Mplus Market Pulse - 13 Apr 2022

MalaccaSecurities

Publish date: Wed, 13 Apr 2022, 08:41 AM

Slipped below 1,600

Market Review

Malaysia:. The FBM KLCI (-0.5%) was dragged down by more than two thirds of the key index components in the red, while foreign funds snapped 15 consecutive days of net buying streak. The lower liners remained downbeat, while the broader market ended mostly lower with the healthcare sector (-1.4%) taking the worst hit.

Global markets:. Wall Street erased all its intraday gains to finish mildly lower as the Dow (-0.2%) fell after the jump in WTI crude oil price back above USD100/bbl stoked further inflationary pressure fears. Both the European and Asia stock markets ended mostly negative.

The Day Ahead

The FBM KLCI skidded below 1,600 in tandem with the negative sentiment across the regional markets after Wall Street overnight’s movements and foreign investors turned net seller for the session. Given the higher-than-expected US CPI data, we expect volatility to persist and investors may focus on the accelerated inflation rate which may trigger a more hawkish tone from the Fed going forward on its monetary policies. On the commodity markets, the Brent crude oil price bounced higher, trading around USD105 per barrel while the FCPO price hovered above RM6,100; both were firmer on the back of easing Covid-19 conditions in China.

Sector focus:. We expect to see buying interest continue to revolve around the plantation and O&G sectors amid firmer Brent crude oil and FCPO prices. Meanwhile, the construction and building material sectors are gaining traction as investors are putting government-related counters on the radar amid speculation of an early election.

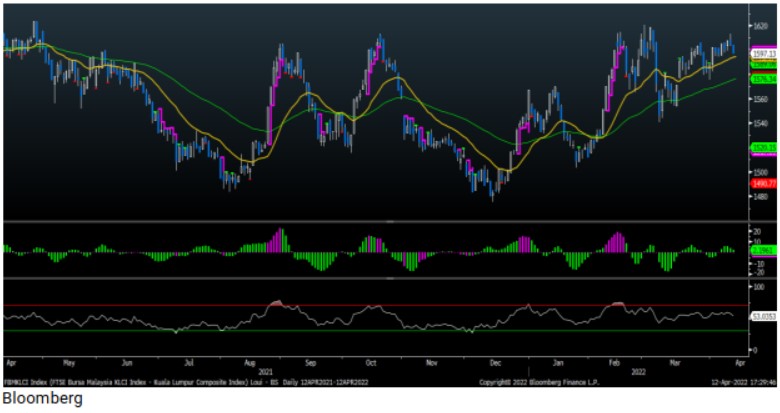

FBMKLCI Technical Outlook

The FBM KLCI extended losses, slipping below the key 1,600 level and its daily EMA9. Technical indicators were positive but weakening as the Histogram trended lower albeit still hovering above the zero line, while the RSI is threading above 50. Resistance is set at 1,600-1,620, while the support is located around 1,580

Company Brief

DRB-Hicom Bhd has signed a memorandum of understanding (MOU) with the Perak state government for the newly launched Automotive Hi-Tech Valley (AHTV) project to jointly identify suitable additional land in the area to be earmarked for AHTV. The current area surrounding the Proton Tanjung Malim plant measures 1,618.7-ha with most already occupied by Universiti Pendidikan Sultan ldris, existing vendors, as well as commercial premises and residential properties. (The Star)

Artroniq Bhd has proposed to acquire the remaining 49.0% stake in Artroniq Innovation Sdn Bhd (AISB) for RM14.7m. The acquisition would be satisfied via the issuance and allotment of 26.1m Artroniq shares at the issue price of RM0.5639 per Artroniq Share. As part of its strategy to expand its profitable ICT business, Artroniq has in 2021 established AISB as a 51.0%-owned subsidiary to undertake the provision of POS solutions and distribution of POS hardware, peripherals and related services. (The Star)

FGV Holdings Bhd's March 2022 crude palm oil production climbed 25.5% QoQ to 215,689MT, as the company’s oil palm fresh fruit bunch (FFB) output rose. The group FFB output rose 25.1% QoQ to 311,578MT. (The Edge)

Kejuruteraan Asastera Bhd (KAB) has inked a power purchase agreement with Mydin Mohamed Holdings Bhd for a solar photovoltaic (PV) system at Mydin Tunjong Hypermarket in Kelantan. The group will design, operate and maintain a grid-connected solar PV energy system on the roof of the hypermarket’s open car park. (The Edge)

Tenaga Nasional Bhd (TNB) will provide smart energy and renewable energy (RE) solutions as the main source of electricity in S P Setia Bhd’s new residential and commercial development projects. The partnership involves the installation of a PV solar system on the roof, the provision of battery solution installation, and the provision of EV charging facilities in S P Setia’s new residential and commercial development project. (The Edge)

Brahim’s Holdings Bhd's share price dropped 33.3% yesterday to a record low of 1.0 sen after the shares trading will be suspended from 15th April 2022, pending Bursa Malaysia’s decision on the company's appeal against the delisting, after the bourse rejected its application for time extension to submit its regularisation plan. (The Edge)

GIIB Holdings Bhd has reported that the recent suspension of one of its directors was to facilitate an investigation into his management and handling of its glove business and accounts. The suspension of executive director Wong Weng Yew from his employment with the group since 28th March 2022, with the suspension extended until 25th April 2022, pending evaluation of his reply to the show cause letter issued to him. (The Edge)

MY EG Services Bhd (MYEG)’s Zetrix blockchain has completed the foundational development for its Layer-1 blockchain functionalities and will launch its mainnet on 15th April 2022. The Layer-1 infrastructure will host applications, protocols and networks to be deployed on top of its proprietary smart contracts and proof-of stake (PoS) consensus mechanisms across a network of validator nodes. (The Edge)

Scomi Group Bhd sank to all-time low of 0.5 sen yesterday, on potential delisting of the PN17 company. This came following the regulator's rejection of its request for further extension of time to submit its regularisation plan. Trading of its shares is slated for suspension with effect from 20th April 2022. (The Edge)

LYC Healthcare Bhd has proposed a private placement of up to 10.0% of its issued shares to raise as much as RM10.3m to finance its business expansion and working capital. Up to 46.5m placement shares will be issued to third party investors at a price to be determined later. From the proceeds, RM5.2m is earmarked for business expansion and RM5.0m for working capital. (The Edge)

CSH Alliance Bhd's wholly owned subsidiary Alliance EV Sdn Bhd (AEV) has been appointed as distributor for commercial electric vans effective 1st April 2022. CSH Alliance has received the contract from BYD Malaysia Sdn Bhd, a subsidiary of China-based technology company BYD Co Ltd. (The Edge)

UEM Sunrise Bhd has completed its issuances of Islamic Commercial Papers (ICPs) and Islamic Medium Term Notes (IMTNs) with nominal values of RM100.0m and RM110.0m respectively. The issuances are under the group's new ICP and IMTN programmes established in October 2021. The ICPs have a tenure of 12 months, while the IMTNs have a tenure of 3 years. (The Edge).

Source: Mplus Research - 13 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

MYEG2024-11-17

SPSETIA2024-11-16

TENAGA2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

ARTRONIQ2024-11-15

DRBHCOM2024-11-15

DRBHCOM2024-11-15

SPSETIA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

UEMS2024-11-14

DRBHCOM2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-13

SPSETIA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-12

DRBHCOM2024-11-12

FGV2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

UEMS2024-11-11

DRBHCOM2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TENAGA2024-11-08

DRBHCOM2024-11-08

DRBHCOM2024-11-08

FGV2024-11-08

FGV2024-11-08

FGV2024-11-08

TENAGA2024-11-08

TENAGA2024-11-07

FGV2024-11-07

SPSETIA2024-11-07

SPSETIA2024-11-07

TENAGA2024-11-07

TENAGA2024-11-07

VELOCITY2024-11-06

DRBHCOM2024-11-06

SPSETIA2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TENAGA2024-11-05

DRBHCOM2024-11-05

DRBHCOM2024-11-05

SPSETIA2024-11-05

TENAGA2024-11-05

TENAGAMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024