The Life Changing Magic of Compound Interest

DividendGuy67

Publish date: Tue, 30 Jul 2024, 12:41 AM

Compound Interest is the 8th wonder of the world (apparently said by Einstein).

- It happens when the interest you earn on your savings balance, gets reinvested, to earn even more interest. Interest earn interest.

- It results in an exponentially growing savings balance.

It is more powerful than Simple Interest.

- Simple interest is not compounded.

- So, it causes the savings balance to grow linearly

- Over time, the gap between Compound Interest vs Simple Interest starts to diverge - initially small, but over longer periods of time, the gap becomes exponentially bigger.

So, what is the life changing magic?

Simply put, it can turn an ordinary 22 year old who starts from nothing, into a 8 digit multi-millionaire by age 60.

- Assume an ordinary starting graduate salary of RM3,500 per month, without any assets except for a degree job.

The only requirements are:

- Start immediately (from age 22).

- Save 20% of monthly salary and 1 month bonus into EPF, assumed to earn 5.5% per annum over the long term.

- 20% = 9% member contribution + 11% employer contribution.

- If you save more, even better.

- Save 10% of monthly salary and 1 month bonus into Quality Businesses/Shares, assumed to earn 10% per annum over the long term.

- The quality shares follow same principles as Warren Buffett.

- It doesn't have to be exactly like Buffett. You can achieve half (~ 10%) of Buffett's lifetime investment returns which is 19.8% in Berkshire.

- Initially, you may not achieve this, but as you get better, you will beat 10% per annum one day.

And that's nearly all of it! (see below for the rest).

Here's what you can expect mathematically.

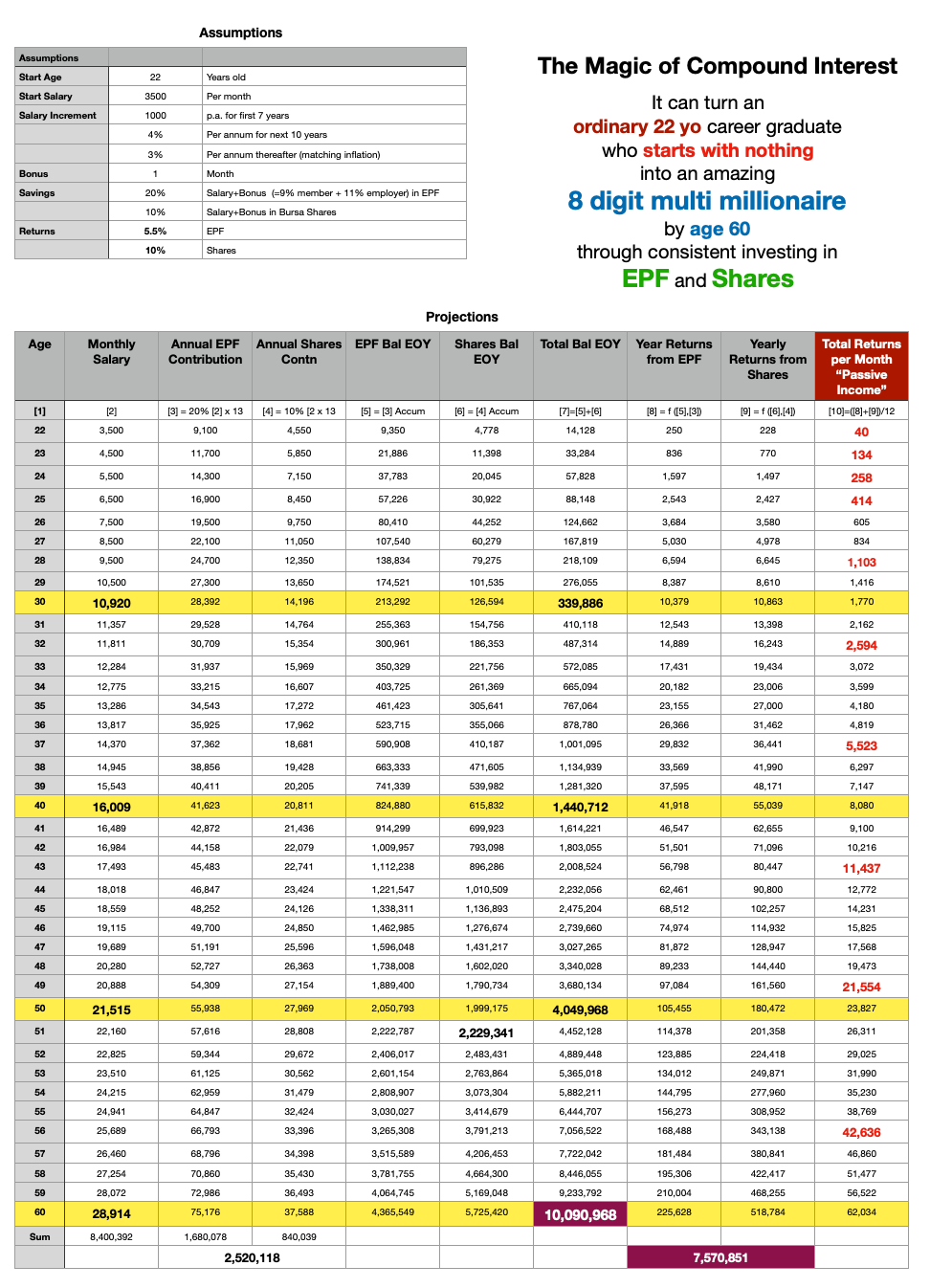

This is a very rich table.

Study this carefully.

Let me point out the columns 1 by 1.

Column [1] = Age. This simply increases by 1 year every year from age 22 to age 60.

Column [2] = Monthly Salary. In your first 7 years, you can learn and grow in your career to turn an initial starting salary of RM3,500 into RM10,500 7 years later, i.e. from a fresh graduate to a middle manager. Nothing spectacular. Quite ordinary. Then, as you. progress, the salary increment assume is a modest one which is only 4% per annum for the next 10 years. Then, the increment is only 3% per annum for the rest of your life till retirement. In short, just an ordinary above average career, but nothing spectacular like becoming a CEO, CFO, CTO or other chief title.

Column [3] = Annual EPF Contribution. This assumes 13 months (12 month salary, 1 month bonus).

- If your bonus is more than 1 month, then, even better.

- In the first year, total 12 months salary + 1 month bonus = 13 months x 3,500 monthly salary x 20% total EPF savings = 9,100.

- At age 30: 13 months x 10,920 monthly salary x 20% total EPF savings = 28,392.

- Simple and straightforward.

Column [4] = Annual Shares Contribution. Same formula as Column [3], except it is halved Column [3] since assume save 10% in shares, which is half of EPF savings of 20%.

Column [5] = EPF Balance EOY.

- EOY stands for "End of Year", i.e. 12 months later.

- In the first year: EPF savings = 9100. It is assumed to earn 5.5% per annum for an average of half a year, because the savings is every month. It is approximated as 9,100 savings x (1 + 5.5% / 2) = 9,350.

- At age 30: 28,392 savings x (1 + 5.5% / 2) + 174,521 prior year EPF balance x (1 + 5.5%) = 213,292.

Column [6] = Share Balance EOY. Same formula as Column [6] except replace 5.5% returns with 10% returns from shares.

- Column [6] starts off as around half of Column [5].

- But due to earning higher returns, it grows faster.

- By age 51, the Balance finally catches up and overtake Column [5].

- In short, comparing EPF balance and Shares balance, despite Shares receiving only half the EPF contribution, gives bigger balance by age 51, due to earning 10% p.a. returns vs 5.5% EPF returns.

- This is one magic of compounding interest!

Column [7] = Total EPF + Share Balances = [5] + [6]. Straightforward.

Column [8] = Yearly Returns from EPF

- In first year, it is simply [5] EOY Balance with interest - [3] EPF contribution = 9350 - 9100 = 250.

- At age 30: EPF returns = 213,292 closing balance - 174,521 opening balance - 28,392 EPF contribution = 10,379 interest.

Column [9] = Yearly Returns from Shares. Same formulae as [8]

Column [10] = Total Passive Income Returns per month. This equals ([8] + [9]) / 12.

- The point of this column is to track the rapid growth in the Passive Income.

- Essentially, your Shares and EPF works for you.

- It creates a rapidly growing alternative / supplementary income.

- In the first year, it is tiny - only RM40 per month.

- In the second year, it more than double to RM134 per month.

- In the third year, it doubles to RM258 per month.

- In the 4th year, it doubles a bit longer than a year to RM414 per month.

- Give 3 more years and it more than double to RM1,103 per month

- Give 4 more years and it more than double to RM2,594 per month.

- Give 5 more years and it more than double to RM5,523 per month.

- Give 6 more years and it more than double to RM11,437 per month.

- Give 6 more years and by this stage, it gives you RM21,554 per month and is now higher than your Actual Monthly Salary of RM20,888 per month. Now, you have equal dual income!

And from here on, the Passive Income continues to grow rapidly like before.

- Notice that if you give another 7 more years, it doubles to RM42,636 and so much larger than your salary.

- Compounding by this stage work wonders - keep doing this by the time you are 60 years old, you collect RM62,034 monthly income!!!

- And your Net Worth is now RM10,090,968 i.e. you are a genuine 8 digit multi-millionaire.

What is the Secret?

There is 1 more critical component besides Start Early (at age 22) + Save 20% in EPF + Save 10% in Shares.

- It is the Shares bit.

- It is not easy to find unit trusts that will earn 10% per annum after transaction costs over 38 years.

- This is something you might need to do yourself.

But the good thing is that if you start early and you save 20% in EPF and save 10% in shares, then, earning consistently 10% per annum in Shares is more than enough.

10% per annum from Shares is enough!

Most young investors are too greedy and impatient!

Actually, when you first start, focus to learn the skills rather than focusing only on the outcome.

- Always track the outcome, but don't be in a rush to make monies fast.

- The fast monies will come later, in the later stages of compound interest - refer to the table in the last 10 years of passive income.

- It is okay to start small like 6% per annum, by investing in quality blue chip stocks that pays dividends with dividend yield say 3%-5% per annum, so that the price gain required is only 1% to 3% per annum.

- Later, you will naturally earn higher.

Learn from the Masters like Buffett.

- Buy superior businesses where you are sure its earnings will be much higher 5, 10, 20 years from now.

- Look for honest and trustworthy management with integrity.

- Look to buy when it is available at an attractive price.

- In time, as you get better, the returns you will get exceeds 6% and may even exceed 10% per annum!

And the Most Important, Most Fundamental Secret!

Compound Interest!

- This means you stay invested.

- No cashing out, unless you can get back into a better instrument (but not necessary).

- The only 1 time you are allowed to partially cash out is when market hits euphoria zone.

- This means the bull market has run its course, when everyone is now owning stocks and telling everyone the wonderful stock they own that is making them lots of monies.

- When this happens, odds are good that those on the sideline will earn more later. This is because after markets have crashed, prices are cheap and buying quality stocks when they are cheap is a wonderful way to accelerate the compounding.

- Learn to read price charts.

- By this stage, stocks will be so overvalued, that you can cash out some of them to build up your cash chest.

- This occurs once every few years (typically 5-10 years).

- You don't have to cash out if you are still a Net Saver with side savings elsewhere.

- This also means no permanent losses.

- This means no derivatives, no warrants or other highly speculative instruments that can result in permanent loss and cannot recover.

- Buffett prefers quality businesses because he doesn't need to do anything when market crashes.

- He knows that the stocks he owns are real businesses that will continue to make profits every year regardless of whether the market crashes or not, or can recover strongly after the crash by its own without him doing anything.

- This allows him to stay invested and to allow Compound Interest to work for him.

- I blogged about an example of this stock like quality banks - see here.

- Remember, avoid 2 x 2 x 2 x 2 x ... x 0. Because the impact of permanent loss during compounding, is to kill your nest egg.

- For superior stocks, don't take profits too fast. Then, instead of compounding interest, you just have simple interest and that's too slow.

- If you don't know the difference between simple vs compound interest, learn and study the difference.

Last 10 years of Passive Income

In case you missed it, I want to call this out specifically.

Go back to the Table and look at Column [10] and look at how rapidly the monthly passive income has grown from age 51 to 60.

- Age 30: Passive income = RM40 per month.

- Age 51: Passive income = RM26,311 per month - beating active salaries.

- Age 60: Passive income = RM62,034 per month and growing!

See how fast the final 10 years works? Super growth!

Another perspective on the Final Years

- Suppose you have a population that doubles every year.

- After 30 years, the population reaches say over 1 billion.

Question: How many years does it take to reach a quarter billion?

- If you didn't know that the answer is 28 years, then, you still haven't understood compound interest!

- It is the final 2 years that turns 25% into 100%! The final years are the ones that does the magic!

- Hence, the importance of the last 10 years of passive income!

Summary and Conclusion

- Compound Interest is Magic! Life Changing Magic! It can turn an ordinary graduate without anything, into an 8 digit multi-millionaire by the time s/he reaches the age of 60.

- The key to compound interest is to keep earning interest on interest. Keep reinvesting.

- EPF is a great vehicle to do so, with capital guarantee. You'll never suffer a permanent loss in your EPF balance (regardless of doomsday predictions - disregard them). EPF works extremely well as a compounding vehicle. The EPF balance keeps making "New Highs" every year!

- Shares are optional vehicle to consider a faster accumulation.

- You don't need more than 10% per annum returns.

- The key is long term safety.

- Buffett's Rule No 1 applies. I've blogged about this here.

- Always maintain a highly diversified portfolio as your account grows from 6 digit (by age 26, 5 years later) to 7 digit (by age 37) and eventually 8 digit (by age 60!).

- Always aim to position your portfolio to make new highs regularly!

- A well diversified portfolio of high quality dividend stocks that grows its earnings and dividends will help ensure this, even if total returns initially may only be 9% per annum.

- At all times, always avoid permanent losses.

- Don't even have 1 permanent loss - avoid derivatives; I've blogged about this here.

- Buffett have demonstrated how by avoiding permanent losses over 8 decades, he has turned 3 digit into 4, 5, 6, 7, 8, 9, 10, 11 and 12 digit net worth!

- With any compounding, it is the final years that matters - so, don't give up half way and don't stop too soon! This is a lifetime journey.

All the best in your life journey to harness the magic of compound interest!!

Disclaimer: As usual, you are solely responsible for your trading, investment and life changing decisions!