Mplus Market Pulse - 05 Feb 2025

MalaccaSecurities

Publish date: Wed, 05 Feb 2025, 12:38 PM

Shifting Focus To The Upcoming Earnings Season

Market Review

Malaysia: The FBMKLCI (+0.70%) rebounded and closed higher at 1,564.56 pts, driven by CIMB (+19.0 sen) and PBBANK (+8.0 sen). On the broader market, the Healthcare (-0.48%) sector declined the most, as investors took a breather awaiting President Trump's response toward China's retaliatory measures.

Global markets: Wall Street extended its gains, buoyed by upbeat earnings and easing trade war fears. Meanwhile, the European market ended slightly lower due to lingering tariff uncertainties, while the Asian market jumped after President Trump agreed to pause tariffs on Mexico and Canada for 1 month.

The Day Ahead

The local bourse reversed its losses and closed mostly higher, supported by banking heavyweights. Meanwhile, despite China's retaliatory measures, Wall Street closed higher as traders shrugged off the trade tensions between US-China and focuses on several upbeat earnings announced including Palantir and Spotify which supported the key index. After a slowdown in the US JOLTS openings, traders will continue to monitor the (i) ISM Non-Manufacturing PMI, (ii) S&P Global Services PMI and (iii) China's Caixin Services PMI today. In the commodities market, Brent Crude is still trading around USD76 per barrel, while gold prices charted its all-time high at USD2,845. The CPO prices maintained above the RM4,300 mark.

Sector Focus: Given the pullback in Construction sector over the past month, we opine it might present bargain-hunting opportunities, supported by JSSEZ initiatives and data centre boom in the country. Although traders have turned cautious toward glove counters following President Trump's decision to pause his tariff orders on Mexico and Canada, we believe investors may hold on as earnings season approaches and we expect sequential growth in their earnings. We also favour Oriental Kopi for its explosive growth potential, its candidacy for a main market transfer and the anticipated shariah status bode well for the company.

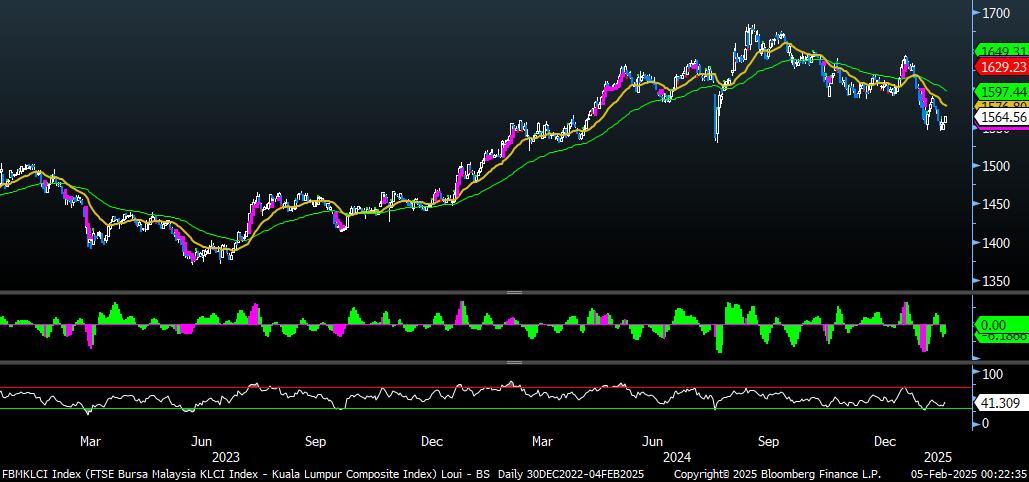

FBMKLCI Technical Outlook

The key index rebounded once again, with MACD histogram is still trading at its negative territory while RSI started trending upward, suggesting mixed signals at the current juncture. Resistance is anticipated around 1,579-1,584, while support is set at 1,544-1,549.

Company Briefs

Fajarbaru Builder Group Bhd's (FAJAR) joint venture with Avionics Pty Ltd has secured an RM131.6m contract from the Australian Department of Defence that expands their scope of works in the redevelopment of military facilities located at the Royal Malaysian Air Force (RMAF) base in Butterworth, Penang. The latest contract is for the delivery phase of Phase Two of the design and construction of the infrastructure project. Fajarbaru's portion of the additional works is RM75.9m, while Avionics' portion is RM55.7m. With the latest contract, Fajarbaru has secured a total of RM115m contracts for the project, while Avionics' portion amounted to RM70m. The contract period has also been extended to Dec 8, 2025, for Stage 1 (Australian leased facilities), and Sept 1, 2026, for Stage 2 (Malaysian facilities redevelopment). (The Edge)

Keyfield International Bhd's (KEYFIELD) wholly owned unit, Keyfield Offshore Sdn Bhd, has secured two contracts worth a total RM59.6m for vessel charter jobs in the United Arab Emirates (UAE) and Malaysia. The first contract was awarded by an undisclosed offshore marine service provider in the UAE for the charter of an anchor handling tug supply vessel. The second contract was awarded by a disclosed commercial diving and remote-operated vehicle service provider in Malaysia for the charter of one dynamic positioning two accommodation work boat. Keyfield did not disclose the names of the charterers due to confidentiality and privacy considerations. (The Edge)

Ann Joo Resources Bhd (ANNJOO) is acquiring the remaining 45% equity interest in Konsortia Etiqa Sdn Bhd (KESB), the owner of 437 acres of industrial land in Kedah, from Datuk Ong Tee Thong for RM96m. Upon completion, Ann Joo's wholly owned unit Ann Joo Management Services Sdn Bhd will hold 96% of KESB, with the remaining 4% retained by another subsidiary, Ann Joo Steel Bhd. Ong was formerly the chairman of beleaguered Perwaja Holdings Bhd and Kinsteel Bhd. (The Edge)

Bina Puri Holdings Bhd (BPURI) is appealing against the summary judgment obtained by Wisma Majujaya Sdn Bhd in the RM28.17m suit filed against it, its wholly owned unit Bina Puri Properties Sdn Bhd, and deputy executive chairman Tan Sri Tee Hock Seng. The summary judgment, which was granted in the Shah Alam High Court on Monday, also ordered Bina Puri and the other defendants to pay the judgment sum of RM28.17m with 8% interest within 14 days. The suit revolved around an alleged RM28.17m sum in returns Wisma Majujaya purports to have been owed as stipulated in a joint venture agreement plus interest Bina Puri failed to pay it. Meanwhile, Bina Puri has been served with a winding-up petition dated Nov 25, 2024, from Export-Import Bank of Malaysia Bhd (EXIM Bank). Bina Puri said EXIM Bank served the winding-up petition on the basis the company failed to pay sums of US$4.9m (RM21.75m) and RM17,253.47. The company said it remains in discussions with EXIM Bank to resolve the matter amicably. (The Edge)

Target 1 Sdn Bhd, one of the parties acting in concert to take over South Malaysia Industries Bhd (SMI), has received another extension to deliver the offer document to the latter's shareholders, pushing the deadline to Feb 11. This is the fourth extension the Securities Commission has granted Target 1 to deliver the document. The initial deadline was on Jan 7. (The Edge)

Ge-Shen Corp Bhd (GESHEN) is to sell Johor Bahru land measuring 4.61 acres in aggregate, with an office, a warehouse, and a factory built atop, to Plastico Sdn Bhd for RM35m in cash. Ge-Shen said the RM35m disposal consideration represents an 8.57% discount to the land's RM38.28m market value, ascribed by Irhamy Valuers International Sdn Bhd in November 2023. The company expects to book a pro forma gain of RM14.26m from the land sale. Proceeds from the land sale will be used to repay borrowings tied to the properties as well as finance the group's working capital. (The Edge)

Senheng New Retail Bhd (SENHENG) is disposing of a piece of freehold industrial vacant land in Tebrau, Johor, measuring 1.041ha to Mactree Sdn Bhd for RM11.21m cash. It acquired the land for RM7.69m back in 2018. Proceeds from the disposal will be used for general working capital purposes. (The Edge)

Source: PublicInvest Research - 5 Feb 2025

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-05

ANNJOO2025-02-05

ANNJOO2025-02-05

ANNJOO2025-02-05

ANNJOO2025-02-05

ANNJOO2025-02-05

BPURI2025-02-05

BPURI2025-02-05

FAJAR2025-02-05

FAJAR2025-02-05

FAJAR2025-02-05

FAJAR2025-02-05

FAJAR2025-02-05

GESHEN2025-02-05

GESHEN2025-02-05

GESHEN2025-02-05

GESHEN2025-02-05

GESHEN2025-02-05

KEYFIELD2025-02-05

KEYFIELD2025-02-05

KEYFIELD2025-02-05

KEYFIELD2025-02-05

KEYFIELD2025-02-05

KOPI2025-02-05

KOPI2025-02-05

KOPI2025-02-05

KOPI2025-02-05

SENHENG2025-02-05

SENHENG2025-02-05

SMI2025-02-05

SMI2025-02-05

SMI2025-02-05

SMI2025-02-04

BPURI2025-02-04

BPURI2025-02-04

GESHEN2025-02-04

GESHEN2025-02-04

GESHEN2025-02-04

KEYFIELD2025-02-04

KEYFIELD2025-02-04

KEYFIELD2025-02-04

KEYFIELD2025-01-31

KEYFIELD2025-01-28

BPURI2025-01-28

BPURI2025-01-28

GESHEN2025-01-27

BPURI2025-01-27

KEYFIELD2025-01-27

KEYFIELD2025-01-27

KEYFIELD2025-01-27

KEYFIELD2025-01-27

KEYFIELDMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 24, 2025