Future Potential of Petronm (Part 1)

davidtslim

Publish date: Fri, 07 Jul 2017, 02:32 AM

Petron Malaysia Refining & Marketing Bhd (“Petronm”) is a downstream player which operates Petron Port Dickson Refinery (PDR), producing a wide range of petroleum products which include gasoline, diesel, liquefied petroleum gas (LPG) and aviation fuel. It also operates petrol retails stations which has 580 stations throughout Malaysia (2016 annual report data). In June 2017 AGM, management stated that 16 new petrol stations started to operate and 23 more are pending for approval. Out of these 596 stations, only 55-60% is owned by Petronm while the rest are owned by non-listed company (Petron Oil Sdn. Bhd).

Fundamental Data

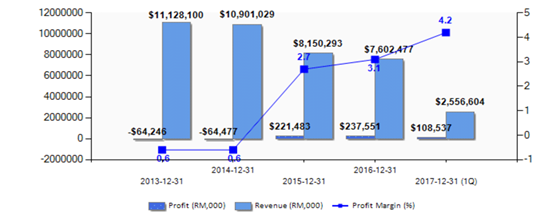

Currently Petronm is trading at PE Ratio of 6.44 (based on current price of RM7.86) with EPS of 122 sen. Its profit has been improving from 2015 to 2017 (Esso Mal was brought over by Petron in 2012) as shown in the graph below:

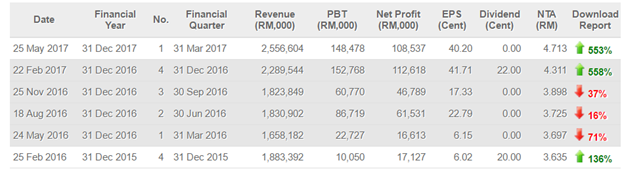

We can observe that the net profit of Q1’17 (108 mil) accounted for nearly 45.5% of the entire 2016 net profit (237 mil). In fact, it has shown big quantum (500%++) of improvement in profit in the recent two quarters as shown below:

Its Return of Equity (ROE) is 25.89% (higher than average) which indicates that it is very effective in generating return (profit) from its total net asset (equity).

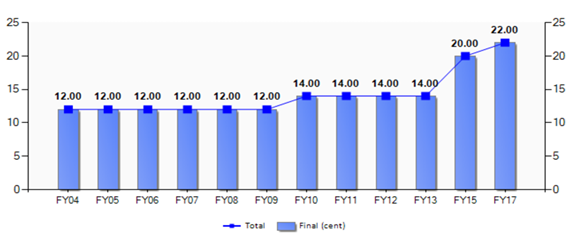

It has decent dividend yield of 2.8% and NTA of RM4.71. More importantly, it has been distributing dividend over past 12 years (except 2014) and the dividend rate is nearly doubled from 12 sen (2013) to 22 sen (2017) as shown in the graph below:

Coming quarter Profit Forecast for Q2’17 (April-June 2017)

Let me has a forecast analysis for their Q2’17 (to be released in August) based on their refinery and retails businesses.

Due to Brent Crude oil price sliding from 31 March as compared to 30 June 2017, it will suffer inventory stock loss as it keeps around 18-21 days crude oil stock (mean stock value become smaller).

Calculation of profit (including stock loss)

1) Brent oil reference price for 31Mar17 = 52.95 USD/brl (based on investing.com 31 March Brent oil closing price at 14.00)

On 30 June, Brent oil closing at = 48.2 USD/brl (based on Brent oil price at Asia time at 11.59pm 30 June 17 from Investing.com)

Stock loss = 864k brl x (48.2 - 52.95)

= USD -4.104mil

= RM-17.65mil

(864k brl is from throughput of 48k barrels per day X 18 days stock)

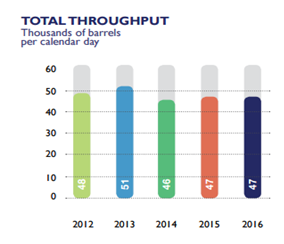

2) Refinery margin in a quarter (based on its regular throughput per day of 48k although its max daily capacity is 88k). Management also told us in AGM that its refinery currently running at around 60% (I use AR report throughput which is more conservative).

= 4.368mil barrels X USD5.3 (estimated profit margin per barrel)

= USD 23.15mil

= RM 99.55mil

Throughput data from 2016 AR as shown in figure below (91 day in Q2 X 48k = 4.368 mil barrels)

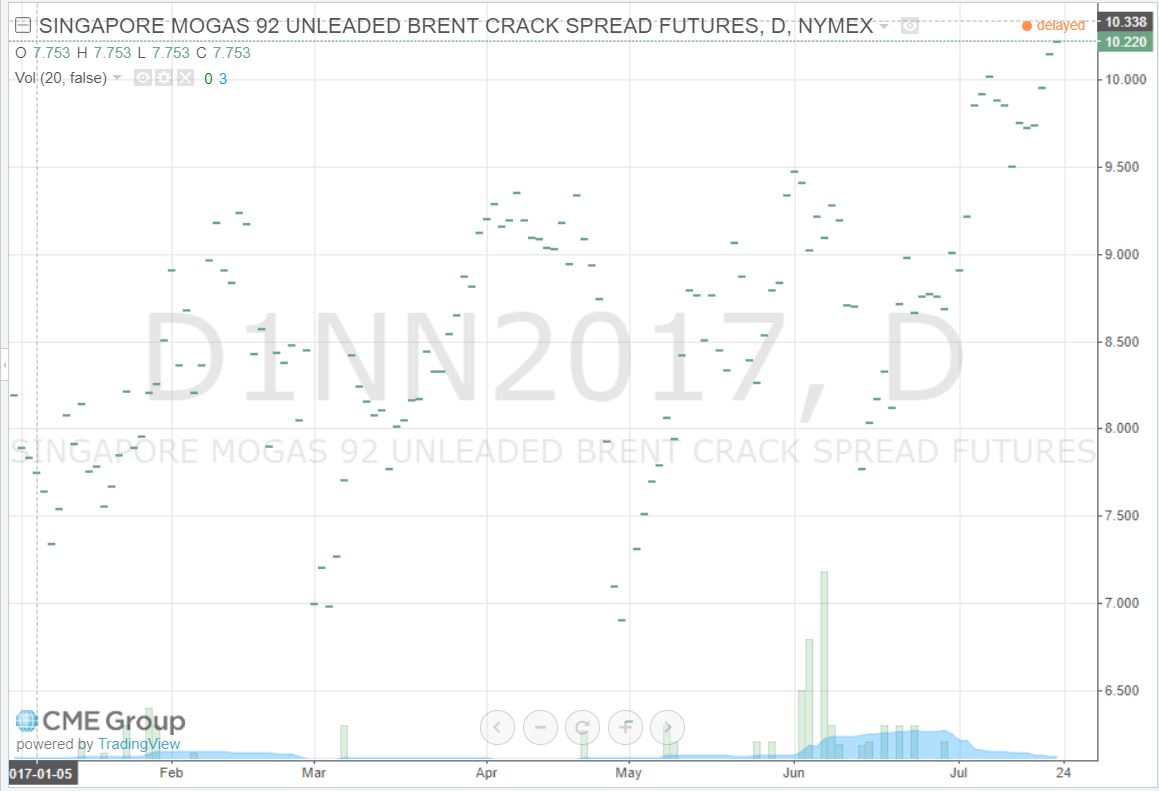

Crack spread (refinery margin) data from CMEgroup.com

Source from (https://s.tradingview.com/x/zt8VhLLF/)

3) The retails segment is expected to perform better (especially Ramadan month falls in June), but let’s assume it performs the same as Q1’17 (as less price up cycles as compared to down during these 3 months):

= 105 mil

105 mil is estimated from i3 Blog - What I learn from Petronm AJM-JAY (2016 marketing margin from table - 418mil/4)

Net Gross Profit = -17.65+ 99.55 + 105

= 186.9mil

Assumming same operating cost and same finance cost of RM34.6 mil as per Q1’17 (from Q1 report),

Net Profit = (186.9-34.6) mil = RM152.3 mil.

(It should has lower finance cost as last quarter paid up 56 mil of loan that lead to lower interest cost)

Assume the same tax rate of 26.9% as per last quarter,

net profit = RM152.3 mil deduct 26.9%

= RM111.33 mil

RM111.33 mil --> EPS of 41.23 sen.

Allowing some margin of errors of about 10% for my calculation, the estimated EPS still has 100.2 mil or 37.11 sen.

Let’s see the possible coming 3 quarters result for YoY comparison

2016 (Actual) and 2017 (estimated) Quarters Profit

|

|

2016 (mil, EPS in sen) |

2017 (mil, EPS in sen) |

|

Q1 |

16.61, 6.15 |

108.54, 40.2 |

|

Q2 |

61,53, 22.79 |

estimated (~100.2,~ 37) |

|

Q3 |

46.79, 17.33 |

estimated by 80% from Q1’17 profit(~86.8,~ 32) |

|

Q4 |

112.62, 41.71 |

estimated by 80% from Q1’17 profit (~86.8,~ 32) |

|

Total |

237.5, 87.98 |

estimated (~382.34,~ 141.2) |

*Q4 normally is their peak of the season and Q1 is the weak season. 80% estimation is consider conservative due to its existing customer base of retail should be increasing from their Petron Mile members of 4 mil+ (In fact, refinery margin is improving from CME data)

Based on current price of RM7.86 with possible 141.2 sen EPS, one can estimate the possible PE for Petronm after Q4’17 result which is to be released in Feb 2018.

Risk

1. Stock loss of finished product (gasoline and diesel) from frequent price drop which is a result of weekly pricing system (estimated affect 5-10% of its retails profit)

2. High volatility of crude oil price (further fuel price drop may result in stock loss) while fuel price up will result in stock gain but this may offset by refinery margin which works opposite to oil price trend (from 2015 and 2016’s results). Crude oil is in decent range in 2017 (USD43-USD53) which is profitable for refinery player (from improving crack spread data from CME website)

3. Big expansion plan (USD1.5B = RM6.4B) which is yet to be finalized or in proposal stage for doubling refinery capacity to 150kbpd. The reason I think why Petronm wants to have this expansion is the current refinery system is not too effective as it can only produce 55% of petrol, 30% of fuel oil (heating oil) and 10% of Jet fuel, where complex refinery system can produce higher percentage of petrol (as what HengYuan has). Management indicated the earliest possible expansion maybe fall in 2018.

4. From the past 10 year records, Petronm (and former Esso Malaysia) never ask for fund from shareholders through right issue and loan stock. Even this maybe happening in 2018, imagine the biggest shareholder (Petronm Philippine) is holding 73% shares, it needs to fork out RM4.74B cash (if right issue). Imagine this RM4.74B is 2.2 times more than Petronm entire current market capital (RM2.12B). If you were Petronm Philippine, if you do not have confident to get back your invested capital or good ROI on your investment, will you invest RM4.74B in an overseas business (entire market value only RM2.12B)?

Summary

Petronm refinery and retails businesses are quite stable and slow growing from year to year. Its market share has grown from 16% to 19% over the past 3 years.

It has set a target to open 50 new petrol stations in 2017 (data from AGM,16 already started and 23 pending approval).

It also has more than 4 millions Petron Miles loyal members which will provide recurring retails business.

It also shows good growth (over 10%) from the commercial segment (Jet fuel, LPG) over the past 1 year.

From refinery prospect, an online data shows show that Malaysia current daily crude oil consumption is 600 thousand bpd which is higher than the total supply. Continuous future vehicle population growth will provide further demand for refinery and retails markets.

More importantly, its earning quality is supported by average RM300 mil free cash flow per year (past 3 years data) and decent 2.5%-2.8% of dividend. Its peer (Petdag) is trading at PE 24.4 with EPS of 98 sen while Hengyuan (pure refiner) shows super profit but negative free cash flow in the last two quarters. Hengyuan has committed big upgrade (RM700 mil) for Euro 4M compliance where Petronm has already fulfilled this requirement.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Future Potential of Petronm

Discussions

most articles shared so far , 300mil-400mil and higher is possible.

350mil-360mil is my expectation. By tht, PetronM shall be traded at range 13.0-18.0 range.

Price now is totally mispriced by market

2017-07-07 14:22

Good artciel. Clear cut points and easy to understand. Most importantly, the figures pointed out are correct. Petron refinery is operating at 50% capacity. Unlike RH research, david has certainly dis his homework properly

2017-07-07 15:35

Thanks David for the hardwork, by the way just want to add 2 additional points :

1) Forex Rate, USD exchange rate against MYR is 4.4265 on 31/3/2017, where as the rate at 30/6/2017

is 4.294 there is about 3% improvement for MYR. This will in a way benefit Petronm, however how big will be the impact is hard to estimate as due to their Forex hedging contracts details is not available.

2) FY2017 Free Cash Flow might be around $100 mils lower due to the budgeted $150 mils Capex for this FY. Previously Petronm spend about $50 mils Capex per FY, hence this FY Free Cash Flow is expected around $210 mils.

2017-07-08 11:29

Thanks 逍遥子 for your 2 additional points for Petronm. We will be clearer in August for its free cash flow level. I expect they can reap good profit from refinery business in Q2.

2017-07-09 22:06

Hello davidtslim, good learning from your report. Thks.

Apprec if you can help me to understand how you derive operating and finance cost of RM34.6m from Q1 report.

2017-07-09 23:58

paperplane2016

Good

2017-07-07 08:20