(Icon) Johore Tin (5) - Dairy Division Is Actually Doing Quite Well

Icon8888

Publish date: Sat, 06 Jun 2015, 09:57 AM

1. Introduction

Johotin has an eventful year in 2014. For the first time in many years, it reported a loss in the June 2014 quarter due to quality issue. In the subsequent quarters, its revenue jumped substantially as it pushed into new markets. While benefiting from lower raw material cost, it was adversely affected by forex losses. The group ended the year with net profit of RM13.0 mil, representing a decline of closed to 35% as compared to previous two years.

Its roller coaster performance over the past few quarters gave rise to many questions. How have its various divisions performed ? Beyond all those exceptional items, is the group's business fundamentals still intact ? What are the things to look out for in the coming quarters ? What kind of earnings should we be expecting ?

Before we proceed to answer the above questions, it is important for us to get to know a new member of the Johotin family - Able Food Sdn Bhd ("Able Food"). This new subsidiary has had a material impact on the group's profitability in FY2014. How the Johotin Group will perform in the future will to a large extent be determined by the profitability of Able Food.

2. Able Food

Able Food is not to be confused with Able Dairies Sdn Bhd ("Able Dairies"), which was acquired by Johotin in 2011 and produces creamer, evaporated milk, condensed milk, etc.

Able Dairies is fully owned by Johotin. It has been the major contributor to group earnings. Out of average group profit of approximately RM21 mil per annum (FY2012 and FY2013), approximately RM15 mil was from Able Dairies.

Able Food is a relatively new entity. It was acquired by Johotin through subscription of 80% equity interest on 2 December 2013 for cash consideration of approximately RM0.8 million.

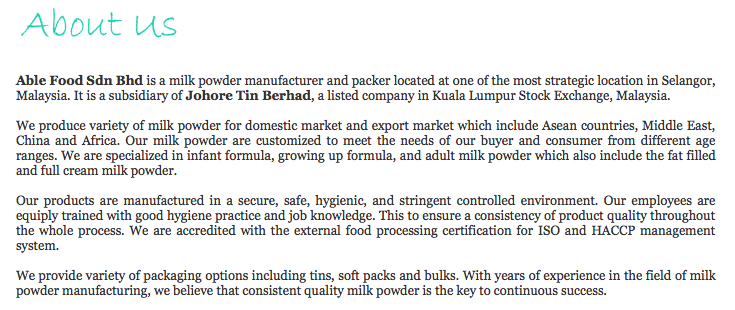

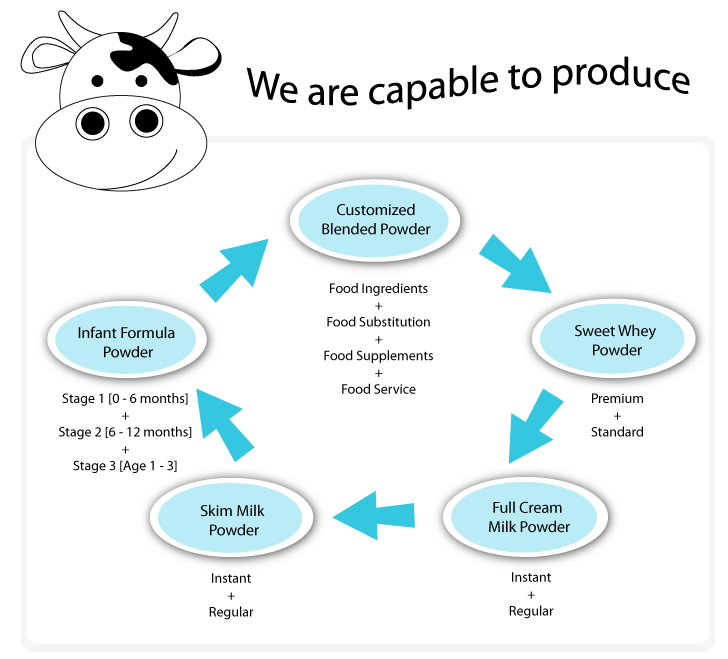

According to its website, Able Food is a milk powder manufacturer and packer. It imports milk power from overseas, mix it with supplements and ingredients before shipping the end products to mostly overseas customers.

Subject to further investigation, it seemed that Able Food commenced operation in the middle of 2014 (after being acquired by Johotin as a shell company in December 2013).

It is very likely the main reason for the spike in overall group revenue during the September and December 2014 quarters (from RM60 mil to RM90 mil per quarter).

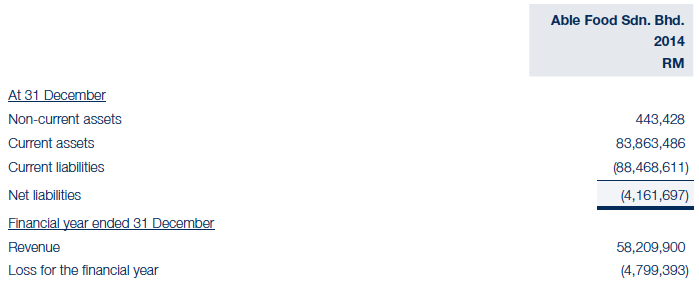

According to FY2014 annual report, Able Food reported net loss of RM4.8 mil in FY2014. Its losses was the main reason why Johotin Group's FY2014 profitability declined substantially.

3. Johotin Group's Historical Performance

The table below sets out Johotin Group's P&L over past 3 years. Please read the notes below the table for further details. For example : if you see "(a)" in the FY2012 table, please scroll down the article to read the explanation (a).

| (RM mil) | Tin | Able Dairies | Able Food | Consolidated | |

| FY2012 | Division | Sd Bhd | Sd Bhd | Others | P&L |

| Revenue | 82.0 | 164.3 | 0.0 | 0.0 | 246.3 |

| PAT | 7.9 | 17.2 | 0.0 | (2.2) | 22.9 |

| MI | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Net profit | 7.9 (a) | 17.2 (b) | 0.0 | (2.2) | 22.9 |

| Net margin (%) | 9.7 | 10.5 | 9.3 | ||

| (RM mil) | Tin | Able Dairies | Able Food | Consolidated | |

| FY2013 | Division | Sd Bhd | Sd Bhd | Others | P&L |

| Revenue | 83.1 | 158.3 | 0.0 | 0.0 | 241.4 |

| PAT | 8.5 | 13.5 | 0.0 | (1.5) | 20.5 |

| MI | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Net profit | 8.5 (a) | 13.5 (b) | 0.0 | (1.5) | 20.5 |

| Net margin (%) | 10.2 | 8.5 | 8.5 | ||

| (RM mil) | Tin | Able Dairies | Able Food | Consolidated | |

| FY2014 | Division | Sd Bhd | Sd Bhd | Others | P&L |

| Revenue | 88.9 | 169.7 | 58.2 | 0.0 | 316.8 |

| PAT | 9.1 | 9.6 | (4.8) | (1.9) | 12.0 |

| MI | 0.0 | 0.0 | 1.0 | 0.0 | 1.0 |

| Net profit | 9.1 (a) | 9.6 (c) | (3.8) (d) | (1.9) | 13.0 |

| Net margin (%) | 10.2 | 5.7 | (6.6) | 4.1 |

| Tin | Able Dairies | Able Food | Consolidated | ||

| Q1 of 2015 ^ | Division | Sd Bhd | Sd Bhd | Others | Figures |

| Revenue | 20.9 | 42.4 | 27.5 | 0.0 | 90.8 |

| PBT b4 EI | 1.3 | 3.2 | 3.9 | (0.4) | 7.9 |

| EI | 0.0 | (2.7) | 0.9 | 0.0 | (1.8) |

| PBT | 1.3 | 0.4 | 4.8 | (0.4) | 6.1 |

| Tax | (0.3) | (0.20) | (0.9) | 0.0 | (1.391) |

| PAT | 1.0 | 0.2 | 3.7 (e) | (0.2) | 4.725 |

| MI | 0.0 | 0.0 | (0.7) | 0.0 | (0.743) |

| Net profit | 1.0 | 0.2 | 3.0 | (0.2) | 3.982 |

| Net margin (%) | 4.8 | 0.5 | 10.8 | 4.4 |

^ estimated figures arrived at by making various guesses, assumptions and working backwards

Some key observations :-

(a) Tin manufacturing division's revenue and profitability has been flattish. Over past three years, they generated average revenue and net profit of RM85 mil and RM8.5 mil per annum respectively. Average net margin has been approximately 10% per annum.

(b) In FY2013, Able Dairies' revenue dropped from RM164.3 mil to RM158.3 mil (a decline of 3.7%). However, its net profit dropped from RM17.2 mil to RM13.5 mil (a decline of 22%).

The drastic drop in net profit was due to lower net margin (8.5% in FY2013 vs 10.5% in FY2012), which was very likely caused by higher milk powder cost (and other raw material).

FY2012 milk powder price of USD3,108 per MT (estimate) was 27% lower than FY2013 milk powder price of USD4,267 per MT (estimate).

(c) Able Dairies reported net profit of only RM9.6 mil in FY2014. That was because it paid compensation of RM8 mil (estimate) for quality related problems. If the RM8 mil is added back (and adjust for 23% tax), net profit would be RM15.7 mil. Net margin would be 9.2%. This is consistent with net margin of 10.5% and 8.5% in FY2012 and FY2013 respectively.

FY2014 milk powder price of USD2,625 per MT was 38% lower than FY2013 milk powder price of USD4,267 per MT.

(d) Able Food commenced operation in mid 2014. It reported a loss of RM4.8 mil in FY2014, of which RM3.8 mil attributable to Johotin (pursuant to its 80% stakes).

According to FY2014 annual report, Able Food has low fixed assets. This implies that it does not have its own manufacturing facility.

This is consistent with what Johotin MD told The Edge in the October 2014 interview :-

"Currently Able Food is engaging third party packers to pack the retail packs. Once the factory is ready in the second / third quarter of next year, it will do most of the packing in house. Hopefully, we can rake in revenue of USD4 mil and USD5 mil a month once it is fully functional."

Based on exchange rate of lets' say 3.3 during the time of interview, USD4 mil is equivalent to RM13.2 mil. This translates into quarterly revenue of closed to RM40 mil. For comparison purpose, Able Food reported revenue of RM58 mil in second half of FY2014. This works out to be RM29 mil per quarter.

Able Food is currently building a new manufacturing facility in Selangor (next to Able Diaries) for a cost of RM18 mil. The group targets completion by Q3 2015. This new manufacturing facility is expected to improve Able Food's profit margin as it will no more outsource the packaging operation to outsiders.

That is why in the FY2014 annual report, the company made the following bold statement :-

"Upon completion of F&B segment's manufacturing capacity by Q3 of 2015, production efficiency and pricing competitivenss will be increased and improved significantly."

(e) The company did not explain why Able Food reported such a huge loss of RM4.8 mil upon commencement of operation in H2 FY2014. One possible reason is that it needs to undertake promotional activities to create brand awareness.

In any event, it seemed that Able Food made a decisiive turnaround in the latest quarter ended March 2015 by reporting PAT of RM3.7 mil (I arrived at the figure by dividing MI of RM0.743 mil by 0.2, which represents the 20% minority stakes in Able Food not held by Johotin).

In my opinion, in the absence of promotions and discounts, it is only natural that Able Food will be doing well. Milk powder price is currently at 5 year low of USD2,500 per MT (vs peak of USD5,000 per MT in 2013). As Able Food's business model involves buying bulk (at low international price) and resells to consumers in package form, the profit margin should be quite attractive.

4. Concluding Remarks

(i) I am pleasantly surprised by the outcome of the analysis as it churns out more useful insights than I originally expected. This allows me to have better understanding of the Group.

(ii) For the tin manufacturing division, I would be happy if it can produce annual net profit of approximately RM8 mil regularly. All evidences point to a matured market with intense competition. This division has recently commissioned a RM15 mil new printing line. The company hopes to offer the services to Middle Eastern and African customers. Lets see whether they can execute as planned.

(iii) The dairy division traditionally reports net profit ranging from RM12 mil to RM17 mil (depends on amongst others, raw material price).

This division has actually done quite well in latest quarter with PBT of RM7 mil (excluding net forex loss of RM1.8 mil). Based on 24% tax rate, net profit would have been approxmiately RM5 mil. If annualised, it would be the highest ever recorded (at RM20 mil).

Of course, it is too early to celebrate. The strong result in March 2015 was primarily due to Able Food's contribution. Too little is known about this new entity. We need to monitor next few quarters performance to see whether earnings momentum can be sustained.

(iv) One of the most frequently heard complains is the group's failure to hedge its forex exposure. A few million Ringgit here and there can add up to a lot of money. And it is also irritating as earnings would have been stronger, share price higher and my wallet fatter, if they have managed it properly : )

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Observations:

1. Kian Joo, Can-One and Johotin all invest in downstream industry with different strategy with the same objective. Kian Joo has contract packing services in milk powder and beverage. Can-One has long invested in dairy business before Johotin follow suit. These downstream activities all have one similar impact to the three companies - helping them to sell more cans.

2. Lets compare the ratios of Johotin dairy segment and those of CanOne, the contract packing division in Kian Joo and Dutch Lady - which is wholly in dairy business.

Dutch Lady - Revenue - RM1,000 million, Operating profit - RM148 million (14.8%), Segment assets - RM345.5 million (Return on assets 42.8%), Total inventory - RM92.5 million

Kian Joo - Revenue - RM51 million, Operating profit - RM3.4 million (6.7%), Segment assets - RM43.5 million (Return on assets - 7.8%), Total group inventory - RM307 million

CanOne - Revenue - RM585.2 million, Operating profit - RM49.4 million (8.4%), Segment assets - RM420.8 million (Return on assets 11.7%), Total group inventory - RM125.3 million

Johotin - Revenue - RM236.7 million, Operating profit (exclude compensation) - RM13.5 million (5.7%), Segment assets - RM206.5 million (Return on assets 6.5%), Total group inventory - RM130.7 million

If exclude Able Food data, the info will be as follows:

Revenue - RM178.5 million, Operating profit (exclude compensation) - RM18.3 million (10.2%), Segment assets - RM122.2 million (Return on assets 15.0%)

Something i cannot understand is why its inventory is so high in comparison to CanOne and Dutch Lady which is double and 4 times Johotin segment revenue in dairy division. Though we can tell how much the inventory is for dairy product or tin can business.

If it is for dairy product, the risks are as follows:

A. Inventory risk - milk powder are perishable, they are food product

B. Pricing risk, high inventory suggest that shareholders better hope that milk powder price will shoot up in the near future.

If milk powder price maintain, it made the cost to finance inventory holding, however low the interest rate and warehouse rental, will actually add unnecessary cost to the company.

Worst still if the milk powder price drop further. It will have tough time selling the inventory - which you must remember, are perishable.

Apart from forex risks which has been discussed in detail, to me these are the risks which is important in understanding Johotin.

Just blowing water.....

2015-06-06 14:45

repusez, please provide comments objectively. Spelling mistakes, grammars, fond sizes, etc. are non-issues.

2015-06-06 15:16

i sold my johotin after dec result out, now Icon888 wrote so much on johotin, so 给力, i feel like i wanna buy back

2015-06-06 21:53

kakashit when I write more articles, it doesn't necessarily mean I am particularly keen. It is more because I am able to dig out more info.

2015-06-06 22:08

To those who worry milk powder is perishable, shelf life of powdered milk is 2 to 10 years.

2015-06-06 23:28

To those who keep on complaining that the company did not hedge its net forex exposure of RM41.8 million as at 31 dec 2014, please be advised that about RM100m of the inventories are related to milk powder business which are substantially sold in USD and can be used to settle its USD payable/bank borrowings.

2015-06-07 00:11

One cannot compare the inventory level of Johotin and Dlady. DLady is a subsidiary of international dairy group where the sourcing is most probably handled by HQ through bulk purchase. Canone business model may be different. Canone is an OEM supplying mainly to domestic market and may have a cost plus arrangement. Thus it need not stock up to take advantage of the low raw material price as whatever cost savings have to pass to its customers. In 2014 it recorded lower selling price as raw material price dropped. As for Johotin, whether it is speculating on milk powder market or has firm order on hand, only time will tell.

2015-06-07 00:31

LOL....dont let my seemingly harmless presentation of facts dampen your appetite on Johotin. My apology if my kiasu analysis upset anyone here. This is not my intention.

Here, i just wish to present a few basic facts, you make your own judgement:

1. Please go to the supermarket and see whether you can find any condensed milk, evaporated milk or milk powder with a shelf life of 2 years or more. May be not my part of the world.

2. From the website of Fonterra, the world largest dairy provider, this is what you can see under nzmp ingredient - skim milk powder section.

"Our manufacturing processes maximise the shelf-life stability of SMP and if stored under the recommended conditions it will be suitable as a dairy ingredient for 24 months".

TO suggest that Johotin who has just recovered from huge loss for quality issue (for reasons not known to us) can actually hold inventory for a longer period ........You make your own judgement.

3. Information on Can-One's dairy business are presented in full in its recent circular. Its inventory level for milk segment is only RM41 million with net receivable in USD worth RM11 million.

At 31 Dec 2014, Johotin net payable in USD of RM41 million and inventory level of RM130 million (tripled that of 2013) and still growing by RM20 million in Q1, 2015.

You make your own judgement.

4. The difference between the dairy segment between Can-One Group and Johotin is that Can-One is purely OEM manufacturer (i.e. does not have house brand) but Johotin has its own house brand.

Naturally Johotin ought to have higher margin as it is earning the traders' margin as well since it is selling its own brand. But is this actually apparent? You make your own judgement.

5. Whether not hedging USD risk and taking long position on milk powder is speculation or a stroke of genius - by the time we hit August, we will know. USD rate is 3.76 at this moment Vs 3.71 by end of Q1, 2015.

Last but not least, I kiasu, don't let me dampen your optimism on Johotin.

2015-06-07 16:15

Also some more statistics which you may be interested in:

If you want to believe that Dutch Lady actually have its head office holding the inventory for them, look at their annual report. Their purchases from related company is around RM270 million for a company with RM1 billion turnover.

Also 36% of FNB revenue is exported directly to Middle East, Africa and other Asian country, according to CanOne's circular.

2015-06-07 17:35

Everything is fine with Canone, it is more superior, I agree, except that its major shareholder is trying to steal from u, LOL

2015-06-07 18:01

I am actually very upset with the deal

I am absolutely convinced that it is a conspiracy to rip off minority shareholders

Canone is such a good company, what a waste

2015-06-07 18:04

And if you think that losing kianjoo is no big deal, there wl be a Part 2. Later on they will engineer a deal for Kianjoo (owned by EPF and Canone boss' proxy) to acquire canone's assets at a depressed price. Since it has been legally established that Canone boss is not related to Kianjoo (which by then is owned by his proxy), he will once again r able to vote in EGM and bulldoze the deal.

I would say that the deal is brilliant for the major shareholder of Canone, but it stinks to high heaven

One of the worst corporate governance ever seen

2015-06-07 18:13

Sorry for bitching about Canone, nothing personal, I just dislike the way they rip off minorities

2015-06-07 18:14

Totally agree with Icon8888 on CanOne. The greatest risk in investing in CanOne is that they never play according to general norm. Else they wouldnt land themselves with Kian Joo in the first place.

Also on the EPF deal, i dont think it will happen simply because it needs 75% shareholders, present and voting at the EGM to approve. See family has enough shares to neutralise CanOne's 32.9%. The deal will then be decided by the other shareholders where EPF cannot vote.

For every 3 voting for the deal, we only need 1 share to vote against.

I would be surprised if CanOne can garner enough shareholders to pass the deal.

However, in respect of my comments here, i am interested only in the operational ratios when comparing it against Johotin.

2015-06-07 18:56

The latest announcement on new USD3 million foreign currency revolving credit make better sense to partially address the USD exposure situation. Revolving credit is a much better tool than trust receipt as it can be rolled forward.

2015-06-24 09:19

Icon8888. Very good article on johotin. I wished i had read it earlier.

I think the recent china 2 child policy will sky rocket all these food based co. Profit.

Suddenly you have double the new born in the largest mkt in the world. Everything is not enough. Have anyone look into this angle??

2015-11-06 13:31

goreng_goreng

good easy to understand article. keep it up ;-)

2015-06-06 12:18