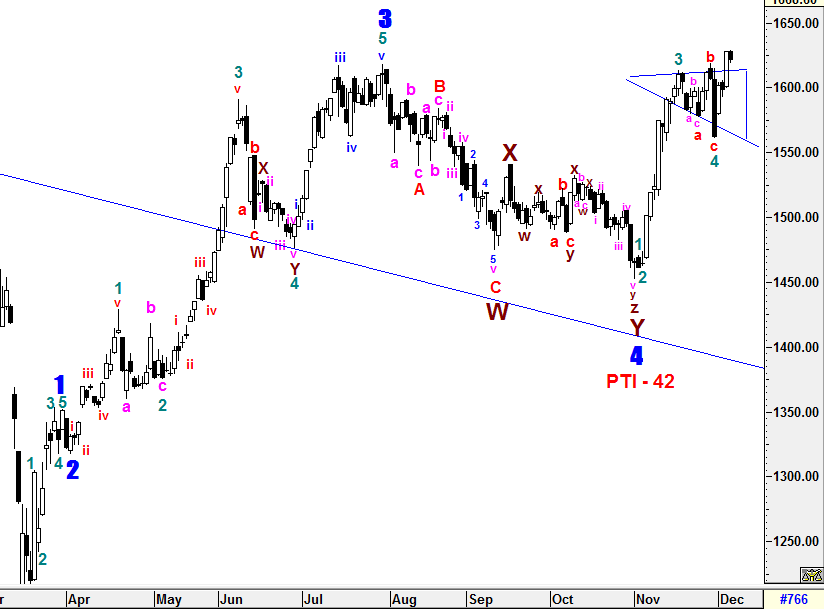

Weekly Time Frame

Finally, KLCI was able closed above 1610 after few hard prolong attempts. It will be a good new start for the Bull to test higher level in order to write off the double top formation which formed years ago. However, caution is required along the way up for any knee jerk reaction possible.

To recap, the Higher Degree of Wave 5 is still being constructed to archieve higher level. The current weekly PTI reading is still remain at 38 which indicating that the prior Higher Degree of Complex Correciton waves WXY was healthy which could succeed Wave 5 at higher level. Therefore, the tendency is high for KLCI to trade higher than 1618.01 (Wave 3) in coming weeks. Subsequent minor waves would be elaborated further in daily time frame.

1) -DMI (red line) curved up with lower margin indicates bearish momentum is increasing with lower pace.

2) +DMI (blue line) curved down with lower margin indicates bull strenght is decreasing with lower pace.

3) ADX (pink line) continue heading up with lower margin implying that the volatility of the current trend is slowing down.

Therefore, the summations of the 3 signals above is still implying uncertainty is reduced with narrow margin but caution is still required for any unexpected knee jerk reaction. From current situaton, +DMI is still staying above -DMI indicates bull strenght is still in favor with improved volatility. Besides that, -DMI and ADX have yet to realize an criss-crossed setup which will spur a strong momentum to the upside. Therefore, a continuous increased in ADX reading is still required in order to validate a prominent trend to be developed.

Prevailing trend could be emerged if Weekly levels listed below was broken:

Resistance - 1639,1650,1682

Immediate resistance - 1621-1623

Immediate Support - 1610 , 1577, 1564, 1556,1530

Support - 1490, 1465 (DT line)

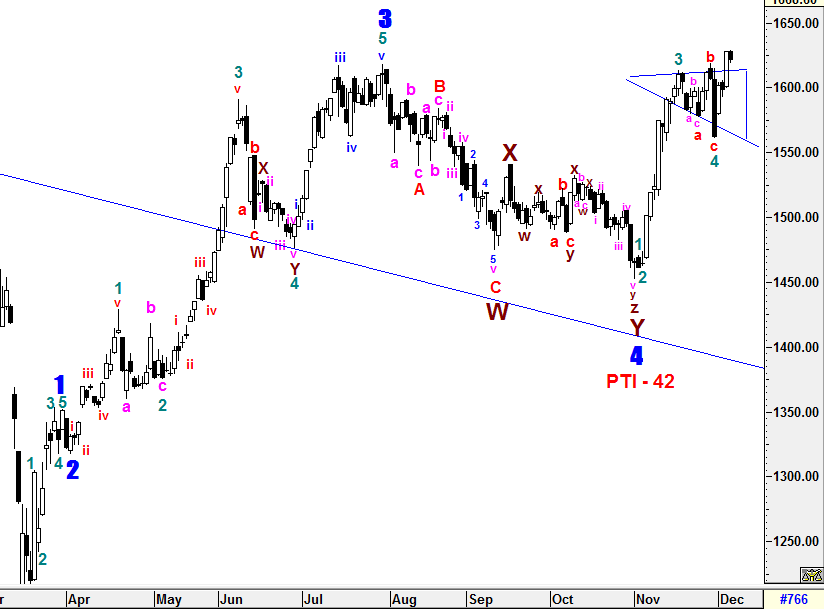

Daily Time Frame

To recap, I did not rule out that the consolidation phase might test or breach the low of 4th sub minuette correction wave at 1578.39 again to form minuette complex waves which could lead to construct a prolong new 4th sub minuette correction wave instead. No doubt that it happened and realized faster than expected at the the low of 1562.71.

Currently, 5th sub minuette wave is being constructed and continous uptrend is expected in coming days after broken out from the expanding triangle formation last week as shown.

To re-iterate, the daily Higher Degree Wave's PTI reading is still remain at 42 indicating the prior Higher Degree of Complex Correciton waves WXY was healthy which could succeed Wave 5 at 3 possible targets level at 1639, 1685, 1706. If we project the target based on Expanding Triangle formation, the target could be at 1730.

The entire wave structures will still be monitored closely if the low of Wave Y at 1452.13 is breached as more complexity wave formations could be emerged such as multiple WXY correction waves may take place before Higher Degree of 5 Waves Bull Run.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if Daily levels listed below was broken:

Resistance - 1639,1650,1682

Immediate resistance - 1621-1623

Immediate Support - 1610, 1597, 1577, 1560, 1554

Support - 1530, 1490

========================================================

Patient is required for the Implusive Waves of the SUPER CYCLE Bull Run.

========================================================

Let's Mr Market pave the waves.

Trade safely

Wave Believer

wehcant

The Sports Performance Research Institute New Zealand (SPRINZ) has studied the performance of surfers during competitive surfing events, in an attempt to inform the development of surfing-specific conditioning.

The results show that surfers spend 54 percent of their time paddling and 28 percent waiting for waves. Interestingly, in a 20-minute heat, surfers ride waves and paddle a total distance of about 1.6 kilometers (one mile).

2020-12-06 11:16