PBBANK - One of many examples of businesses with Recovery and Resilience Power to avoid Permanent Losses

DividendGuy67

Publish date: Wed, 24 Jul 2024, 01:57 AM

In my previous post here, I touched about the important topic of LWAP - Long Term / Lifetime Wealth Accumulation plans.

If you want to accumulate wealth long term, it is important to be at least "slow and steady". There's good reasons for this.

Why fast and risky works short term but not long term?

Try to understand this maths first - compare 2 investors over a 3 year period first.

- Investor A earns +20%, +20% and -20%. (let say aggressive trading, with wins and losses, here 2 wins, 1 loss).

- Investor B earns +6%, +6% and +6% (let say EPF)

If both investors started with RM100k, which investor will have the bigger accumulation 3 years later?

If you think Investor A, you are wrong. The "slow and steady" actually wins this short 3 year race. The proof? Simple multiplication mathematics.

- Investor A = 100k x 1.2 x 1.2 x 0.8 = 115k.

- Investor B = 100k x 1.06 x 1.06 x 1.06 = 119k. B>A.

The passive investor B, who parks his monies in EPF and do nothing, BEATS the Active Investor A who has 2 wins and 1 loss year.

- Why?

- Short answer = the significant -20% permanent loss that A incurred. B did not have any permanent loss.

Second example why fast and risky doesn't work long term

Consider a great Warrant Trader C.

- Warrant Trader C can compound his monies 100% per annum using leverage.

- So, first year, he turned RM100k into RM200k! He is very happy.

- Second year, he turned RM200k into RM400k with another +100% performance. He now feels like GOD!

But, 3rd year, he couldn't anticipate market crash.

- In just a matter of days, his warrants fell 80% in value.

- Is he successful to accumulate long term wealth?

Unfortunately no.

- His RM400k portfolio has shrunk 80% to RM80k, less than his original capital of RM100k.

- Compared to EPF Investor B, he has less final wealth.

Why lower final wealth? Short answer: The one time -80% loss.

Buffett's brilliance

Buffett's brilliance is recognizing that LWAP (lifetime wealth accumulation plans) is not about how many years of 100% returns.

It's really about whether you will suffer the one time big / significant permanent loss or not.

To accumulate wealth over lifetime, you must always avoid - at all times throughout your investment career - large permanent loss.

So, why show PBBANK as example of one?

Firstly, it is important to know that 99% of Bursa stocks do not have the characteristics of banking stocks like PBBANK. Why?

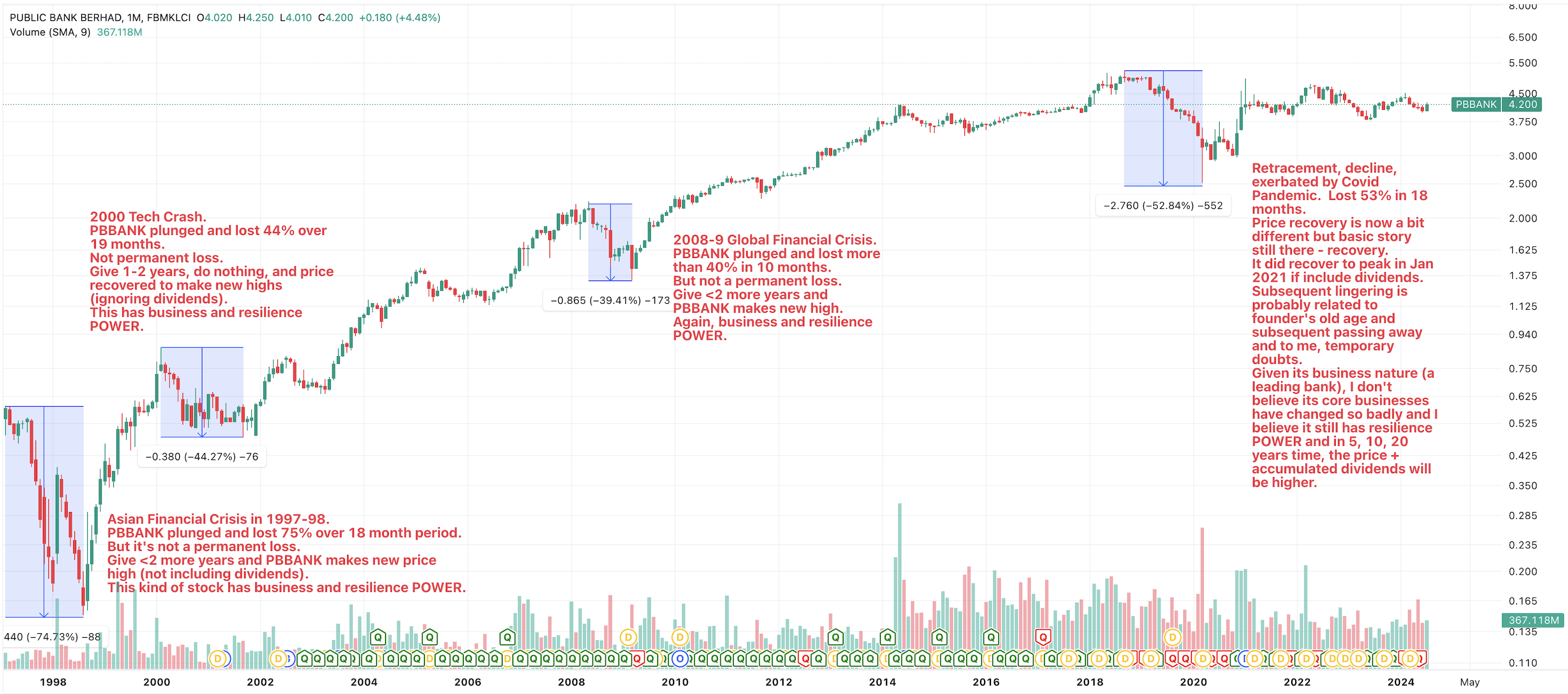

This is because the truly superior businesses have a certain business and earnings characteristics and a price characteristics that looks like this over the past 30 years.

Key observations:

- The Market Price of PBBANK is not guaranteed - stating the obvious, it goes up, it goes down, it crashes, etc.

- The Market Price of PBBANK can plunge as low as 75% - see Asian Financial Crisis in 97-98. This is not a small fall (and a fantastic opportunity!)

- The Market Price of PBBANK can plunge again and again and again - see 2000 Tech Crash, see 2008-9 Global Financial Crisis, see Covid Pandemic periods.

And guess what?

- Everytime it crashes, within 1-2 years, the price bounce back up.

- This price ignores dividends that it still pays out and the positive earnings it still generates. The business is not the same as price.

- If you included dividends, you will get your monies back sooner if you do nothing.

- And your account will keep making new highs over time.

- You will have avoided the permanent loss if you did nothing.

- You will have made even more if you bought more of PBBANK when its price is depressed.

- Of course, the risk of default is never zero - so, you still need to diversify to at least 20, 30 different stocks similar to PBBANK with excellent business and resilience power.

So, in my book, PBBANK, a few other banks (like MAYBANK, CIMB, RHBBANK, HLBANK, etc.) are "Wealth Accumulators" that differentiates them from vast majority of other stocks. If you hold a diversified range of these special vehicles over the long term (and maybe buy more when markets crashed), they will help you to accumulate your wealth long term.

Why does it work with banks?

Malaysia's banking system is just one of a few examples. In reality, you should diversify across sectors, but let's try to understand why it works with banks first.

The real answer is complex, no guarantees, but the short answer is:

- Banks in Malaysia have a tendency to make profits during good economic times and bad economic times including recessions. Check their annual reports for the past 20-30 years.

- The banking system have been around before I was born. Before my father's time. Before my grandfather's time. Before my great grandfather's time.

- I expect the banking system to still be around and grow bigger in 5, 10, 20, 30 years time.

- The big difference I see with banks vs other industries is the regulator - BNM (Bank Negara Malaysia). Within the region and globally, Malaysia probably have one of the better regulatory supervisor out there and as long as it remains independent and not political, this should continue. I take comfort that even during 1MDB when there's massive failure, the system still works! I hope to never see a repeat of 1MDB in Malaysia.

So, they qualify and belong to my definition of "Wealth Accumulators".

A diversified portfolio of these Accumulators will help you avoid permanent loss over the long term, if you have the right temperament and right mindset.

Does Lifetime Wealth Accumulation works with just 1 stock like PBBANK?

The answer is a resounding NO! Too much risk and if it works, you are lucky in your lifetime. We can never predict the long term future. To ensure the highest chance, you should diversify across businesses, across sectors, across asset classes. Something like 20 stocks as a minimum in the stock portfolio.

Can I find a Minimum of 20-40 of these Wealth Accumulators in Bursa?

You need to do your own homework. But first, do you know the characteristics of Wealth Accumulator?

It's not how much profits they make in their best year.

Instead, it is defined by their "resilience" during bad times.

The only question here is - when they eventually suffer a bad time (and needs to be rare, not every 2nd year), can the business bounce back and make profits and even higher profits (and usually quite fast) than before to avoid permanent loss?

If the answer is yes, then you have found another potential wealth accumulator.

Psuedo Wealth Accumulators

Another big picture alternative are what I called Pseudo Wealth Accumulator where after setback, you are confident that the business will regain its footing to make new profits that will be many times larger than the current loss after 1, 2, 3, 5 years. But it doesn't mean they will never suffer another loss beyond that - they still can.

So, these pseudo accumulators can still do part of the same job over that temporary period. You can still buy them when their prices are depressed, and hold them for a few years to earn same or higher total returns ...

But because they are "psuedo", you have to eventually sell them. This carries more risk for most people, so, better if you can find the real accumulators and there are some in Bursa, even if the quality may not be the same as say Coca-Cola over many decades.

Summary and Conclusion

Obviously, there's more to LWAP than I can write above. But to get there, you have to recognize some of its key elements. Not all elements are equally important.

The most important of these elements is avoid significant / large Permanent Loss.

You must avoid it because even if you just incur it once, it will derail your accumulation plans, and you may have to start over again, losing time. In other words, a permanent loss = permanent loss of time.

So, you must safe guard against significant / large permanent loss. There are other reasons, but I hope this is enough to open your eyes.

The examples of Investor A and B are not theoretical - they are real life people.

The example of Trader C is also not theoretical - it's real life people.

And successful long term investors who kept their superior stocks during the Asian Financial Crisis, during Tech Crash, during GFC, during Covid pandemic, during all other market crashes are not theoretical too.

Some of you may have seen or know people (maybe your parents, maybe your parents friends) who literally held through market crashes with superior stocks like PBBANK and others, ordinary folks who earn ordinary salaries but have amassed 7 digit over many decades. In some cases we know of 8 digit from ordinary folks. I am luckier because I earned more than my parents but in my early years, I also suffered significant permanent loss that has caused a permanent loss of time too, so, I talk from decades of personal experience. My lifetime outperformance is not that great, because of that past significant permanent loss that cause loss in time.

So, in wealth accumulation, for ordinary folks, it is the "slow and steady" over decades that wins the race. If they didn't go with this route, odds are they'll be much poorer as a result.

Remember, diversify. And must sell the pseudo accumulators too.

Disclaimer: As usual, you are solely responsible for your trading and investment decisions.