Mplus Market Pulse - 15 Jul 2020

MalaccaSecurities

Publish date: Wed, 15 Jul 2020, 09:38 AM

Recovery still intact

Market Review

Malaysia: The FBM KLCI (-0.5%) retreated on the back of renewed volatility after unemployment rate rose to 5.3% in May 2020 which saw the increase in number of unemployed person rose by 47,300. The lower liners also trended lower, while the broader market was painted in red with the exception of plantation sector (+0.02%) after CPO prices rose above RM2,500 per tonne.

Global markets: US stockmarkets rallied on a wild session as the Dow jumped 2.1%, while the S&P 500 (+1.3%) saw all 11 major sectors in the green as investors digest the first batch of corporate earnings, whilst the US Dollar weakened to five week low against a basket of currencies. European stockmarkets finished mostly lower, while Asia equities were painted in red yesterday.

The Day Ahead

Although the unemployment rate rose, the quantum appears to have peak which bodes well for the general economy as businesses gradually re-opened. We think that upsides are still in prevalent and any weakness will be cushioned by gains in glove heavyweights amid the on-going shortages of masks, gowns, face shields and gloves in the US with the rising number of new cases of Covid-19.

Sector focus: Despite the healthcare sector also took a fall alongside with weakness across the board, we think that any weakness at present is any opportunity for nibbling on beaten down healthcare-related stocks. At the same time, the higher CPO price is a boon for plantation stocks.

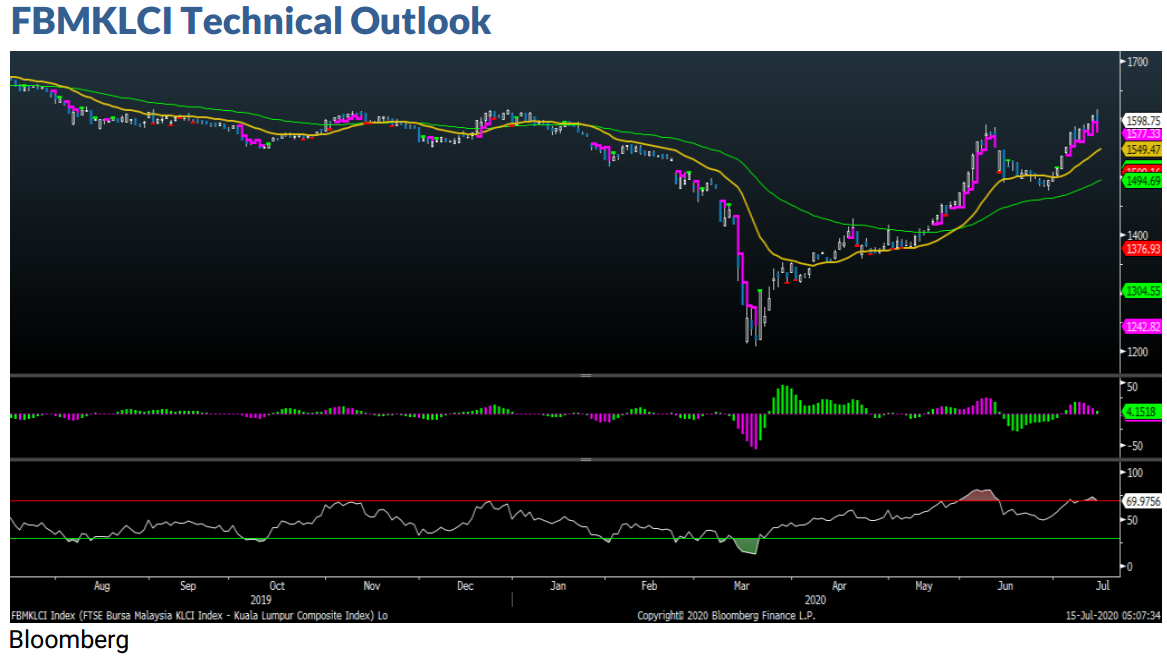

The FBM KLCI has formed a hammer candle, recovering from the daily EMA9 level as the key index briefly re-tested the 1,615 resistance yesterday. With upsides still on the cards, we believe it may revisit the1,615 resistance, and next resistance will be set around 1640. Downside risk is pegged at 1,570, followed by 1,550. Indicators are now mixed as the MACD Histogram has turned red, although it is still above the zero level, while the RSI is treading near the overbought territory.

Company Brief

Digi.com Bhd’s 2QFY20 net profit fell 26.6% YoY RM288.0m on lower revenue during the movement control order (MCO) which started on March 18 but it is positive that business activity will resume to pre-MCO levels. Revenue for the quarter declined 6.2% YoY to RM1.45bn. (The Star)

Tenaga Nasional Bhd has received a notice of additional assessment for year of assessment FY18 amounting to RM1.81bn from the Inland Revenue Board (IRB). The power giant had received the notice which was similar to the notices which it had received in the past years. These notices are pending in court and it has obtained an interim stay order against the payment of the disputed taxes. (The Star)

Advancecon Holdings Bhd’s unit Advancecon Infra Sdn Bhd (AISB) has bagged a RM19.9m contract to undertake earthworks and other related works at Sime Darby Property Bhd’s Bandar Bukit Raja 2 development in Klang, Selangor. The group's orderbook now, which stands at RM722.3m, provides earnings visibility for at least 24 months, while it continues tendering for new jobs. (The Edge)

Duopharma Biotech Bhd and Pharmaniaga Holdings Bhd will be undertaking the fill and finish processes for the Covid-19 vaccine, once a vaccine is developed, said Science, Technology and Innovation Minister Khairy Jamaluddin. The two companies were chosen as both are government-linked; Duopharma is owned by Permodalan Nasional Bhd and Pharmaniaga is owned by Boustead Holdings Bhd and currently have unused capacity that can be directed towards this purpose. (The Edge)

Practice Note 17 company Konsortium Transnasional Bhd’s (KTB) is expected to suffer from a massive drop in revenue in FY20 due to the movement control order (MCO), resulting from rising cancellations and passenger refunds. It issued 1QFY20 with a net loss of RM12.1m against a net profit of RM402,200 recorded in the previous corresponding quarter on lower revenue. Revenue for the quarter tumbled 41.0% YoY to RM21.3m.

Meanwhile, KTB’s external auditor Messrs Al Jafree Salihin Kuzaimi PLT has pointed out a material uncertainty with regard to its financial statements for FY19, which could raise doubt over the group's ability to continue as a going concern. The auditor stated that KTB’s current liabilities had exceeded its current assets by RM70.3m in FY19. (The Edge)

HB Global Ltd has reported that Keh Chuan Seng has emerged as its largest shareholder in the company, after acquiring 150.0 m shares. The acquired shares represent a stake of 32.1%, less than 1.0% from the 33.0% level that would trigger a mandatory general offer (MGO). The block trade was transacted at two sen per share, a discount of 84.0% to its closing price of 13 sen on the previous session. (The Edge)

Berjaya Media Bhd (BMedia) will be delisted from the Main Market of Bursa Malaysia on 17th July 2020 after Bursa Securities dismissed its appeal for an extension of time to submit its regularisation plan. (The Edge)

Source: Mplus Research - 15 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-16

TENAGA2024-11-15

DPHARMA2024-11-15

DPHARMA2024-11-15

SIMEPROP2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-13

ADVCON2024-11-13

CDB2024-11-13

CDB2024-11-13

DPHARMA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-12

CDB2024-11-12

CDB2024-11-12

DPHARMA2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-11

CDB2024-11-11

CDB2024-11-11

DPHARMA2024-11-11

DPHARMA2024-11-11

DPHARMA2024-11-11

DPHARMA2024-11-11

DPHARMA2024-11-11

DPHARMA2024-11-11

SIMEPROP2024-11-11

SIMEPROP2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TENAGA2024-11-08

CDB2024-11-08

DPHARMA2024-11-08

SIMEPROP2024-11-08

SIMEPROP2024-11-08

TENAGA2024-11-08

TENAGA2024-11-07

BSTEAD2024-11-07

CDB2024-11-07

CDB2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

SIMEPROP2024-11-07

SIMEPROP2024-11-07

SIMEPROP2024-11-07

TENAGA2024-11-07

TENAGA2024-11-06

CDB2024-11-06

PHARMA2024-11-06

PHARMA2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TENAGA2024-11-05

CDB2024-11-05

SIMEPROP2024-11-05

SIMEPROP2024-11-05

SIMEPROP2024-11-05

TENAGA2024-11-05

TENAGAMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024