My telegram reshares

My pump and dump stock for 2021 - foreign dumping edition

Philip ( buy what you understand)

Publish date: Tue, 05 Jan 2021, 06:48 AM

Philip Farms:

https://youtu.be/0WJTn5X4XDA

How to understand risk reward modelling by Howard marks

The rise of stock market has really coincided with the reduction of interest rates around the world

The concept is simple

Interest rates provide the blanket of risk free rate, basically meaning the guaranteed return by government for you to store money with them

So all investing then becomes risk in relation to other deals

For example if buying us T-bills is giving you 2%

Then to take a larger risk we would need something like 4% to take a bank fixed deposit

Then 8% to buy corporate bonds

Then 10% returns to buy stocks

Etc so on so forth

That is the big mental model here

Same goes in investing in companies

You don't mind getting 3% dividends and returns investing in say pchem and public Bank

Rock solid blue chips with relatively low risk

A commensurate 5-8% investing in REITs with their 90% payout, fixed income

10-20% investing in growth stocks like yinson, serba, kpower, scib etc etc with higher operational risk

50% working at your job, 100% returns investing in a gold mine or franchise business

These are the minimum requirements for your returns for dabbling into risky ventures

If we look at it in relation to the government interest rate

The problem I see with a lot of investors is they do not know how to evaluate risk properly

Take for example this one...

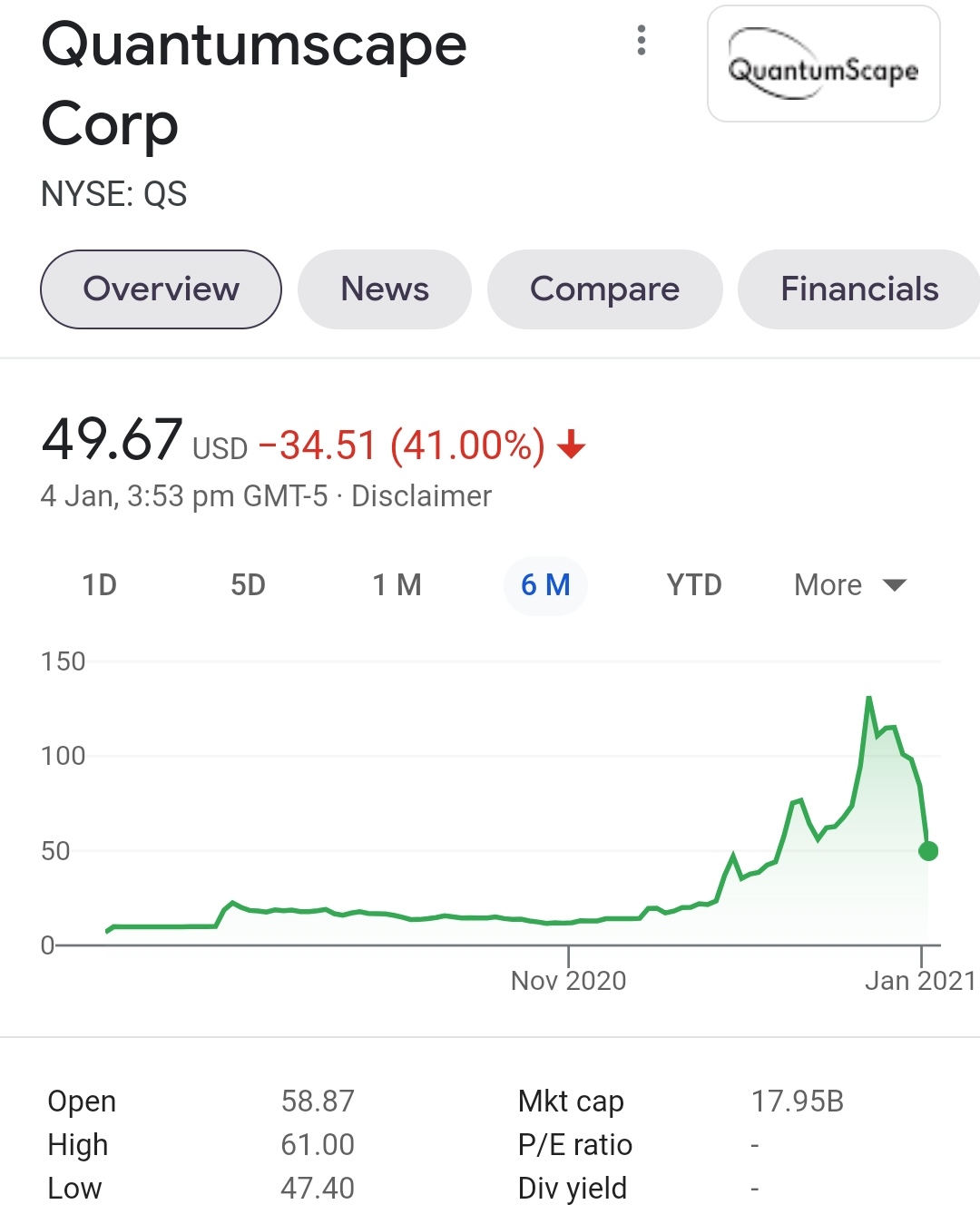

How did this go to 50 billion?

How did it drop to 18 billion?

We need to start by evaluating risk and putting it on the proper world view

How risky is a business for you to invest in that has 200 employees, 300 million in funds, has never made a profit or has yet produced a commercial product and the only reason you are buying is because of a white paper, Volkswagen putting in a 1 billion fund merger and expectations of the future

The risk is very low, if the company was asking 500 million market cap valuation

The risk is astronomical if the company is asking 50 billion market cap valuation

Now looking at palantir, same risk reward analysis

You have an 18 year company with 1 billion in revenues

2500 employees

The relative risk is much lower when the asking price is 25 billion USD, at 14 per share

As it goes higher, the risk pops higher because now you are baking in future growth into it

Now looking at risk free rates, how about a 2 stocks I have begun a position in recently

Wilmar and China mobile

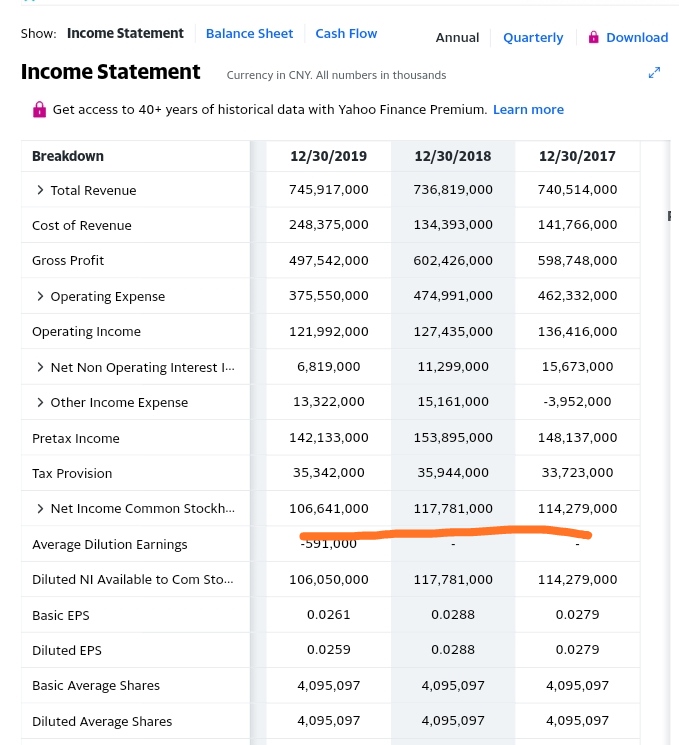

At 44 what am I getting into in China mobile? A company that is earning 100 billion yuan and pays 50 billion yuan in dividends or 7%

With roughly 50% payout

It is 70% of the China market with unicorn 20% and China telecom 10%

So you have to weigh in the lack of huge growth versus the risk free rate for holding the company

Obviously this valuation is only because delisting in USA is causing funds and investors to dump the stock

Buy when everyone is selling

But again... What kind of earnings am I looking at? Did China mobile earnings and revenues drop by half since last year?

The business itself has not changed

Yes it is not a go getter

Or a big growth company

But... The risk reward of the company is very low if you look at the business model, stability of business etc

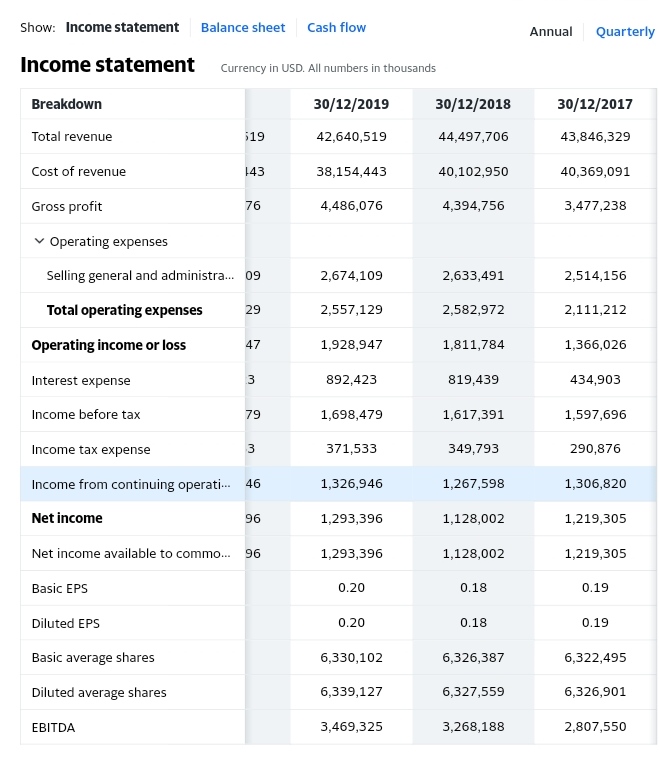

For Wilmar same thing, boring rock solid companies that has slow growth, but very low risk versus reward rate

Buying this at 4.15, what do I get? A boring agriculture business

... With a huge cooking oil with 70% dominance of China.

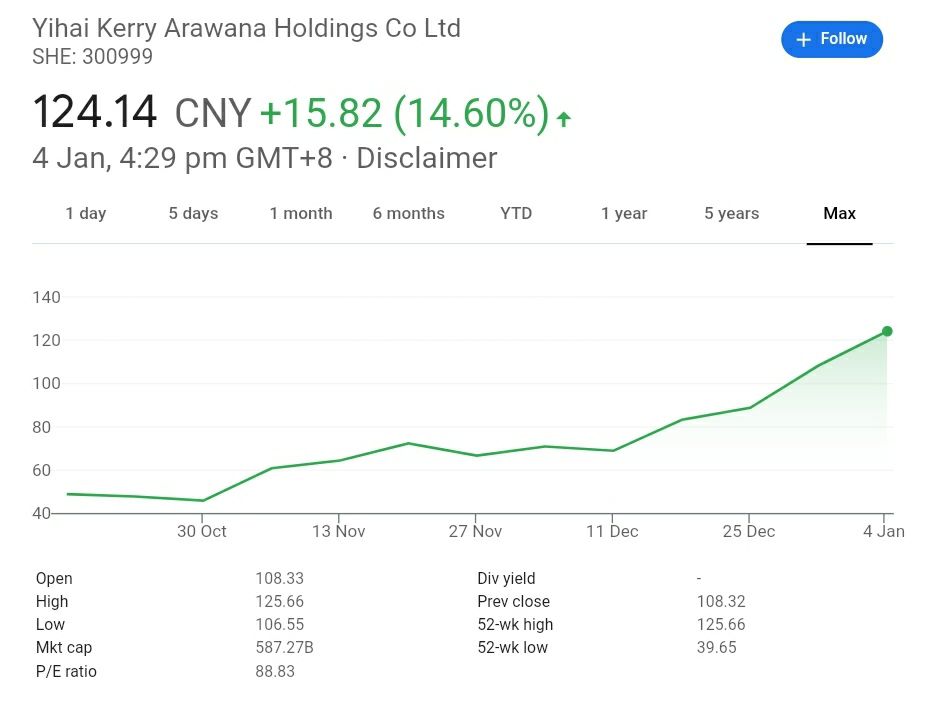

The big question to ask is how much ownership of yihai does Wilmar own

And what is the relative valuation

The stock market is always very funny, the sum does not equal the parts

In the case the parts are worth more than Wilmar when it owned 90% of yihai Kerry?

Wilmar 30 billion... Yihai 100 billion

Incredible

So the thing is here... You don't have to always invest in the new new thing like bitcoin and tech stocks etc for your returns

Sometimes... Boring simple to understand business is best

And what could be easier to understand than 70% market dominance of cooking oil

I hope you learned something new today.

Compliance: I have 5% weightage of Wilmar in my portfolio@4.15, and 5% weightage of China mobile in my portfolio@44. Boring businesses.

More articles on My telegram reshares

Why I bought Mynews & Kawan... another foray into trading gimmicks

Created by Philip ( buy what you understand) | Sep 30, 2022

Why I bought even more SERBADK bonds and stocks

Created by Philip ( buy what you understand) | Jun 15, 2021

HOW TO BUY LEAPS OPTION CALLS. No genting, no problem

Created by Philip ( buy what you understand) | Feb 25, 2021

My thoughts on palm oil industry. And the recent drop in palantir results.

Created by Philip ( buy what you understand) | Feb 17, 2021

MY BIG PURCHASE FOR 2021. THE COMPANY THOMAS EDISON FOUNDED.

Created by Philip ( buy what you understand) | Feb 10, 2021

Discussions

Be the first to like this. Showing 6 of 6 comments

Now you know the stock market is always very funny, the sum does not equal the parts.

2021-02-08 17:28

So what's the PE for china mobile? Why does it show EPS as 0.0259?

Wllmar, what is the NTA? Cause if you just add up the assets without deducting debt, you get the wrong answer, for those companies with high gearing.

2021-02-11 19:20

Sslee

Yes now you understand the parts are worth more than Insas when it owned 545 million of Inari and everything else inside Insas.

2021-02-08 17:26