Malaysia Stock Analysis – OCK (0172)

LouisYap

Publish date: Tue, 15 Oct 2019, 11:17 AM

Malaysia Stock Analysis – OCK (0172)

OCK Group (“the Group”) has four major business divisions that drives our business, namely Telecommunication Network Services, Trading of Telco and Network Products, Green Energy and Power Solutions, as well as M&E Engineering Services. OCK is the largest Telecommunication Network Services (“TNS”) provider in Malaysia and a rapidly-growing regional independent Tower Company (“TowerCo”).

More recently, OCK has expanded its regional footprint through expanding its presence in Myanmar, Vietnam, Indonesia, Cambodia and China. OCK is focus on developing an independent ASEAN tower company and currently has a telecommunication tower portfolio of more than 4,000 telecommunication towers. OCK’s ambitions is to successfully penetrate into two high growth telecommunication tower markets, in Myanmar and Vietnam.

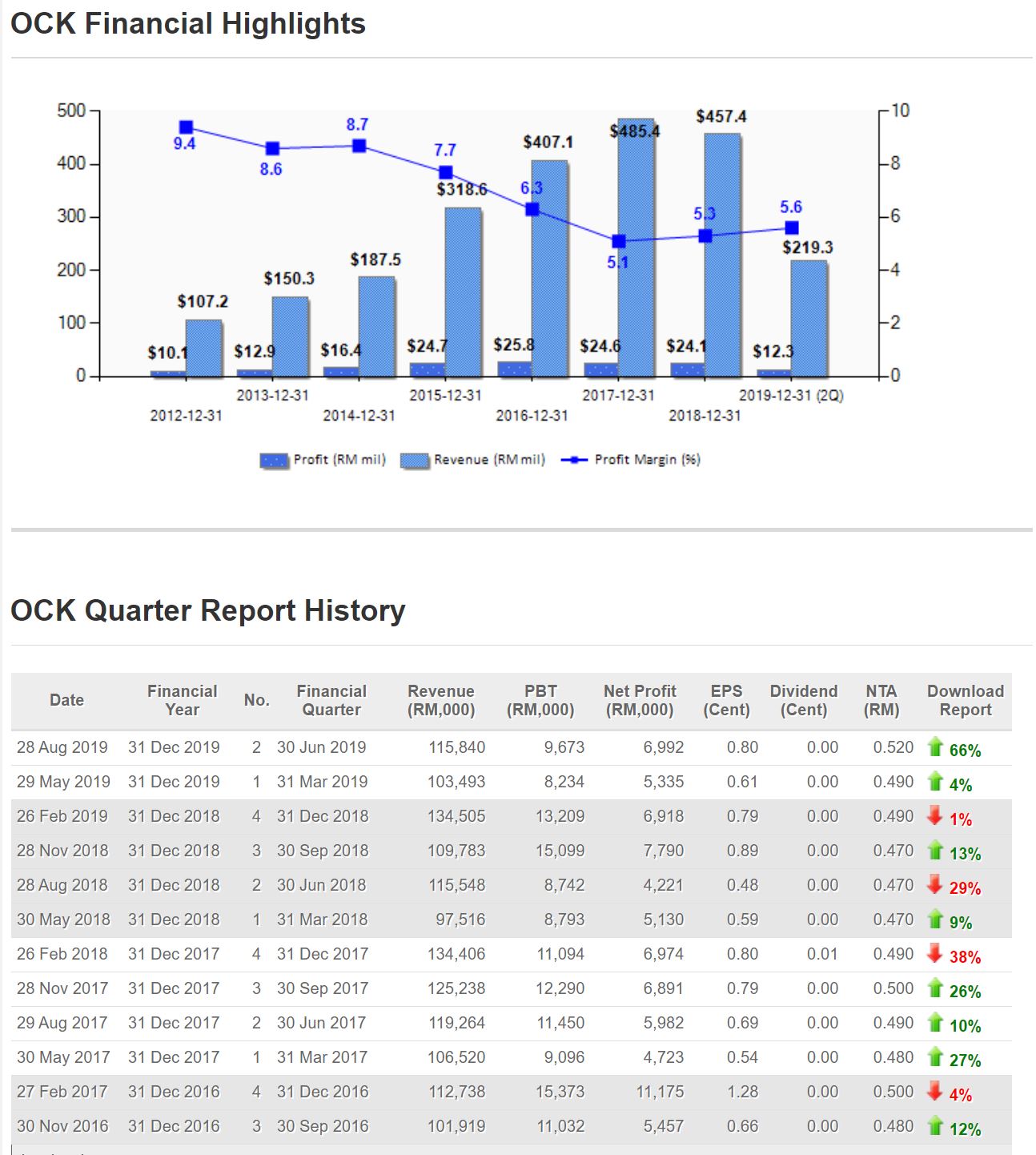

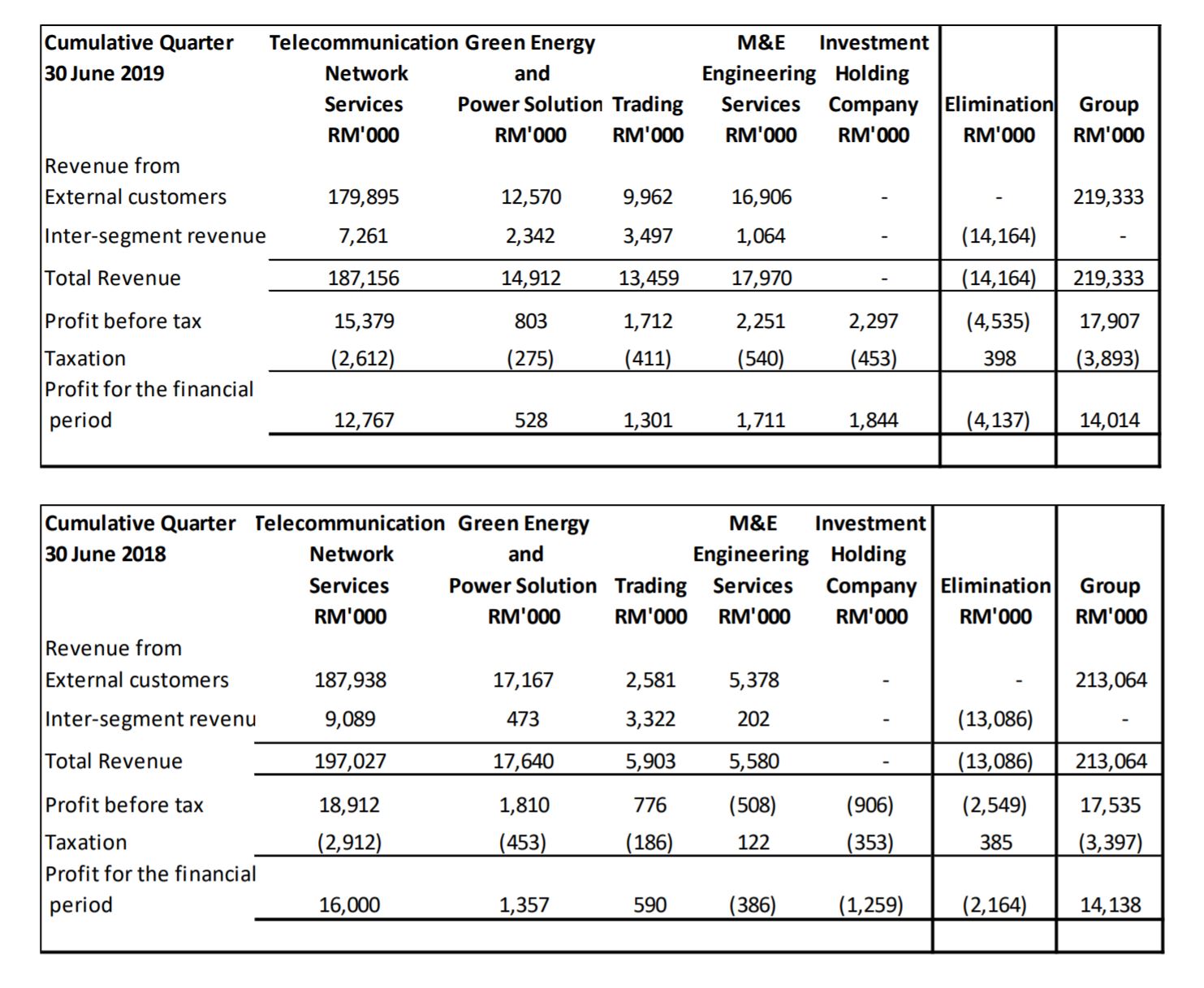

For the current quarter ended 30 June 2019, the Group reported a higher revenue as compared to the corresponding quarter of previous year, mainly due to higher revenue contribution from M&E Engineering Services.

The total revenue of RM115.8 million recorded for the current quarter was higher as compared to the revenue in the preceding quarter of RM103.5 million mainly due to higher revenue contribution from Telecommunication Network Services (“TNS”) and M&E Engineering Services in current quarter.

Future Prospects:

OCK’s outlook on the industry in Malaysia is in line with the rest of the Mobile Network Operators (“MNOs”) and that is to expand and upgrade their 4G long-term evolution (“LTE”) network coverage. OCK is also optimistic about the new direction taken by the Government with regard to implementation of the National Fiber Optic and Connectivity Plan outlined in Budget 2019, as well as opportunities to build and own telecommunication sites in various states. In addition, OCK sees prospects from an aggressive geographical expansion from one of the MNO in Malaysia, which will allow the Group to build its tower portfolio.

OCK has identified a new trend in Malaysia, where MNOs are starting to outsource internal managed services to third parties in the industry. This is positive for OCK since they currently manage more than 28,000 telco sites in Malaysia and Indonesia. As such, the prospects going forward seems positive, as they strive to maintain their leadership position as the largest TNS provider in Malaysia.

In Malaysia, OCK currently owns in excess of 424 Towers and is rapidly undergoing expansion to increase its tower ownership with support from major MNOs. In Myanmar, OCK has completed and handed over 969 telecommunication sites and is still rolling out its current outstanding orderbook of more than 500 telecommunication sites. OCK has achieved a milestone of securing built-to-suit and co-location contracts with all four MNOs, namely Telenor Myanmar Limited, Myanmar Posts and Telecommunications, Telecom International Myanmar Company Limited and Ooredoo Myanmar Limited. OCK will be aggressive in its initiatives to build more sites to cater to the growing demand of daily data usage in this greenfield telecommunication market.

In Vietnam, OCK is currently the largest independent TowerCo, owning more than 2,673 sites. As the Towerco ecosystem is fragmented, OCK foresees consolidation opportunities. The focus in this country will be on both brown and greenfield opportunities as the market gears up for the rolling out of 4G LTE network.

As of now, OCK has built a tower portfolio of more than 4,000. In 2019, OCK is on track to be an independent tower portfolio of more than sites across Malaysia, Myanmar, and Vietnam. In their aspirations to build an Asean TowerCo, OCK will continue to venture into the Asean region to secure more valuable telco sites. As for the OCK’s Green Energy business segment, OCK is optimistic with the recent announcement from the government to open tender for the third round of the 500MW largescale solar projects worth an estimated value of RM2 billion.

-------------------------------------------------------------------------

➡Stock Value Investing・Financial Knowledge⬅

To find out more information detail on our seminar, please Whatsapp us at

☎ 017-6699680

OR click here to WhatsApp :

➡➡ https://api.whatsapp.com/send?phone=60176699680

✅ What is Stock? Is it Risky?

✅ What is Stock Key Indicator?

✅ Long Term, Middle Term & Short Term Investment.

✅ Fundamental Rules for Stock Selection.

✅ Winning Strategies of Stock Investment.

✅ Strategy to maximize profit from IPO.

✅ Combination of FA & TA Strategy to increase winning chance in Stock Investment.

✅ Understanding Your Financial Health & Safe investing in Stock Market.

✅ Generating Passive Income from Stock Investment.

✅ Maximizing Your Profit Through Leveraging.

✅ Understanding Value Investing for Your Financial Freedom Dream.

✅ Understanding Basic Financial Knowledge.

✅ Gateway from Your Current Predicament

alivetoinvest

Copy & paste

2019-10-17 13:35