Glove Supply and the Supply-Demand Disequilibrium (Top Glove, Supermax, Hartalega, Kossan, Intco, and Others)

Ben Tan

Publish date: Tue, 16 Feb 2021, 06:04 PM

The top 3 concerns expressed regarding the near- and mid-term future of the rubber glove industries can be grouped as COVID-related, demand-related, and supply-related. I have previously discussed my findings and analysis in a summarized manner in the links below:

1. COVID-related:

- Timeline of the pandemic (as of beginning of January 2021)

- Additional problems with the timeline, and associated risks (as of end of January 2021)

2. Demand-related:

- Glove imports in the US (the main market)

- Glove imports in the UK, Canada, and Japan (3 of the top 4 second-tier markets)

- Post-pandemic demand drivers

3. Supply-related:

However, up to now I have not discussed in detail the worldwide supply side of the equation, as well as the supply-demand dynamics and the currently existing disequilibrium. I will attempt to do that in a concise manner below.

My Research

Over the last few weeks I have been working on a research related to the global supply of nitrile and latex gloves. I spent a substantial amount of time on the research in order to make sure that the data is as representative as possible. As with any real-life research though, albeit my best effort, available data is imperfect for a number of reasons, including the dynamically changing nature of the business, trade secrets, and different reporting standards in different jurisdictions, among a myriad of other reasons. Some general statistics related to my research:

- I managed to identify 123 manufacturers of nitrile and rubber gloves in the world.

- These include 86 Malaysian companies, 18 Chinese companies, a major Thai company, and a number of predominantly smaller players with manufacturing facilities in Thailand, Indonesia, Vietnam, India, Sri Lanka, USA, Taiwan, UAE, Algeria, Ukraine, and Turkey.

- Of these, I managed to unearth the production capacities of 72, including all of the major players.

- The highest percentage of available production capacity data is related with the listed companies, and in particular the newcomers in the glove manufacturing industry in Malaysia, of which I counted 19 companies, including 5 acquisitions of pre-existing players. Production capacity information is available for all of them.

- The second highest percentage of available data comes from companies members of the Malaysian Rubber Glove Manufacturers Association (Margma). I found information for all but 13 of these companies.

- I have strong suspicions that some of the other Malaysian companies, which are not members of Margma, have been acquired by some of the bigger players, or they have closed doors, as I did not find any up-to-date mentions of some of these companies.

- Overall, the data I have collected accounts for over 95% of the available production capacity of nitrile and latex gloves in Malaysia, according to data published by Margma last year, and I believe for over 90% of the available production capacity in the world.

Some additional notes on how the data might have been adjusted:

- The present capacity is estimated as at end-2020 for most companies. Where reports for extra capacity coming online have emerged, they have been taken into account in the present capacity figures.

- When the exact end date of additional capacity being commissioned is not known, the end of the earlier full year is used in most cases, unless discrepancies between different sources exist, in which case the end of the present full year at which the capacity is expected to be commissioned is used.

- The figures are self-reported by each of the companies, directly or indirectly. Thus, some of the figures may be inflated.

- At all times, the self-reported figures are taken to mean maximum production capacity at 100% utlization rate of the manufacturing facilities.

- The final figures are adjusted to 80% utilization rate. The industry average across the major players is 75%-80%, and it is lower for the smaller players.

- The full set of data is available upon request to anyone interested.

General Findings

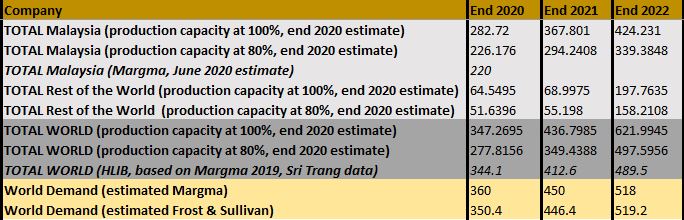

In my glove supply findings, I provide reference estimates from a 2020 Margma report (source), and from a Hong Leong Investment Bank (HLIB) report which is based on 2019 Margma estimates and data from Sri Trang (source, a downloadable file).

Demand data is based on 2021 Margma data cited by Top Glove (source), and on a 2020 Frost & Sullivan report (source).

My production capacity estimate for Malaysia at 80% utilization rate is above the 2020 Margma figure. My estimate for the world is below HLIB's estimate for 2020 and 2021, but above their estimate for 2022. This may be due to different adjustments or assumptions that might have been made in their analysis. For instance, the assumption for 2020 and 2021 might be at higher utilization rates than the normal utilization rates (closer to 100% for instance).

Additionally, I have included Margma's and Frost & Sullivan's natural growth estimates only. I have not included estimates on the excess demand for 2020 and 2021. According to Ansell (source, a downloadable file) and according to data by AmerCareRoyal cited by Forbes (source) the demand for gloves in 2020 was actually 585 billion gloves (from 350.4 and 360 billion projected by Margma and Frost & Sullivan).

As can be seen above, with all of these assumptions in mind, the projection is that by the end of 2022 there will be a shortage of between 20 billion and 30 billion nitrile and latex gloves.

Supply-Side Considerations

One of the most frequently expressed concerns on the supply side is that production overcapacity will lead to oversupply and a sudden sharp drop of average selling prices across the board. As can be seen from the illustration above, that is unlikely to happen. However, let's look more closely at where the main additional supply will come from.

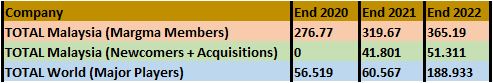

The main extra production will come from 3 groups of sources - Malaysian companies which are members of Margma, Malaysian newcomers and companies acquiring existing glove manufacturers, and major players in other countries. A major player is defined as a company whose production capacity at present is at least 5 billion pieces of nitrile and/or latex gloves. Where a company's main production facilities are in Malaysia, the company is listed as a "Malaysian" company for the purposes of this research.

As can be seen, most extra capacity will come from non-Malaysian players. Of these, by far the biggest contributor is the Chinese company Intco Medical. Intco plans to expand its production capacity to a total of 120 billion gloves over the next 15 months according to company's latest announcement (source). The current capacity of the company (as of last week) is 45 billion gloves. However, this capacity includes 24 billion vinyl gloves, and 21 billion nitrile gloves. For the purposes of this study we do not look at the vinyl glove market. In my assumption for the extra capacity, I have excluded the current capacity of vinyl gloves and I have assumed that all of the extra capacity will only go towards nitrile glove production. In other words the assumption is that by 2022 Intco will be able to produce 96 billion nitrile gloves per year. The second biggest non-Malaysian player - Sri Trang (Thailand), plans to increase its current production capacity of 32.619 billion pieces per year to 49.133 billion pieces per year by 2022 (source).

However, the second and third largest capacity expansions will be done by Malaysian companies. Top Glove reported 84 billion pieces production capacity (excluding vinyl gloves) and the company plans to increase that to 121.1 billion pieces by 2022 (source). Supermax plans to increase its production capacity from 26.175 billion pieces at present to 48.425 billion pieces by 2022 (source). As I have discussed before, this extra capacity excludes any capacity that will be commissioned overseas (see here).

There are so far 5 known acquisitions by non-industry players of Malaysian rubber glove companies:

- Diversified Gateway Solutions acquiring Duramitt (source)

- Salcon acquiring JR Engineering (source, source)

- Vizione Holdings acquiring SSN Medical (source, source)

- Inix Technologies acquiring L&S Gloves (source)

- Eonmetall Group acquiring Lienteh Technology (source)

Of course the acquired companies already have a certain amount of production capacity available. However, I have elected to give the figure for 2020 as 0 in this case in order to illustrate better this perceived additional capacity from newcomers to the industry. As can be seen, the maximum capacity from all 14 newcomers and 5 "acquirers" is estimated to be 51.311 billion pieces by 2022. This figure is significantly smaller than the figure for extra capacity coming from Intco alone, and it is slightly bigger than the extra capacity coming from Top Glove alone. Additionally, the 15 newcomers are expected to face difficulties such as raw material constraints, labor force shortages, and construction and production line installation related problems (source)

In total, out of the total projected extra capacity of 274.7 billion pieces per annum, 132.4 billion (48%) will come from major players outside of Malaysia, 88.42 billion (32%) will come from established players in Malaysia, and 51.3 billion (18.5%) will come from newcomers to the industry in Malaysia. In terms of individual players, 79.5 billion extra pieces per annum (or 29% of the entire extra capacity) will come from Intco, and 37.1 billion pieces (or 13.5% of the entire extra capacity) will come from Top Glove.

Conclusion

As a growth industry for over a decade now, the glove manufacturing industry is demand-driven. Any self-reported plans on additional production capacity will inevitably take the corresponding demand into account. Thus, it is possible that players with aggressive expansion plans but at the same time with major exposure to certain individual markets (Intco, exporting 50+% of its production to the US for instance) may change their strategy if the situation requires it. Overall, supply will be running behind demand at least in the next 2 years (according to Hartalega - for the next 3 years; source) even with the aggressive expansion of Intco, Top Glove, other major players, and the inevitable newcomers.

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-22

HARTA2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

TOPGLOV2024-07-22

TOPGLOV2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

TOPGLOV2024-07-18

HARTA2024-07-18

HARTA2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-17

HARTA2024-07-17

HARTA2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

TOPGLOV2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

TOPGLOV2024-07-16

TOPGLOV2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

TOPGLOVMore articles on Trying to Make Sense Bursa Investments

Created by Ben Tan | Jun 04, 2021

Created by Ben Tan | May 09, 2021

Created by Ben Tan | May 04, 2021

Created by Ben Tan | May 01, 2021

Discussions

Hi Ben, thanks for your great effort in compiling the information. Truly amazing!

The various sources you provide will be very useful. I've bookmarked this page so that I could return later to study the details and dynamics when I have time. Thank you.

2021-02-16 18:51

Ben, your report covers the breath and depth of the world supply-demand of gloves. You are extraordinary.

2021-02-16 20:03

接种疫苗推高需求 全球缺124亿只手套

https://www.klsescreener.com/v2/news/view/790979/%E6%8E%A5%E7%A7%8D%E7...

2021-02-16 20:04

Excellent job, Ben. I am taking on your offer. Please email me your data. I shall PM my email address to you. Be sure to check your i3 message box.

2021-02-16 20:55

Under the new normal even post pandemic, glove usage will be increased. Food handlers and processors , airline personnel and entertainment staff .......many will be wearing gloves and masks........outside the healthcare industry.

2021-02-16 20:57

Thanks again Ben! Certainly not easy doing such research work.

I've read many times in various articles how non-medical usage of gloves are really contributing to the overall growth in gloves demand & how it will continue to carry thru post-Covid. I think it's very real. Humans are habitual beings. When we're being forced to do something repeatedly, it locks into our subconscious mind. Hence few years down the road we can expect to see ppl in the service line continue to wear gloves as per requirement today.

2021-02-16 22:25

Imagine333, observatory, dumbdumb123, Stock Eyes, invest200, huat8787, katsul51, Goldberg, omione, CJkenho, Trump2020, thank you for your comments.

huat8787, thank you for sharing this link. Yes, this is the latest glove industry research report I have referred to in my article.

omione, I just sent the file over to you.

dumbdumb123 and CJkenho, yes, usage in non-medical industries (especially in developing countries where pre-COVID it was near zero) will be the main added growth (extra growth on top of the 8-10% annual growth pre-COVID) factor moving forward. It will not be purely due to habits and hygiene awareness, but predominantly due to official safety requirements that are being put in place.

2021-02-16 22:35

Ben,

I’ve done some back-of-the-envelope calculations for Capex for expanding glove production capacity.

According to Top Glove press release when reporting the Q1FY2021 result, it plans to spend RM10 billion over the next 5 years to add 100 billion pieces capacity. This works out to be RM100 Capex per 1,000 pieces, or USD25 Capex per 1,000 pieces (assume USD1 = RM4).

During the last quarter, Top Gloves probably achieved a blended ASP in the order of USD70. The operating expenses, which include depreciation of earlier Capex, is only about USD20 per 1,000 pieces. This magnitude of profit (before tax) is almost USD50 per 1,000 pieces. Given a Capex of just USD25, it takes only 6 months for investment to breakeven!

Even if we assume ASP eases to USD45 later, still it only takes 12 months for investment to breakeven. This serves as a very powerful incentive for all current and would be glove producers to join the fray.

I performed a similar rough calculation for Intco Medical. In its latest capacity expansion announcement made 2 weeks ago, Intco plans to spend CNY 5 billion for a production facility of 45.75 billion medical glove capacity.

https://vip.stock.finance.sina.com.cn/corp/view/vCB_AllBulletinDetail.php?stockid=300677&id=6894219

This works out to be CNY109 Capex per 1,000 pieces, or about USD17 per 1,000 pieces (assume USD1 = CNY6.5). If the figures quoted by both sides are correct, the Chinese producer has about a 30% cost advantage over Top Glove.

If we assume Intco's operating expense is also around USD20 per 1,000 pieces (as discussed earlier, Intco in fact has a higher operating margin), Into could breakeven investment within 12 months with an ASP of around USD37 (=$17 Capex + $20 operating expenses). The ASP required for a 3-year investment return is about USD 26 (=$6 Capex per year + $20 operating expenses).

Of course, the above calculation assumes 100% capacity utilization, which if lowered to 80% to 90% would raise the ASP bar a bit higher. But on the other hand, the assumed $20 operating expenses are probably on the high side as it includes depreciation, which means it is double-counted in the Capex.

Of course, there could be other constraints like factory construction time (even with China speed), production line installation, and NBR supply where new petrochemical plant capacity only arrives in stages. But I feel that these constraints will ease over a 2 to 3 years horizon.

That brings me to the question of what is the long-term sustainable ASP that can balance the incentive for glove producers to expand really fast. In the Intco case, the above simplistic calculation shows roughly USD26 ASP will sustain a 3-year breakeven timeline.

This could be uncomfortable for the current glove stock valuation. For example, in the RHB report for Top Glove on 18 Jan, RHB TP is based on 3 scenarios of long-term ASP post-2023. The bull/ base/ bear scenario ASP is USD47.5/ USD37.5/ USD 27.5 respectively. In other words, based on the above calculation, Intco could still breakeven within 3 years even with an ASP that is below the RHB’s bear scenario. As long as it can get all the necessary funding (for example through its HK listing), the math is on its side.

My reasoning could be wrong. Otherwise, it seems to point towards a rather low ASP in a few years time.

2021-02-16 23:29

observatory and Supermax2020, thank you for your comments.

observatory, thank you very much for your detailed analysis. Yes, the ROI for any capex in glove production expansion right now is astoundingly high, and with other things equal, any extra expansion right now will result in a 100% return on that investment within less than a year. However, as you mentioned there are certain constraints, especially in terms of raw material, and in many cases (especially in the midst of a pandemic) - in terms of human resource availability.

Now bear in mind the following things:

- Your calculation for expansion capex ROI is based on the present year's ASP, which as we all know will not be sustained at this level for an extended period of time. Thus, any extra capacity that will come on board due to raw material constraints (for instance) after 2 or 3 years, will have far worse ROI than any capacity that goes online right now. That is the reason why existing players have aggressively moved their expansion plan timelines within this year, as opposed to the previously 2- or 3-year timeframe. That is also why we don't see new players with projected timelines of starting production in 2-3 years into the future. In fact, this is the reason why Japan and Germany, as well as to a large extent the US, scratched off the idea of building up domestic capacity. The US will commission domestic capacity from US manufacturers to the tune of 12 billion pieces per annum, which will serve about 10% of the needs of the local market and will be used exclusively as a cushion, rather than as an actual market-mover. In fact, observing the national strategic plans of the main glove importers was the main reason I delayed my entry in gloves until I was certain it would not happen at any meaningful scale.

- As we have discussed, Intco has the incredible start-up advantage to be able to get land practically for free, and likely other incentives from the local Chinese governments. However, this is not the case for anyone else, and it is most certainly not the case for any of the Malaysian players. Thus, the ROI time curve looks very differently for other players (the vast majority of the players). Also as I have mentioned before, I believe post-pandemic (or even beginning within the pandemic itself, once extra capacity is available from Malaysia and domestically), the Chinese companies will face tremendous difficulties with exports to the US, Japan, and likely other aligned major import destinations. Presently the main reason why the Chinese companies are able to increase their share of the imports to these markets is because Malaysia still does not have the capacity to fully serve the existing demand. Trade and geopolitical issues are unlikely to disappear. At present the US imports of Chinese PPE are allowed only very reluctantly on the American side, and are viewed as a "deal with the devil", like how the EU and Russia are in extremely tense relationships, but the EU still needs to import gas and petrol from Russia. Once the need is not there, the problem will lie with the exporter, and the EU would love to not import fuels from Russia (hence you had the war in Syria for instance).

All of this is the reason why, even though at present any new capacity expansion is likely to result in over 100% ROI within 1 year, we are not seeing an actual explosion of hundreds of players rushing to invest in opening new factories. Most of the new capacity comes from existing players as they have better access to self-produced raw materials as well as to third-party raw material providers. On Intco's expansion, I follow the case with a lot of interest, but my mid-term expectations on Intco's business prospects are negative.

2021-02-17 00:13

Hi Ben, thanks again for spending time to explain your thought in detail, which is really insightful.

I agree newcomers are at a disadvantage in expanding capacity. By the time they iron out their start up problems due to their lack of experience, the ASP would have been much lower than today. That’s why some Malaysian producers that you’ve listed acquired existing players. However, the acquisition does not create new capacity in the market and therefore will not impact ASP.

Intco is one of the few current players that are in a lucky position to expand really fast as they have ready setup and know-how in place, and their public listed status lends them the platform to raise funds quickly and more easily. I haven’t checked the other listed player Chinese Bluesail. Until recently Bluesail is about the same size as Intco. In theory, Bluesail could enjoy the same cozy relation with local governments, but the management seems to be more conservative.

Therefore my main focus is on Intco. Not so much as an investment opportunity (not that I can access China market). But given its low breakeven price and sky-high ambition, I want to know if it will play a spoiler role in its pursuit of market share.

Based on its 2020Q3 financial statement, Intco has net cash of CNY3.7 billion. Given its current market cap of around CNY80 billion at Shenzhen ChiNext, if it’s lucky it could potentially raise say another CNY16 billion cash in its second listing in HK assuming a 20% new equity issue at current valuation. With a total of about CNY20 billion (about USD3 billion) cash in its war chest, based on its Capex of USD17 per 1,000 pieces, the back of the envelope calculation shows it could potentially fund 1,000 * 3/17 = 176 billion capacity without even raising debt or using future cashflow.

I’ve thought about geopolitics. Developed countries account for about 70% of global glove demand. The US alone probably accounts for about 30%. In the world of increased Sino-American rivalry, Chinese exporters could face increased barriers into the US market.

However, since the US represents a fraction of the world demand, the trade obstacle imposed on Chinese imports will not have much impact. Like water trade will flow around barriers. Chinese imports will flow to the non-US market while Malaysian products come to dominate the American market. This is the scenario that played out when US Custom banned Top Glove import. In response Top Glove just channeled products to the non-US market, displacing other players that increased their export to the US. The same dynamic happened when India banned Malaysia palm oil in early 2020 where Malaysian export just switched places with Indonesian.

The entire China export industry (not just gloves) will face bigger obstacles if US manages to line up European Union, Japan and other developed countries to form a unified trade wall against China. But I view it as a very low probability scenario as each country has its self-interests to take care of. In fact just in Dec last year EU signed a free trade agreement with China despite the plea by the incoming Biden’s administration to delay it.

To recap my concern is not so much on Chinese players dominating the market. Rather my concern is whether their low-cost advantage (using the example of 3 year ROI even with an ASP as low as USD26) could spoil the market, thereby destroying the case of current glove stock valuation which has assumed a higher long-term ASP.

2021-02-17 02:05

Hi observatory,

Thank you once again for sharing your thoughts.

First, on the issue of extra supply. To be sure, ASPs will most certainly fall. This is inevitable and this will be a result of the supply starting to catch up with demand eventually. However, as mentioned above, extra supply serves as a self-fulfilling prophecy of sorts, destroying its own economic value. Intco's market valuation assumes a lot higher ASPs for longer time than the valuations of the Malaysian listed glove companies do. Thus, churning out seemingly infinite extra production wouldn't serve Intco any particular good (and in fact, it may serve it more bad than it would for other glove companies). In other words, the risk of oversupply or even the risk of supply catching up with demand too soon, may be significantly higher for Intco than for other players. So as we have discussed before, I believe extra production expectations will continue to get adjusted based on demand expectations. It is widely believed that while ASPs will gradually fall, they will eventually settle at levels somewhat higher than the levels from pre-pandemic times as the catching up with demand will be happening at a faster pace (i.e. demand growth will be faster than pre-pandemic).

On geopolitics, I don't think it will be as easy for Intco to switch away from the US market. Top Glove was able to make the switch without it impacting the company in any major way, because of two main reasons:

1) It has a significantly more diversified customer portfolio than any other player in the world (far more diversified than Intco);

2) The ban happened amid conditions in which demand everywhere in the world far outstripped supply.

These are the reasons why I have jokingly mentioned elsewhere that the timing of all of the turmoil around Top Glove's business practices is actually good. The company has both the cash to resolve the problems, and it has the capacity based on the current economics of the market, to not be affected financially in a significant way.

Intco relies heavily on the US market for its exports, and from my checks the US is not a fraction of its exports, but rather by far its largest exposure. Any consideration the US could give to imposing ban on China imports, or to imposing heavy import tariffs for instance, can only happen once the pandemic is put under control in the US. So it will coincide with a period during which the supply-demand disequilibrium will not be as massive as it was last year. Thus, this in my view is a major risk to Intco which the company has either not considered sufficiently enough, or has purposefully omitted in its releases to its shareholders.

Overall, we can never know how the dynamics will truly play out. However, we can only trust that business sense will prevail and companies (in particular Intco) will have the sensibility to moderate their business decisions based on market conditions - which I believe will happen.

2021-02-17 08:50

Excellent write up as usual, Ben.

I'm impressed you managed to extract more information about Intco than I was able to. Trying to find the annual reports alone made me want to #headdesk.

One question on my mind, for the 2020 estimated figures you gave, why do you put in the assumption that overall production is going to operate at 80% capacity?

If demand still outweighs supply (albeit at not such a large spread), wouldn't natural market forces equilibrium mean that overall production would be higher than than to the point where it should meet or at least slightly exceed demand?

2021-02-17 09:03

sikusiku, thank you for your comment.

Regarding utilization rates, I purposefully left two assumptions in the final findings - at 100% utilization and at 80% utilization. Additionally, I added references so that it is easier for people to see how industry experts might assume the utilization rates will be moving. I didn't want to arbitrarily make my own assumptions, i.e. I didn't want to say things like "utilization rates in 2021 will be 95%, but in 2022 they will fall to 85%" or something like this, although this is a likely scenario.

2021-02-17 09:08

Hi Ben! Thanks for your view again.

I agree we can never know fully how the dynamic will develop in the future. What we can however do is to look into past records for guidance.

I too believe the secular growth of gloves far into the future. In the past, the leading Malaysian glove makers have shown remarkable collective restraint in their capacity expansion. They scale back expansion when market demand didn’t grow as fast. Such “cooperation” has ensured all efficient players could maintain profitability. But such implicit understanding might be more difficult when foreign big players like Sri Trang and Chinese start appearing.

Looking back into past financial data, excluding the bumper year of 2020, in the decade since 2010 operating profit margin for Top Glove was 7% to 13%, Supermax 9% to 16%, Kossan 11% to 17%, while Harta was at a different level of 20% to 33%.

Such good, but not excessively high margin, is one reason why Malaysian glove leaders continued to dominate the market until now. The moderate operating margin did not provide adequate incentive for new challengers to take on incumbents that already have the economy of scales.

This also explains why the long-term trend of ASP is actually downward. I’ve tracked Hartalega blended ASP year by year. Until 2019 its annual reports would display a chart showing annual nitrile glove shipment. A rough estimate of its ASP can be derived by dividing annual revenue with shipment quantity and converting it to USD based on the exchange rate at that time.

Over the 2011-19 period (where it was almost a pure nitrile glove producer with 90% to 95%), ASP gradually declined from around USD40 to USD25 per 1,000 pieces, representing a compounded annual decline rate of about -5% to -6%. It’s clear that the law of economy would drive down ASP, even during a period of high demand growth. This is why I’m skeptical that the long-term ASP could settle at a higher level. There seem no convincing economic reasons to support a higher plateau for long term ASP.

In a more likely scenario, if all key players including the Thai and Chinese could “cooperate”, long term ASP should revert to a cost-plus basis where leading players continue to enjoy an operating profit margin of say 10% to 15%, or even 20% for an innovator like Harta. After tax, the net margin may be around 10%, plus or minus a few percent, as achieved by key players in the last decade (again excluding 2020). However, this will imply a reversion to ASP below USD20+, i.e. the bear case scenario in RHB valuation I mentioned in the earlier comment.

Yes, in that case, Intco shareholders who are new to the party will be proven too optimistic. Having said that, Intco forward PE (the only relative valuation measure I can find) is at 11 times, while higher than Top Glove it’s lower than Harta.

But note Intco’s valuation is not solely based on the high ASP assumption. I’ve read those Chinese analyst reports, news articles and investor blogs. The sentiment is clearly based on Intco aggressive expansion for market shares. It seems to prioritize market dominance first and high profitability can wait.

Besides, even if minority shareholders may abhor the idea of destructive competition, the controlling shareholder can have a different calculation. Right now Intco controlling shareholder Mr. Liu merely sits on his paper wealth consisting of 40% company shares. Mr. Liu couldn’t cash out by selling his stake without bringing the price down. From his perspective, therefore, it could be better to exploit the current high valuation to attract more capital. Hence the Hong Kong listing on the premise of rapid expansion and long-term growth. Intco current valuation expects it behaves like a growth company. Rapid market share and revenue growth come first. Lower profitability could be tolerated during the growth period.

Actually, the pursuit of market share at all costs is not new in China. China shareholders should have gotten used to it. Not just solar PV panel and steel coils. During the bike sharing craze a few years ago, Ofo, Mobike and other aspiring unicorns competed to burn cash, rolling out free bikes for users while still figuring out their business models. When the dust settled they already burned more than USD5 billion and 25 million bikes ended up in “bicycle graveyard”. At least the glove sector would have a more benign competition. Players can still make a profit even despite slashing prices.

2021-02-17 18:26

I also don’t think Intco needs to worry about US protectionism or even outright ban, despite US being a key market currently. Even though Intco annual capacity has already increased to 45 billion, that is still a fraction of its announced additional capacity of 190 billion. If the management senses the risk of over concentration in US, it could aggressively future capacities to non-US market.

Glove impose little switching cost on customers. I doubt customer loyalty on branded gloves, not to mention many producers are OEM. To prise open new markets outside US, Intco just needs to lower price sufficiently given it’s already a low cost producer.

If I’m in Mr Liu’s shoes, I will be more concerned on how fast I could seize the opportunity to raise the multibillion necessary to support aggressive expansion. Luck will play a role here. One is the sentiment of Hong Kong IPO market, which currently is piping hot. The other is whether ASP can stay high for the next few quarters so that their investment bankers can sell a good story to fetch a lofty valuation. Afterall the IPO market is mostly about sentiment where participants are motivated by quick money.

Therefore, although current consensus is glove ASP will remain elevated at least until end of 2021, it might not be a bad thing if ASP normalize sooner. It will at least pour cold water on Intco’s second listing and deter it from raising the necessary fund to launch a race to the bottom.

2021-02-17 18:28

US imported Vinyl gloves in quantity for year 2020 increased nearly 50% compare to rubber gloves at only 20%.

The ASP of imported vinyl gloves has risen from US$10.56 in 2019 to US$26.20 in 2020, a 148% y-o-y increase, the ASP for Q4 was US$36.56.

On the contrary, the ASP of imported rubber gloves has risen from US$24.85 in 2019 to US$36.84 in 2020, a 48.3% y-o-y increase only, the ASP for Q4 was $54.43.

I believe it was due to shortage of rubber gloves, and US forced to import higher volume of vinyl gloves thus paying higher ASP. ASEAN glove makers need to capture the additional 50% or nearly 30 billion pieces of vinyl glove volume back to rubber glove market share.

2021-02-18 00:31

observatory and super_newbie, thank you very much for your detailed comments.

observatory, we are running into something we've touched on during some of our private chats, and which I wouldn't necessarily want to discuss publicly as it involves investment strategy. To be sure - I agree that ASPs falling faster than they are projected to fall will have a beneficial long-term effect on all players except for Intco. I have no doubt in China's capability of spoiling a market, specifically from a short run point of view, so I am observing with interest Intco's moves.

On the geopolitics of China's exports and the macroeconomics of the sector, any possible long-term sustainable prospects for Intco would have to (likely inevitably) involve a focus switch of their exports to developing countries. And at the same time, as we have discussed, while Intco is able to run on a very impressive operating margin right now, this is unlikely to sustain as their current major advantage (government incentives at start-up) doesn't provide them with long-term cost benefits, while at the same time the pre-existing disadvantages of the China producers remain. In other words, their prospects are bleak - both in the mid term where the bulk of their extra capacity will likely only come on board as ASPs start falling (and in fact it will be a cause of the fall), and in the long term when economically they are much more likely to crumble than to succeed. In this sense, I believe that once ASPs start falling, Intco will experience severe difficulties in finding the needed capital for further expansion relatively quickly. Again, I will be observing the unfolding of the situation with great interest.

super_newbie, the usability of vinyl gloves is significantly lower than that of nitrile and latex gloves. Additionally, there are serious concerns over their safety in food handling industries (where they are mainly used), as well as on their environmental impact. Thus, they are unlikely to ever become widely used in the developed countries, and they are likely to have niche, likely diminishing over time, usage in developing countries. So yes - the main reason for the rise in their imports is most certainly related to the shortage of the superior nitrile and latex gloves. This is truly a one-off event, so I don't think it's worth it for ASEAN manufacturers to invest heavily in this niche.

2021-02-18 05:06

Sri Trang will ramp up capacity to 50 billion gloves next year and to 100 billion in 2026. It currently has a 32 billion-glove capacity.

I think it will play to its strength in latex & not be constrained by nitrile availability.

https://asia.nikkei.com/Business/Health-Care/Thai-medical-glove-maker-invests-1.6bn-to-triple-capacity-by-2026

2021-02-18 16:39

pxxluo, thank you for your comment.

I reviewed Sri Trang's latest financial statement (from a couple of days ago), you can find it here: https://links.sgx.com/FileOpen/MDA%20STA%20FY20_EN_Online.ashx?App=Announcement&FileID=648459 (on page 7).

Interestingly, they have actually cut down (slightly) their expansion plan. You can see their expansion plan they announced with the previous quarter results release in November here: http://stgt.listedcompany.com/misc/mdna/20201116-stgt-mdna-3q2020-en-02.pdf (on page 3).

2021-02-18 17:06

Hello Observatory@你好,

You have elaborated on the culture of doing business in China. Even if they lower the price to grab the market, such "innovative" and "smart" methods, I am afraid that they have already performed before I was born on this earth. In other words, I am afraid that it has been staged in all parts of the world, including Malaysia, but it is just how serious and obvious this situation is.

Using the (南海策略)strategy to "innovate" to create new demands in order to reach other competitors' markets, this strategy was used by Harta about 13 years ago. At present, everyone is paying attention to Intech's (where is the advantage...) or (tossing the price to grab the market...) in order to "stabilize" its "position" as the industry leader.

How this (红海策略) used by Intech’s management affects the market or competitors is also one of the factors in valuation. Only when everyone considers all factors, the strengths and weaknesses of the company, can investors be more comprehensive and objectively measure the potential risks of the company, especially the 50% of Intech’s main export volume-assuming-is blocked by the Americans, and the financial sector is What is its valuation?

The construction capacity failed to achieve the expected results. What is the management's other solution and plan?

If the overall downward trend of Asp is unavoidable, what are the actual actions of management to increase the profit margin of the company ahead?

Please forgive me for my lack of knowledge, not much study, and graduated from elementary school. I probably use valuation to turn it into "evaluation", perhaps I have a better understanding and appropriateness of the view of the overall financial industry (evaluating the glove industry). Evaluation is a very subjective thing, and it is not directly related to what happens in our real lives. It arises from the fact that the person making the evaluation thinks what is going on, regardless (how much the judgment differs from the fact).

Healthy competition is immortal. Its profitability can also exceed the growth curve of its peers. I believe the financial industry is more willing to give it a higher evaluation.

2021-02-18 18:03

Hi Ben Tan, Sri Trang (NC2) share price today up 27%, hitting record high again!

2021-02-18 20:18

Expect all will be killing each others in 2 years time, only the best will stay.

Top 4 will still there with Top Gloves still No.1 & Supermx being No.4.

2021-02-18 20:24

Bao2lai, cpchuan, Flying Fox, thank you for your comments.

@Bao2lai, I believe some of observatory's comments might be getting misunderstood. He is not specifically optimistic on Intco's future, in fact he thinks (and I agree with that) that Intco might spoil the market for everyone, including for themselves. Intco doesn't have a clear strategy other than trying to grab as much of the market share as quickly as possible, which might lead to a run to the bottom for everyone. In this sense, they are likely the most major threat to the glove industry as a whole, specifically in the mid term.

@cpchuan, yes, this was slightly unexpected for me. In their announcement from a couple of days ago, they did not mention anything particularly unexpected. However, it seems like the market has reacted on the news of them tripling their capacity by 2026 - something which was announced with their last quarterly report in November 2020. I guess as this is a full year report, it has gotten a lot more attention.

@Flying Fox, my expectation is that specifically the newcomers will be unable to survive. Additionally, I am not too optimistic on the prospects of some of the smaller listed companies, whose share price rose in tandem with the share price of the major players.

2021-02-19 10:54

This is the best analysis ever for gloves industry..unbiased and reliable..thank you sir

2021-02-19 12:31

Ben, your table uses the assumption that glove demand in 2021 is +25% compared to 2020, and grows another +15% in 2022.

Historically, glove growth demand is usually 8% per annum or something IIRC. ... in 2020, glove demand shot up from 290b to 360b, a +24% increase.

So, all in all, that table assumes that glove demand in 2022 will be 518b compared to 290b in 2019, a whopping +78% increase. ... which is more than possible if the pandemic continues or worsens, I guess?

without a pandemic though, I'm a bit skeptical that glove demand in 2022 would be 178% that of glove demand in 2019...

2021-02-19 19:46

Jimmy07, jasonred79, iswara, thank you for your comments.

jasonred79, as explained in the article, the demand estimates are not mine. They come from two independent researches - Margma (2021) and Frost & Sullivan (2020). Both of them are linked to in my article.

2021-02-22 10:59

Imagine333

Incredible and very detailed analysis.

2021-02-16 18:12