KLCI waves

KLCI waves 22 - Wave C Emerged and Ended?

hotstock1975

Publish date: Sat, 29 Aug 2020, 05:42 PM

Weekly Time Frame

Once again 1572 was failed to hold and KLCI closed sharply lower at 1525.21 after 1540 broken further. Caution is still required when rebound take place until further clearer signal to justify the trend reversal.

On other hand, the higher degree of correction will be elaborated further in daily time frame.

-DMI (red line) is curving up indicates bearish momentum is in favor with resistance at point R1 which may provide some short term halt in bear mode otherwise bear may continue to emerge if R1 breakout. +DMI (blue line) is continuing heading down with greater margin exponentially and broke below support S1 indicates the pace of bull strenght is continuing decrease. ADX (pink line) is curving down which implying the volatility of the current bull trend is still uncertain in shorter term. Therefore, the summations of the 3 signals above is implying uncertainty still remains and knee jerk reaction is unavoidable as expected.

Prevailing trend could be emerged if weekly levels listed below was broken:

Resistance - 1610

Immediate Resistance - 1553, 1560-1580

Immediate Support - 1520

Support - 1505,1485,1475 (UT line)

Daily Time Frame

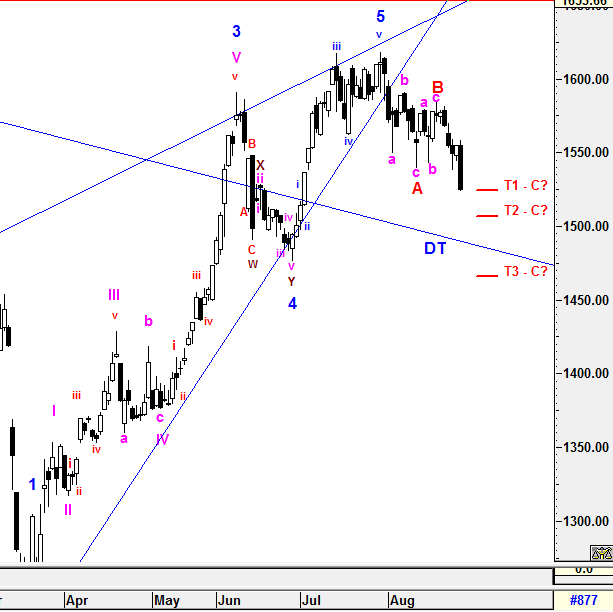

Due to magnitude of the momentum, there are acceptable threshole allowances to fit or qualify the wave counts criteria. No doubt that wave B was formed at 1584.36 (almost 61.8%) which had qualified the minimum criteria of wave counts with 3 sub minutte waves "abc" formation.

To recap, each wave A and B were formed with 3 sub minutte waves "abc" and currently wave C is being constructed with possible regular 5 sub minutte waves (Zig Zag Formation) OR 3 sub minutte waves (Complex waves such as WXY).

Therefore, there would be 3 possible target of wave C as below:

T1) 1536.26 (61.8%)

T2) 1506.31 (100%) - Marginally above DT line

T3) 1457.85 - 1465 (apx 161.8%) - lowest level to validate the entire Super Bull Cycle.

From these 3 target level above, KLCI had already met and crossed beyond the minimum criteria of target (T1). Therefore, the type of the entire correction formation will be monitored closely as wave C has the most properties of wave forms which may lead to complexity formations and may end in between the range of T1 - T3 stated above based on magnitude of the momentum with valid signal.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if daily levels listed below was broken:

Resistance - 1580, 1610

Immediate resistance - 1536, 1550

Immediate support - 1503, 1514

Support - 1490 (DT line)

Let's Mr Market pave the waves to a healthy Super Bull Cycle.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021