(Icon) Sam Engineering - Excellent Result. Share Price Can Potentially Double Within 2 Years

Icon8888

Publish date: Sun, 01 Mar 2020, 01:00 PM

1. Excellent Result

Last Friday, Sam Engineering released its financial result for the quarter ended 31 December 2019.

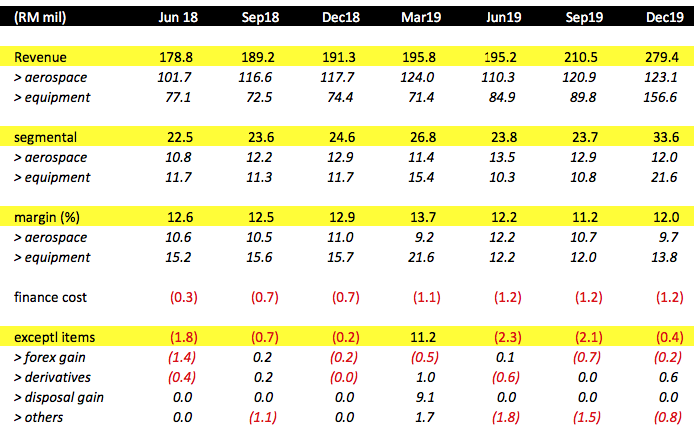

Key observations :

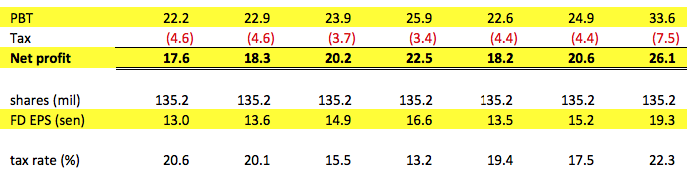

(a) EPS at all time high of 19.3 sen.

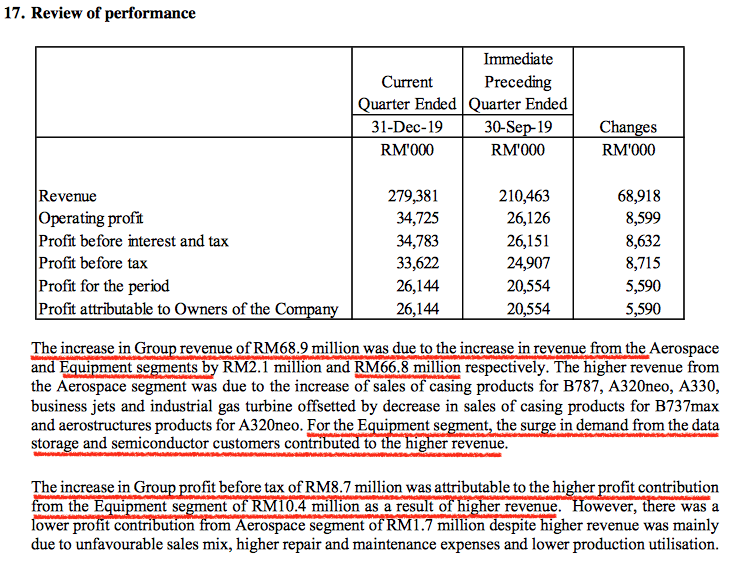

(b) Aerospace revenue is flattish at RM123 mil, but Equipment revenue registered a huge jump from RM90 mil to RM156 mil (73% jump Q-o-Q).

Accordingly, segmental profit for Equipment division jumped by 100% from RM10.8 mil to RM21.6 mil. Aerospace division's segmental profit remains more or less the same Q-o-Q.

(c) Minimal exceptional items. What we see is what we get.

2. Result Commentaries

As shown above, it is pretty straight forward : higher revenue contribution from Equipment division leads to higher PBT.

3. Outlook

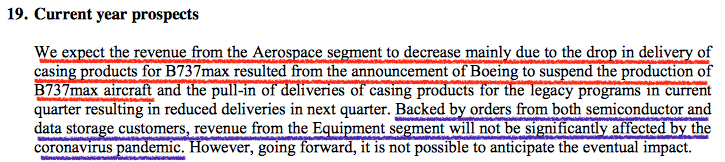

Revenue contribution from Aerospace division is expected to drop going forward as Boeing has suspended production of 737Max beginning January 2020. In August 2019 AGM presentation slides, the Company mentioned that 737Max accounted for <10% of yearly revenue. If that is the case, how much will be the impact on profitability ?

Based on past 12 months figures (October 2018 until September 2019), total group and Aerospace division revenue was RM792 mil and RM471 mil respectively. A 10% drop in group revenue is equivalent to RM79 mil decline. Meaning Aerospace division revenue will drop from RM471 mil to RM392 mil. That is a drop of 17%.

Assuming the same impact on PBT, Aerospace division's PBT is expected to decline from RM50.7 mil (October 2018 until September 2019) to RM42 mil, a drop of RM8.6 mil, or RM2.2 mil per quarter. Accordingly, we can expect Aerospace division's PBT in coming quarter to drop from RM12 mil to RM9.8 mil (a drop of RM2.2 mil per quarter).

Based on assumption that Equipment division maintains same profitability (in previous articles, I mentioned that I believe semicon upswing can last for few years due to 5G), its PBT will be RM21.6 mil.

Adding the two together, total PBT will be RM9.8 mil + RM21.6 mil = RM31.4 mil. Based on tax rate of 22% (same as this quarter), net profit will be RM24.5 mil. Based on 135.2 mil shares, EPS of 18 sen (a drop of 1.2 sen from current quarter).

If annualised, can expect full year EPS of 72.4 sen. Based on current price of RM7.50, prospective PER is 10.4 times.

To arrive at Target Price, I will leave it to you to decide what PER to apply. For comparison purpose, its peers Dufu, UWC, Greatec, MI Technovation etc are all trading at PER of more than 25 times.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Market overlooks it

One day when a reputable IB starts writing it will fly

Let’s just worry about earnings

PE is never a problem in this internet era

2020-03-01 13:29

Icon, is this your longest holding stock? Annualized eps should be 65 sen, no?

2020-03-01 18:58

Sam generously on its dividend payment partly due to its biggest shareholder at Singapore hold almost 70% total shares. This is good to invest in for the dividend. But I am not sure why its traded volume is so little until the market forget it.

2020-03-01 21:58

why market does not give SAM high pe? look at their margin.

Dufu =19%

UWC = 23.4%

greatech =30%

MI = 25.6%

SAM = 9.3% ,

i am not saying SAM is not going to be a good pick it's still growing comfortably but look at those semicon exposure business they are so lucrative and most are still growing and expected to grow more 20%. its just an opinion of mine

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

To arrive at Target Price, I will leave it to you to decide what PER to apply. For comparison purpose, its peers Dufu, UWC, Greatec, MI Technovation etc are all trading at PER of more than 25 times.

2020-03-01 23:10

I like SAM.

But i'm wondering if banking on Malaysia Market similarly overvalues SAM the same way it does to the other semicon related stocks is a good idea.

Still at this price, pretty ok lah for a Temasek run biz.

Have not studied the numbers in depth.

2020-03-02 02:02

Philip ( buy what you understand)

Icon8888 already lost money until 1 month gone from i3investor

2020-06-07 08:00

Dia ambil cuti saket a.k.a. MC

Posted by Philip ( buy what you understand) > Jun 7, 2020 8:00 AM | Report Abuse

Icon8888 already lost money until 1 month gone from i3investor

2020-06-07 08:17

value88

Market does not give high PE to SAM just like to other technology stocks, and I wonder why ?

Maybe the reason is it has aerospace division, apart from semiconductor division. Market mainly appreciates semiconductor division as it will ride on 5G wave ?

SAM is indeed selling at cheap valuation based on its earnings capability.

2020-03-01 13:19