MY BIG PURCHASE FOR 2021. THE COMPANY THOMAS EDISON FOUNDED.

Philip ( buy what you understand)

Publish date: Wed, 10 Feb 2021, 04:00 AM

Philip Farms telegram reshares:

Yes it is for me... Core reason and biggest profit center for GE. Like I said, I'm buying for the next 5 years.... Hard to compete short term with you la bosku

You sure you not training pilots anymore ka sifu LC, I just realized this group is a very strong source of aviation and sea logistics scuttlebutt

But my question is... How do you think the airline industry will perform 5 years from now? Better or worse than today?

If the answer is yes, then what would you buy

Haha @Ikanbiliskecil is a very knowledgeable aircraft guy... He hates Tony Fernandez guts..

( On rolls royce)

Wow.i buy with a 5 year view... You have 10 year view, impressive. The first of these nuclear plants in UK will come up in 2031. Any idea on revenue and profitability?

The big mental model on why aviation is interesting to me.

1. The gold digger never makes money, but the one selling the shovels always does. And there are less than 10 major aircraft engine suppliers in the world, and aircraft makers basically only got 2, boeing versus Airbus.

2. The capital cost to start and get in this business is autonomical. And due to safety issues, reputation and aircraft restrictions and requirements, very hard for any Tom Dick and Gary to come in. This is one industry that China copycats will not be able to flood into. Its the kind of business where you need a huge track record to get into. And you can only get the track record by being in it. Chicken and egg story, so basically no one else can get into. Kind of like Mercedes competing in GT1 constructors category. If everyone else pulls out... Then only AMG left, how to compete?

3. If Boeing and Airbus can survive multiple accidents and scandals and still be in business... You know this is something that any idiot cousin can run and still make money

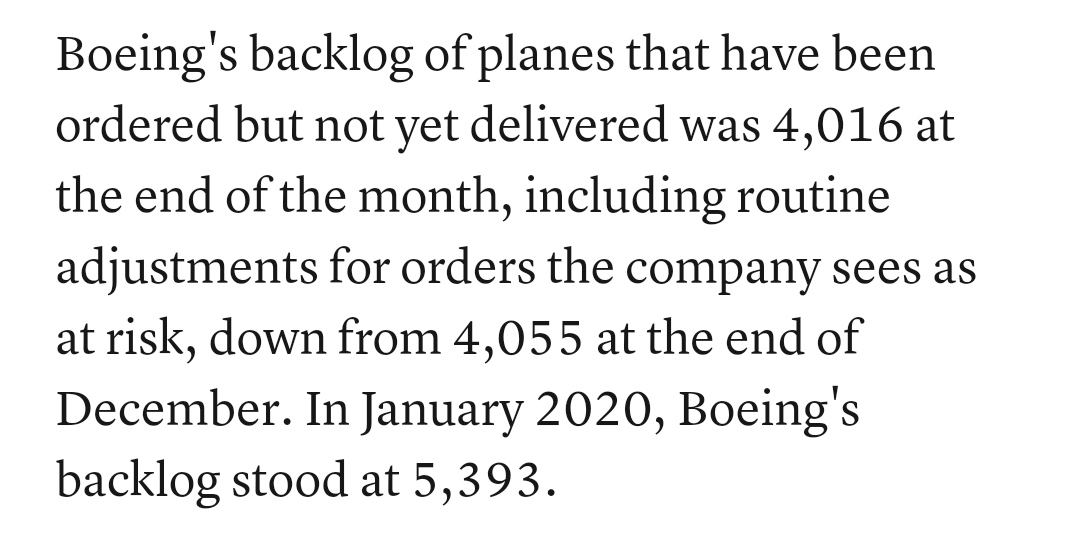

You have heard of Tesla backlog... But order book for boeing and Airbus cut down from 8.6 years to deliver to "only" 6.4 years

Meaning there is still only 2 major aircraft makers in the market

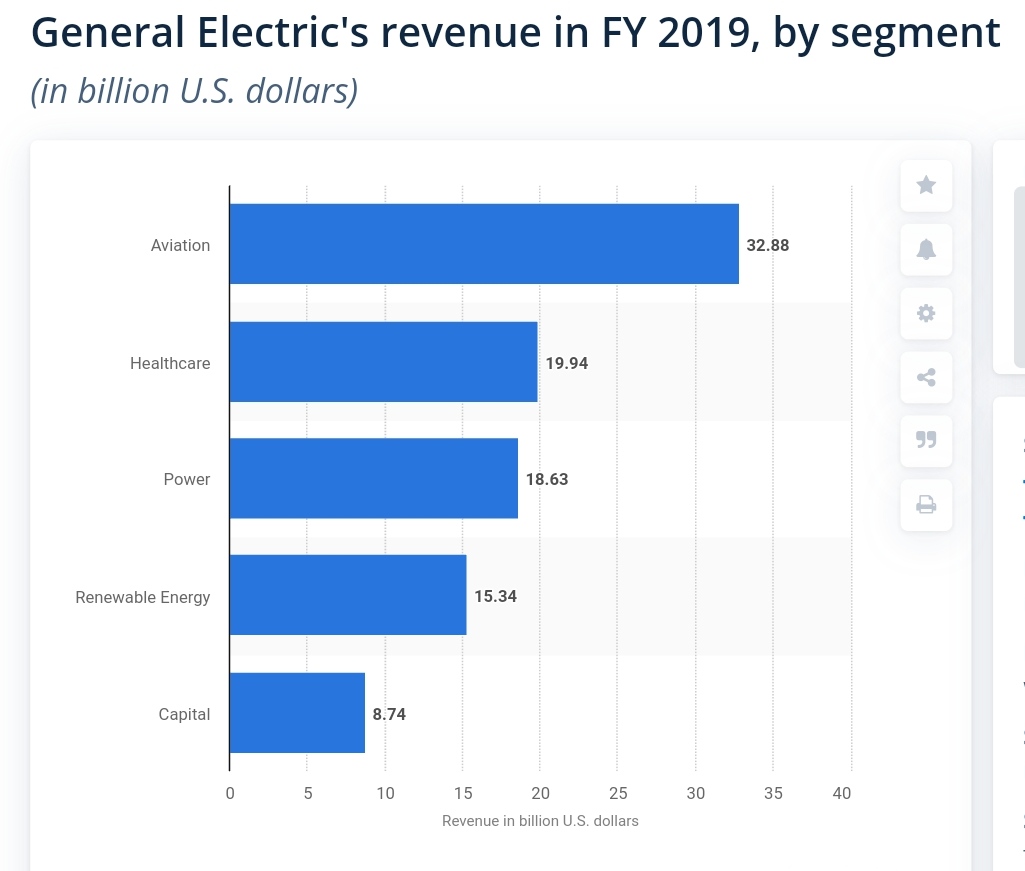

4. For aviation, GE did 32.8 billion for the most expensive part for any plane, the jet engines. The question is, so many planes are grounded, when things go back up... The servicing, spare parts alone maintenance alone will be amazing once people start flying again.

I don't know about you, but I can bet my bottom dollar once this nightmare is over( and it will end), everyone will be traveling again with a frenzy.

I don't know exactly when, and my track record for predicting timing has always been horrible( just look at my purchase of pchem ), but I do know it will happen in the next 5 years.

I guarantee it.

I don't mind being early to a party... Just as long as I'm there for the main course.

You don't want to dress well to go to the wrong hotel...

5. And yes, the improvements technology of ge in aviation will inevitably lead to improvements in hydro turbines, natural gas turbines, power plant controls, wind turbines efficiency etc.

So yes, I am very into GE, 200k shares@11.20 done.

And of course new GE... Still a work in progress, but a lot of acceleration in dropping dead weight like GE lighting.. it's oldest segment. Undoing its oldest problems and spinning off ge capital into genworth financial and synchrony financial to raise cash, kicking out flannery and immelt and replacing it with an outsider who can see what needs to be done without being tied down with the legacy of holding until GE business.

https://www.google.com/amp/s/www.cnbc.com/amp/2018/10/02/cramer-explains-why-ges-board-really-booted-former-ceo-john-flannery.html

So they finally did all the right things that I like. Cut dividend from 1 dollar a year to 1 cent.

Started paying back the pension plan

https://www.pionline.com/pension-funds/ge-kicks-25-billion-pension-plan-funding#:~:text=General%20Electric%20voluntarily%20pre-funded,spokeswoman%20confirmed%20in%20an%20email.

81% funded and getting the rest insured

So... No more ge capital and cutting down insurance, trying to cut down on debt and cutting dividends, concentrate back on their core competency instead of financial engineering.

New management, culp is the first outsider to become ceo of GE in its 126 year history. His party package is tied to the performance of GE shares, so he is very aligned with shareholder performance. If ge share price goes up by 50%, he gets paid 47 million. So you can be sure ge will start going back to basics, selling of unnecessary assets and buying back shares instead of giving out dividends. And if he gets the stock price back up to usd19.... Then he gets paid 230 million. At times the turnaround may seem impossible... But if you are getting paid that much to do a miracle... I would work my ass off as well.

The new transparent GE

I think GE has turned the corner, and I like what I see moving forward.

I hope you learned something today.

My foreign portfolio

Stoneco

Palantir

Uniqlo

Wilmar

China mobile

GE

My trackable portfolio in i3 with transactions.

https://klse.i3investor.com/servlets/pfs/120720.jsp

More articles on My telegram reshares

Created by Philip ( buy what you understand) | Sep 30, 2022

Created by Philip ( buy what you understand) | Jun 15, 2021

Created by Philip ( buy what you understand) | Feb 25, 2021

Created by Philip ( buy what you understand) | Feb 17, 2021

Created by Philip ( buy what you understand) | Jan 05, 2021

Stock Eyes

Thanks Philip, it is very high quality article, thanks for sharing

2021-02-15 11:10