Traders Brief - FMCO extension to undermine sentiment

HLInvest

Publish date: Mon, 14 Jun 2021, 10:53 AM

Global. Ahead of the key US May CPI data, Asian markets edged higher (MSCI Asia Ex Japan +0.3%) following a decline in US 10Y Treasury yield overnight despite an upbeat US May CPI, in anticipation that the Fed will maintain its accommodative policy during its 15-16 June FOMC meeting. Wall St ended higher as investors scaled back expectations for early policy tightening by the Fed after May’s CPI spike was envisaged as temporary. The Dow up 13 pts to 34479 (-0.4% WoW) whilst Nasdaq rose 49 pts to 14069 (+1.8% WoW).

Malaysia. KLCI fell 4.7 pts to 1575.2 (-3 pts WoW) to record its 3rd straight decline as investors gauged the recent domestic political development with regard to the meetings of major political party heads with the Agong as well as unabated Covid-19 daily numbers. Market breadth was negative as 531 losers beat 443 gainers. Foreign institutions (- RM143m; 5D: -RM427m) resumed selling for the 3rd day whilst retailers (+RM70m; 5D: +RM318m) and local institutions (+RM73m; 5D: +RM109m) were the major net buyers.

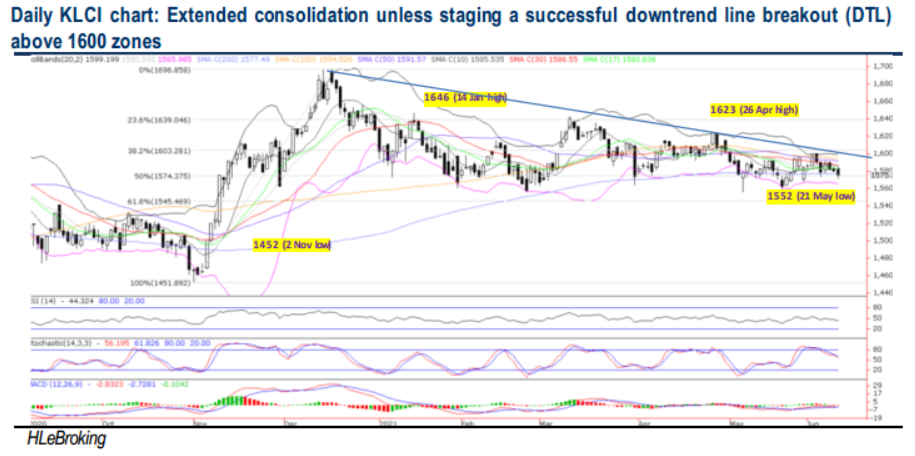

TECHNICAL OUTLOOK: KLCI

KLCI ended 3.3 pts WoW at 1575, a tad below the key 200D SMA at 1577. In the wake of the FMCO extension to 28 June and KLCI’s breakdown below the DTL (or 1600 levels) and multiple SMAs, we expect the KLCI near-term negative momentum has intensified with key supports at 1565 (lower BB) and 1552 (YTD low). If a decisive breakdown arises, the crucial supports are seen at 1545 and 1533 (20M SMA). On the upside, the near-term resistance level is anticipated at 1591 (50D SMA)-1,600 psychological mark.

MARKET OUTLOOK

While we still believe a recovery is an eventuality, investors turn more cautious about the heightened risks of economic and corporate earnings growth prospects following an extension of the FMCO to 28 June. Nevertheless, there is light at the end of the tunnel as we expect downside risks are cushioned by the government’s pledge to further ramp up in daily vaccination rates at 300k jabs/day by Aug (from 150k currently). We maintain our short term range bound call for now as the KLCI continues to trade within the 1565-1552- 1545 supports whilst resistances are pegged at 1591-1600-1623 levels.

To take a more defensive stand amid near term lockdown headwinds, HLIB’s BUYs recommendation includes a mix of value, growth picks, and yield focus i.e. MAYBANK (TP RM9.40), TENAGA (TP RM12.50), IJM (TP RM2.29), FRONTKN (TP RM3.88), SUNWAY (TP RM2.11), BURSA (TP RM11.82), AXREIT (TP RM2.54), ARMADA (TP RM0.80), INARI (TP RM3.81), MBMR (TP RM5.20), SENTRAL (TP RM0.98), FOCUSP (TP RM1.10), and TOPGLOV (TP RM6.76).

Source: Hong Leong Investment Bank Research - 14 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

ARMADA2024-11-23

MAYBANK2024-11-22

ARMADA2024-11-22

AXREIT2024-11-22

AXREIT2024-11-22

BURSA2024-11-22

BURSA2024-11-22

BURSA2024-11-22

FOCUSP2024-11-22

FOCUSP2024-11-22

FRONTKN2024-11-22

FRONTKN2024-11-22

IJM2024-11-22

IJM2024-11-22

IJM2024-11-22

MAYBANK2024-11-22

MAYBANK2024-11-22

MAYBANK2024-11-22

MAYBANK2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-21

AXREIT2024-11-21

AXREIT2024-11-21

AXREIT2024-11-21

AXREIT2024-11-21

AXREIT2024-11-21

AXREIT2024-11-21

BURSA2024-11-21

BURSA2024-11-21

FOCUSP2024-11-21

FOCUSP2024-11-21

FRONTKN2024-11-21

IJM2024-11-21

IJM2024-11-21

IJM2024-11-21

IJM2024-11-21

INARI2024-11-21

MAYBANK2024-11-21

MAYBANK2024-11-21

MAYBANK2024-11-21

MAYBANK2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-20

BURSA2024-11-20

FRONTKN2024-11-20

IJM2024-11-20

IJM2024-11-20

INARI2024-11-20

MAYBANK2024-11-20

MAYBANK2024-11-20

MAYBANK2024-11-20

MAYBANK2024-11-20

MAYBANK2024-11-20

MBMR2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TOPGLOV2024-11-19

AXREIT2024-11-19

AXREIT2024-11-19

BURSA2024-11-19

FRONTKN2024-11-19

IJM2024-11-19

INARI2024-11-19

MAYBANK2024-11-19

MAYBANK2024-11-19

MAYBANK2024-11-19

MAYBANK2024-11-19

MBMR2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TOPGLOV2024-11-18

ARMADA2024-11-18

ARMADA2024-11-18

BURSA2024-11-18

FRONTKN2024-11-18

IJM2024-11-18

IJM2024-11-18

INARI2024-11-18

MAYBANK2024-11-18

MAYBANK2024-11-18

MAYBANK2024-11-18

MAYBANK2024-11-18

SENTRAL2024-11-18

SUNWAY2024-11-18

SUNWAY2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-16

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

FRONTKN2024-11-15

FRONTKN2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

SUNWAY2024-11-15

SUNWAY2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

BURSA2024-11-14

BURSA2024-11-14

FRONTKN2024-11-14

FRONTKN2024-11-14

IJM2024-11-14

IJM2024-11-14

IJM2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

MAYBANK2024-11-14

MAYBANK2024-11-14

SUNWAY2024-11-14

SUNWAY2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TOPGLOV2024-11-13

AXREIT2024-11-13

FRONTKN2024-11-13

IJM2024-11-13

IJM2024-11-13

IJM2024-11-13

IJM2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

SUNWAY2024-11-13

SUNWAY2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TOPGLOV2024-11-12

AXREIT2024-11-12

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

INARI2024-11-12

INARI2024-11-12

INARI2024-11-12

MAYBANK2024-11-12

MAYBANK2024-11-12

MAYBANK2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA