Commentary: Of Retailers and Institutions

Ben Tan

Publish date: Sat, 24 Apr 2021, 11:44 AM

I have been asked a few times now by users to have more commentary-oriented posts as opposed to data-oriented posts. I have generally been reluctant to do that, because such posts can easily be misinterpreted as baseless bashing, causing panic, or trumpeting up of stocks or asset classes. This has never been my goal. As I know everyone's individual situation is unique, and I believe that any sort of non-data-backed commentary amounts only to a personal opinion, I believe raw data is generally more beneficial than anyone's individual analysis. However, I think there are a few topics that are worth discussing and sharing opinions on.

One such topic is that of the investment strategies of retailers and institutions. As more and more retailers are (to an extent forcefully) becoming active investors, this topic seems grossly underdiscussed.

Retail Investors' Advantages

As a retail investor, your main strategic advantage is that you are able to wait. Your second advantage is that you are not required (due to rules or due to the size of your portfolio) to be broadly diversified. Another advantage, which is mostly a by-product of an improperly set up system, is that your payout from your investments is not based on how much you earned this quarter for instance, but on how much your investment makes for you over your lifetime.

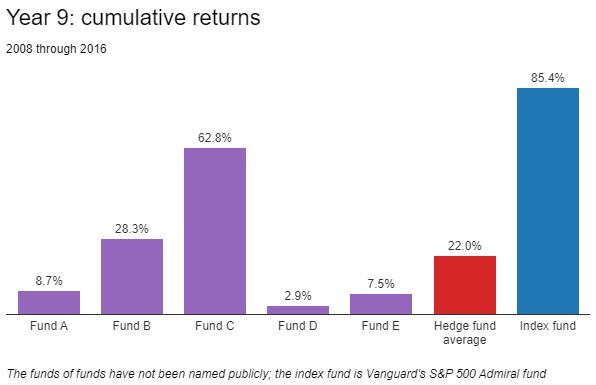

Fund managers cannot wait, they have to be nimble and to jump from place to place, looking for the best mathematical yield based on all the publicly available information. At the same time, remember that actvely managed funds as a whole are not doing particularly well. There was a fun bet between Warren Buffett and a hedge fund guy, where Buffett bet that an index fund (passive fund) tracking the S&P 500 will outperform a basket of the most sophisticated hedge funds over a 10-year period. And of course it did happen (see here). So jumping from stock/asset to stock/asset doesn't appear to be the best strategy even if (or more like - because?) you pay hefty fees to get the best and most qualified fund managers in the world. By the way, the difference in performance was not negligible:

On diversification - even if a fund manager is absolutely convinced that a stock will do extremely well (like how JP Morgan's fund managers are actually very certain Top Glove and Hartalega will do very well for instance - see here, but coincidentally their financial analysts believe Top Glove and Hartalega will do very bad - see here), they cannot allocate more than 10% weightage to that one stock in most cases, especially when it concerns funds in which regular retail investors can put their money. This means that by definition as a fund manager you need to buy stocks (or other assets) with lower expected yields. As a retailer, you have no such constraints. Here is a simple example to illustrate that:

A fund manager considers a total of 100 stocks for their portfolio. They believe that each of these stocks will yield anywhere between 50% and -50% return over the next year. Out of these, the distribution of the top 10 stocks in terms of their projected returns looks like this:

Stock A - 50%

Stock B - 35%

Stock C - 20%

Stock D - 15%

Stock E - 13%

Stock F - 12%

Stock G - 11%

Stock H - 10%

Stock I - 9.5%

Stock J - 9%

Now let's say that the fund manager indeed decides to allocate his/her entire portfolio in only these 10 stocks - an impossibility in practice, but let's make it interesting and fair. The mandate of the fund is that they can allocate a weightage of a maximum of 10% on each of these stocks, so they distribute their portfolio allocation equally among the 10 stocks. If the fund manager was right in their estimates, the total return of this portfolio will be 18.45%, which is a very commendable achievement.

However, let's assume that you are a retail investor faced with the same choice. You are not required to allocate only 10% of your portfolio per stock. This means that you can select, for instance, the following allocation: 50% stock A, 30% stock B, 20% stock C. Your return with such allocation, provided the projected returns materialize, will be 39.5%.

Note that this is a simple illustration and it is not meant to take into account all nuances. It just illustrates why a fund cannot maximize their return, and in fact are by definition limit-bound. However, if you have no knowledge about asset valuation, your best bet would still be to go with a fund as the chance a professional fund manager selects good stocks would be much higher than you doing it.

Retail Investors' Disadvantages

When a trend or any new piece of data is available, large institutions have algorithms worth millions of dollars that allow them to move enormous amounts of capital within seconds. As a retailer, you can never, ever, match that. Thus, following trading charts, you are always at the tail end of chasing. Of course we are still in the longest bull market in the history of centralized stock exchanges, so trading right would've done you good. However, after every bull market comes a bear market. The more exuberant and long a bull market is, the more protracted and/or deep the subsequent bear market will be. As I've mentioned in this channel, we are likely at the top of the exuberance of any market in modern history, so consider the implications. And trading doesn't work well in protracted bear markets without any significant volatility, unless you have the required tools. The tools required are the capability to take short positions. These capabilities are usually not readily available to retail investors, plus they are riskier by definition.

In a nutshell, by trading frequently, or by using financial instruments that require you to trade frequently (such as leveraged instruments), you are essentially giving up your main strategic advantage.

My Opinion

Instead of chasing numbers constantly, as a retail investor your time may be spent more productively and ultimately more beneficially to yourself, by learning a little bit every day. This will eventually help you overcome your biggest disadvantage - the amount of understanding and knowledge about the investments you are making.

Try to understand the business you are considering investing in a little bit better. Your best initial sources of information are publicly available industry reports, and annual reports of companies within the industry. Then check on publicly available financial analyst reports - not for their "target prices", but to spot check what they are focusing their analysis on. This would give you a better targeted idea of what you should look for. Reading past articles could help you understand if a company's manager is considered to be an honest and capable person. Hopefully public forums, such as this, could one day turn into a useful spot for constructive discussions for retail investors, too.

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

More articles on Trying to Make Sense Bursa Investments

Created by Ben Tan | Jun 04, 2021

Created by Ben Tan | May 09, 2021

Created by Ben Tan | May 04, 2021

Created by Ben Tan | May 01, 2021

Discussions

Sslee, thank you for your comment.

I really don't want to comment on any individual stock, although I understand what you mean, and I agree that there are many clear signs of inefficient valuations on Bursa.

2021-04-24 16:13

Thank you Ben for taking the time to write all your articles. I really enjoy reading them. Please continue the good work.

2021-04-24 21:12

sslee

Thong Jai every night look at INSAS bank statement before going to bed.

maybe he takes it to wash room as well

no dividends => no share value at all

2021-04-24 21:17

@ben tan, Do we need to subscribe to cimb trading or report freely available? Is it possible for you to share the link to these reports?

2021-04-24 22:50

LimitUp, i3lurker, ezmoney, thank you for your comments.

ezmoney, that would be the fastest way to get it, although it frequently gets shared in groups and chats a little later, too. I believe you could even find it uploaded on i3 sometimes.

2021-04-25 12:59

Without disrespect to any parties.maeket is not efficent.look at plantation counters.cpo prices have been on the uptrend since last year ( hitting their high 8 years } breaching $4,000 per tonne mark for the past 1 month yet most counters still lethargic and trending at their 2018 level { unlike glove counters jumping to their high

2021-04-26 09:48

palm oil prices up but costs even up more.

Net effects cancel each other

and maybe potential losses for all plantation counters, just need a covid cluster and all is finished.

also just need a conflict palm oil ban and all is finished

the market is efficient

except that you just dun understand the hell of Big dangers involved....

2021-04-26 11:05

Jonathan Keung, i3lurker, thank you for your comments.

Unfortunately, in general [****] is a fundamentally inefficient stock market. I have briefly mentioned some of the reasons for that before:

- Imperfect information and information asymmetry - lack of or poor quality information, and/or insider information exploitation;

- Educatedness of market participants and, more importantly, lack of suitable educational opportunities;

- Number of market participants and concentration of capital - with the outflow of foreign investors, and the difficult access for foreign retail investors to the market, this problem is exacerbated.

Note that when I say that the market is inefficient, I in no way want to offend any of the market participants. On the contrary, market participants adjust to the conditions in which they operate. When the conditions are suboptimal, market participants, based on their mandates and positions, usually operate suboptimally, too.

I don't necessarily think this inefficiency shows up particularly with the CPO/plantation niche though.

2021-04-26 18:03

Sslee

Nowadays data are easily available in the internet and in fact information overloaded are the norm.

How useful are information when investing fraternity is chasing forward PE or finding the next amazon?

I had been writting about value investing and asking this question:

Should we took the standard definition of intrinsic value wholeheartedly: Intrinsic value is the Present value of the investment of all the expected cash flow over the lifetime discounted at the appropriate discount rate. Or question the definition why equity part of asset or at least the current assets minus total liabilities should be added to this intrinsic value?

In this case the intrinsic value of INSAS is Liquid assets – total liabilities + (CF1/ (1+d)^1) + (CF2/(1+d)^2) + ----- +(CFn/(1+d)^n)

Where:

CF = Cash Flow in the Period

d = Discount rate

n = The period number

This Intrinsic value is actually a Discounted Cash Flow (DCF)

Example of intrinsic value of INSAS is then the Sum of DCF expected cash flow from varies business streams.

For INSAS assets rich case, it is my opinion that the liquid assets minus total liabilities should be added to this intrinsic value.

How to explain Insas holding in Inari alone is worth more than 3X insas market cap?

Stock [INARI]: INARI AMERTRON BHD

Announcement Date 08-Apr-2021

Substantial Shareholder's Particular:

Name INSAS BERHAD

Details of Changes:

Currency -

Date of Change Type Number of Shares

05-Apr-2021 Acquired 100,000

Registered Name M & A Nominee (Asing) Sdn Bhd for Montego Assets Limited

Nature of Interest Indirect Interest

Nature of Interest Indirect Interest

Shares Ordinary shares

Reason Acquisition in the open market

Total no of securities after change

Direct (units) 0

Direct (%) 0.00

Indirect (units) 545,503,575

Indirect (%) 16.33

Total (units) 545,503,575

Total (%) 16.33

Date of Notice 08-Apr-2021

2021-04-24 14:31