Artroniq Bhd - What’s Hiding Behind the Numbers?

DouglasLiu

Publish date: Fri, 01 Sep 2023, 10:16 PM

Investors keeping an eye on Artroniq might find their recent financial results puzzling. So, what exactly lies behind these numbers?

Strategic Business Shifts

First, let’s clarify that Artroniq has parted ways with several non-profitable businesses. These include resin compounds for wire and cable, among others. This move aligns with the company's new direction focusing on more lucrative sectors: ICT, financing, semiconductors, and electric vehicles.

Investment and Share Price

Artroniq has also gone through multiple fundraising rounds. While the solid performance of their share price does indicate investor interest, it's important to dive deeper to understand the full picture.

A Nod to Shareholders

In recognition of the positive share price performance, bonus issue of warrants were distributed to shareholders. While this is a rewarding gesture, the financial performance still raises questions that need addressing.

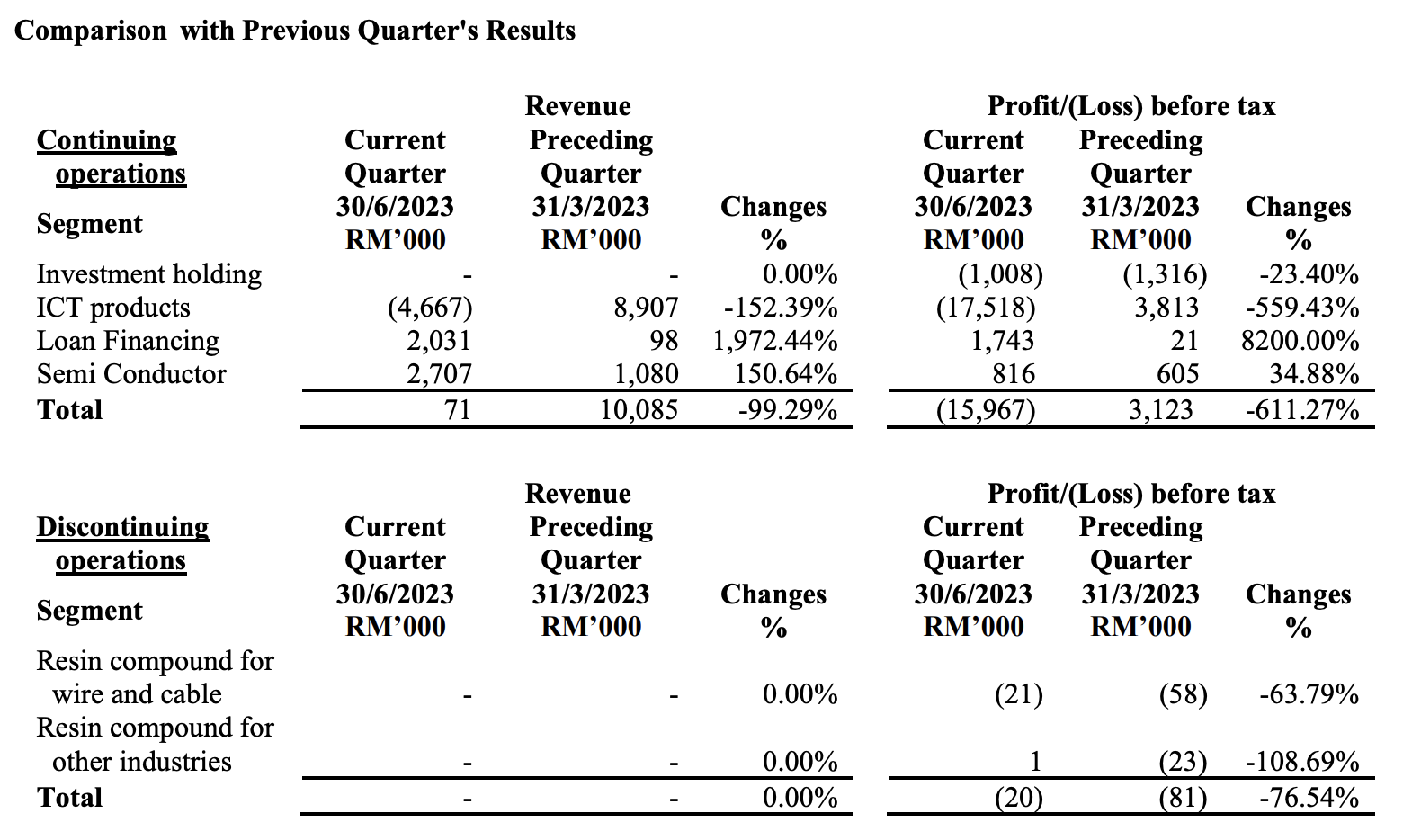

Revenue Woes in ICT

The revenue from the ICT segment shows a concerning negative figure of RM4.66 million. According to the financial report, this is due to customer returns over manufacturing defects. However, Artroniq is in trading, not manufacturing, and therefore, this issue is expected to be a temporary hiccup, and there is a very high chance for reversal of such impairment on the numbers in the upcoming quarters.

Balance Sheet Clean-Up

On a side note, it is also important that the company has realigned its financial year to end on June 30 and initiated housekeeping measures, including an impairment of goodwill on its ICT business. This seems to be a strategic move to streamline the balance sheet.

What's Next?

In the coming months, Artroniq is set to venture into the electric vehicle and blockchain sectors. These new initiatives could provide an additional growth engine for the company, making it an increasingly appealing investment opportunity.

Final Thoughts

While the recent financial report may be unsettling for some, it appears to be a temporary setback. With its new business directions and upcoming ventures, the future for Artroniq seems brighter. If you’re looking for a promising semiconductor company to invest in, this might be the right time to consider Artroniq, especially where there FEAR stemming from uninformed investors.

Disclaimer: This article is intended for informational purposes only and does not constitute financial or investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

More articles on EV

Created by DouglasLiu | Oct 17, 2023

Created by DouglasLiu | Jul 27, 2023

.png)