Athena Advisors - Reading the Leading Indicator

AthenaAdvisors

Publish date: Thu, 28 May 2020, 06:01 PM

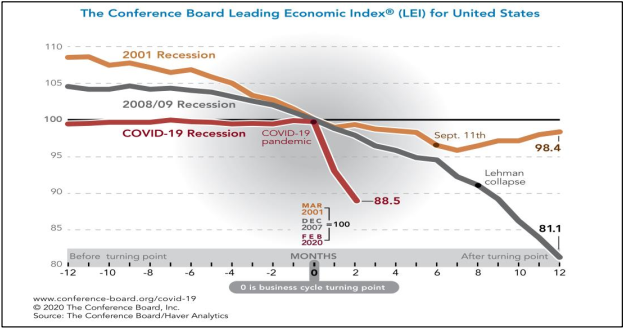

World is likely to see a deep recession with no sign of fast rebound for now, according to the Conference Board Leading Economic Index. The decline is much sharper compared to previous recessions like the bursting of the tech bubble in 2001 and the Great Recession of 2008–2009 with widespread damage to labour markets and industrial activity. My view is that the imminent reopening of some sectors won’t be enough to generate a fast rebound for the economy at large.

Banks are cautious to lend. No matter how much money is thrown at them by governments, there is a limit to how much risk they can take. A financial system's ability to sustain increasing levels of credit rests upon a vibrant economy. A high-debt situation becomes unsustainable when the rate of economic growth falls beneath the prevailing rate of interest owed as the slowing economy reduces borrowers' ability to pay what they owe. Creditors may refuse to underwrite interest payments on the existing debt by extending even more credit. When the burden becomes too great for the economy to support, defaults rise. Fear of defaults will prompt creditors to reduce lending even further. Barely five months into the year, U.S. investment-grade companies already have issued more than $1 trillion in debt — nearly as much as in all of 2019 on Fed's promise of "no limit" purchases of Treasury, investment-grade corporate and even junk bonds.

Fed’s liquidity injection is seemed to be a success is when viewed through the lens of the stock market. And over the last decade, there is little evidence to suggest that the never-ending emergency measures of global central banks have a good correlation to foster full employment and price stability. A company that a year ago was focused on growth and international expansion might now need to shift much more towards cost-cutting. Question to ask now is whether the post-recovery profit environment will justify currently lofty but temporary stock valuations? Earnings estimates have dropped dramatically and are we well prepared for a harsh dose of reality.

Chee Seng, Wong

CIO, Athena Advisors

wong-chee-seng@outlook.com

More articles on Athena Advisors

Created by AthenaAdvisors | Jun 30, 2020

.png)

.png)