Mplus Market Pulse - 18 Feb 2021

MalaccaSecurities

Publish date: Thu, 18 Feb 2021, 10:09 AM

Market Review

Malaysia: The FBM KLCI (-0.7%) succumbed to further profit taking activities after languishing in the negative territory for the entire trading session with more than two-third of the key index components finished in the red. The lower liners were traded largely on a mixed tone, while the broader market trended mostly lower amid the negative market breadth.

Global markets: US stockmarkets ended mixed again as the Dow added 0.3%, but the S&P 500 and Nasdaq shed 0.03% and 0.6% respectively dragged down by the weaknesses in technology sector. European stockmarkets extended their losses, while Asia stockmarkets were mostly downbeat.

The Day Ahead

Following the announcement of MCO extension in several states, the local bourse endured a rough ride as economic recovery progress took another backseat. The weakness was also largely in line with the negative performance across regional peers which we reckon that the pullback is deem to be healthy to allow the recent gains to be digested. While the market liquidity has yet to taper, we think the rotational play amongst the lower liners may prolong with the on-going batch of corporate earnings release largely in focus.

Sector focus: In view of the recent downturn in gloves manufacturer stocks, we think that valuations have now turned more appealing. Vaccine-related stocks are also in the limelight amid the roll-out of national vaccination plan. CPO price re capturing RM3,600/MT may garner some trading interests within the plantation sector, while energy stocks may continue to ride on the higher crude oil prices.

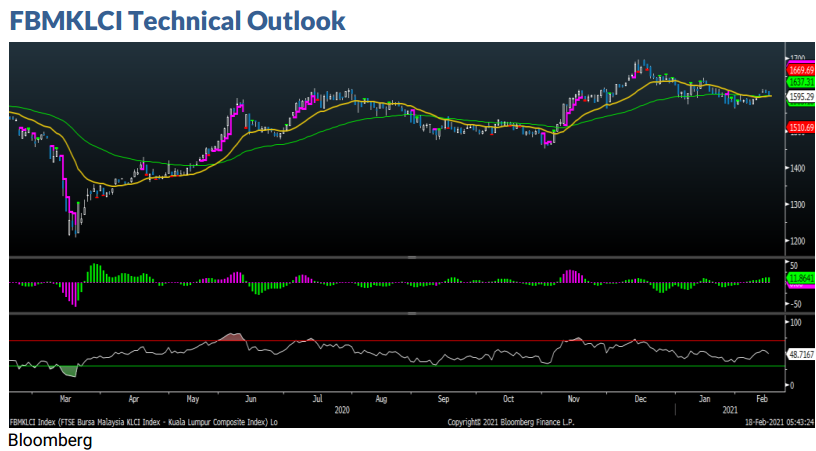

The FBM KLCI has formed a bearish candle as the key index has slipped below the 1,600 level. Although the pullback stance is still largely in place, we think that the downside risk will be cushioned towards the support at 1,580, followed by 1,560. On the flipside, a breakout above 1,600 may indicate that recovery is back on track towards the next resistances at 1,620-1,650. Indicators have turned weaker as the MACD Histogram has turned red, while the RSI has slipped below 50.

Company Brief

Datasonic Group Bhd has announced that the government has ordered six additional electronic-gate system (e-gate) from the company for an extra RM1.7m. This is on top of the original RM7.0m contract, announced on 3rd February 2021, to supply 16 units of foreigner e-gate with facial recognition system at the Malaysia Singapore entry/exit point to the Immigration Department. (The Star)

Kuala Lumpur Kepong Bhd’s (KLK) 1QFY21 net profit jumped 113.8% YoY to RM357.4m, driven by a jump in plantation earnings. Revenue for the quarter rose 5.5% YoY to RM4.30bn. (The Edge)

Mr DIY Group (M) Bhd’s 4QFY20 net profit increased 19.1% YoY to RM108.3m, on the rise in average monthly sales per store, as well as sales contribution from the 141 net new stores added during the year. Revenue for the quarter grew 24.5% YoY to RM768.3m. An interim dividend of 0.7 sen per share, payable on 8th April 2021 was declared. (The Edge)

Uzma Bhd’s unit has bagged two licences from the Energy Commission to import liquefied natural gas (LNG) for regasification in the country. The licences allow Uzma to bring LNG into a regasification terminal by any means other than by transhipment, and to transport or distribute natural gas via regasification terminal or pipelines to consumer premises within Malaysia, pursuant to the implementation of Third-Party Access system. (The Edge)

MGB Bhd has bagged a RM442.8m contract to construct affordable home projects in Dengkil and Ijok in Selangor. Its wholly-owned subsidiary MGB Construction & Engineering Sdn Bhd was awarded the contract by Seloka Sinaran Sdn Bhd (SSSB) and Kemudi Ehsan Sdn Bhd (KESB). Both SSEB and KESB are subsidiaries of LBS Bina Group Bhd whom also owns the majority of MGB shares. (The Edge)

Source: Mplus Research - 18 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

DSONIC2024-11-22

DSONIC2024-11-22

KLK2024-11-22

KLK2024-11-22

LBS2024-11-22

LBS2024-11-22

LBS2024-11-22

MGB2024-11-22

MRDIY2024-11-22

MRDIY2024-11-22

UZMA2024-11-22

UZMA2024-11-21

DSONIC2024-11-21

DSONIC2024-11-21

KLK2024-11-21

KLK2024-11-21

KLK2024-11-21

MGB2024-11-21

MGB2024-11-21

MGB2024-11-21

MRDIY2024-11-21

UZMA2024-11-21

UZMA2024-11-21

UZMA2024-11-20

KLK2024-11-20

KLK2024-11-20

KLK2024-11-20

KLK2024-11-20

MRDIY2024-11-20

UZMA2024-11-19

DSONIC2024-11-19

KLK2024-11-19

LBS2024-11-19

LBS2024-11-19

MRDIY2024-11-19

MRDIY2024-11-18

KLK2024-11-18

KLK2024-11-18

MRDIY2024-11-16

MRDIY2024-11-15

KLK2024-11-15

KLK2024-11-15

KLK2024-11-15

LBS2024-11-15

LBS2024-11-15

LBS2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

UZMA2024-11-14

KLK2024-11-14

KLK2024-11-14

KLK2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

UZMA2024-11-13

KLK2024-11-13

KLK2024-11-13

MRDIY2024-11-13

MRDIY2024-11-13

UZMA2024-11-13

UZMA2024-11-12

DSONIC2024-11-12

DSONIC2024-11-12

KLK2024-11-12

KLK2024-11-12

KLK2024-11-12

KLK2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIYMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024