Athena Advisors - Drowning Oil and KLCI

AthenaAdvisors

Publish date: Tue, 05 May 2020, 06:08 PM

Let the fact speaks for itself. I leave it to all of you to conclude.

Bank of China puts an initial loss of more than RMB 7 billion (US$1 billion) by retail investors from the collapse in a product linked to May West Texas Intermediate future contracts. Caixin reported that more than 60,000 clients have invested in Bank of China’s “Crude Oil Treasure” product. Investors have lost their margins of RMB 4.2 billion and owed the bank a further RMB 5.8 billion.

Oil is now a buyer’s market as prices have plunged to multi-decade lows. The United States Oil Fund (USO) is once again shaking up oil markets that it intends to sell off all its WTI contracts for June delivery and will now focus on futures contracts that are further out. Ongoing simultaneous oversupply and demand crises drive storage shortage by mid-May both onshore and offshore. Demand for storage drove a spike of 700% on daily lease rates for tankers. Efforts to date, may not be enough for a near-term stabilization. “There’s a glut of oil like no one has ever seen before” - President Trump.

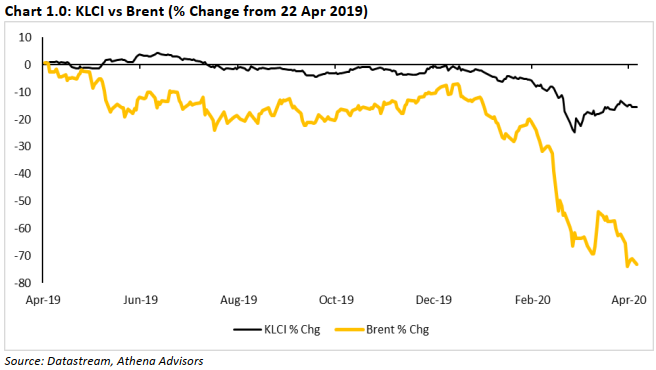

Sharp contrast between moves in oil prices and KLCI seen. Even before Monday's once-in-a-lifetime fire sale in oil, crude prices had priced in at least some of the massive demand drop while local equity market continued to climb. As at April 2020, oil and gas counters take up 3.66% of total KLCI market capitalization. This compared 3.83% a year ago. Lower oil exports, risk of deflation, Petronas’ capex cycle, business continuity for both the upstream and downstream players, reprioritise fiscal spending are among pitfalls to watch. It was reported that every US$1 drop in Brent crude oil price, Malaysia is expected to lose RM300 million in oil-related tax revenue.

Chee Seng, Wong

CIO, Athena Advisors

wong-chee-seng@outlook.com

More articles on Athena Advisors

Created by AthenaAdvisors | Jun 30, 2020

.png)

.png)