UZMA (7250) - Detail of Dec 2019 AGM

LouisYap

Publish date: Mon, 30 Dec 2019, 10:32 AM

[Details of UZMA (7250) Dec 2019 AGM]

Stock price: RM 1.00

Company Highlights:

1) The company's vision is to become the top 5 OGSE (Oil and Gas Services and Equipment) player in Malaysia, and the company currently ranks 24th.

2) Management believes that the supply and demand for crude oil is gradually stable.

3) Petronas released its outlook report last Friday (December 13, 2019), and it is expected that the workload will be increasing in 2020.

4) 12% of the company's current business is from overseas and 88% is from domestic; the company's goal is to reach 30% of overseas business and 70% of domestic business.

5) 35% of the company's current income is recurring and 65% is project income; the company's goal is to achieve recurring income of 60% and project income of 40% Income will be more stable.

6) Management said that the new energy advocated by the government is an opportunity rather than a threat for the company. UZMA has begun planning to enter this area, bidding on a number of government projects, including LSS3.

7) The company's opportunities for continued growth include Brownfield Rejuvenation, Well P & A, and Flexible Pipeline.

8) The company's debt ratio is less than 1.0, and the management is to borrowing loan after receiving work.

9) The company's US dollar debt has gradually decreased.

10) On the whole, the company's financial status is healthy, flexible.

Q&A Time:

✅ Q: Will the US dollar fluctuation affect the company?

A: Our US dollar debt has been reduced. We will continue to manage foreign exchange risks.

✅ Q: I found that the company has a single large customer that contributes more than 50% of its revenue. Who is it? Is there a risk of relying on a single customer?

A: It is actually Petronas Carigali, and we believe they will continue to issue contracts to us.

✅ Q: What is the comfortable debt ratio of the company?

A: We will control it at about 1.0, and the highest is also 1.2, but we have many engineering contracts on our hands.

✅ Q: Not long ago, it was reported that the company involved a lawsuit. Will this affect the company's finances?

A: This is still in progress, we are not convenient to disclose too much, but I can only say that this will not have a big impact on our finances.

✅ Q: What is the potential risk of the company?

A: First, it is the price of crude oil. Although we will not be much affected by fluctuations in oil prices, because we are brownfield players and not greenfield players, but the overall contract volume will be affected. Historically, we can survive crude oil prices of $ 40 a barrel. If oil prices fall below $ 40, it will affect our overall capital. We are also trying to increase our continuous income as much as possible, reduce the income from the project, and have consolidated the company's income. Second, policy changes, such as the need to use new wells, old wells to be discarded, and so on. In general, aside from these two factors, the company has not had much of a problem.

Team Opinion:

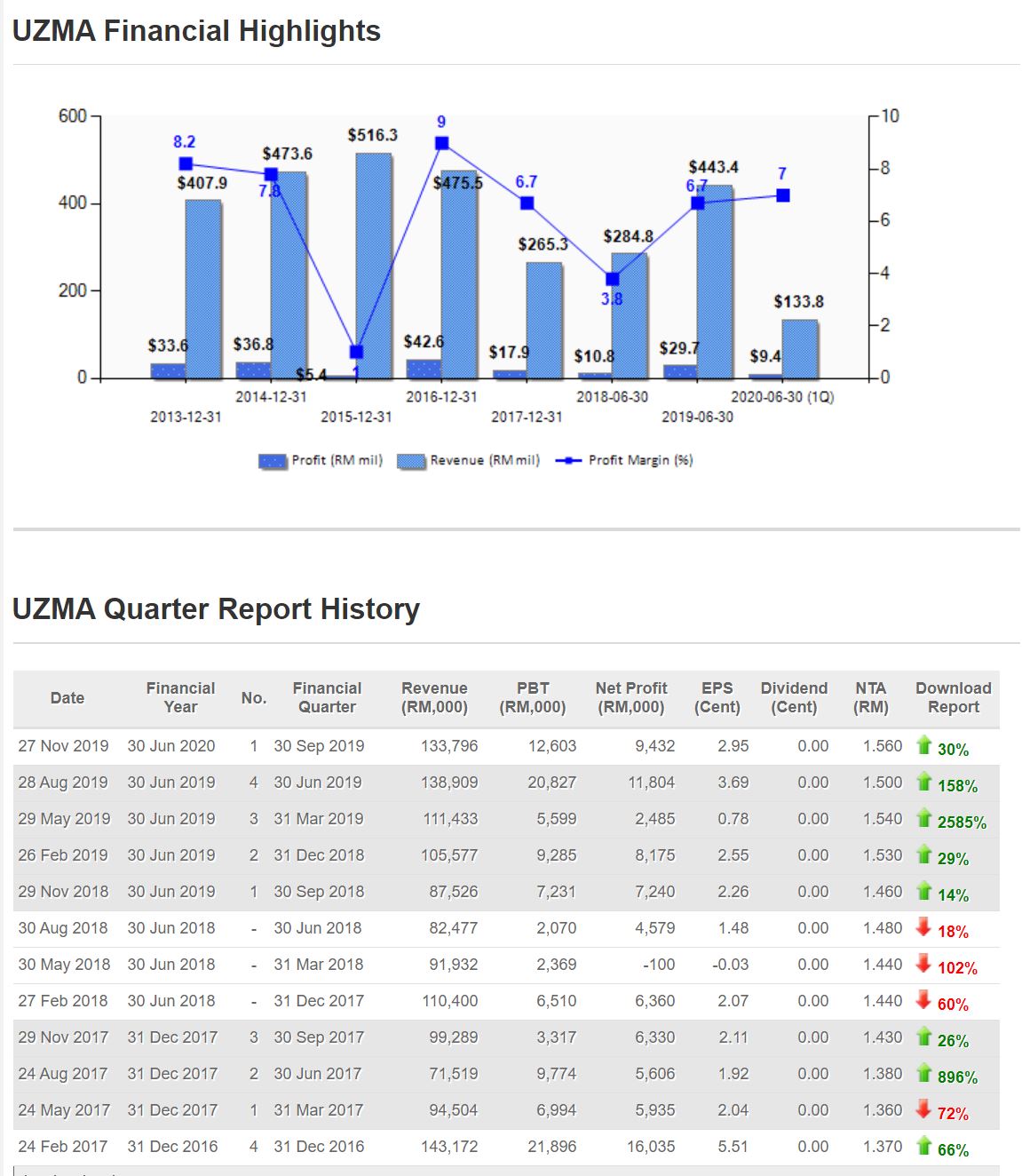

Overall, UZMA's management has clear objective, and the company has no major problems. The only thing to worry about is that the company's performance will be affected by the raining season, so the quarterly comparison will decline, especially Q3, which may cause short-term traders. Arbitrage leaves the market, causing the stock price to pull back, but the management's goal is to achieve double-digit growth in FY2020 turnover. Assuming margin can be maintained, and the profit is expected to grow by double-digits every year. There may be reversal impairment (one-time profit), and the stock price correction may be an opportunity.

The team believes that as long as the oil price does not fluctuate too much and the policy has not changed much, the company has not had a big problem

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: