INARI (0166) -Details of AGM Nov 2019 Meeting

LouisYap

Publish date: Fri, 27 Dec 2019, 10:06 AM

[INARI (0166) -Details of AGM Nov 2019 Meeting]

Recently, Inari's stock price dropped to RM 1.61 with close to 14%, it was the worst days in the company's history. The drop is mainly because of Broadcom is currently considering selling off the business division Radio Frequency (RF) Chip Unit with $10 Billion USD, the company is currently looking for buyers together with Credit Suisse Group AG

And the below dialog is coming from AGM Nov 2019

✅ Q: Has the new health sensor and 2D, 3D facial recognition modules of IOT business reached the full production stage?

A: After customers announced that their new smartphones will use IRIS technology, we have been researching IRIS Scan devices, health sensor, 2D, 3D facial recognition devices. At of now, the products in this respect have been qualified and are in production.

✅ Q: How much of these products are expected to contribute to the turnover of IOT business in FY2020?

A: We predict that in FY2020, IOT's contribution will account for about 8% to 10% of total turnover.

✅ Q: Please tell us more about the production space of Block A, Block B and Block C for the company's new factory P34 in Penang.

A: The production space of Block A, Block B and Block C are 210,000 sqft, 210,000 sqft and 260,000 sqft, respectively. The total space of the P34 is 680,000 sqft. P34 is the largest factory for INARI, and in Block B, we have already prepared for the RF testers spill over of 5G business in the future.

✅ Q: What caused a sharp drop in turnover from Taiwan? Is Taiwan's turnover forecast to decline?

A: The sharp drop in Taiwan's turnover is due to the fact that the subsidiary Amertron Incorporated, Philippines' business is an expired product. We do not predict any contribution from this production line in the future.

✅ Q: What other countries contribute to the company's turnover?

A: Other countries include Germany and Hong Kong, which contributed a turnover of RM3.1 million, accounting for only 0.3% of the company's total turnover, which shows that it has small impact.

✅ Q: INARI's stock price is flat recently. Will the company do something pleasant?

A: You feel flat because you are not in our position and we are very excited now. We must know that the field of science and technology is an industry that is constantly learning and researching and will never stop. We will continue to invest in R & D and make more profit for shareholders. 5G is coming soon, and I'm very exciting. In another 3 years, we will see our growth very strong.

✅ Q: Will the advent of 5G have more other semiconductor competitors join in, resulting in increased cost pressure?

A: We have been in this business for so many years, and the cost pressure will never stop. What we should do is continue to make ourselves stronger to win market share. In fact, INARI has proven its ability in the RF industry in the past few years. We have won the Best Suppliers (Best Contract Manufacturers) award in 2010, 2015 & 2017.

✅ Q: What is the profit margin satisfactory to INARI? When the business volume becomes high, will margin be depressed?

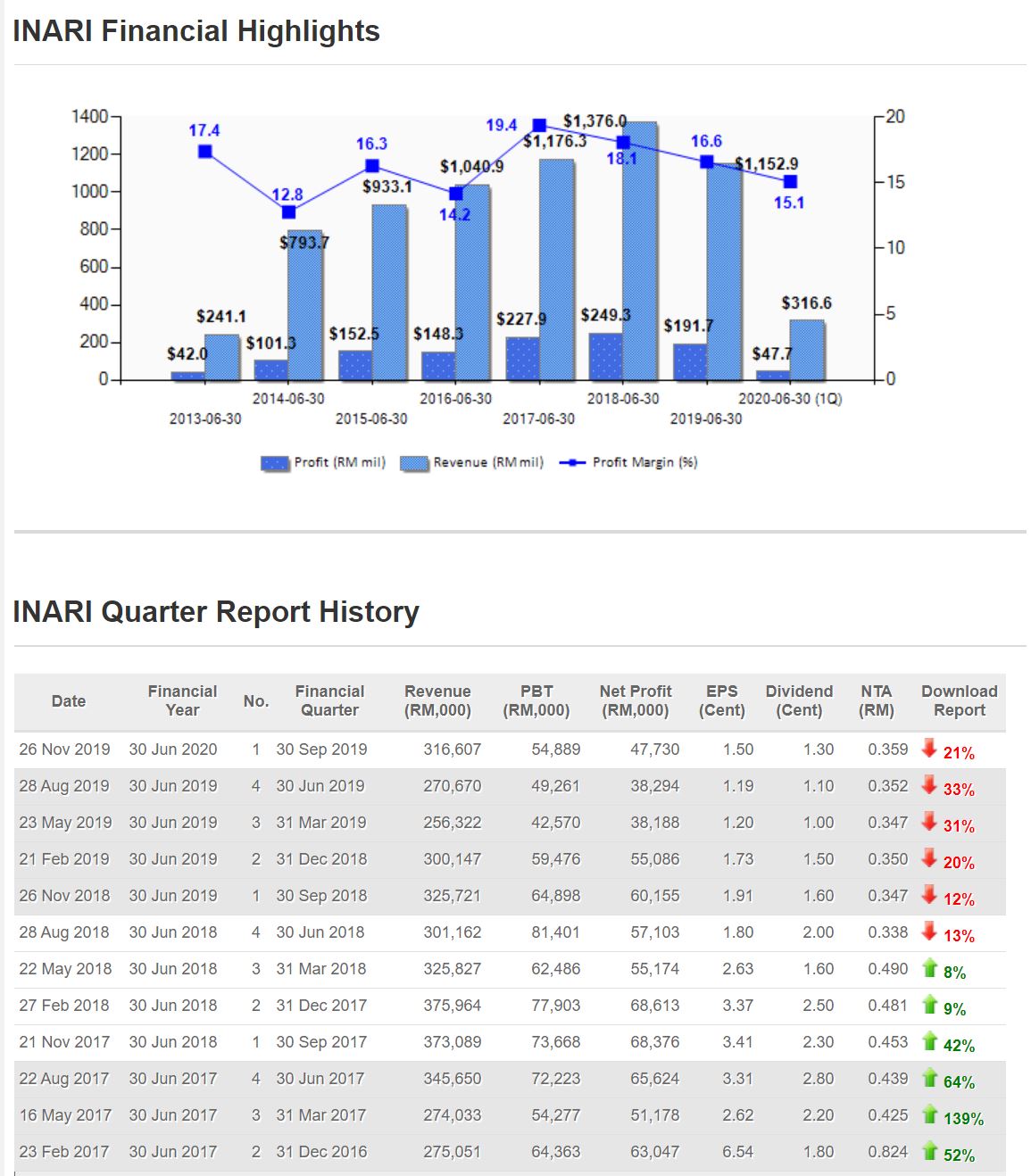

A: About 15% to 18%, the best in Malaysia. We don’t do business too extreme in pursuit of high margins. We make money and we give back to our customers in order to create a long term business relationship with our customer. We are focusing on the amount, not the margin. The higher the turnover, the more profit is made.

✅ Q: I believe that 5G is not limited to smartphones, but INARI seems to focus on smartphones only?

A: Yes, 5G is not limited to smart phones, it can also be used in many places, such as smart cars, even factories. Can you imagine how many sensors will be used for this? At that point of time, the sensors will be in short supply, and all these things are interlinked, as I said, if we are patient enough, we will wait until the day of big growth.

✅ Q: You said we have to wait 3 years. Do you think that the China-US trade war will continue to affect the company?

A: We don't know when the China-US trade war will stop, and no one can predict. I understand that investors will divide investment strategies into short-term, medium-term and long-term, and we are focusing on long-term.

✅ Q: How much money will the company invest in R & D and expansion each year?

A: Approximately RM 120 mil to RM 150 mil.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: