PBBANK - I added at 4.18

DividendGuy67

Publish date: Fri, 24 May 2024, 03:17 AM

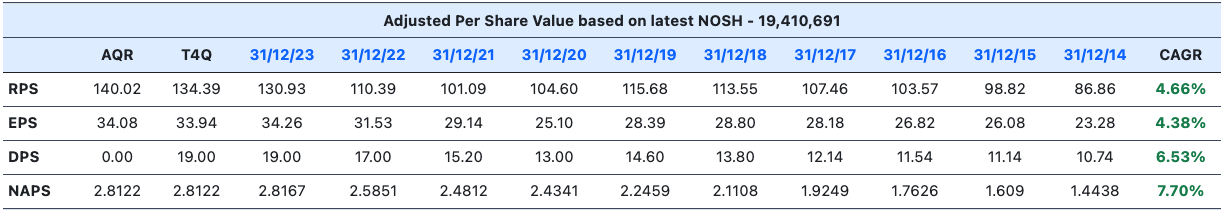

Past 10 Year Performance Metrics = B+

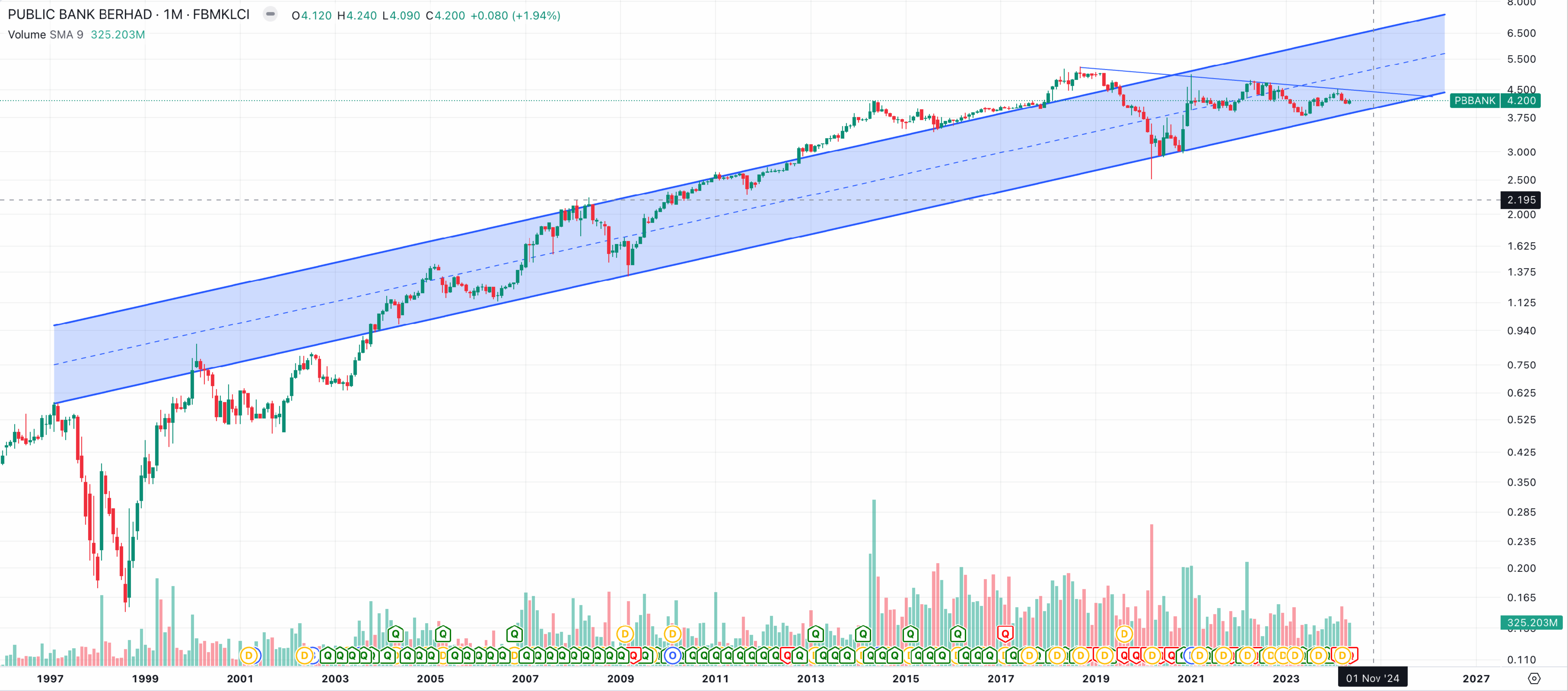

Past 30 Year Monthly Chart

Key observations:

1. Stock on long term uptrend the past 30 years, due to its excellent fundamentals.

2. The channel shown is just a rough guide. Of course, during Asian Financial Crisis (1997), US Tech Crash (2001-2) and its recovery (2003), it was undervalued, and it took Mr Market many years before recognizing that it was undervalued. Anyone who bought during this period 1997-2003 would have done extremely well today.

3. Being an excellent business, it can sometimes overshoot the top of the channel - e.g. from 2013 to 2019. I suspect the top of the channel is not yet determined.

4. There is a downtrend line resistance drawn from 2018 peak down to today, i.e. nearly 5+ years now. This is key technical breakout line. If PBBANK breaks above this line, over the next 5 years, we can see it trading at maybe RM8.

5. PBBANK is clearly doing a long term consolidation lasting 5+ years already. This is typically indicator of potentially strong moves ahead. Odds are upwards, although nothing is guaranteed.

I added at RM4.18 today. Lower prices is an add for me, subject to Position Sizing limits below.

- DY on cost is 4.8% (assuming 19 sen / 4.18).

- Dividend growth rate is conservatively estimated at 5% per annum, vs 6.53% per annum over past 10 years.

- If Dividends keep growing at 5% per annum, then, by 2031 (8 years later), its Dividend Yield on Cost becomes 6.72%. Keep growing and by 2037 (14 years later), it gets to 9% per annum. Keep growing and by 2043, it gets to 12.06% per annum. The beauty of dividend growth stock is that your yield keep rising every year!

- At 5% dividend growth each year, by 2038 (15 years later), the sum of all dividends received will pay for the original capital, i.e. all the shares will be free.

Risks

1. Founder (Teh Hong Piaw) passed away on 22 Dec 2022 since forming PBBANK in 1966. He is irreplaceable.

2. Current MD and CEO (Tay Ah Lek) was his right hand man for extremely long time, and he is now 82 years old. Not exactly young.

3. Many of the Board and Management are older than 60. This is both good and less good, but overall, their Management rating gets a B+ from me, and is higher than many other local companies.

Target Position Size

This stock is of course better to buy during a crisis, but if it breaks out above the 5+ year downtrend line resistance, we will not see PBBANK trading at this price again for an extremely long time.

I plan to accumulate more on weakness, and chase a little bit if it keeps rising below the 5+ year downtrend line resistance. For this stock, definitely larger than normal neutral position (3% capital), even at higher prices, because of its EPS, DPS and NAPS growth. 5% would be neutral for me for this stock personally because I like its growing future dividends for a lifetime.

To me, this is one of the few, rare, Warren Buffet "Buy and Hold" stock in Malaysia, where our favourite holding period should be "forever".

Disclaimer: As usual, you are solely responsible for your trading and investing decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jan 22, 2025

Discussions

My GTC Limit Buy order at 4.00 was filled. Plenty of time to accumulate, still no where near my full position yet, but lower price is an add and over multi-year basis, it's in accumulation zone. With DPS of 19 sen, DY has now risen to 4.8% per annum.

Objectively, can still wait for price to fall below RM4 for better pricing but I have GTC Buy orders below RM4 to wait. For long term holdings, won't argue over sens.

2024-06-25 23:19

yes agreed... someone pressing , giving us more to collect... no need to fret , dividend good enough ...

2024-06-26 00:06

DividendGuy67

My GTC Limit Buy order at 4.06 was filled. It lowered my average buy price to 4.12. The stock is now my 2nd largest holding after MAYBANK by market value, and forms 3.7% of my highly diversified portfolio comprising of 40 stocks with dividend yield on cost > 3% p.a. with 13 other stocks for short/mid/longer term trading positions. My median position size is around 2% of portfolio, so, 3.7% is quite a significant weighting, almost doubling the median position size. This is a long term hold for me, the play is to collect a growing dividend income in the coming years. With 19 sen annual dividend, at an average cost of 4.12, the dividend yield on cost is 4.61% which beats FD handsomely, and should this grow by 5% per annum over the next 14 years, we can expect the dividend yield on cost to rise to over 9% per annum. Nice long term position.

2024-06-07 23:01