Malaysia Stock Analysis Report – HIBISCS (5199)

LouisYap

Publish date: Tue, 29 Oct 2019, 11:43 AM

Malaysia Stock Analysis Report – HIBISCS (5199)

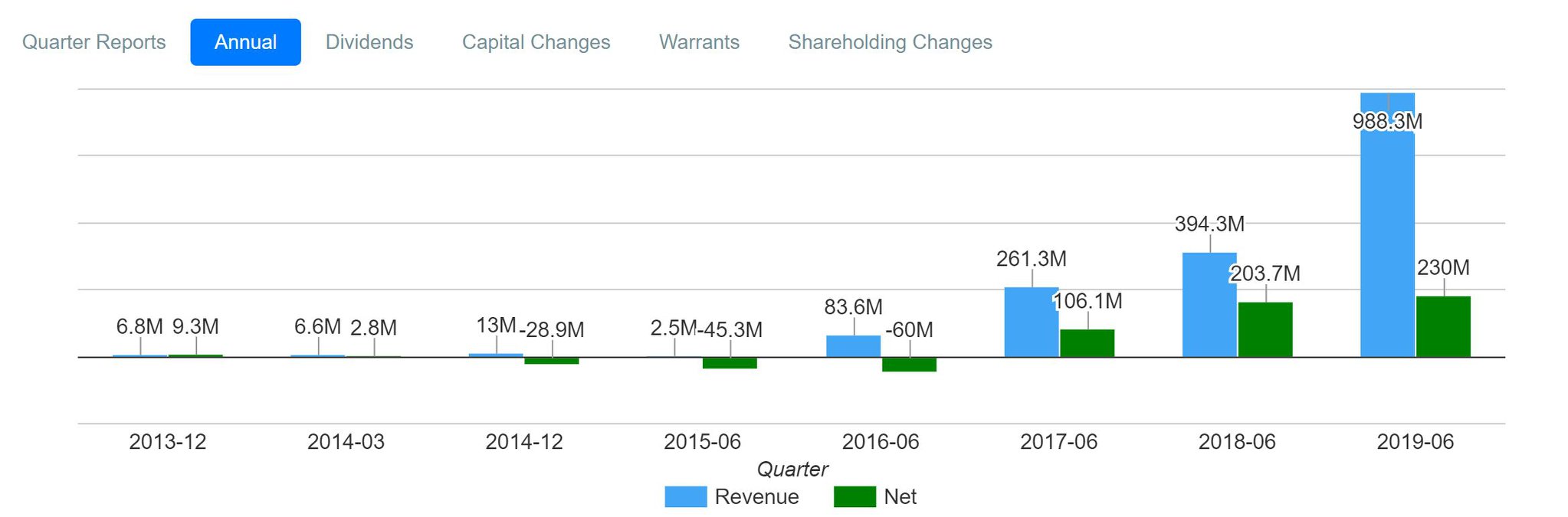

The latest quarterly (Q4) results of HIBISCS record the company's performance from April 1 to June 30.

The company's revenue is mainly from North Sabah (RM 586.8mil) and Anasuria Hibiscus (RM 396.3 mil), while EBITDA is North Sabah (RM 294.6 mil) and Anasuria Hibiscus (RM 281.3mil).

*North Sabah's business*

In this quarter, a total of 491 thousand barrels of crude oil (Q3: 578 thousand barrels) were obtained. The average selling price per barrel of oil was US$72.59 (Q3: US$67.87), and the turnover decreased slightly by 6.8% quarter-to-quarter.

The average operating cost of producing barrels of oil is $13.60 (Q3: $11.77). Profit before tax fell by 5.0% quarter-to-quarter. At present, the average daily oil production is 5,057 barrels, an increase of 5.3%.

*Anasuria Hibiscus's business*

In this quarter, only one oil extraction was carried out, and a total of 302 thousand barrels of crude oil (Q3: 249 thousand barrels) was obtained. The average selling price per barrel of oil was US$66.84 (Q3: US$60.39), and the turnover increased by 32.9% quarter-to-quarter. The average operating cost (OPEX) for producing oil per barrel is $20.93 (Q3: $23.27).

Profit before tax increased by 39.6% quarter-to-quarter. At present, the average daily oil production is 3,053 barrels, an increase of 9.9%.

The business of Anasuria Hibiscus is continued improving. It seem that the company's pre-tax profit increased by 12.7% quarter-to-quarter.

The main reason for the decline in company performance was due to taxation. The company's latest quarterly tax expense rose to RM 67.6 mil, mainly due to the company's Deferred Tax Expense RM 26.8 mil (Q3 Deferred tax income RM 7.2 mil). This also makes the company's earnings drop.

The main reason why Deferred Tax was recorded in the accounts was that the company invested RM 49.2 mil in assets during the quarter, and these assets were tax deductible. This also resulted in a deferred tax expense of RM 19 mil.

The management's vision is to produce oil at 20,000 barrels per day in 2021, and getting 100 mil barrels of net proven and probable reserves.

*North Sabah's business**

Performing well at average uptime of 94%, only a slight drop of 1% compared to last quarter. Due to maintenance work, the average operating cost per barrel of oil (OPEX) is expected to increase again in the next quarter.

*Anasuria Hibiscus's business*

Performing at average uptime of 87.1%, higher than last season. Performance is affected by two things:

First, scale extrusion of GUA-P3 and TL-P2 to increase oil recovery rate;

Second, the maintenance work was delayed until the end of June.

After the company hopes to repair the project, the average uptime will maintain its original level or further improvement in the 2020 financial year

Team Opinion:

This quarterly result are still within the expectations, at least the turnover and pre-tax profit is. Although the after-tax profit fell this quarter, it was mainly due to Deferred Tax Expense.

In terms of pre-tax profit, the company's ability to make money remains at the same level.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

Taehyung

so what is your conclusion ?

2019-10-29 11:47