Mplus Market Pulse - 8 Feb 2021

MalaccaSecurities

Publish date: Mon, 08 Feb 2021, 11:44 AM

Market Review

Malaysia: The FBM KLCI (-0.4%) formed a bearish candle and erased all its previous session gains, snapping a three-day winning streak on profit taking activities with more than two-third of the key index components finished in the red. Meanwhile, both the lower liners and the broader market closed on a mixed tone.

Global markets: US stockmarkets remain upbeat with the Dow (+0.3%) ascending higher for the fifth straight session, driven by the optimism over the prospect of economic recovery following the acceleration of Covid-19 vaccine rollout, whilst the number of new cases continued to dwindle. European stockmarkets closed mixed, while Asia stockmarkets ended mostly higher.

The Day Ahead

The FBM KLCI underperformed its regional peers last Friday, as gloves and plantation heavyweights lost their ground following their recent rallies. The selling pressure among local and foreign institutions continued to weigh on the local bourse despite buying interest among local retail investors. With the US stockmarkets inching higher last Friday, we expect the local bourse may see some rebound, but traders should be trading cautiously ahead of the Lunar New Year holiday. The lower liners may see some rebound ahead of the vaccine rollout.

Sector focus: We expect buying support to surface within the plantation counters today on the back of higher crude palm oil price. Besides, technology, furniture and consumers related stocks should continue their uptrend move throughout the reporting season period.

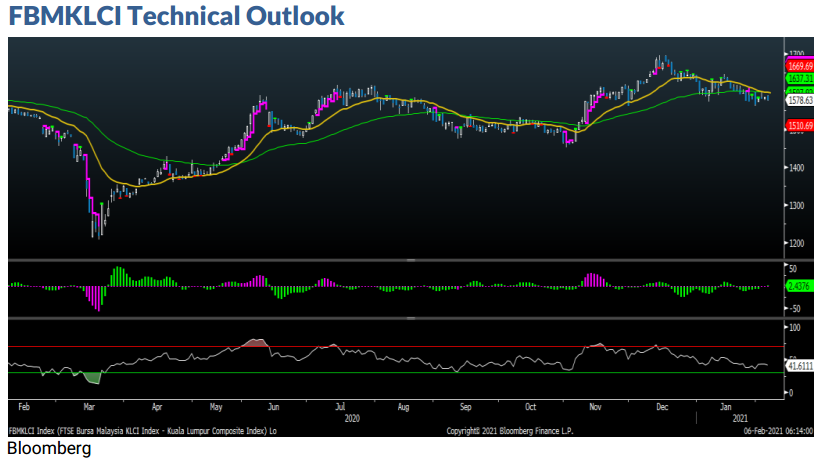

The FBM KLCI snapped its three-day gains, but managed to close marginally above the EMA120 level. We think the 1,600 is still crucial for the FBM KLCI, should it hovers below 1,600, the key index should continue to trade on a rangebound manner. Support is pegged around 1,560, followed by 1,550. On the technical indicators, the MACD Histogram has turned red, while the RSI remained below 50.

Company Brief

MBM Resources Bhd has appointed Muhammad Fateh Teh Abdullah, the former head of automotive distribution division at Hicom Holdings Bhd, as its new President and CEO effective 8th February 2021. With the appointment of Fateh, Annie Chin will cease to be the acting president & CEO of the Group and will resume her position as the Group’s Chief Financial Officer. (The Star)

Media Chinese International Ltd issued a profit warning to inform its shareholders that the group’s quarterly earnings will more than halve for 3QFY21. The dual-listed media group is expecting its profit attributable to owners to be in the range of US$1.2m (RM4.9m) to US$1.5m. (The Edge)

Techbond Group Bhd has proposed to undertake a bonus issue of up to 431.3m new shares on the basis of five bonus shares for every four existing shares, with the entitlement date to be determined later. (The Edge)

Toyo Ventures Holdings Bhd intends to raise up to RM46.2m via a private placement to fund its Vietnam power plant project. The group is planning to issue up to 16.1m new shares or 10.0% of its share capital to third-party investors to be identified later. The indicative price of the placement shares is assumed at RM2.88 each. (The Edge)

Vizione Holdings Bhd has proposed another private placement just after eight months, to raise funds to be used for its existing and future projects, as well as capital expenditure. It plans to raise up to RM48.4m by placing up to 30.0% of its issued shares to third party investors to be identified later, with an indicative issue price of 20.5 sen per placement share. (The Edge)

mTouche Technology Bhd is raising fresh capital of up to RM79.4m via a cash call to finance its diversification into the distribution and sale of Covid-19 test kits, as well as funding of the wellness business and working capital. (The Edge)

Pertama Digital Bhd’s CEO Aiza Azreen Ahmad has resigned from her post after a three-month stint at the Government technology group, citing her pursuit of other opportunities. She was appointed as CEO of the group on 25th November 2020. (The Edge)

Source: Mplus Research - 8 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024