Mplus Market Pulse - 30 Mar 2022

MalaccaSecurities

Publish date: Wed, 30 Mar 2022, 10:18 AM

Recovery on the cards

Market Review

Malaysia: The FBM KLCI (-0.9%) turned volatile with more than two thirds of the key index members closed in red as profit taking activities escalated yesterday. The lower liners, however, closed flat after recovering from their intraday lows, while the construction sector (+0.01%) outperformed the negative broader market.

Global markets: Wall Street extended its lead as the Dow (+1.0%) advanced for the fourth straight session, lifted by optimism over the progress of negotiations between Russia and Ukraine. The European stock markets also trended higher, while Asia stock markets closed mostly positive.

The Day Ahead

Without significant fresh catalysts, the local market traded lower with as 12 out of 13 sub-indices joined the FBM KLCI in the negative territories. Nevertheless, we opine that the buying interest may return, taking cues from the overnight Wall Street performance as investors cheered the positive developments from the peace talks between Russia and Ukraine. We expect a broad based recovery in our local exchange. Meanwhile, on the commodity prices, the Brent crude oil traded lower around the USD110 per barrel mark, while the CPO price hovered around RM6,000.

Sector focus: As both the crude oil and CPO prices are still in a rangebound mode, we believe traders may avoid the energy and plantation sectors, while the technology stocks may ride on the positive cues from Nasdaq overnight. Also, traders may position themselves in the recovery-themed stocks such as consumer, financial, tourism and aviation stocks in the anticipation of the borders reopening by 1st April.

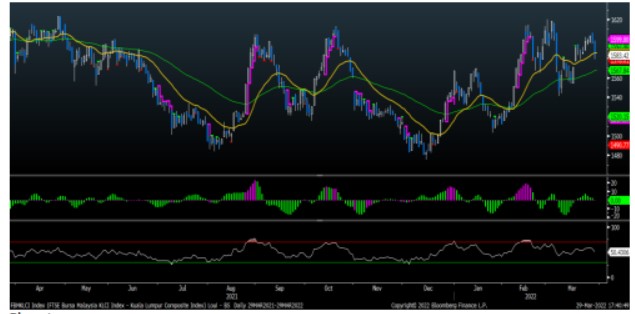

FBMKLCI Technical Outlook

The FBM KLCI extended its pullback move as the key index closed below the daily EMA9 and EMA20 level. Technical indicators, however, remained positive as the MACD Histogram has extended a positive bar, while the RSI hovered above 50. The resistance is located at 1,600, while the support is pegged around 1,550-1,560.

Company Brief

Artroniq Bhd, which received an unusual market activity (UMA) query from Bursa Malaysia has reported that it is currently in discussions to acquire a stake in a ICT company. The group is currently in discussions to acquire a stake in a ICT company as well as to monetise the assets of the group's previous manufacturing business, wherein the details have yet to be finalised at this juncture. (The Star)

Hiap Teck Venture Bhd’s 2QFY22 net profit fell 6.0% YoY to RM28.2m, mainly due to lower sales volume that offset the higher selling price. Revenue for the quarter fell 6.4% YoY to RM333.2m. (The Star)

SCGM Bhd’s 3QFY22 net profit fell 22.4% YoY to RM6.3m, due to higher deferred tax expenses. Revenue for the quarter, however, rose 14.1% YoY to RM71.3m. A third interim dividend of 1.4 sen per share, payable on 28th April 2022 was declared. (The Star)

Advanced Packaging Technology (M) Bhd (APT) has proposed a reorganisation under which a newly formed company; Greater Bay Holdings Bhd will take over its issued share capital and assume its listing status. Under the proposal, APT will cease its function as the listed vehicle within the APT Group and continue as an investment holding company, as well as an operational company carrying out its existing business of manufacturing and distributing flexible packaging materials. Besides the reorganisation, APT has also proposed a share split involving the subdivision of every 1 existing share into 4 subdivided shares. (The Edge)

Pos Malaysia Bhd will be increasing its fuel surcharge by 5.0% for shipments that move between Peninsular Malaysia and Sabah/Sarawak, effective on 1st April 2022. With the ongoing tension and very unfortunate events taking place in Ukraine, jet fuel price has surged sharply recently. (The Edge)

Yinson Holdings Bhd’s 4QFY22 net profit dropped 3.0% YoY to RM65.0m, mainly due to higher financing costs arising from the drawdown of a RM1.00bn sukuk in December 2021 and fair value losses on investments of RM29.0m. Revenue for the quarter fell 40.6% YoY to RM741.0m. (The Edge)

Kronologi Asia Bhd's 4QFY22 net profit climbed 15.2% YoY to RM6.6m, on the back of higher revenue. Revenue for the quarter gained 0.7% YoY to RM99.5m. (The Edge)

Apollo Food Holdings Bhd's 3QFY22 net profit rose 44.7% YoY to RM5.0m, due to higher sales. Revenue for the quarter improved 26.3% YoY to RM54.3m. (The Edge)

Kim Loong Resources Bhd’s 4QFY22 net profit surged 215.6% YoY to RM31.6m, driven by higher palm oil prices. Revenue for the quarter jumped 95.3% YoY to RM495.6m. A dividend of 5.0 sen per share was proposed. (The Edge)

LB Aluminium Bhd's 3QFY22 net profit fell marginally by 0.6% YoY to RM14.8m, due to a higher tax provision and losses in its property business. Revenue for the quarter, however, rose 36.6% YoY to RM197.1m. (The Edge)

Source: Mplus Research - 30 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

KRONO2024-11-17

YINSON2024-11-16

HIAPTEK2024-11-16

POS2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

HIAPTEK2024-11-15

HIAPTEK2024-11-15

YINSON2024-11-15

YINSON2024-11-15

YINSON2024-11-15

YINSON2024-11-14

HIAPTEK2024-11-14

YINSON2024-11-14

YINSON2024-11-14

YINSON2024-11-13

GBAY2024-11-13

GBAY2024-11-13

YINSON2024-11-13

YINSON2024-11-12

YINSON2024-11-12

YINSON2024-11-12

YINSON2024-11-11

GBAY2024-11-11

GBAY2024-11-11

YINSON2024-11-11

YINSON2024-11-11

YINSON2024-11-11

YINSON2024-11-08

YINSON2024-11-08

YINSON2024-11-08

YINSON2024-11-07

KRONO2024-11-07

YINSON2024-11-07

YINSON2024-11-07

YINSON2024-11-07

YINSON2024-11-07

YINSON2024-11-06

KMLOONG2024-11-06

YINSON2024-11-06

YINSON2024-11-06

YINSON2024-11-06

YINSON2024-11-05

YINSON2024-11-05

YINSON2024-11-05

YINSONMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024