Malaysia Stock Analysis Report – Dialog (7277)

LouisYap

Publish date: Thu, 14 Nov 2019, 11:51 AM

Malaysia Stock Analysis Report – Dialog (7277)

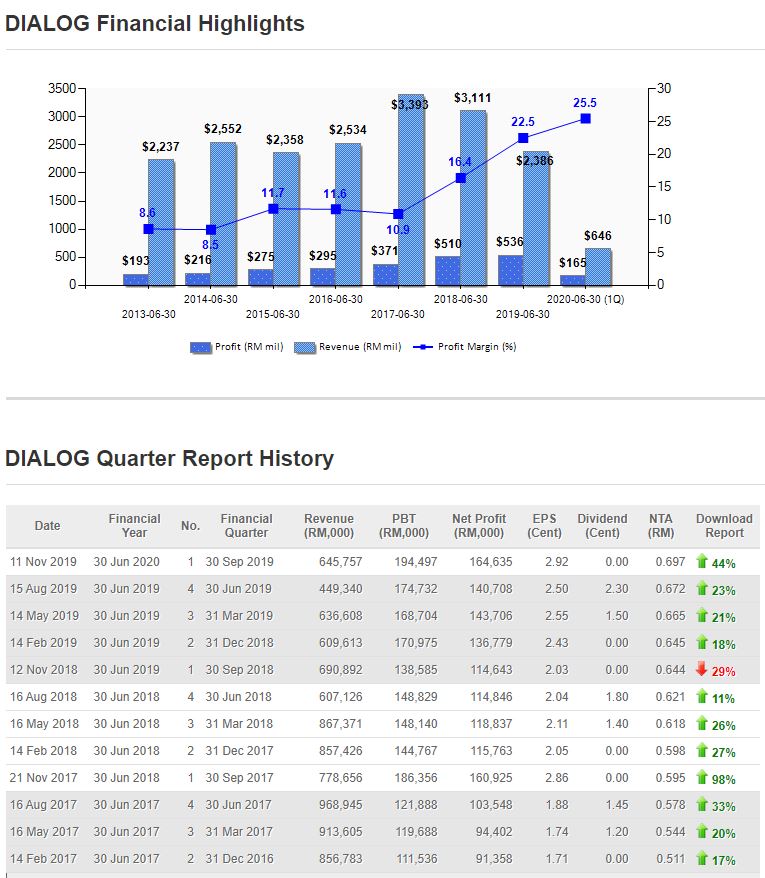

Dialog Quarterly Report Update 2019 Q3 - Turnover, earnings both has rose in 2 consecutive quarter

Performance:

Turnover: RM645.7m, YoY fell 6.5%, QoQ rose 43.7%

Net profit: RM 164.6m, YoY up 43.6%, QoQ up 17%

One-time profit/loss:

According to the quarterly report, Dialog recorded "Fair Value gain on deemed disposal of a joint venture" of RM 28.5mil.

During the quarter, Dialog purchased an additional 25% stake in JointVenture - Halliburton Bayan Petroleum, so the company became a subsidiary of Gamuda.

Main Reason:

In 1Q2020, Dialog recorded a profit after tax of RM 140.6mil, an increase of 19.1% compared with the same period last year. Although turnover fell 6.5%, Dialog still recorded better earnings.

The increase in earnings was mainly due to the growth of Malaysia's business, especially in the engineering and construction business and products and services business.

Compared to the previous quarter:

Dialog recorded a pre-tax profit of RM194.5mil, an increase of 11.3%. Mainly contributed to the one-time off Fair Value gain.

Future Prospect:

The first and second phases of PDT are already in operation, and the third phase of reclamation is expected to be completed by the end of the year.

PDT3 is still under construction, with an initial investment cost of RM 2.5bil, which is expected to be completed by 2021. Upon completion, it will bring an additional 500 acres of oil to Dialog.

In addition, Dialog also won a five-year contract with Petronas on Jul 2019, and it can be extended.

The management is optimistic about the 2020 financial year! And Dialog performance in FY 2020 will continue to be strong.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: