Why I bought Mynews & Kawan... another foray into trading gimmicks

Philip ( buy what you understand)

Publish date: Fri, 30 Sep 2022, 03:46 PM

For some reason during this period of economic activity I find myself with itchy fingers. And thanks to some good sharing from my telegram group again from seasoned traders like Ivan, Whysoserious and that Singapore guy who has 85% in tesla. Somone recently shared a very interesting book about Nicholas Darvas, which started my new burst of enthusiasm in trading for retail investors:

https://en.wikipedia.org/wiki/Nicolas_Darvas

I find myself thinking about his trading methodology which seems to be very correlated in how I do my own stock picking. To be honest, I find myself very lucky indeed, picking stocks that I know very well in industries that I have exposure to, not to mention that time itself is on my side as I wait for the company to perform over time and bring me good returns.

And so, I find myself starting to gamble again, learning how to trade. I must admit, I am a very very horrible trader, but it seems so far that luck is on my side.

So the 2 stocks I have picked for trading on a darvas box theory:

Small amount for itchy fingers ( 0.3% of my portfolio each)

Mynews (yes I hold QL, but I do love the industry) - bought 28 sept 2022 400K shares@ 0.455 average

PTRB (frozen seafood exporter, really love the industry) - bought 28 september 2022 400K@ 0.42 average.

KAWAN (frozen food manufacturer) - bought 26 september 2022 100k@2.2 average

So for trading, I still like the theory of Darvas which is to concentrate on fundamentals, before buying the stocks. His idea is to time the buying process, hold on to the winner and cut the losers.

In this case what are the overall fundamentals that I am looking at?

1. Worldwide recession - Historically, during recessions I find the dollar generals and CVS to be doing very well as people start pinching pennies and going for the rm5 stores. As their buying power decreases, the population then starts taking the little joys they can find by buying the cheap meals (KFC and Mcdonalds and Family Mart and CU) to obtain the sugary sweets to help them feel slightly better over the period. You can see companies like this doing very very well indeed versus the big ticket items and upper scale businesses. If Tealive can do 5 million sales from one small outlet in ITCC Sabah, you know how the population is spending to reduce their stress levels.

2. Exporters - Currency exchange especially MYR/USD pairs is how the US exports their inflation woes to us. This is not necessarily a bad thing, especially for companies that deal with export of products overseas. If you look at my main portfolio, my main thesis for buying has always been growth companies that can compete on the world stage. Basically any company that is headquartered in malaysia, deals in RM and sell in USD.

HARTALEGA(USA)

PCHEM (SEA)

SKPRES (DYSON)

YINSON (BRAZIL)

QL (CHINA, JAPAN, AUSTRALIA)

3. Strong revenue growth - You can see the revenue increasing year after year which shows signs that the company is able to compete on an equal level internationally without the crutch of the government contracts. I firmly believe that any company that is able to consistently grow its revenues year after year on an upward trend for export will be rewarded by good growth in share price long term.

What is Darvas box theory?

The basic idea behind this dancer turned stock trader is to look at industries which are very favourable and growing with good growing revenues. Basically things like tech of the day, or construction during his time, or petrochemicals in my days (plastics where the super material of the eighties). After one has selected this growing industry, then we look at the top performers where the growth is happening and monitor.

Now for most important part, now that you know WHAT to buy, the question becomes WHEN to BUY and WHEN to sell. To be honest, if you have looked at my portfolio you will notice that I am exceptionally bad at this as well, as I tend to buy the wrong stocks at the wrong time and sell at the wrong time. The only saving grace for me has been that I have bought the RIGHT stocks ( with a few painful exceptions), so over time I seem to be doing well in the stock market.

So.... according to my learned trader friends, the Darvas box theory is a simple evaluation of risk profiles based on narrow band trading. Here are the basic rules behind his trading band:

- A stock is making a new 52-week high

- After the high is set, there are three consecutive days that do not exceed the high

- The new high becomes the top of the box and the breakout point leading to the new high becomes the low of the box

- Buy the break of the box once it exceeds the high by a few points

- Sell the low of the box if it is breached

- Add to your position as it moves into each new box.

The mental model here then becomes: hold on and ride the winners, and get rid of losers.

I like this theory (assuming you are buying the right stock over time).

*Please note that I am very very much a working amateur on this while attending classes as a 60 year old uncle. But the thought pattern behind the volume of moving stocks and prices are very interesting indeed for me.

Take for example a stock I have been monitoring for a while now, which is Kawan. They are doing very well indeed with growing business and growing production ever since MCO ended. Their halal roti has been ending up in middle east and around the world, and they have full HACCP accreditation. I know for a fact that Kawan has tons of cash, exporting out of malaysia, and competing on the global scale.

So checklist:

1. 52 - week high - check. Start monitoring.

2. after new high set - box the high and low for the narrow band of trading.

3. once broken in july - consecutive days that just touch the previous high. new box within the narrow band.

4. a 3rd new high set in august with increasing volume. Box and monitor.

5. September broken - with newer high achieved. Take position. (remember I am ultra conservative. All I know is during recession when all stocks are going down, a stock that is resilient and going up should not be underestimated.)

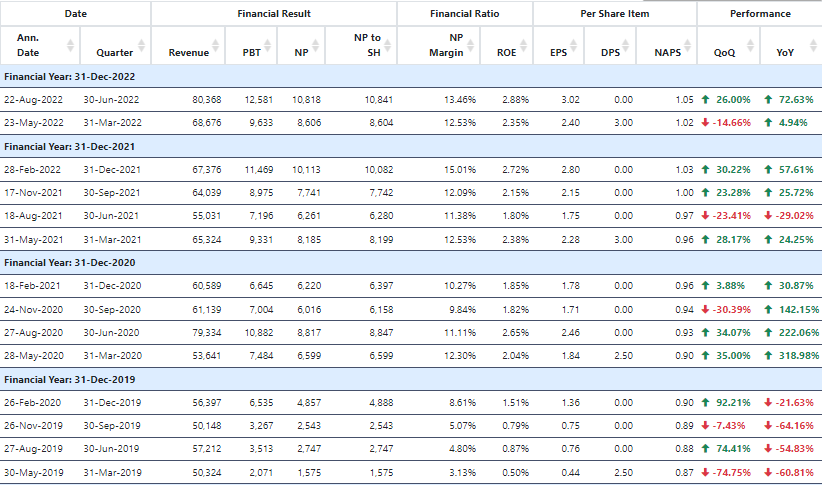

So now we look at the growth:

good growth, good profitability and ROE ever since the drop during pandemic but consistent ever since. So for a trading view, it fits.

Lets buy and monitor and see if it works out. AS LONG AS REVENUE AND EARNINGS KEEP GOING UP, the chart should always follow. As usual, Darvas always looks at protecting the downside, so how do we look at that? (use the bottom of the box as the stoploss estimate), if it falls below the comfort level, cut loss like a little girl and run away. In this I am very unfamiliar, but I do understand his mental model. We shall monitor and follow.

Heres another one I am looking at:

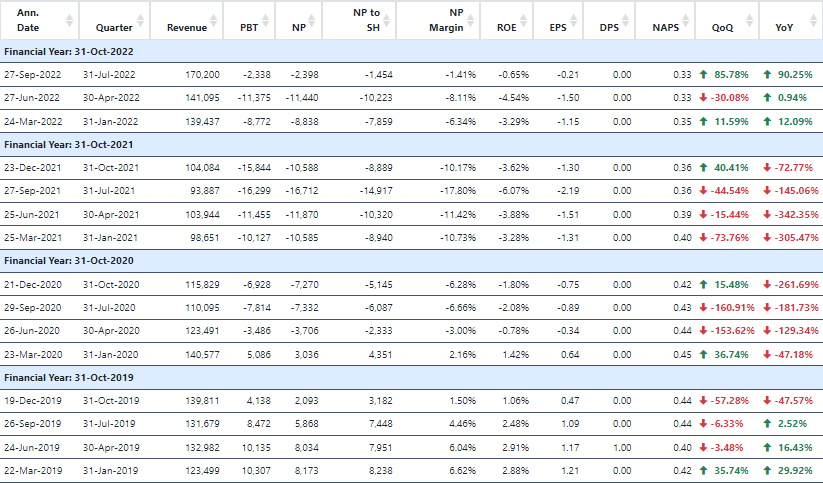

Yes it looks horrible, especially for a company that sells newspapers ( which is a dead industry whichever way you look at it). Huge cash burn, followed a pivot into getting korean family mart wannabe CU. Yes I have a ton of QL bought for ages, but yes I still love the industry and Mynews is selling Cheap. So question is, why buy now?

Look at the latest quarter. Yes they still have cash burn, almost 14 million in wastage and destroyed inventory. And yet they were able to reduce the cash burn by a lot this quarter to 2 million (I still hate spicy korean food though), with an expectation from management of a profit next quarter. There must be a lot of spenders who find joy in buying cool desserts and spicy fast food that is cheaper than your regular Mcdonalds and KFC, and I think CU and FM both fit that growing niche. I wouldnt go whole hog into Mynews, but as a trading vehicle, it is very very interesting to me.

the graph for mynews:

If you look at it the volume and the trend, we are looking at a possible breakout in the box between 0.5 and a cut loss point of 0.41. I must admit I bought it with some trepidation due to the good results, and a cheap asking price. If it turns out well, I will add more, if it goes below the low of the previous darvas box i drew, cut loss immediately instead of holding like a fool. Slight greed here, coupled with a good feel about the industry.

Lets monitor and see.

P.S. for those who were monitoring my trackable portfolio, you might have noticed my position in PTRB. Forget about my analysis in it. This is pure gambling for me (itchy fingers syndrome). I just love frozen seafood caught by local fishermen and exported to dubai. No brainer for me.

I hope we all learn something new today,

Welcoming all constructive comments.

Phillip.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-26

KAWAN2024-07-25

MYNEWS2024-07-25

MYNEWS2024-07-25

MYNEWS2024-07-25

MYNEWS2024-07-25

MYNEWS2024-07-25

MYNEWS2024-07-25

MYNEWS2024-07-24

MYNEWS2024-07-24

MYNEWS2024-07-24

MYNEWS2024-07-24

MYNEWS2024-07-24

MYNEWS2024-07-24

MYNEWS2024-07-24

MYNEWS2024-07-23

KAWAN2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWS2024-07-23

MYNEWSMore articles on My telegram reshares

Created by Philip ( buy what you understand) | Jun 15, 2021

Created by Philip ( buy what you understand) | Feb 25, 2021

Created by Philip ( buy what you understand) | Feb 17, 2021

Created by Philip ( buy what you understand) | Feb 10, 2021

Created by Philip ( buy what you understand) | Jan 05, 2021

Discussions

Philip ( buy what you understand)

So far I like the stock as a trade idea. We will see.

2022-10-01 05:45

I love KAWAN too, a good company, bought and sold all twice. Will come back again when the market sentiment is at low level.

2022-10-01 11:25

Philip ( buy what you understand)

If one sees any more interesting trade ideas following the same principles that I have outlined, please forward it to me for more reading and understanding. Thanks

2022-09-30 21:39