KLCI waves

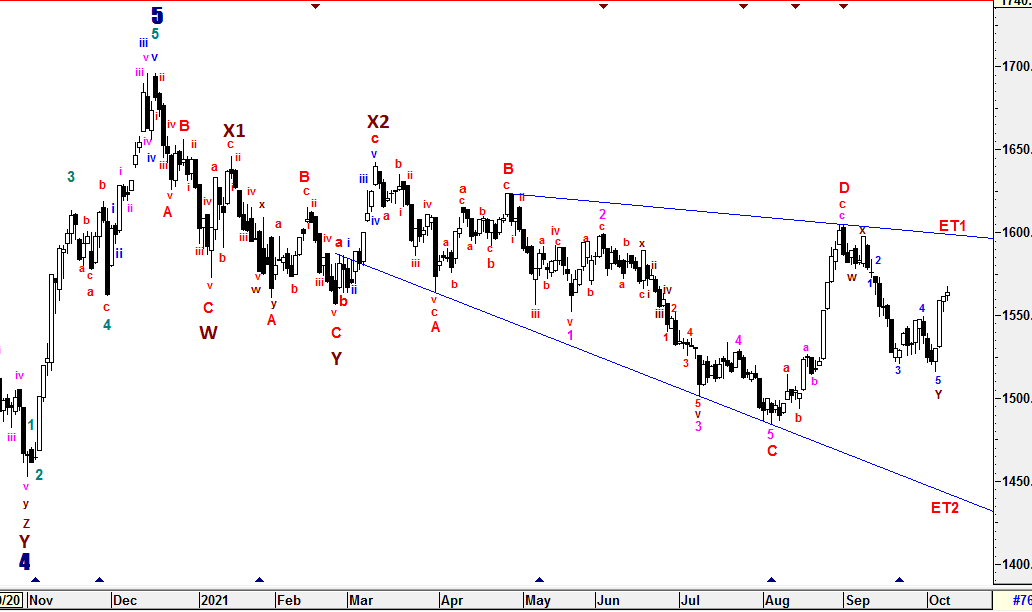

KLCI waves 79 - DEAD CAT BOUNCE OR TRUE REVERSAL ?

hotstock1975

Publish date: Mon, 11 Oct 2021, 08:14 AM

Weekly Time Frame

To recap from prior session 78, weaker momentum continued and closed below 1532 to realize Three Black Crows Candlestick which indicates downward pressure still remain. Therefore, i was still holding the view that the downward momentum emerged within the Expanding Triangle Formation (ET1 - ET2).

{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{

For the past one week, sentiment gradually improved and KLCI rebounded back into Three Black Crows Candlestick region which reduced the downward pressure after the realization of the bearish candle formation. However, we would see KLCI would be in short consolidating below the lower gap resistance at 1573.78 before clearer signal emerged. Let's check the temperature of the trend.

TREND indicators

1) -DMI (red line) continue heading down with greater margin indicates bear strength is decreasing with greater pace.

2) +DMI (blue line) curved up with lower margin indicates bull strength is increasing with lower pace.

3) ADX (pink line) is still decreasing with consistent margin implying that the volatility of the current trend is still in consistent pace.

Therefore, the summations of the 3 signals above is still implying Bear strength is in favor. +DMI is remained below -DMI for the fourth week indicating the Bull strength is still out of favor and slower ADX has indicated the current trend is not firmed yet. Since all indications is still favor on Bearish mode together with the realization of Bearish Candle Formation last week, I am expecting KLCI will be consolidating in between ET1 and ET2 in Medium Term as the current rebound is not justified as solid trend reversal. Therefore, caution is still required unless ET1 could be penetrated to the upside.

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

From wave count perspective, the Higher Degree of Correction wave would be prolong with Multiple WXYXZ complex waves before a new set of Higher Degree of Bull Wave take place. Besides that, wave D has been justified to end at 1604.98 and wave E might be in its way to the downside. Therefore, Wave Z is still not been realized yet. Subsequent minor waves would be elaborated further in daily time frame.

Prevailing trend could be emerged if Weekly levels listed below was broken:

Resistance - 1610, 1615, 1619, 1627, 1633, 1642, 1650, 1700, 1720

Immediate Resistance - 1564, 1571, 1575, 1580, 1590, 1595, 1600

Immediate Support - 1557, 1548, 1533, 1530, 1520-23, 1510, 1505, 1500

Support - 1484-1488, 1474-1476, 1466, 1452, 1447, 1436, 1407

Daily Time Frame

To recap from session 78, micro sub minuette waves WXY was justified as sub minuette waves a and sub minuette waves b was completed with almost met the minimum criteria FIBO 38.2% at 1553 as labelled. However, i won't rule out that there could still some rebound reaction towards FIBO 38.2% to end sub minuette waves b with new wave structure.

{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{{

For the past one week, momentum has changed where new wave structure emerged in sub minuette waves a/b. Therefore, micro sub minuette wave Y has been revised as 5 waves structure as labelled. Although there was an minor double bottom after the bullish divergence signal, i am still holding the prior assumption with wave E is still underway and believe moving towards ET2 gradually with a possible another micro sub minuette complex waves emerged.

As usual, i am still leaving Wave Z alone since the assumption of new corrective wave above is still yet to be justified with wave E is still in the run unless there is an new catalyst to drive KLCI to penetrate above ET1 for new wave structure.

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

To reiterate, Wave Z could be formed in various correctives wave structure (Zig-Zag, Flat, Diagonal and etc) with momentum changes.

Since Multiple Complex Wave emerged, the new set of Higher Degree of 5 Waves Bull Run or Primary Wave 3 have yet to be seen until all corrective waves are served convincingly unless Wave X1 (1646.24) is penetrated. Thus, Higher Degree of Correction is still being prolong by these Multiple Complex Waves WXYXZ.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if Daily levels listed below was broken:

Resistance - 1615, 1620, 1625-1628, 1639, 1645, 1650, 1662, 1679, 1685, 1700, 1720

Immediate resistance - 1570, 1573, 1581, 1590-1593, 1600, 1608-1610

Immediate Support - 1562-63, 1556-1557, 1546-1548, 1536, 1530, 1522, 1515, 1512, 1505, 1500

Support - 1495, 1490, 1484-1488, 1475 , 1461-1466, 1452, 1435

==================================================================================

Patient is required for the SUPER CYCLE Bull Run.

=================================================================================

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 1 of 1 comments

hotstock1975

Attempted to close above weekly Lower Gap 1573.78. Most important if it can close above weekly Upper Gap at 1575.97 on Friday. Let's watch.

2021-10-11 13:21