(Icon) Alliance Bank - One Off Provision Affected Previous Quarter Earning. Time To Buy On Weakness

Icon8888

Publish date: Wed, 13 Nov 2019, 10:24 AM

A good stock is one that provides reasonable return with minimal risk.

Most of the time in the past few years, Alliance Bank traded above RM4.00 per share. It is now trading at RM2.85.

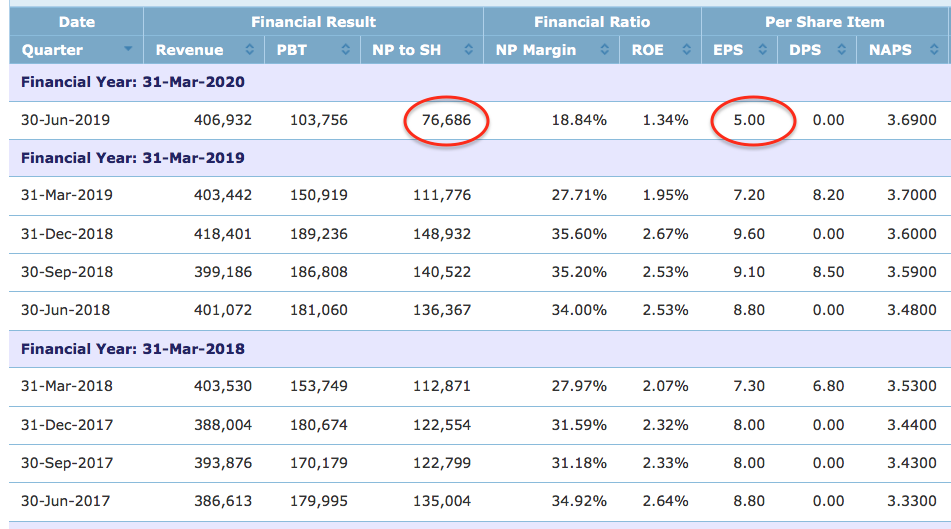

In the recent two quarters, it posted a drop in earning. This is especially the case for the quarter ended June 2019, whereby its earning dropped from the customary RM140 mil per quarter to RM77 mil (EPS of 5 sen only). This caused investors to panic and sold down the stock heavily.

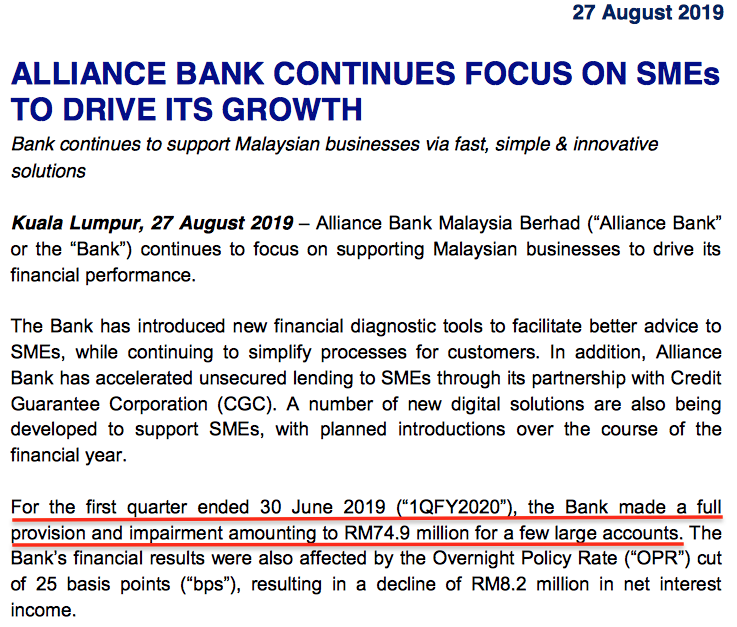

But if you take a closer look, the lower profit was due to RM74.9 mil provisioning for a few big loans, which is one off. The following is extracted from the company's press release :

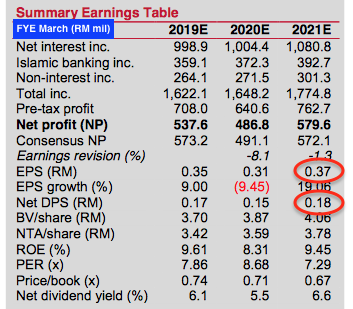

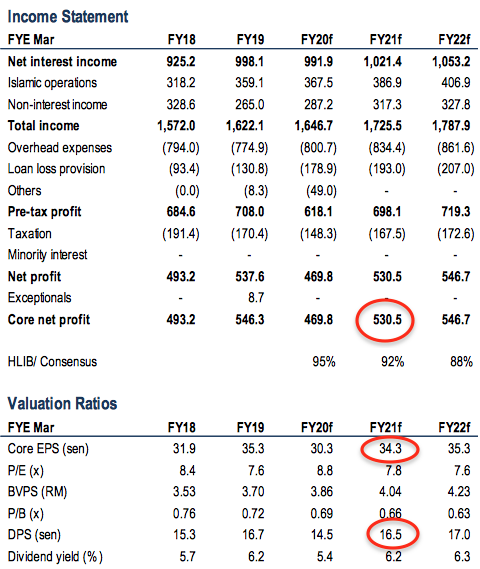

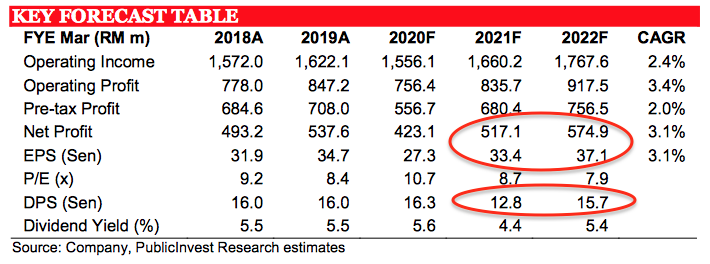

Analysts expect earnings to normalise going forward :

(Kenanga IB, 30 October 2019)

(Hong Leong IB, 9 October 2019)

(Public IB, 28 August 2019)

With estimated DPS of 16 sen, dividend yield at current price is approximately 5.6%.

Alliance Bank is owned and controlled by Singapore's Temasek. First class management, of course.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Discussions

Now no more saying people pump and dump? now say people accurate pulak? no say people accumulated a lot then share this post? where u learn ur manners...suddenly so polite. just curious no offence, I am glad that choivo finally learn some manners

2019-11-14 00:12

Jaks ?

price went up coz company no money forced to sell carparks

malaysians have car park fetish so pumped price up

2019-11-15 17:22

Hahahaha i3lurker,

When financial tsunami hit the shore many performance loans with become non-performance loans. One off provision will become many off provisions.

2019-12-06 18:49

Fabien "The Efficient Capital Allocater"

Icon, Alliance is impacted (loan loss provisions) due to their huge exposures to London Biscuits

2019-11-13 11:08