Nominee Account and Short Selling - A Matter to Consider

Ben Tan

Publish date: Mon, 19 Apr 2021, 02:46 PM

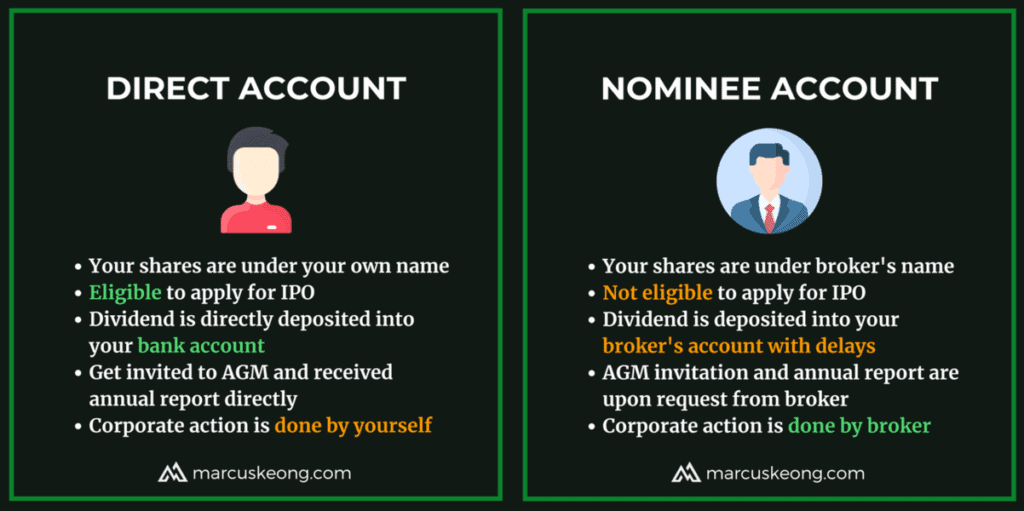

A number of people have been asking how a short seller is able to borrow shares to short, even when there are seemingly very few willing lenders. One way they could do that is by reaching out to nominees. There are two main types of trading accounts available to retail investors - nominee account and direct account. The primary difference between the two types of accounts is that with a nominee account you do not own the shares. The shares you buy are registered under the nominee's name. Here is a great summary of the differences between the two types of accounts, provided by Marcus Keong (no affiliation):

(Source)

An i3 forum article giving a similar explanation can be found here.

While the operational technicalities are complicated, in general a nominee pools all shares bought by their clients under one "omnibus" account. In other words, the shares you bought a few days ago via your nominee account are not necessarily the exact same shares you are selling today, for instance.

All of this means that if you buy shares via a nominee account, the nominee (likely) has the right to lend the shares for short-selling without asking for your explicit consent. This might be something you might want to bear in mind if you do not wish for your shares to be lent out to a short seller for some reason.

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

More articles on Trying to Make Sense Bursa Investments

Created by Ben Tan | Jun 04, 2021

Created by Ben Tan | May 09, 2021

Created by Ben Tan | May 04, 2021

Created by Ben Tan | May 01, 2021

Discussions

A nominee holds something in trust for the real owner. If the nominee has the right to trade or deal with the shares held in trust, it looks rather odd to me. Something is not quite here, i guess.

2021-04-19 19:31

Not sure how this lender willing to let these shorties terrorise their share prices.

Lets say rakuten lend 1 million shares of TG at rm 6 average and shorties shorted all to rm 3.

Now, that's 50% drop in share prices. So, is that mean shorties will pay back in future at rm 3 per share price including misc. fees?

2021-04-19 19:42

This is very true and valid point. Have to agree.

However, as a trader, none of this concerns me. low cost and reliable electronic broking is more important.

It is also delusional to believe that 3% RSS short position is going to lead to a drastic decline in share price.

In the USA, with the use of OPTIONS and shares, MORE than the total outstanding shares can be shorted. E.g. Gamestop.

Bursa is not NYSE.

Note (Intraday IDSS AND PDT Short sellig is STILL BANNED):

Malaysia’s SC (Securities Commission) and Bursa Malaysia have announced an extension of the temporary suspension on Intraday Short Selling (IDSS) and intraday short selling by Proprietary Day Traders (PDT Short Sale) to 29 August 2021.

2021-04-19 19:42

We need to find out which brokerage firms involved in lending their customers shares to this shorties.

Then, we close the account and move to a more responsible brokerage firm.

Check it out guys. Dont let them ruin our investment.

https://www.investopedia.com/ask/answers/05/shortsalebenefit.asp

2021-04-19 20:28

Sounds cool Dante bro! Go out and change the world!

With you in charge, no more shorties! IB's defeated!

Yay! :D

2021-04-19 20:33

Ya thats true, but for cimb itrade, nominees account can enjoy lower brokerage

2021-04-19 23:48

Goldberg, IMwhatIM, Dante5566, pharker, thank you for your comments.

pharker, due to admin cost savings, brokerages can usually offer cheaper rates for nominee accounts, but that's not always the case. For instance, M+ (no affiliation) offers only direct accounts, and it offers one of the lowest rates for brokerage fees.

2021-04-19 23:55

ONLY SOZHAI BELIEVE

LEND SO LITTLE SHARE

WILL MAKE SHARE PRICE DROP

HA

:DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD

2021-04-19 23:59

REST FEW DAYS

HOLIDAY FEW BARS

KNN

COME BACK

STRAIGHT SEE RUBBISH AGAIN

:DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD

2021-04-19 23:59

IF GOT TIME

BRUSH MORE SKILL

BRUSH MORE KNOWLEDGE

:DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD

2021-04-20 00:00

AND, another thing - Ben Tan claims he's an investor.

If you are investing, you'd be HAPPY about a short term share price correction.

You would'n't "cry mother, cry father" about a paltry 3% Short Interest. Compared to 130% in Gamestop.

Instead you would be buying.

A BIGGER ELEPHANT than short selling, is MARGIN CALL selling.

When is Ben Tan going to cover MARGIN CALL's like Fool You Yin's in Jaks 2018 (MATCH the dates with the price chart and see how badly MARGIN CALLS can affect a share's price):

MR KOON YEW YIN 29-Nov-2018 Disposed 7,610,000 0.000

MR KOON YEW YIN 28-Nov-2018 Disposed 7,583,600 0.000

MADAM TAN KIT PHENG 23-Aug-2018 Disposed 620,000 0.000

MR KOON YEW YIN 23-Aug-2018 Disposed 909,000 0.000

MADAM TAN KIT PHENG 21-Aug-2018 Disposed 2,043,600

MR KOON YEW YIN 21-Aug-2018 Disposed 1,950,000 0.000

MR KOON YEW YIN 20-Aug-2018 Disposed 5,697,700 0.000

MADAM TAN KIT PHENG 17-Aug-2018 Disposed 1,650,000

MR KOON YEW YIN 17-Aug-2018 Disposed 3,200,000 0.000

MADAM TAN KIT PHENG 13-Aug-2018 Disposed 1,350,000

MR KOON YEW YIN 13-Aug-2018 Disposed 3,416,400 0.000

MADAM TAN KIT PHENG 10-Aug-2018 Disposed 1,609,300

MR KOON YEW YIN 10-Aug-2018 Disposed 1,620,000 0.000

MADAM TAN KIT PHENG 09-Aug-2018 Disposed 3,107,800

MR KOON YEW YIN 09-Aug-2018 Disposed 4,320,000 0.000

MR KOON YEW YIN 08-Aug-2018 Disposed 6,872,000 0.000

MR KOON YEW YIN 07-Aug-2018 Disposed 6,850,300 0.000

MR KOON YEW YIN 06-Aug-2018 Disposed 1,356,800 0.000

MR KOON YEW YIN 03-Aug-2018 Disposed 2,711,100 0.000

MADAM TAN KIT PHENG 30-Jul-2018 Disposed 1,000,000

MR KOON YEW YIN 30-Jul-2018 Disposed 6,662,900 0.000

MADAM TAN KIT PHENG 27-Jul-2018 Disposed 693,000 0.000

MR KOON YEW YIN 27-Jul-2018 Disposed 2,962,500 0.000

MR KOON YEW YIN 26-Jul-2018 Disposed 1,599,900 0.000

MADAM TAN KIT PHENG 25-Jul-2018 Disposed 1,250,000

;D

2021-04-20 01:44

Guess who was yelling to buy Supermax in Jan - Feb during its DRASTIC decline.

Someone who coincidentally LOVES to use MARGIN finance.

Someone who LOVES to gamble.

Someone who is a compulsive liar.

Someone who LOST face and his battle with IB's by 2nd of March.

;D

2021-04-20 01:54

This post explained well one of the reason why I don't like nominee account.

Plus, I'm a RELATIVELY long-term investor. The RM4 difference per trade is not really a concern to me (I'm using CGS-CIMB, charges RM12 per contract).

And I get my dividends on payment date, direct.

2021-04-20 09:36

Pinky, Lukey_Greek, thank you for your comments.

Lukey_Greek, there is no point in paying attention to trolls spreading lies. I have never bought on margin, I likely never will, and I don't recommend to anyone to do that as leveraged positions are extremely risky.

2021-04-20 12:58

I have contacted Rakuten and they have said and I quote "Kindly be inform that we do not have Securities Borrowing Lending (SBL) facilities and short sell facilities".

2021-04-21 10:27

AhmadInv98, thank you for following up on this. The answer they have given you is correct - Rakuten is not an approved SBL lending representative. However, their parent/partner Kenanga is. Here is the full list: https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/assets/5d...

Thus, even though the answer they have given you is correct, that doesn't mean the shares you have bought via your nominee account cannot be lent for shorting without your approval/consent. You can think of the shares you have bought as an "amount" of shares, rather than as a concrete units of shares with corresponding registration/issue numbers. Here's an example to make it clearer to understand why this is the case:

- Let's say you want to buy 1 lot of 100 shares. Let's say the issue number of this lot is 11223344.

- If you bought these shares through a direct account, they reside under your CDS account and they are yours and yours only. If you decide to sell these shares at a later point, you will be selling exactly the same lot of shares, with issue number 11223344.

- If you bought these shares through a nominee account, they reside under the CDS account of the nominee. They get piled up there together with all the other shares bought by other account holders with the same nominee. Thus, they are technically just a number for you, and this number corresponds to a "claim" over a number of shares within this huge pile of shares. You do NOT hold shares with issue number 11223344. Thus, if you decide to sell your shares at a later point, you will most likely be selling a completely different lot of shares, say, with issue number 34567890.

This is an oversimplification of the matter, and I don't pretend that it is perfectly accurate, but it can give you a general idea of the mechanics and why the nominee has the authority to decide on lending part of the entire pool of shares held by them for short selling.

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

2021-04-21 10:49

Ben Tan, the link you gave me got an 404 error. Regardless, the whole situation is foggy and shady. I'll transfer my TopG shares to Mplus. Thx for the insight

2021-04-21 14:30

zzzz52, AhmadInv98 thank you for your comments.

AhmadInv98, I think i3 has cut the link somehow. Let's try again: https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/assets/5d85b5b639fba239d80da0e8/SBLNT-Lending-Reps-List-Sept2019.pdf

2021-04-21 15:00

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)

Goldberg

From the looks of it Rakuten is happily lending TG shares to SHORTIES/JP Morgan. I will not trade under Rakuten trading platform in future as I don't approve of such revolting practice.

Thanks Ben for the article.

2021-04-19 15:32