

A blessed new year to all!

Let me start by wishing all readers a very blessed new year.

Over the course of the year-end break, sitting far away in the mountains of Whistler and in the serenity of a snowy white Christmas, I spent some time pondering on the state of the world and the changes we’ve seen, especially in the last few months.

Since this is my first column for the year, perhaps I will kick off by sharing some of my thoughts and expectations on the global front.

TIME magazine picked Donald Trump for Person of the Year, who is defined as someone who had the greatest influence, for better or worse, on events of that year.

For better or worse, President Trump’s policies will shape prospects not just for the US but will also heavily influence economies and politics around the world. Under his stewardship, the US will prioritise trade and economy over more altruistic values of freedom, liberty and justice.

His election win was already a game changer in many respects, notably, the turning point for negative interest rates and yields. After his inauguration later this month, his policies will begin to crystallise and give weight to forecasts and expectations.

Trump’s economic policies, or Trumponomics as they call it, mirror that of another president, Ronald Reagan in the 1980s. Like Reaganomics, Trumponomics will centre around corporate tax cuts, increased government spending – on infrastructure and military – and deregulation.

For good measure, Trump has added bullying of Corporate America – for multinationals to bring funds, currently squirrelled offshore, home and keep investments in the country – to his repertoire.

We’ve seen some initial success – in the headlines of how he convinced Carrier and Ford to scrap plans to set up plants in Mexico and instead keep jobs in the US.

Clearly, he holds significant sway, with his Cabinet filled with successful corporate and business elites. And it is evidently not limited to the business arena either. Last week, he has rather dramatically strong-armed Republicans into reversing their vote to do away with an ethics watchdog. This bodes well for the quick passage of his fiscal stimulus plans. Republicans currently control Congress.

The net effect will be positive for US domestic economy, at least for the next 2-3 years. A growing budget deficit could be a problem in the longer term. But for now, unemployment will fall further, beyond the current 4.6% that is deemed “full employment” by the Fed. Inflation will rise and interest rates will follow, as will a stronger US dollar.

This will fuel the "animal spirit" of the business sector. The market wants to be positive, as evidenced by the Dow Jones Industrial Average’s recent rally. The benchmark index is now just a hair’s breadth away from the psychological 20,000 milestone.

Both Trump and his Cabinet are expected to take the hardline approach on the issue of trade. He has promised to pull out of the TPPA and renegotiate international trade deals like NAFTA and has set the stage for confrontation with China.

I believe the US will be able to extract some economic concessions from China.

But this is also because China too is at a crossroads. I suspect it will sacrifice some immediate economic gains for long-term geopolitical advantages. After all, China's economy is overheated.

It’s interesting how the different sociopolitical structure of the 2 countries can facilitate this trade-off – the US, which requires quick results, and China, which is a long-term planning economy.

In other words, I suspect the US will make immediate economic gains while China (and Russia) will further their geopolitical advantages, which could translate into economic gains – but many, many years later.

For Malaysia and ASEAN, we are likely to see slower demand, along with China’s slowdown. A stronger US dollar translates into continued weakness in regional currencies.

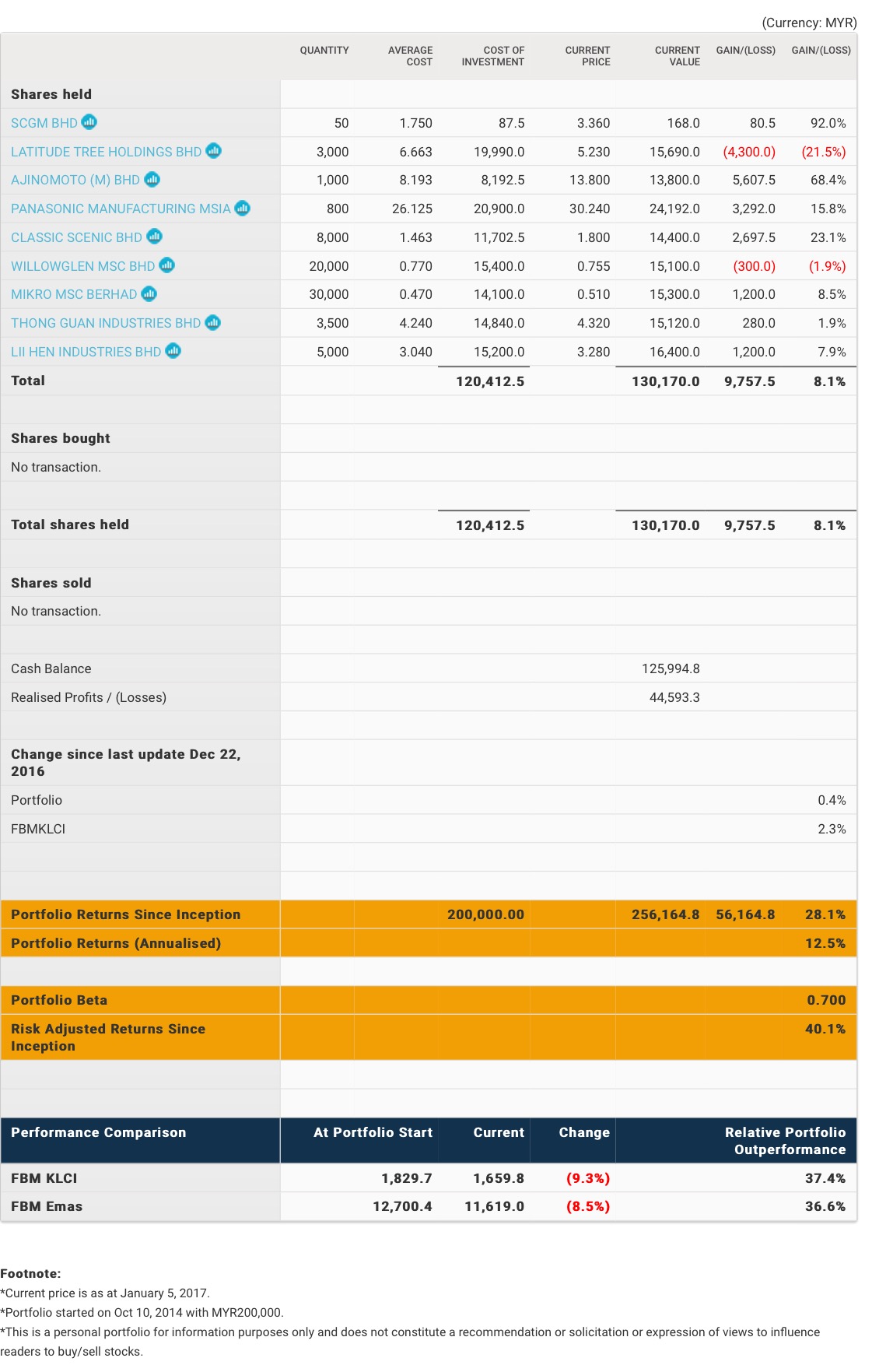

I did not make any transactions last week. I do intend to accumulate more stocks in the coming weeks. My portfolio is now about 51% invested.

My total portfolio returns stand at 28.1% since inception. I continue to outperform the FBM KLCI, which is down 9.3% over the same period, by some distance.

Source: The Edge

More articles on David68

Created by david68 | Mar 02, 2017

Created by david68 | Dec 26, 2016