Positions of different market participants for EUR/USD

DonkeyStock

Publish date: Wed, 20 Jul 2022, 10:07 AM

The EUR is trading at parity with USD, which means 1 EUR can only change 1 USD now. Not long ago, 1 EUR can fetch 1.2 USD.

Some of the reasons that lead to the weak EUR are high energy prices, trade deficit, loose monetary policy, and the spread between US Government Bond and EU Nations' government bonds.

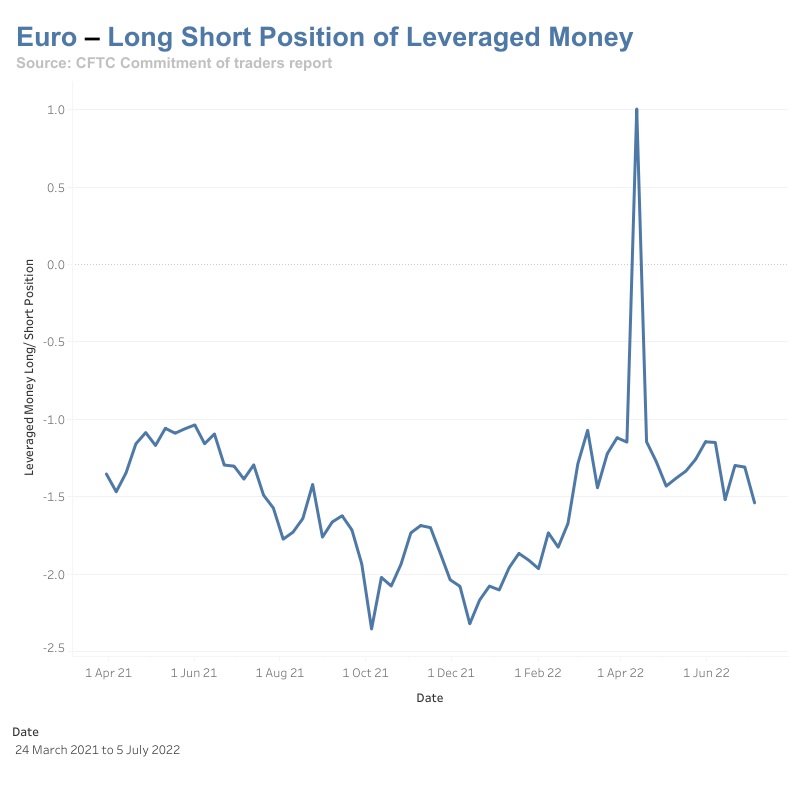

Let us take a look at the positions of Leverage Money (aka hedge funds) in the futures and options market. The hedge funds are still having a net short position on EUR although they had closed a huge portion of their short position since October 2021.

The long-short ratio of Leveraged Money is currently at -1.539. which means the number of contracts shorting the EUR is 153% more than the number of contracts long the EUR.

The trend is your friend. If you want to tap on this trend, you can open an account using my referral link. refer.ig.com/gwofengc-9

Source for the net positions of market participants in EUR: https://www.isquareintelligence.com/insights/financial-products-euro-fx-futures-data

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.