Mplus Market Pulse - 13 May 2022

MalaccaSecurities

Publish date: Fri, 13 May 2022, 09:16 AM

Approaching oversold

Market Review

Malaysia:. The FBM KLCI (-1.1%) endured another volatile session with selling pressure across the broad, mirroring the weakness on regional peers. The lower liners turned downbeat, while all 13 major sectors on the broader market finished in red with the technology sector (-4.4%) underperformed.

Global markets:. Wall Street ended mostly lower after the Producer Price Index in April 2022 rose 11.0% YoY suggested that the inflationary pressure likely to be prolonged; the Dow (-0.3%) and S&P 500 (-0.1%) fell, but the Nasdaq rose 0.1%. The European stock markets ended lower, while Asia stock markets ended mostly negative.

The Day Ahead

The FBM KLCI fell into the negative territory in line with the regional peers as investors remained jittery following the overnight tumble on Wall Street. Given the persistent inflation worries, we believe the selling pressure may prolong on Wall Street, translating to spillover selling activities on the technology sector. On the broader market, we expect bargain hunting activities to emerge in the recovery themed and plantation sectors ahead of the reporting season. On the commodities, the crude oil was little changed at USD 107 as OPEC+ was struggling to meet the output target, while the CPO price hovered around RM6,400.

Sector focus:. Traders may focus on the banking sector following the OPR hike. Besides, we believe the energy stocks should trend higher with the elevated crude oil price. Meanwhile, the increase in value of Baltic Exchange Dry Exchange above 3,000 may signal an uptrend move in the transportation & logistics sector.

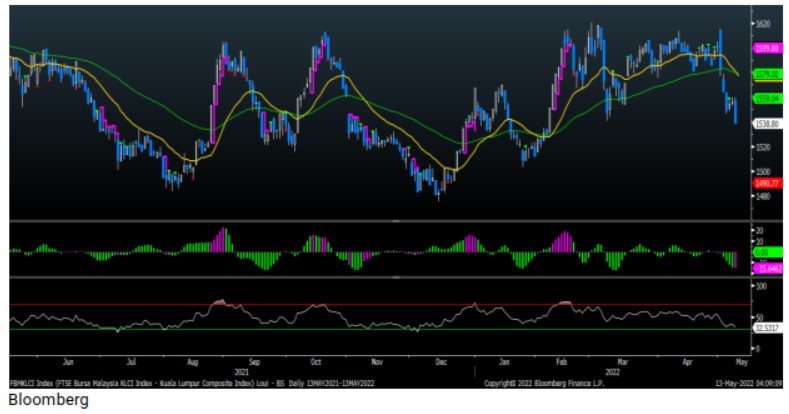

FBMKLCI Technical Outlook

The FBM KLCI pared early gains and dipped into the negative territory, swinging below the SMA200 level. Technical indicators remained negative as the MACD Histogram extended a negative bar, while the RSI is hovering below the 50 level. Next support is located around 1,500-,1,510, while the resistance is pegged around 1,570-1,580.

Company Brief

Gas Malaysia Bhd’s 1QFY22 net profit jumped 64.2% YoY to RM91.3m, mainly due to a higher gross profit, lower administrative expenses and higher contributions from its joint venture companies. Revenue for the quarter rose 54.8% YoY to RM1.78bn. A dividend of 6.87 sen per share, payable on 27th July 2022 was declared. (The Star)

Pentamaster Corp Bhd’s 1QFY22 net profit rose 26.9% YoY to RM20.4m, on improved revenue. Revenue for the grew 26.8% YoY to RM146.0m. (The Star)

Serba Dinamik Holdings Bhd and its four top executives involved in the submission of false information have paid a total of RM16.0m compound issued by the Securities Commission Malaysia (SC). Payment for the compound was made on 9th May 2022. The company and three of its subsidiaries are currently facing winding-up petition from its creditors who provided RM1.20bn in syndicated term financing after failing to service the debt in December 2021. (The Edge)

Top Glove Corp Bhd executive chairman Tan Sri Dr Lim Wee Chai has raised his stake in the rubber glove maker after buying more shares in the company, which has seen its share price fall to its lowest in over 2 years. Lim raised his direct stake in Top Glove to 27.4% after acquiring 1.5m shares at RM1.53 each. Lim also owns an indirect stake of 8.5% in Top Glove. (The Edge)

Yinson Holdings Bhd through its unit YR C&I Pte Ltd (Yinson Renewables) is forming a joint venture with Plus Xnergy Holding Sdn Bhd via its wholly-owned subsidiary Plus Xnergy Services Sdn Bhd to develop and implement commercial and industrial (C&I) rooftop solar photovoltaic (PV) projects in Malaysia. This follows the collaboration agreement signed in August 2021 when both parties expressed their intention to enter into a business alliance to invest and develop up to 250MW of PV C&I projects within and beyond Malaysia. (The Edge)

Greatech Technology Bhd 1QFY22 net profit tumbled 38.0% YoY to RM28.9m, due to the decline in gross profit (GP), share grant expenses and less net foreign exchange gain. Revenue for the quarter, however, rose 7.4% YoY to RM102.2m. (The Edge)

Sentral Real Estate Investment Trust (Sentral REIT)’s 1QFY22 net property income (NPI) dropped 2.9% YoY to RM30.5m, on lower contributions from Wisma Technip, Menara Shell and QB3-BMW. Revenue for the quarter fell 5.5% YoY to RM38.8m. (The Edge)

GFM Services Bhd plans to raise RM18.2m via a private placement of 115.1m shares to fund future investments to grow further its business as well as for the group’s working capital requirements. This marks its second cash call this year after it completed in April 2022 a private placement involving up to 20.0% of its issued shares. (The Edge)

Kelington Group Bhd's unit, Kelington Engineering (Shanghai) Co Ltd, has bagged a contract to perform gas hook up works in Beijing, China. The RMB123.0m contract (worth approximately RM80.0m), was awarded by China's largest semiconductor foundry. (The Edge)

Source: Mplus Research - 13 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-22

GREATEC2024-07-22

KGB2024-07-22

SENTRAL2024-07-22

TOPGLOV2024-07-22

TOPGLOV2024-07-22

YINSON2024-07-19

PENTA2024-07-19

SENTRAL2024-07-19

TOPGLOV2024-07-19

YINSON2024-07-19

YINSON2024-07-18

GASMSIA2024-07-18

KGB2024-07-18

PENTA2024-07-18

PENTA2024-07-18

SENTRAL2024-07-18

YINSON2024-07-17

GASMSIA2024-07-17

GASMSIA2024-07-17

PENTA2024-07-17

PENTA2024-07-17

SENTRAL2024-07-17

TOPGLOV2024-07-17

YINSON2024-07-17

YINSON2024-07-16

GASMSIA2024-07-16

GASMSIA2024-07-16

PENTA2024-07-16

PENTA2024-07-16

SENTRAL2024-07-16

TOPGLOV2024-07-16

TOPGLOV2024-07-16

YINSON2024-07-16

YINSON2024-07-15

GASMSIA2024-07-15

PENTA2024-07-15

PENTA2024-07-15

PENTA2024-07-15

PENTA2024-07-15

PENTA2024-07-15

SENTRAL2024-07-15

YINSON2024-07-15

YINSON2024-07-12

GASMSIA2024-07-12

GASMSIA2024-07-12

GASMSIA2024-07-12

GREATEC2024-07-12

GREATEC2024-07-12

PENTA2024-07-12

PENTA2024-07-12

PENTA2024-07-12

SENTRAL2024-07-12

TOPGLOV2024-07-12

TOPGLOV2024-07-12

YINSON2024-07-12

YINSONMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jul 10, 2024