Mplus Market Pulse - 28 Apr 2022

MalaccaSecurities

Publish date: Thu, 28 Apr 2022, 08:47 AM

Drifting away from 1,600

Market Review

Malaysia:. The FBM KLCI (-0.7%) retreated with more than two-thirds of the key index components in red, spooked by the weakness on Wall Street overnight. The lower liners also tumbled, while the construction (+0.3%) and REIT (+0.02%) sectors outperformed the negative broader market.

Global markets:. Wall Street staged a mild recovery after coming off from the intraday highs as the Dow (+0.2%) rose on a barrage of mixed corporate earnings. The European stock markets also recovered some of its previous session losses, but Asia stock markets ended mostly lower.

The Day Ahead

The FBM KCLI extended its sideways consolidation phase below the 1,600 level on the back of industrial products heavyweights-led selldown following the overnight selling activities on Wall Street. While global uncertainties may still loom, the recovery-themed sector on the local bourse may gain traction as further relaxation of Covid-19 SOPs effective 1st May 2022 could signal a greater extent of economic recovery. On the commodities market, the FCPO surged above RM6,900 following Indonesia’s decision to widen the scope of its export ban to include CPO. The crude oil price remained supported above USD100.

Sector focus:. We reckon the strong surge in FCPO sparked by the Indonesia’s widening of export ban may ignite another round of rally in the plantation sector. Besides, the revision of mask mandate may benefit the recovery-themed sector such as consumer, tourism and banking.

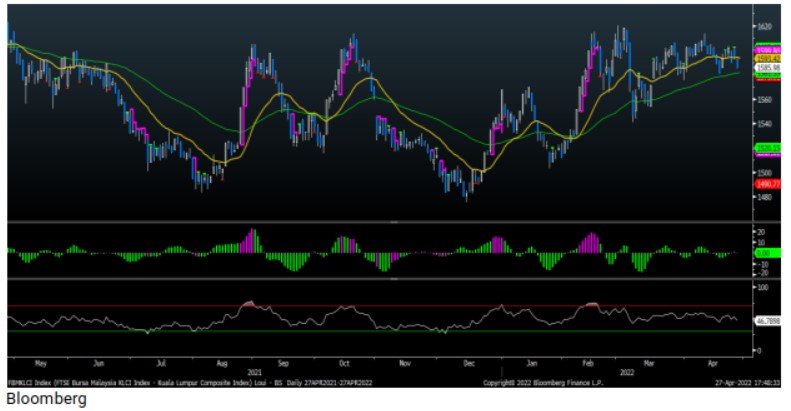

FBMKLCI Technical Outlook

The FBM KLCI retreated and skidded below the SMA50 level as the key index still struggling to find direction. Technical indicators remained neutral as the Histogram was still swaying around the zero-line, while the RSI hovered below 50. 1,570-1,580 is the immediate support to watch, while 1,600 and 1,620 will act as resistance points.

Company Brief

Fraser and Neave Holdings Bhd’s (F&N) 2QFY22 net profit fell 9.3% YoY to RM93.9m, amid commodity price pressures and unfavourable foreign exchange translation. Revenue, however, rose 1.8% YoY to RM1.11bn. (The Star)

Samchem Holdings Bhd’s 1QFY22 net profit rose 3.4% YoY to RM19.6m, due to an increase in average selling price. Revenue for the quarter grew 10.2% YoY to RM364.5m. (The Star)

ACE Market-bound MN Holdings Bhd has secured contracts worth RM32.5m of underground utilities and substation engineering services and solutions in Selangor and Johor. The company received a letter of award from Syarikat Pembenaan Yeoh Tiong Lay Sdn Bhd. (The Edge)

Malaysia Marine and Heavy Engineering Holdings Bhd (MHB) has inked a strategic alliance with Singapore-headquartered Dyna-Mac Holdings Ltd for a consortium agreement to cooperate and jointly bid on targeted international projects. The deal was signed between Malaysia Marine and Heavy Engineering Sdn Bhd and Dyna Mac Engineering Services Pte Ltd. (The Edge)

Top Glove Corp Bhd's wholly-owned subsidiary TG Excellence Bhd will cancel RM40.0m worth of Islamic bonds under the latter's RM3.00bn perpetual sukuk programme on 29th April 2022 pursuant to TG Excellence's buy-back transaction notification. (The Edge)

Unisem (M) Bhd's 1QFY22 net profit rose 11.6% YoY to RM50.7m, driven by higher sales volume as well as improvement in average selling prices. Revenue for the quarter increased 13.5% YoY to RM424.5m. (The Edge)

GIIB Holdings Bhd has announced a further 14-day suspension of Wong Weng Yew as one of its executive directors as an external independent auditor had just commenced an investigation into Wong's previous handling of the company's accounts. The suspension was previously extended until 25th April 2022, pending the evaluation of his reply to a show-cause letter issued to him. (The Edge)

Petronas Gas Bhd (PetGas) plans to set aside some RM1.40bn in capital expenditure for the current year, compared with RM1.20bn last year, as it expects a step-up in maintenance activities for major projects announced last year, in line with its growth aspirations. The 5 projects for which a final investment decision was made last year are a 42km lateral gas pipeline to Pulau Indah, new oxyalkylate facilities, a new lateral gas pipeline in Sepang, the Southern Peninsular Gas Utilisation expansion, a new compressor station in Kluang and the Terengganu Crude Oil Terminal off-gas rerouting project in Kerteh. (The Edge)

Shin Yang Shipping Corporation Bhd has proposed to acquire 100.0% of Piasau Gas Sdn Bhd for RM22.8m cash. Piasau Gas is principally engaged in the business of manufacturing, distribution and marketing of industrial gases, provision of services and maintenance and trading in welding equipment and machinery. (The Edge)

Vitrox Corporation Bhd’s 1QFY22 net profit jumped 62.9% YoY to RM50.0m, underpinned by higher revenue and stronger USD. Revenue for the quarter expanded 42.5% YoY to RM185.3m. (The Edge)

IGB Real Estate Investment Trust (REIT) 1QFY22 net property income soared 72.7% YoY to RM107.7m, on reversal for impairment of trade receivables in the quarter under review and lower rental support given to tenants. Revenue for the quarter added 34.6% YoY to RM133.8m. An income distribution of 2.51 sen per unit, payable on 30th May 2022 was declared. (The Edge)

Ireka Corp Bhd has appointed Messrs Baker Tilly Monteiro Heng PLT as its new external auditor for the financial year ended 30th June 2022 until the next AGM. Ireka recently received a written notice from Crowe Malaysia PLT indicating its intention to resign as the external auditors of the company owing to a lack of audit resources. (The Edge)

CapitaLand Malaysia Trust (CLMT) 1QFY22 net property income rose 45.0% YoY to RM36.1m, on the back of a gradual reopening of more economic sectors. Revenue for the quarter grew 19.3% YoY to RM67.6m. Distributable income amounted to 0.95 sen per unit was announced. (The Edge)

Kossan Rubber Industries Bhd’s 1QFY22 net profit plunged 91.0% YoY to RM90.1m, as demand for gloves and their average selling price normalised following greater control of Covid-19 infections worldwide. Revenue for the quarter fell 68.5% YoY to RM690.6m. (The Edge)

British American Tobacco (Malaysia) Bhd (BAT Malaysia) has urged the government to focus on tackling the tobacco black market, which is expected to see an increase in activity following the reopening of borders on 1st April 2022. The black market currently commands 60.0% of the total market and causes a loss of RM5.00bn in tax revenue every year. (The Edge)

Bursa Securities had issued a show-cause notice to Anzo Holdings Bhd over the suspension and delisting of its securities. The regulator has informed Anzo to furnish it with representations by 6th May 2022 as to why a suspension should not be imposed on the trading of its shares, as well as why Anzo should not be delisted. (The Edge)

S P Setia Bhd has proposed to undertake a renounceable rights issue of new class C Islamic redeemable convertible preference shares (RCPS-i C) to raise up to RM1.18bn on an entitlement date to be determined later. The group intends to utilise the proceeds raised to redeem all outstanding RCPS-i B which were issued in December 2017 and to repay borrowings. (The Edge)

Source: Mplus Research - 28 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

SPSETIA2024-11-17

TOPGLOV2024-11-17

UNISEM2024-11-16

BAT2024-11-16

KOSSAN2024-11-15

CLMT2024-11-15

F&N2024-11-15

IGBREIT2024-11-15

KOSSAN2024-11-15

KOSSAN2024-11-15

KOSSAN2024-11-15

KOSSAN2024-11-15

PETGAS2024-11-15

PETGAS2024-11-15

SPSETIA2024-11-15

SYGROUP2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-14

CLMT2024-11-14

F&N2024-11-14

IGBREIT2024-11-14

IGBREIT2024-11-14

KOSSAN2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

PETGAS2024-11-14

PETGAS2024-11-14

SYGROUP2024-11-14

TOPGLOV2024-11-13

F&N2024-11-13

F&N2024-11-13

IGBREIT2024-11-13

PETGAS2024-11-13

PETGAS2024-11-13

SPSETIA2024-11-13

SYGROUP2024-11-13

TOPGLOV2024-11-13

UNISEM2024-11-13

UNISEM2024-11-12

F&N2024-11-12

F&N2024-11-12

F&N2024-11-12

IGBREIT2024-11-12

IGBREIT2024-11-12

KOSSAN2024-11-12

KOSSAN2024-11-12

PETGAS2024-11-12

PETGAS2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

SYGROUP2024-11-12

SYGROUP2024-11-12

SYGROUP2024-11-11

F&N2024-11-11

F&N2024-11-11

IGBREIT2024-11-11

IGBREIT2024-11-11

IGBREIT2024-11-11

KOSSAN2024-11-11

KOSSAN2024-11-11

KOSSAN2024-11-11

PETGAS2024-11-11

PETGAS2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-11

SYGROUP2024-11-11

SYGROUP2024-11-11

TOPGLOV2024-11-11

TOPGLOV2024-11-08

F&N2024-11-08

F&N2024-11-08

IGBREIT2024-11-08

IREKA2024-11-08

KOSSAN2024-11-08

KOSSAN2024-11-08

PETGAS2024-11-08

PETGAS2024-11-08

TOPGLOV2024-11-08

TOPGLOV2024-11-08

VITROX2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

IGBREIT2024-11-07

IGBREIT2024-11-07

KOSSAN2024-11-07

KOSSAN2024-11-07

KOSSAN2024-11-07

PETGAS2024-11-07

PETGAS2024-11-07

SPSETIA2024-11-07

SPSETIA2024-11-07

SYGROUP2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

IGBREIT2024-11-06

IGBREIT2024-11-06

IGBREIT2024-11-06

KOSSAN2024-11-06

KOSSAN2024-11-06

KOSSAN2024-11-06

KOSSAN2024-11-06

KOSSAN2024-11-06

KOSSAN2024-11-06

KOSSAN2024-11-06

PETGAS2024-11-06

PETGAS2024-11-06

SPSETIA2024-11-06

TOPGLOV2024-11-06

TOPGLOV2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-05

F&N2024-11-05

F&N2024-11-05

IGBREIT2024-11-05

KOSSAN2024-11-05

KOSSAN2024-11-05

KOSSAN2024-11-05

KOSSAN2024-11-05

PETGAS2024-11-05

PETGAS2024-11-05

SPSETIA2024-11-05

SYGROUPMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024