Unfazed by Volatility: 5 Malaysia REITs with Strong Fundamentals (KingKKK) - AXREIT, CLMT, IGBREIT, SUNREIT, PAVREIT

KingKKK

Publish date: Sun, 21 Apr 2024, 04:00 PM

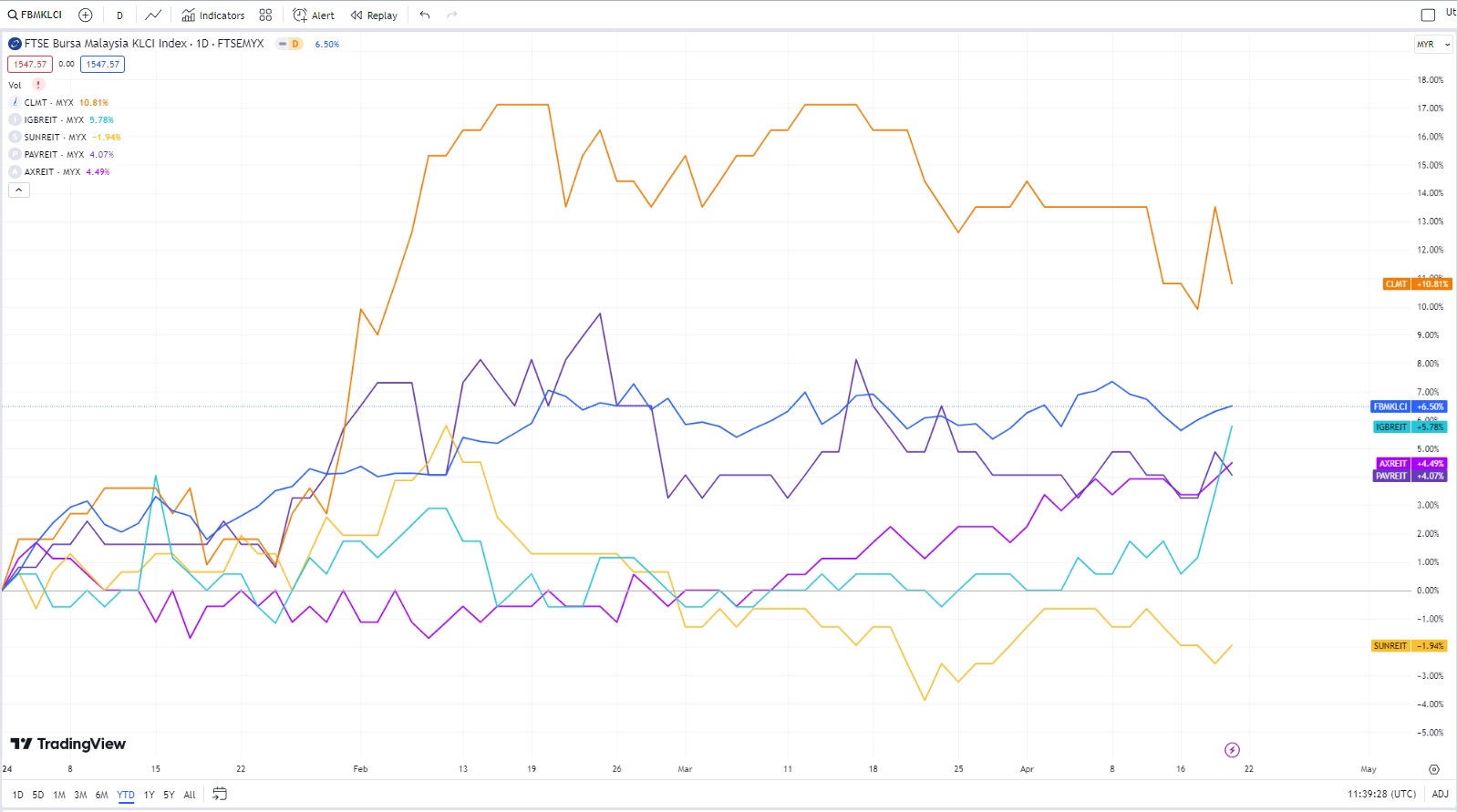

Some investors prefer to receive consistent dividend from their investment. REITs may be appealing to this category of investors. As the market turned more volatile recently, what are 5 REIT stocks which have good and stable dividend yield/share price?

Stocks | Dividend yield | Share Price Performance YTD, % |

AXREIT | 5.77% | 4.49% |

CLMT | 6.78% | 10.81% |

IGBREIT | 5.72% | 5.78% |

SUNREIT | 6.12% | -1.94% |

PAVREIT | 5.37% | 4.07% |

Dividend yield from Google

Share price performance from TradingView

1. AXIS REIT (AXREIT) - 5.77% dividend yield

Axis REIT, established in 2005, is Malaysia's first Real Estate Investment Trust (REIT). Listed on Bursa Securities, it focuses on owning and investing primarily in industrial and office properties across Malaysia. Their strategy revolves around two main goals:

Stable Distributions & Unit Value Growth: Axis REIT prioritizes providing consistent income to its unitholders through rental income generated by their properties. They also aim to see the Net Asset Value (NAV) per unit rise over time, indicating overall portfolio appreciation.

Shariah-compliant Growth: In 2008, Axis REIT reclassified as an Islamic REIT. This allows them to tap into a wider investor base while adhering to Shariah principles in their operations and acquisitions.

To achieve these goals, Axis REIT actively manages its portfolio of 63 properties spread across six Malaysian states. Their management team oversees tenant relations, lease agreements, and property maintenance to ensure steady rental income. They also strategically acquire new properties and may divest of existing ones to optimize the portfolio and maximize returns.

By focusing on income generation, capital appreciation, and Shariah compliance, Axis REIT aims to be a reliable investment option for both Shariah-compliant and non-compliant investors seeking exposure to the Malaysian industrial and office property market.

Menara Axis which is owned by AXREIT

2. CAPITALAND MALAYSIA TRUST (CLMT) - 6.78% dividend yield

CapitaLand Malaysia Trust (CLMT) is a real estate investment trust (REIT) that focuses on acquiring and managing shopping malls, offices, and service apartments. They actively manage their portfolio to optimize rental income and property values through renovations and tenant engagement. Sustainability is a key focus, incorporating environmental and social considerations into property management. Overall, CLMT functions as a professionally managed property investment vehicle, prioritizing returns for investors through strategic acquisitions and efficient portfolio management. It has 8 properties with 4.3 million Net Lettable Area (NLA). Details of the portfolio is as below.

Portfolio Overview | CapitaLand Malaysia Trust (clmt.com.my)

Quennsbay Mall which is owned by CLMT.

3. IGB REIT (IGBREIT) - 5.72% dividend yield

IGB REIT is managed by IGB REIT Management Sdn Bhd, responsible for investment decisions and maximizing asset value. The company focuses on owning and managing shopping malls (like Mid Valley Megamall) and office spaces (like The Gardens South Tower). They actively manage their properties to optimize rental income through renovations, tenant relations, and maintaining high occupancy rates. In essence, IGB REIT acts as a professionally managed investment vehicle in real estate, focusing on generating income for investors through strategic property ownership and efficient management.

Mid Valley Megamall which is owned by IGBREIT.

4. SUNWAY REIT (SUNREIT) - 6.12% dividend yield

SUNREIT operates in Malaysia as a real estate investment trust (REIT) which primarily invests in diversified assets in Greater Kuala Lumpur, Penang, and Perak. They actively manage their properties to optimize rental yields, potentially through renovations and maintaining high occupancy rates. The company owns a diversified portfolio of 19 properties comprising 5 retail properties, 6 hotels, 5 offices, an education property and two industrial properties, with a combined property value of RM9.0 billion as at 31 December 2023.

Sunway Pyramid which is owned by SUNREIT.

5. PAVILION REIT (PAVREIT) - 5.37% dividend yield

Pavilion REIT, founded in 2011, is a Malaysian company that invests in income-generating real estate, primarily high-end shopping malls. They focus on malls in prime locations, like Kuala Lumpur's "golden triangle," and aim to benefit from Malaysia's economic growth. Most of their properties are retail space, but they also have some office buildings. Pavilion REIT makes money by leasing space to tenants like stores, restaurants, and offices. In short, Pavilion REIT is a successful real estate investment trust in Malaysia that focuses on owning and managing high-quality retail and office properties.

Pavilion REIT which is owned by PAVREIT.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-26

AXREIT2024-07-26

CLMT2024-07-26

CLMT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-26

IGBREIT2024-07-25

AXREIT2024-07-25

CLMT2024-07-25

CLMT2024-07-25

CLMT2024-07-25

CLMT2024-07-25

CLMT2024-07-25

CLMT2024-07-25

CLMT2024-07-25

CLMT2024-07-25

IGBREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-24

AXREIT2024-07-23

AXREIT2024-07-23

AXREIT2024-07-22

AXREIT2024-07-22

AXREIT2024-07-19

AXREIT2024-07-18

AXREIT2024-07-18

PAVREIT2024-07-18

PAVREIT2024-07-18

PAVREIT2024-07-18

PAVREIT2024-07-18

PAVREIT2024-07-18

PAVREIT2024-07-18

PAVREIT2024-07-18

PAVREIT2024-07-17

AXREIT2024-07-17

AXREIT2024-07-17

PAVREIT2024-07-17

PAVREIT2024-07-16

AXREIT2024-07-16

AXREITMore articles on Stock Market Enthusiast

Created by KingKKK | May 13, 2024

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024

speakup

those are the Best of the Best REITS in malaysia! a must have in every investor porfolio

2024-04-21 21:31