KLCI waves 7 - update

hotstock1975

Publish date: Thu, 21 May 2020, 02:46 AM

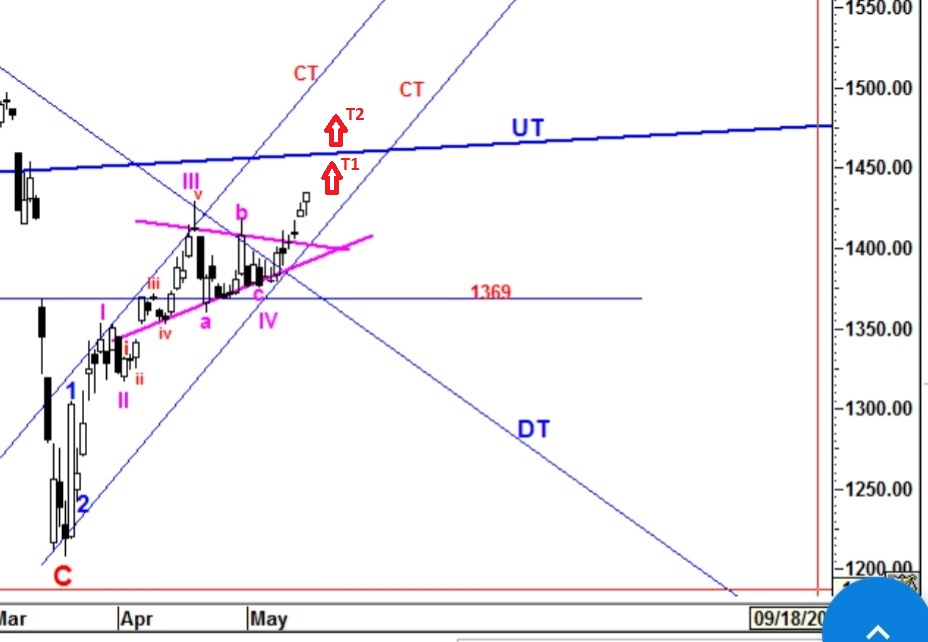

From the past 3 days actions, the triangle breakout was succeeded without forming "d-e" waves which i should not have abandon in earlier session. Sub 4th wave correction (IV) has been validated after it breached above "b" wave (1418.42) and wave III (1428.95). No doubts that Sub 5th wave (V) has been on the way up thereafter. Since we are still in the 3rd wave extension (pink color) of the higher degree of 3rd wave (3), there are 2 potential targets' projection for Sub 5th wave (V) as listed below:

T1) 1462.41 (beneath UT line)

T2) 1488.82

Once either target hit, we will assume the higher degree of 3rd wave (3) is completed and renew another higher degree of 4th wave (4) correction/consolidation phase before another uptrust higher degree of 5th wave (5). Besides that, we won't forget that it has already traded above 1407 which provides some additional strenght for further up move in Weekly time frame. If all these counts are valid, Major Wave C could be ended at 1207.8 and it won't be tested again.

Last but not least, DowJ and S&P500 are running in 5th wave up leg at the same time. Is the Bull Run Cycle just started?

Let's Mr Market pave the way.

Wave Believer

More articles on KLCI waves

Created by hotstock1975 | Jan 24, 2022

Created by hotstock1975 | Jan 17, 2022

Created by hotstock1975 | Dec 20, 2021