(Icon) Kobay Technology - Growing From Strength To Strength

Icon8888

Publish date: Thu, 05 Mar 2020, 02:47 PM

1. Introduction

Kobay is principally involved in manufacturing of precision components, tooling, automation equipment for aerospace, semiconductor and oil and gas industry.

It is based in Bayan Lepas, Penang. It also has a property project in Langkawi.

I first wrote about it in June 2018 when it was trading at RM1.05.

Today, it is trading at RM1.89, an 80% gain.

But its profit has grown by a lot as well. So the stock is still cheap and hence, potentially has further upside.

2. On A Winning Streak

Key observations :

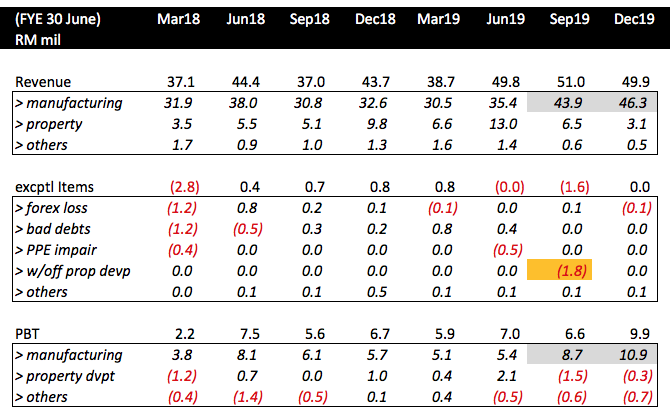

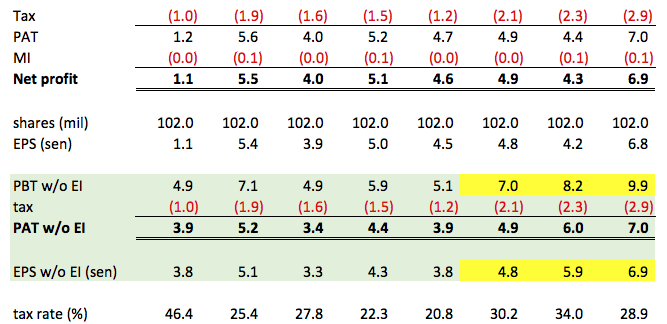

(a) In September 2019 quarter, property development division incurred a one off expense of RM1.8 mil pursuant to change of development plan (orange highlighted). That dragged down earning. Without that exceptional item, EPS in that quarter was approximately 5.9 sen.

(b) manufacturing division registered significant growth in second half of 2019. Revenue jumped by more than 30% from RM35 mil in June 2019 Q to RM46 mil in December 2019 Q. PBT grew by more than 100% from RM5.4 mil to RM10.9 mil during the same period (gray highlighted).

Due to the strong growth, the group registered EPS of 6.9 sen in latest quarter (yellow highlighted).

3. Concluding Remarks

In the December quarterly report, the company commented that in coming quarters, manufacturing division might face slow down in demand from semiconductor industry clients, but oil and gas backlog might cushion the decline.

Based on latest share price of RM1.89 and annualised EPS of 27 sen (being 6.9 sen x 4), prospective PER is approximately 7 times. This compares favorably with other industry players such as Dufu, UWC, MI, etc that are trading at PER of more than 25 times.

I stick my neck out to call for BUY.

Note : Together with Sam Engineering, this stock is in i-Capital portfolio.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

A few red flags for me.

1. Any business with a good core that decides to diversify into property development makes me worry. Soft property market plus huge receivables is a big headache.

2. The impairments and late payments +90 days delay is worrying especially when credit impaired.

3. There are a few deals with suppliers/contractors of director related family members.

4. Development companies building high end properties should have much higher profit margins. This is impacted by high construction costs, which lead back to the director family member related suppliers selling at high price to company. I have seen almost every trick in the book and know how companies with a property development arm can do many tricks to funnel cash out of company in a legal way. I'm not saying kobay is one of them, as their manufacturing am is doing fabulous, but the red flags give me some cause for concern.

But other than that, their valuation, cash position and business growth is a very consistent increasing line.

It's your call to make.

2020-03-05 21:39

lching

low volume is the main consideration for me.

2020-03-05 14:53