Malaysia Stock Analysis – GAMUDA (5398)

LouisYap

Publish date: Thu, 31 Oct 2019, 10:53 AM

Malaysia Stock Analysis – GAMUDA (5398)

GAMUDA is a large-scale construction and industry developer in Malaysia and can be regarded as the leader in the construction industry. The company contracted several government projects, and GAMUDA also built MRT 1 & MRT 2. In addition, GAMUDA also has KESAS, SPRINT, LITRAK and SMART franchise avenues.

At present, most of the pre-tax profit from the latest quarterly earnings comes from the water and franchise road, about 33%.

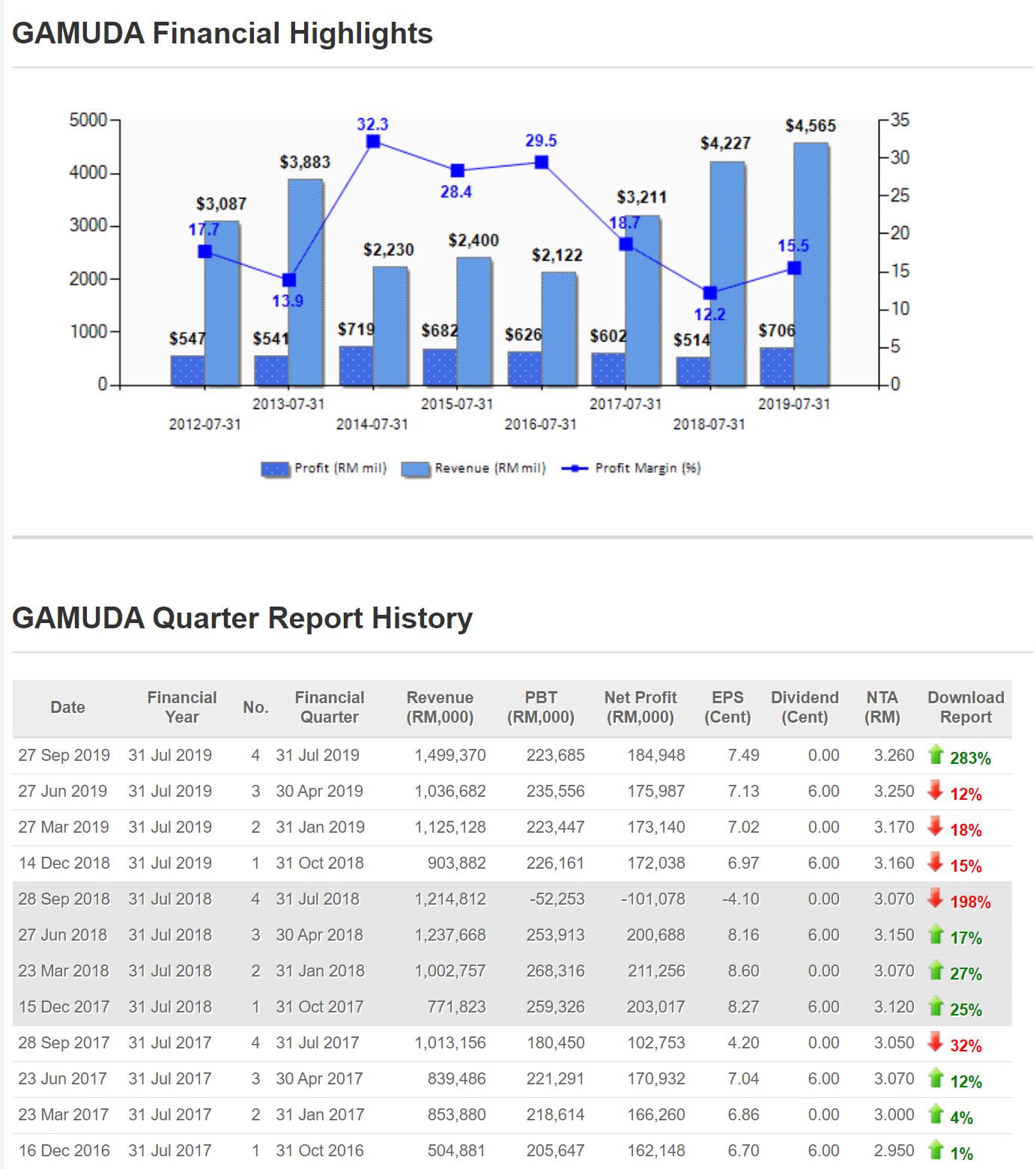

Performance:

Turnover: RM 1,499m YoY rose +23.7% QoQ rose +44.6%

Net profit: RM 184.9m YoY rose +278.5% QoQ rose +5.1

Annual performance

GAMUDA recorded at RM 3.1b real estate sales, and it was recorded RM 3.6b in the last financial year. It was considered a good performance in the current challenging property environment in Malaysia, and with the support of two projects in Vietnam, overseas real estate sales are still very strong.

At present, sales of overseas real estate account for about two-thirds.

GAMUDA's net profit was 706m lower than the previous fiscal year, which was excluding the one-time loss from the sale of Splash last year and the one-off discount for the accounts of the company.

The decline was mainly due to the reduced contract value of the sale of Splash and MRT 2.

Quarterly results:

GAMUDA LAND sold a property valued at RM 1.1b on 4Q2019. Two projects in Vietnam, Caladon City and Gamuda City continue to achieve outstanding results and are still the largest contributors to overseas sales.

GAMUDA's net profit in 4Q2019 is RM 185m, slightly lower than RM 201m in 4Q2018, which is excluding the one-time loss from the sale of Splash last year and the one-off discount on Gamuda Water's accounts receivable. Net profit decline is attributed to the sale of Splash and the reduction in contract value of MRT Line 2

GAMUDA ENGINEERING

The contract value of MRT 2 is RM 30.52b. At the end of July, the elevated project is currently 59% completed and the underground project is 60% completed. Pan Borneo Highway in Sarawak is 45% completed.

GAMUDA LAND

The real estate sector sold RM 3.1b worth of real estate this year, compared to RM3.6b in the same period last year. Overseas projects contribute two-thirds of total sales.

Two developments in Vietnam, Gamuda City and Celadon City continue to achieve stable performance and are currently the largest contributors to overseas sales.

Sales of high-end apartments in Melbourne are underway. As for the Anchorvale Crescent project in Singapore, it is still in progress.

Horizon Hills and Jade Hills in Malaysia continue to be on sale. Sales of Gamuda Garden are showing signs of increasing.

GAMUDA INFRASTRUCTURE CONCESSIONS

The traffic volume of all highways has been stable. On 21 June 2019, the government proposed to take over Gamuda's KESAS, SPRINT, LITRAK and SMART. Gamuda's shareholding on these four highways is currently worth RM 2.36b

As for Splash, Gamuda has a 40% stake and has sold RM2.55b to Air Selangor. It has received RM 1.9b and the remaining RM 650m will be recovered within nine years.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: