Capital cycle - Why the glove industry is unlikely to repeat its past performance

Ricky Yeo

Publish date: Fri, 08 Jul 2016, 08:16 PM

The global disposable glove industry is a $10 bil market with Malaysia glove manufacturers accounting for 50-60% of the global production.

Glove manufacturers in Malaysia namely Topglove, Hartalega, Kossan and Supermax have always been the darling for investors due to their ability to generate strong shareholders return. Take Hartalega and Kossan. Every dollar invested in them 8 years ago will return RM14-15 today even after the recent rundown on share price. And these are totally justified due to their ability to continously generate high profit margin and ROIC.

However there's just one problem. They have too much money.

The most common ways companies can raise funds to grow their business are either through debt market (credit facilities), equity raising or funds generated from the business. Thanks to their strong free cash flow generation capabilities, they have not dip their fingers into the debt & equity market yet. Most players have little to no debt in their balance sheet. But that is very likely to change soon as they continue to embark on their aggressive expansion plan.

Topglove has openly expressed their intention to increase their current market share from 25% to 30% and targeting 1-2 M&A per year. It is unlikely they'll have any funding issue due to their cash hoard of RM 360 mil and the ability to raise RM1 billion for acquisition if necessary. Their secondary listing on SGX serve as a prelude for any future capital raising and M&A opportunities.

Not to be outdone, Hartalega, Kossan and Supermax have each embark on their own expansion plan with Kossan spending RM 450 mil, Supermax throwing a billion on its Glove City project and Hartalega's NGC project that will cost some RM2.2 bil upon completion.

Imagine you are the top dog in the glove business, your business is flushed with cash even after giving out generous dividend, the banks have standby credit facilities at a very attractive rate if you like to borrow; the equities market will easily oversubcribe should you choose to raise equity, and on top of that, your competitors are all expanding aggresively, and you have a business that thrive on economic of scale so size matters a lot, what will you do? Are you going to stand still or expand?

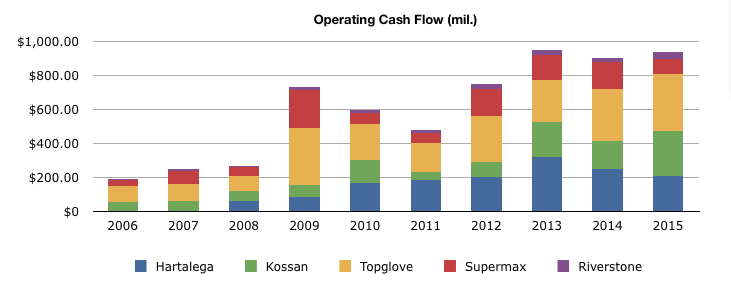

Thanks to the underlying strength of the business, operating cash flow have been sitting above RM 800 mil for the past few years.

Flushed with cash, all major players have embarked on aggressive expansion plan...

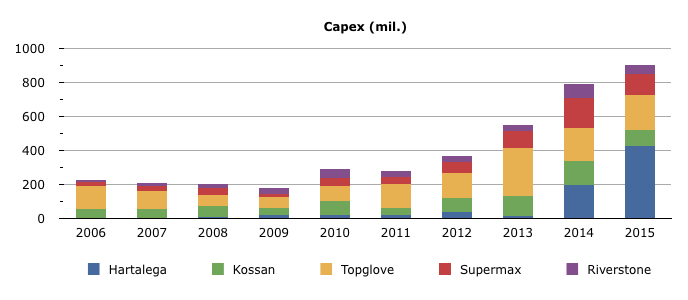

Capital expenditure are set to top RM 1 bil this year, a 300%+ jump compare to capex of RM 290 mil. at the turn of the decade.

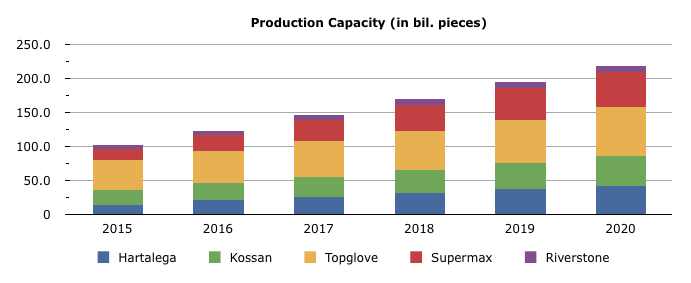

At the current rate of expansion, production capacity is going to balloon...

Doubling current capacity to more than 200 bil pieces by the end of this decade. Far outstripping the projected annual demand growth of 7-8%.

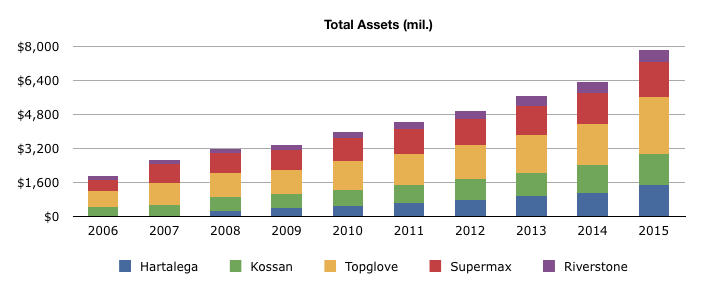

Meanwhile assets continue to swell...

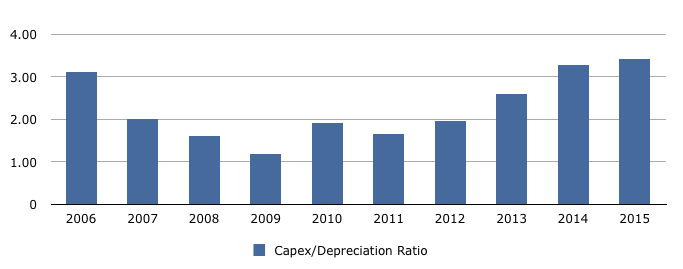

With capex to depreciation ratio hitting alarming level...

A capex/depreciation ratio of 1 depict company is spending enough just to maintain current growth rate. Here the glove players are spending 2-3 times over their depreciation level since 2010 to expand their business.

Now you ask, isn't that a good thing?

Growth can be good but too much growth on the supply side is almost always disastrous to an industry. The past 16 years are littered with great destructive examples.

Dry bulk shipping industry (2003-2009)

During the super boom era, China's insane appetite for commodity i.e iron ore create a huge demand for the industry. Players in the industry load up debts, pile up orders on Panamax size vessel to ease supply side constrain. A Panamax vessel takes an average 1-3 years to build. The demand slowdown from China coincide with the peak of new vessels coming on line. Sudden surge of new supply meets a slow down in demand. The rest is history.

US housing industry (2003-2007)

Right after the dotcom bubble in 2000, the Feds pushes interest rate close to 1%. With cheap credit everywhere and investors searching for yield, the housing market becomes the gold mine. Housing developers, flushed with funds, floaded the market with new houses to meet the appetite of property investors. The rest is history. Watch The Big Short if you haven't.

Spain's housing market, Australia's iron ore industry, oil & gas sector, the gold mining industry, steel industry etc are all littered with case studies of boom and bust due to excessive supply flowing into the industry.

To understand why, when an industry is flushed with cheap capital, capital misallocation becomes rampant. Companies overpay for M&A and spend excessively on purchases that yields minimal economic value. It is hard to say no when everyone wants to give you their money. And all of these ends up destroying long term shareholders return.

What we have been discussing so far are looking from the supply side equation. The issue with demand side is it is harder to estimate and project. During the commodity boom, many analysts have deep conviction that China has a 20 years runway. Not many people expect China's GDP to slowdown at the turn of the decade.

Insiders in the industry are projecting 7-8% annual growth in disposable gloves demand for the next 5 or more years. What we don't know is how accurate is those demand projection, but what we do know is production capacity growth will definitely outstrip that figure.

Rest assured the glove industry is not going bust next week. However looking at where the industry is heading too and considering most production capacity will come online over the next 2-3 years, there is little doubt margin and average selling price is going to get squeezed and lower future ROE. And there's little doubt the next 5 years is going to be very different from the past.

More articles on Intelligent Investing

Discussions

Hi TiongBahru thanks for the reminder, I've added a few more comments on that. If you are interested to read more http://latticework.com/hidden-champions-asia/

2016-07-08 20:52

Great article analysing and explaining boom & bust cycle of an industry.

The grove demand is world-wide so it may not has the sudden surprise like dry bulk industry when a single country, i.e. China, slows down. However, I do agree the coming supply is greater than predicted annual demand growth rate, so yes, the profit margin will be squeezed and we will see grove companies not doing as well in coming 2-3 years.

2016-07-09 07:48

Thanks Ricky, was thinking of taking a look into glove companies until the president of glove association told the players not to expand wantonly. That's a warning all the capacity increase on the cards are probably excessive and we will see intense competition ahead.

2016-07-09 08:14

Preparing for future demands always lead to a oversupply temporary, especially when everyone is doing it. excellent article.

2016-07-09 11:21

M'sia gloves makers have big advantage with their highest productivity in the world, proven with the biggest market share thus far. If the view of the author on oversupply is right, its consequence to M’sia gloves makers would not be as described by him. Those gloves makers with poorer productivity such as those in Indo, Thai , Vietnam, Sri Langka have to take the toll of the oversupply before the wave threatening those in M’sia especially the top three. SuperM is not in the league.

The same development happened many years ago, the first round of victimized gloves makers were small manufacturers such as SPI, Sime, Mbf etc and the second round were those of GLC such as KC, Ansell, Card. etc.

2016-07-09 16:53

TiongBahru

Hi Ricky. With all due respect, I looked at the same argument in 2009/2010 when there were a lot of announcements of capacity expansion. The future increase in capacity did worry me as an investor back then. In hindsight, however, much of the online capacity were nicely absorbed by the market. Your analysis is good. But it would be better if you could show us the demand side economics

2016-07-08 20:28