Mplus Market Pulse - 17 Dec 2024

MalaccaSecurities

Publish date: Tue, 17 Dec 2024, 11:42 AM

Focus On Technology And Cocoa

Market Review

Malaysia: The FBMKLCI (-0.12%) closed lower, as Banking heavyweights dragged down sentiment on the local bourse. In contrast, the Technology sector (+0.99%) performed the best, led by VITROX (+19.0 cents), benefiting from the Trump administration's protectionist policies and a weakening ringgit environment.

Global markets: Wall Street began the week on a mixed note, with the S&P 500 and Nasdaq rising, while the Dow remained flat ahead of the upcoming FOMC meeting and key economic data set for release later this week. Meanwhile, both European and Asian markets closed in negative territory.

The Day Ahead

The FBMKLCI began the week on a softer note, as losses in Banking heavyweights weighed on sentiment in the local bourse. However, Wall Street traded mixed as investors looked ahead to the anticipated Fed interest rate cut later this week, along with several key data releases, including (i) Retail & Core Retail Sales, (ii) US GDP, (iii) Unemployment Claims, (iv) Core PCE Price Index, and (v) the BoJ monetary policy conference, setting the tone for monetary policy next year. In the commodities market, Brent crude oil traded flat at around USD73-74, as China's stimulus packages fell short of investors' expectations, and investors took a pause ahead of the FOMC meeting. Gold prices also traded flat around USD2,650 mark, while CPO prices continued to pullback for another session, traded below the support of RM 4,800.

Sector Focus: As attention shifts to the upcoming FOMC meeting, trading activities in the US may slowdown. However, we believe buying interest may emerge on the local front amid the ongoing window dressing activities throughout December. We believe stocks that linked to data center supply chain and Technology will perform well under the stronger USD environment. Meanwhile, cocoa price at a fresh record could benefit GCB.

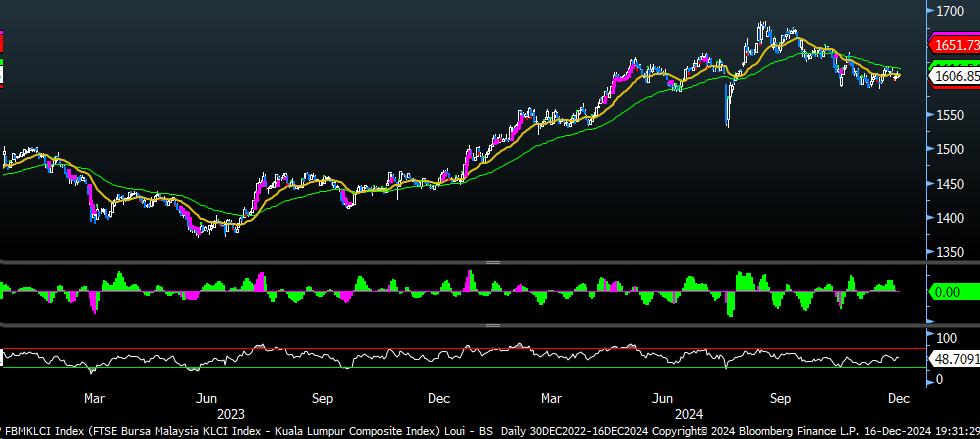

FBMKLCI Technical Outlook

The FBMKLCI continues to retreat after hitting the 60-day MA line. As the MACD Histogram has performed a rounding top formation and the RSI trended below 50, suggesting that the momentum is negative at this juncture. Resistance is envisaged around 1,621-1,626, and support is set at 1,586-1,591.

Company Briefs

Gamuda Bhd's (GAMUDA) Australian subsidiary, DT Infrastructure Pty Ltd, has secured a A$625m (RM1.8bn) engineering, procurement and construction (EPC) contract for the 585MW Goulburn River Solar Farm in New South Wales. The project, awarded by Lightsource bp's subsidiary, will commence on Jan 1, 2025, and includes civil, structural and electrical infrastructure works. (The Edge)

Aluminium products manufacturer Winstar Capital Bhd, set to debut on Bursa Malaysia's ACE Market on Dec 19, posted a 3QFY2024 net profit of RM3.31m on revenue of RM58.76m. Its aluminium extrusion segment contributed 57.7% of total revenue, followed by building materials and solar PV system installation. For the first nine months of FY2024, Winstar reported a net profit of RM6.99m on RM147.93m in revenue. (The Edge)

MClean Technologies Bhd's (MCLEAN) shareholders have approved its plan to diversify into plastic injection moulding and undertake a private placement. The company will acquire We Total Engineering's plastic injection moulding business for RM6.04m. The private placement will issue up to 49.3m new shares to raise RM12.3m, which will fund the acquisition and support working capital. Shareholders also approved a RM35m capital reduction to offset accumulated losses. (The Edge)

DRB-Hicom Bhd (DRBHCOM) has signed memoranda of understanding (MOUs) with the Malaysian Investment Development Authority (Mida) and the Malaysia Automotive, Robotics and IoT Institute (MARii) to enhance Malaysia's automotive industry through the Automotive Hi-Tech Valley (AHTV) project in Tanjung Malim, Perak. The agreements, made with its JV partner Zhejiang Geely Holding, aim to transform AHTV into a global automotive hub for next-generation vehicles and high- tech components. (The Edge)

Puncak Exotika Sdn Bhd is no longer a substantial shareholder of Sapura Industrial Bhd (SAPIND) after disposing of 500,000 shares on Dec 13 at 82 sen apiece, totalling RM410,000. This transaction reduced Puncak Exotika's stake from 5.63% to 4.95%, falling below the 5% substantial shareholding threshold. (The Edge)

Tissue paper manufacturer NTPM Holdings Bhd (NTPM) reported a net profit of RM162,000 for 2QFY2025, compared to a RM4.03m net loss a year earlier, supported by a RM5.92m forex gain. This is despite revenue declining 2.6% to RM218.77m from RM224.66m, as both its tissue paper and personal care product segments recorded weaker sales. The company declared a first interim dividend of 0.4 sen per share, payable on Jan 20. (The Edge)

Crest Group Bhd (CREST) is acquiring a RM16.5m industrial property in Puchong, Selangor, from Oasis Harvest Corp Bhd (OASIS) to establish its new headquarters and consolidate central region operations. The purchase, funded by IPO proceeds and internal funds, is below the property's RM20.05m net book value, leading to a RM3.85m net loss for Oasis Harvest. The loss-making seller plans to use the proceeds for debt repayment, marketing and working capital. The deal is expected to complete in 2Q2025. (The Edge)

Marine & General Bhd's (M&G) net profit for 2QFY2025 rose 46.7% YoY to RM12.1m from RM8.22m, driven by higher charter rates. Revenue increased 1.3% YoY to RM93.1m, supported by rising oil drilling activities and improved regional economic conditions. Despite lower utilisation rates in both upstream (75%) and downstream (77%) divisions, its upstream division remained the primary revenue contributor, making up 84% of total revenue. No dividend was proposed for the quarter. (The Edge)

George Kent (M) Bhd (GKENT) has won a RM45.5m contract from Kwasa Land Sdn Bhd for the Kwasa Damansara township development in Sungai Buloh, Selangor. The project includes constructing a suction tank, pump house, water reservoir, 11kV switching station and associated works. It will begin on January 9, 2025, with a completion target of July 8, 2027. (The Edge)

IT services provider Infomina Bhd (INFOM) has secured a US$2.6m (RM11.6m) purchase order from Hong Kong Exchanges and Clearing Ltd (HKEX) for technology application, infrastructure operations and support services. The order, effective from December 1, 2024 to December 31, 2027, includes renewing licence subscriptions, providing training, overseeing hardware and software installation, and ongoing maintenance and support services for HKEX's software environment. (The Edge)

Perdana Petroleum Bhd (PERDANA) has secured a charter contract for an anchor handling tug and supply (AHTS) vessel from IPC Malaysia BV. The contract, awarded to its subsidiary Perdana Nautika Sdn Bhd, is for a three-year period with a possible three-year extension. The contract value depends on the vessel's assignment location. The vessel will support drilling rigs, offshore installations and derrick barges, performing towing and anchor handling operations. (The Edge)

Advancecon Holdings Bhd (ADVCON) has secured a RM44.6m main infrastructure contract from Sime Darby Property Bhd (SIMEPROP) for the Elmina West development. Awarded to its subsidiary, Advancecon Infra Sdn Bhd, the project will run from January 2, 2025, to July 1, 2026. The scope includes roads, drainage, water reticulation, sewerage, telecommunications and other essential infrastructure. With this contract, the group's unbilled order book has increased to RM321.6m. (The Edge)

Source: PublicInvest Research - 17 Dec 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-17

GAMUDA2025-01-16

GAMUDA2025-01-16

GAMUDA2025-01-16

GAMUDA2025-01-16

GAMUDA2025-01-16

GKENT2025-01-16

MCLEAN2025-01-16

WINSTAR2025-01-15

CREST2025-01-15

DRBHCOM2025-01-15

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

GAMUDA2025-01-14

INFOM2025-01-14

INFOM2025-01-14

INFOM2025-01-14

INFOM2025-01-13

GAMUDA2025-01-13

GAMUDA2025-01-13

GAMUDA2025-01-13

GAMUDA2025-01-13

GAMUDA2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-13

SIMEPROP2025-01-10

DRBHCOM2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GKENT2025-01-10

SAPIND2025-01-10

SIMEPROP2025-01-10

SIMEPROP2025-01-10

SIMEPROP2025-01-10

SIMEPROP2025-01-10

SIMEPROP2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GKENT2025-01-09

MCLEAN2025-01-09

MCLEAN2025-01-09

MCLEAN2025-01-09

SAPIND2025-01-09

SIMEPROP2025-01-09

SIMEPROP2025-01-09

SIMEPROP2025-01-09

SIMEPROP2025-01-09

SIMEPROP2025-01-09

SIMEPROP2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GKENT2025-01-08

INFOM2025-01-08

INFOM2025-01-08

INFOM2025-01-08

MCLEAN2025-01-08

MCLEAN2025-01-08

MCLEAN2025-01-08

MCLEAN2025-01-08

MCLEAN2025-01-08

SIMEPROP2025-01-08

SIMEPROP2025-01-08

SIMEPROP2025-01-08

SIMEPROP2025-01-08

SIMEPROP2025-01-08

SIMEPROP2025-01-08

SIMEPROP2025-01-07

ADVCON2025-01-07

CREST2025-01-07

DRBHCOM2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

INFOM2025-01-07

SIMEPROP2025-01-07

SIMEPROP2025-01-07

SIMEPROP2025-01-07

SIMEPROP2025-01-06

DRBHCOM2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

SIMEPROP2025-01-06

SIMEPROPMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025

Created by MalaccaSecurities | Jan 08, 2025