RGB -- 初生之犊转换变为稳重青年的成长故事

荷兰客栈

Publish date: Tue, 11 Oct 2016, 03:38 PM

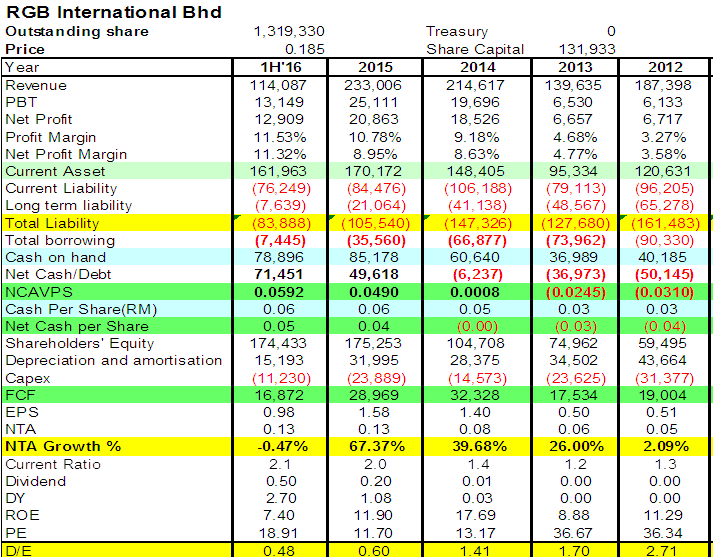

股价 – RM0.185

股数 -- 1.319bil shares

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on 荷兰客栈

Discussions

Cash from Operation 60,000.00

Share Outstanding 1,328,906.00 0.05

24.4%

2016-10-11 16:07

Haha, maybe discount a bit....20-30% will do for this very first project...kampate

2016-10-11 16:33

not kyy la, i see the format of the statistic and i think i know who is he!

2016-10-11 16:53

20-30% should be reachable target if next Q eps exceeding 0.7 Sen. Let's pray hard for it... haha

2016-10-11 16:57

hihi nice to meet you 荷兰客, i will study this company thoroughly, hope to learn 20% kung fu from you, that will be far enough for me

2016-10-11 17:01

woah, everyone is migrating to i3, can follow back sifu sifu cari makan

2016-10-11 17:03

missed the chance to interact with you this year, very tulan, hope to join you all in jb next year!

2016-10-11 17:03

Oh, for me they have very good reputation, if i can learn 10-20% from any one of them, then i sibek shiok liao

2016-10-11 17:57

This counter will start catching eye balls with 2 well know sifu's recommendation..

2016-10-11 19:56

For small cap company, need to check integrity of the major shareholders/directors.

2016-10-11 21:06

Figures look good. But, don't you think online gambling is just within a click in the IT era.

2016-10-11 21:37

I am not.

By knowing the technologies are transforming or disrupting several industries, I am not sure gambling will be spare?

Please kindly share your view and enlighten me.

2016-10-11 23:00

hi intelligent investor, have you been to any of the casino before? you can know the difference between online gambling and casino once you step into the casino, i think.

2016-10-12 08:17

Dangerous stock, NTA 0.13 with price to book of 1.42 times. Economy downturn may hit the prospect. Dueterte whack on drug, now smoking also whack, next maybe gambling also. High risk.

2016-10-12 16:25

why u must have RGB now, read this before too late for you to enter, or u should buy back if u already let go............

http://aimthebull.blogspot.my/search/label/RGB

2016-10-12 17:13

Casino and prostitute oldest industry. So far they survive over thousand yrs

2016-10-12 20:58

I edy let go at 0.18 - 0.185, need bullet, will buy back later, no regret

2016-10-12 21:07

based on 2015 figures: EV=199.23M, EBIT=25.111M, EV/EBIT=7.93 which is considered fair value only... there is no margin of safety buying at this price... P/BV=1.48... also shows that it is not cheap...

2016-10-13 13:01

Ricky Yeo, agree with what I said above? or can you share what is your calculation of its intrinsic value? thanks...

2016-10-13 13:06

too much goreng smell in this counter (and more importantly, it has no margin of safety!) so I would suggest stay away from it...

2016-10-13 13:06

kai, i normally do not use DCF model to count the intrinsic value... haha...

2016-10-13 15:40

Indeed from earning point of view RGB doesnt appear to be undervalued. But its ability of churning good cash flow make it quite attractive to me :)

2016-10-13 16:38

Shld focus more on cash flows! Earnings can be manipulated! Like how keen hide their great cashflows! Also how other companies hiding their great wealth under the sun!

2016-10-15 00:22

paparplane and kai sifus, the reason why i do not like to use DCF model is that there are too many assumptions we need to make..such as what is the growth rate, discount rate that you want to use... we must be very careful in assumptions, else garbage in, garbage out...

2016-10-17 14:42

Benjamin_8888

Lol

2016-10-11 16:01