Mplus Market Pulse - 23 Sep 2020

MalaccaSecurities

Publish date: Wed, 23 Sep 2020, 10:15 AM

Finding stability

Market Review

Malaysia: The FBM KLCI (+0.4%) snapped a three-day losing streak after hovering mostly in the positive territory as the key index outperformed the mostly negative regional peers yesterday. The lower liners, however, finished mixed, while the broader market also ended on a mixed note with the healthcare sector (+1.7%) leading the advancers list.

Global markets: US stockmarkets rebounded overnight as the Dow (+0.5%) rebounded from three-day slump after US Federal Reserve policymakers demand the Congress to deliver another round of stimulus measures to aid the sluggish economy. European stockmarkets ended on a mixed note, but Asia stockmarkets remained downbeat yesterday.

The Day Ahead

Despite yesterday recovery which was mainly led by bargain hunting activities, the near term outlook remains indifferent with uncertainties remain on the table. We also note that significant upsides over the near term will be capped by the lack of fresh catalyst which may keep investors at bay. In the meantime, the lower liners are also going on an extended consolidation spell as traders were quick to lock in any profits.

Sector focus: It appears that there are mild signs of bargain hunting in selected beaten down healthcare stocks, while vaccine-related theme are also in focus. We also favour the consumer sector on the economy recovery play theme with unemployment data demonstrate improvement over the past months.

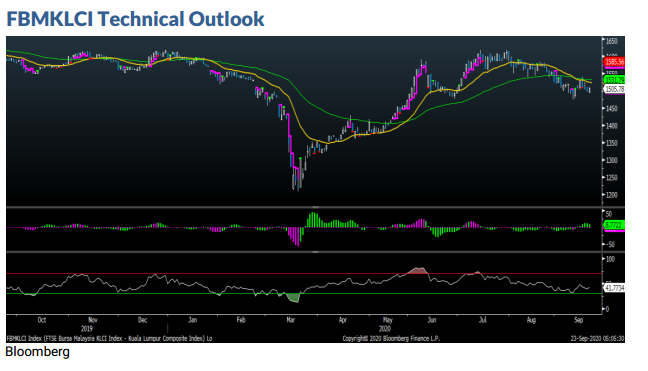

Despite opening lower, the FBM KLCI was quick to recover all its intraday losses before closing higher for the first time in four days. The rebound has sent the key index back above the 1,500 level. Still, we think that the consolidation will continue to take place with next resistances at 1,515 and 1,555. The support, meanwhile are located at 1,480, followed by 1,450. Indicators have turned mixed as the MACD Histogram has turned green, but the RSI remains below 50.

Company Brief

Notion Vtec Bhd's unit Notion Venture Sdn Bhd has secured a sales contract to supply nitrile gloves to a European firm for US$82.2m (RM337.8m). The gloves will be delivered over two tranches to Europe for meeting the medical needs in Covid- 19 affected areas. (The Star)

T7 Global Bhd’s unit T7 Gasetc Sdn Bhd, which owns 51.0% stake in T7 Wenmax Sdn Bhd, had proposed to acquire the remaining 49.0% stake in the latter from Megaxus Resources Sdn Bhd in a RM39.2m deal which will enable it to recognise full profit contribution from the latter which has an order book of about RM400.0m. (The Star)

Kanger International Bhd has inked a proxy agreement with Shenzhen Public Health Technology Co, Ltd (SZPHT) to get the rights to distribute a COVID-19 vaccine developed by China National Pharmaceutical Group Corp (Sinopharm). Under the agreement, SZPHT will get dealership status from Sinopharm, following which Kanger would get the right to distribute the vaccine in Southeast Asia. (The Edge)

Asdion Bhd and five of its directors have been reprimanded by Bursa Malaysia for breaching ACE Market Listing Requirements, with the five directors being hit with a collective fine of RM145,000. Asdion was found to have failed to have carried out a limited review on its quarterly report for the financial periods ended 31st March 2018 and 30th June 2018, with its board accused of failing to look at the competency in its finance and accounting resources and ensuring proper procedures for financial reporting. Other offences included the failure of its directors to attend required training, as well as a 107.5% deviation between its unaudited loss after tax and minority interests and audited figures for the financial year ended 31st March 2018. (The Edge)

Pasukhas Group Bhd has signed a partnership agreement with BB Energy Sdn Bhd to extract river sand for the export market. BB Energy has been granted a concession and temporary occupational licence for Sungai Miang, Mukim Pekan, Pahang, by Pengurusan Pasir Pahang Bhd (PPPB). Under the agreement, Pasukhas will have the exclusive rights to access, extract, dredge, sell and distribute the river sand originating from Pekan, Pahang. The contract will last for a year, with the option to extend for another year — involving 200,000m³ of sand production per month. (The Edge)

KESM Industries Bhd’s 4QFY20 net loss stood at RM3.3m, vs. a net profit of RM2.3m recorded in the previous corresponding quarter amid lower volume from its burn-in, testing and electronic manufacturing services. Revenue for the quarter declined 34.8% YoY to RM46.3m. A final dividend of 6.0 sen per share was proposed. (The Edge)

Widad Group Bhd is collaborating with IAQ Solutions Sdn Bhd to develop and supply solutions and services for indoor air quality solutions, particularly to prevent and control airborne diseases. The collaboration is expected to enhance its end-to end facilities management offerings. (The Edge)

Malakoff Corp Bhd is to acquire a 71.0-ha. piece of land in Alor Gajah, Melaka for RM150.0m for future renewable energy projects. The land could be used for large scale solar, waste to energy, biomass and biogas power plants. The land is currently an oil palm plantation with a tree-age profile of 13 to 19 years that has produced 710 tonnes of fresh fruit bunches (FFB) over the past three years. (The Edge)

Axiata Group Bhd president and CEO Tan Sri Jamaludin Ibrahim will be retiring as chairman of the group's mobile arm Celcom Axiata Bhd on 15th October 2020, while Datuk Izzaddin Idris will take over the chairmanship effective 16th October 2020. Izzaddin is currently the executive director/deputy group CEO and group CEO-designate of Axiata, and a director of the board of Celcom Axiata. Jamaludin, whom Axiata announced in January has had his contract as president and CEO of Axiata that expired on 2nd March 2020 extended till year end, will continue in these roles until end-December 2020. (The Edge)

Iconic Worldwide Bhd has proposed a private placement of up to 97.1m shares, representing not more than 30.0% of its issued capital, to raise up to RM47.6m for its personal protective equipment (PPE) business. Of the proceeds, RM46.6m would be used to fund part of its planned RM155.5m investment into its PPE business, which would involve buying land for a new production facility and the installation of glove dipping and face mask production lines there. The remainder would be funded through a combination of internal funds and borrowings. (The Edge)

Source: Mplus Research - 23 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

T7GLOBAL2024-11-17

WIDAD2024-11-16

NOTION2024-11-15

AXIATA2024-11-15

MALAKOF2024-11-13

MALAKOF2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-12

AXIATA2024-11-12

AXIATA2024-11-12

MALAKOF2024-11-12

T7GLOBAL2024-11-11

AXIATA2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

MALAKOF2024-11-08

T7GLOBAL2024-11-07

AXIATA2024-11-06

AXIATA2024-11-06

MALAKOF2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-05

AXIATA2024-11-05

MALAKOF2024-11-05

MALAKOF2024-11-05

T7GLOBALMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024