Top Glove: How Is the Gloves Short Seller Closing Their Short Position?

Ben Tan

Publish date: Wed, 17 Feb 2021, 06:09 PM

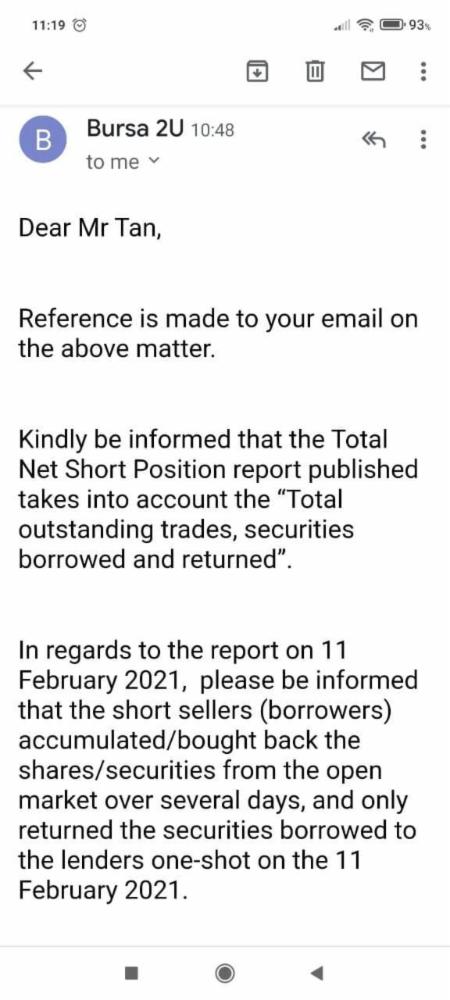

Over the past few weeks, we saw some curious things happen, surrounding the likely largest short position by value ever opened on a single stock on Bursa Malaysia - the short position on Top Glove. I summarized all of these events here. In my post I speculated that the recent closing of parts of that short position has happened in off-market transactions. A member of another forum shared the following screenshot of an email they have received from Bursa Malaysia inquiring about that:

On further inspection, this explanation doesn't hold water. Let's look more closely into the timing of events.

In total, we can cluster the suspicious occasions of closing of short positions on Top Glove's stock in 3 groups:

Occasion 1: 4-22 January 2021, EPF getting back their shares

Between 4 January (when the massive short position was opened) and 10 January, no buying back of shares of Top Glove was observed. Between 11 January and 21 January the short seller(s) of Top Glove stock bought back a total of 15,698,598 shares of Top Glove on 4 different days. On 21 January, EPF got back 19,699,000 of the shares it had previously lent via the SBL facility (source). Then on 22 January, EPF got additional 36,051,480 shares back (source). This makes a total of 55,750,480 shares that have been returned to EPF within this period.

This means that 40,051,882 shares were returned to EPF that have either never been shorted, or that have been bought back via off-market deals. Having in mind that the short position's main strength in suppressing the share price was associated with its sheer size, it would make little sense for the short seller to have been holding 40 million shares and not shorting them. Bear in mind that the short seller continues to pay borrowing fees as long as they hold the shares, no matter if they short them or not. Thus, basic logic would dictate that the only possible solution to the equation is that the short seller has procured the extra 40 million shares via off-market deals.

Occasion 2: 10 February 2021, the short seller starts closing aggressively

On 10 February, the net short position on Top Glove decreased by 27,600,000 shares. However, as I wrote in my earlier article, this amount is larger than the volume of shares traded on the open market for the entire day. Bursa's explanation, as you can read above, is that the short seller had been buying the shares over a period of several days before returning them to the lender in "one-shot" (quote from Bursa's email). For the short seller to do that makes little sense, because as mentioned above, as long as they hold the shares - no matter if they are shorting them or if they are buying them, they pay a borrowing fee to the lender.

However, let's assume that Bursa's explanation is accurate. Let's also assume that the short seller had been accumulating the bought back shares for the entire week of 8-10 February. The total volume of transactions for that period (3 trading days) was 85.61 million shares. Of this amount, EPF bought 16.33 million shares, Top Glove performed a share buyback exercise for 600,000 shares, and EPF sold 1.06 million shares (source, source, source, source). The total remaining amount of "unknown" transactions was for 69.74 million shares. If the short seller was the buy side for 27.6 million of these shares, that would mean that the short seller bought 39.6% of all the shares on the open market that were not bought by EPF or by Top Glove within that period of 3 trading days.

Occasion 3: 15 February 2021, the closing of short positions continues

On 15 February, the net short position on Top Glove decreased by another 17,680,000 shares. Let's once again assume that Bursa's explanation applies and the short seller has been accumulating shares for several days. Obviously since they last returned shares to the lender on 10 February, this would mean that they have been accumulating only in the time period after 10 February. In that time period there were only 2 trading days - 11 February (half day) and 15 February. The total volume of transactions within this period was 23.23 million shares. If what Bursa claims is true, then out of this volume, the buy side would have been the short seller in 76.1% of the trades! The opposite should also be true - all other market participants would have been responsible for only 23.9% of the open market transactions.

Even more impressive is that if that is indeed the case, then the short seller has managed to buy the shares without disturbing the overall market at all. The market price of the stock in these two trading days fluctuated within a very narrow range - between RM6.16 and RM6.25. Thus, this huge volume of bought shares by the short seller has had only an insignificant effect on the market price. A truly remarkable achievement.

Update: 18 February 2021

Based on the latest data, accurate as of 16 February, the short seller has covered additional 16,300,000 shares worth of short positions. Since this is based on just 1 day of trading, we will assume that all of this amount was covered on 16 February itself. On that day the total trading volume on Top Glove's stock on Bursa was 29.84 million shares. Therefore, if the short seller indeed covered their position via open market activity, they were the buy side in 54.6% of the transactions for the day.

For the two trading days of this week we have up-to-date data for, the short seller has returned a total of 33,980,000 shares. The total volume of trades for these two days is 42,830,000 shares, and the price has only moved in the range between RM6.05 and RM6.25. This would signify that if what Bursa Malaysia claims is true, the only major player buying Top Glove's stock must be the short seller, while almost everyone else is only selling.

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trying to Make Sense Bursa Investments

Created by Ben Tan | Jun 04, 2021

Created by Ben Tan | May 09, 2021

Created by Ben Tan | May 04, 2021

Created by Ben Tan | May 01, 2021

Discussions

The whole exercise is more opaque than the cup of black coffee I just had. It stinks to high heaven. It just reinforced my belief that they are all in it together in one big cabal with the retailers at the bottom of the food chain. So much for RSS being assisting in providing liquidity to the market. All nice soundbites to hoodwink the retailers. And that is how retailers should approach investing in this casino with their hard earned money. With a healthy dose of skepticism, and always do your homework!

2021-02-17 22:38

bullpiano, JuzzyOracle, thank you for your comments.

bullpiano, I was unable to find information that would confirm if off-market covering of previously opened short positions is allowed on Bursa. However, simple logic would dictate that this practice is not allowed. The reason more transparency is brought to the short selling practices in general is so that investors can make informed decisions based on the existing open market positions on a stock. Thus, if a short position has been opened via open market activity, it should be required to be closed via open market actions, too.

JuzzyOracle, unfortunately in cases like this there is hardly anything retailers could do to prepare themselves in advance. The only thing that could help is if retailers make sure both the relevant authorities (in this case SC) and the media hear about suspicious looking cases, so that they hopefully investigate further.

2021-02-18 05:12

Very informative. Appreciate your effort to combine all the facts into 1 piece. Unlike other bloggers who are just bull and shitting along the way. Thanks !

2021-02-18 10:02

WHEN STOCKS GO UP, then players get 10year jail for stock manipulation, ramping up , insider trading etc THE AUTHORITIES AND LAW punishes severely BUt its okay if someone manipulates it downwards by driving fear into investors ! Because they have never seen it before ...a 200million shares shortie GORILLA playing in bursa pond !

2021-02-18 12:51

MCDX chart was showing higher IB fund from 8 Jan - 18 Jan, whereby TopGlove was up from 5.8 to 6.77. Then another batch from 22 Jan - 26 Jan, whereby TopGlove was up from 6.02 to 6.58. The last batch was from 29 Jan - 5 Feb, whereby TopGlove was up from 6.21 to 7.07.

All of these buying batch ended up with sharp drop after IB stop buying before they bought again after the sharp drop.

2021-02-18 15:59

Such pattern is similar in Harta and Supermax too. Now the question is whether they made money by buying back Top Glove above 5.80 (first batch), 6.02 (2nd batch) and 6.21 (3rd batch)

2021-02-18 16:02

BeLikeBuffett, cherry88, mikeazk, Citadel00, Thepolicia, AdCool, Peter5151, thank you for your comments.

mikeazk, the conclusion is that most likely what Bursa is saying is false, i.e. the chance of it being false based on simple math is a lot higher than it being true. Bursa might be misled by the short seller though, we do not know. It would be great for them to check thoroughly on that of course.

AdCool, the short seller is most certainly losing money, no matter at what price or how they have covered their shorts. Their average shorted price is 5.80 as of yesterday, so if there is any question it would be how much money they have lost.

2021-02-18 17:01

Even if they are losing money, they are not letting off the gloves counters. They are still attacking it amidst lesser attacks nowadays. So who was the one selling down gloves? warrants issuers? We should wait until most warrants (in money) expired by mid March 2021.

2021-02-18 17:14

Is off market transaction allowed? see the link below on bursa's trading manual

https://www.bursamalaysia.com/sites/5d809dcf39fba22790cad230/assets/5fcdabe439fba27a9596b8f6/POs_Trading_Manual_v27_Final_highlighted.pdf

Clause:

"7.1.3 Short selling is only applicable to Normal Market, and not allowed for Odd lot, Buying-in and DBT markets."

So DBT markets (direct business transactions) are not allowed

2021-02-18 22:41

Clause 7.2.2 in the trading manual for RSS (Regulated Short Selling) specifically:

"POs must open and use a designated trading account (RSS trading accounts) for RSS orders. Normal orders and Direct Business Transactions (DBTs) are not allowed in RSS trading account. With the exception of :

a) erroneous trades on non-RSS approved securities and shares of non-RSS approved securities credited into the designated RSS account arising from corporate action. To facilitate rectification, normal buy and sell would be allowed to close off such positions. The PO is required to report such cases if any in the Monthly Compliance Report.

b) normal buy transactions of RSS approved securities in the RSS account are for return only."

Normal buy transaction of RSS securities are for return only...still DBT IS NOT ALLOWED

2021-02-18 22:44

Hi Mr Ben Tan,you did well comb thru the short seller data.After receiving the BURSA email replied,I have followed up with request them to publish daily the RSBB ( regulated securities buy back !!! ) ,since we have RSS( now in trading platform daily ),Net short position ( daily annoucement ond day delay) for transparency and level playing filed to all.The "One shot" return of borrow securities accumualate many days is tantamount ambush shooting the retailers. If the off market deal by major shareholders need announce, then the short sellers off market deal should not be an exception !!! If pump and dump is a illegal, then the dump ( short sell together with bad write up /rumours legally or illegally) and pump isnt it illegal as well? Hope all can write to BURSA to make the requests and give them pressure and urgency to do that ...The short sell Game stop here !!! Good luck !

2021-02-18 23:00

Don't need to delve too much into RSS.

What is the point of understanding it if its not making sense?

Stocks goes up and down with or without RSS.

You seems to be delving into RSS just to justify the sake of why the stock price is being artificially pushed down.

It could be other reasons that you are not aware of but its not always when a stock goes down that RSS is to be blamed.

What you need to know is that RSS merely expedited the drop but not entirely contributing to the drop.

2021-02-19 03:05

1) ASP is coming down

2) Number of shareholders in glove co increases by 300%

Dont have to waste yr time to study so much.

2021-02-19 06:01

I still believe that , short selling should not be allowed, especially not the owner of the share.

2021-02-19 08:03

@CharlesT. If that is true, dont you think TS LWC and Stanley are so silly to be expanding their businesses?? They should listen to you!!

2021-02-19 08:19

Biz still has to expand lah or else some other may overtake them....but once in a century pandemic n high ASP (sharp increase in profit by more than 15 times etc) cannot sustain loh

2021-02-19 08:42

Will likely be back to its normal net profit margin in next 2 to 3 years time

2021-02-19 08:44

@Ben, based on Bursa report on 19-Feb. net short position been reduced another 15m shares on 18-Feb. Again without moving the open market price.

2021-02-19 08:44

Over the years, those who bought n hold Big 4 glove co shares are proven to be very good long term investment...no doubt on that

However, for those latecomers who bought during Q4 last year will likely to be a bad inv in long run

Mark my words

2021-02-19 08:46

AdCool, bullpiano, hylees, Protectcap, AzerothJr, CharlesT, Winner88, LossAversion, lkoky, thank you for your comments.

@AdCool, the short seller has to continually suppress the prices until they successfully exit their positions. For instance, currently they are suppressing Supermax as much as possible, because this is one way in which they may recuperate some of the losses incurred on Top Glove and Harta. Supermax's shareholder base comprises of retailers to a much larger extent than how it is for any of the other major glove companies, so suppressing the price is easier as long as they are able to find the necessary amount of shares to short.

@hylees, yes, I found the same information. I hope people will inquire with Bursa and with SC for a confirmation on if this practice is indeed disallowed.

@Protectcap, yes, I hope more people will inquire about this with Bursa. Extra transparency has never hurt anyone, except for anyone doing shady deeds, of course.

@AzerothJr, the reasons for market price fluctuations of a company's shares are a myriad. The goal here is not to explain all of them.

@CharlesT, your first statement is true - eventually the ASPs will go down, and if you have read my other posts, you would know that I believe that is a rather healthy thing to happen. In any case, your comments are not related to this post.

@lkoly, yes, the skill of the short seller is incredible in buying (according to Bursa - in open market transactions) huge amounts of shares without that resulting in a corresponding market price increase.

2021-02-19 10:47

We have been witnessed bull and bear cycle in Bursa in a short period. Don't get too excited of bull run in counters other than glove companies.

2021-02-19 14:27

Ben, You continue to do a great job unearthing several mysteries. There seems to be so many suspicious activities going on.

Certainly Bursa”s email to you is a major disappointment. Shameful in fact.

I wonder whether anyone in a responsible position has noticed your revelations. Any rules that allow manipulation of the market should be reviewed promptly. Looks like our market is not ready for complex trading schemes unless transparency is required. The CEO must review the situation to safeguard investors. We don’t hear of suspicious activities in other bourses in S.E.Asia

I hope your efforts will bear fruit in the near future.

2021-02-22 22:40

.png)

bullpiano

@Ben Tan, Thank you for the analysis.

Is it legal for short-seller to buy shares via off-market deals?

2021-02-17 21:08