(Icon) YTL Power - Reaching Inflection Point ? Completion of Jordan IPP By Mid 2020 Should Boost Earning

Icon8888

Publish date: Mon, 25 Nov 2019, 11:10 AM

1. Introduction

Recently, I added YTL Power to my portfolio. The stock is trading at all time low of 69 sen. The last time it traded that low was during the 1998 Asian Financial Crisis.

Of course, a stock trading at all time low doesn't mean it is a good buy. We have to look at fundamentals, right ?

2. Historical and Prospective Earnings

Operation wise, the company has been facing a lot of headwind recently. Its Singapore power business is not doing well due to oversupply. Its 60% owned Yes 4G's 1BestariNet contract has just been discontinued by the government. In coming quarters, this division will pose a material drag to earning.

On the other hand, its Wessex Water is still extremely profitable (net profit of RM500 mil per annum, if I am not wrong). Its associate companies PT Jawa and Electranet Australia are doing well.

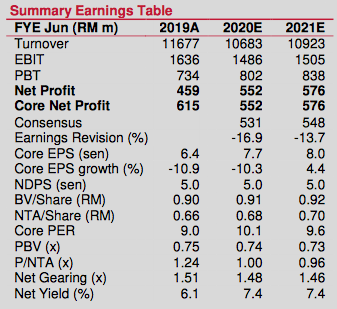

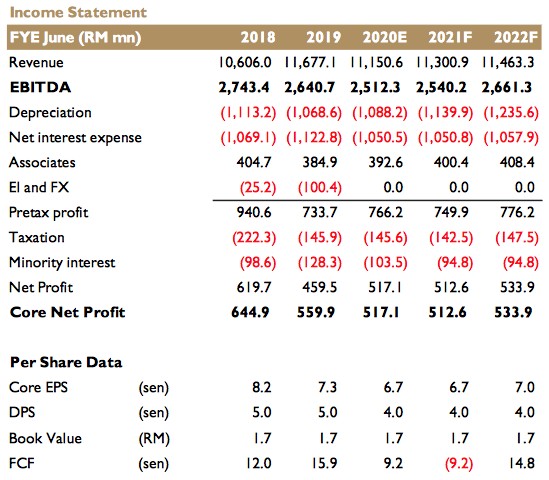

Due to the existence of so many different entities, it is difficult for me to make a credible predicton of the group's earning. So I rely on analysts' earning forecast :

(Kenanga IB, 7 November 2019. Expects prospective FY2020 EPS of 7.7 sen)

(TA, 15 OCtober 2019. Expects prospective FY2020 EPS of 6.7 sen)

(MIDF, 30 August 2019. Expect prospective FY2020 EPS of 6.7 sen)

On average, Analysts expect prospective EPS of 7 sen. Based on current price of 70 sen, prospective PER is 10 times. I leave it to you to decide whether this is cheap or expensive.

On average, Analysts forecast DPS of 4.5 sen. Based on current price of 70 sen, dividend yield is 6.4%. Yummy, nobody can dispute that.

3. Jordan IPP

YTL Power owns 45% equity interest in Attarat Power Company ("APCO") which is constructing a shale oil powered IPP in Jordan. The remaining 45% and 10% is owned by China's Guangdong Yudean Group and Estonia's Eesti Energia respectively. According to latest news, first unit is expected to commence operation by mid 2020 (7 months away). The second unit by end 2020.

AMMAN — An oil shale power station affiliated with the Attarat Power Company (APCO) is expected to be connected to the national electricity grid by May of next year at a capacity of 470MW, covering 15 per cent of Jordan’s electricity needs.

According to APCO experts, producing the aforementioned amount of electricity will require the combustion of 10 million tonnes of oil shale annually, the Jordan News Agency, Petra reported.

Project CEO Jason Pok said that this project is one of the largest oil shale endeavours in terms of funding, stating that it has received $2.2 billion from international, Chinese, Malaysian and Estonian companies.

The IPP has generation capacity of 470MW. Based on 45% equity interest, YTL Power's effective capacity is 212 MW. (For comparison purpose, Jaks and MFCB's effective capacity is 360 MW and 260 MW respectively).

According to this 2017 article, the 45% stake is expected to generate profit of USD47 mil upon full completion. Based on 4.1 exchange rate, it works out to be RM192 mil.

(Please note the article below is quite old, dated 2017)

YTL Power International Bhd has been a relatively lacklustre counter for investors. Between the sluggish take-off of its mobile broadband network, YES 4G, and the stark absence of new power projects, the group lacks a growth story compelling enough for investors.

The good news is that YTL Power expects to turn the corner, but it will take another three years to do so.

Last week, the company announced the successful financial close of its US$2.1 billion power venture in Jordan’s Attarat Power Company.

YTL Power will have a 45% stake in the 554mw (gross capacity) oil shale-fuelled mine mouth power plant project. China’s Guangdong Yudean Group Co Ltd will have 45% equity interest while Estonia’s Eesti Energia AS will hold the remaining 10% stake.

The financial close is a major milestone for the project, which has been in the works as far back as 2008. YTL Power only became involved in 2011. With the financing in place, construction is expected to begin later this year and conclude in late 2020.

So, how will Attarat fare?

A key selling point of the project is that it is entirely denominated in US dollars.

“Where else can you find a 30-year concession project that is in US dollars?” YTL Power executive director Yeoh Seok Hong points out.

“When we first began negotiating for this power plant, the exchange rate (ringgit versus US dollars) was only 3.10. Today, it is around 4.45,” he says.

On top of that, Yeoh guides that Attarat is expected to generate an internal rate of return (IRR) in the mid-teens. This does not include the IRR of the oil shale mining operation that accompanies the plant.

Assuming a modest 5% IRR for the mining operation, the entire project looks to be highly lucrative for YTL Power.

Based on a total IRR of 20%, a back-of-the-envelope calculation shows that YTL Power’s share of the earnings will be around US$47 million a year. This is based on the 25:75 equity-to-debt ratio for the project, which works out to be a US$236 million equity investment from YTL Power.

The project is also attractive from a risk perspective. After all, it is fully guaranteed by the Jordanian government.

“The financing is only for 15 years. This includes about four years for construction. That means this project will be able to pay off the debt in about 11 years. After that, everything will be free cash flow,” explains Yeoh.

4. Concluding Remarks

(a) At current all time low share price and after factoring in expected contribution from APCO, YTL Power is an attractive investment proposition for me. Earning wise, the APCO profit coming in next year will make it very defensive, despite the expected continued weakness of its Singaporean and Yes 4G divisions.

(b) The coming 12th December 2019 UK election will be a very important event to watch. Opposition leader Jeremy Corbyn is a radical leftist. He vows to nationalise utilities such as post and water, etc.

In my opinion, this particular risk is mitigated by the fact that UK has strong Rule of Law tradition. So in the event that Jeremy Corbyn becomes Prime Minister, it will have to overcome many obstacles to implement his Socialist policies.

First of all, he needs to get approval from Parliament (which he is expected to be a minority government, even if he managed to snatch power). And then there is the Judiciary, which is expected to have a say on pricing, etc. So, I don't really worry too much about this particular risk.

In addition, according to various polls, the Conservative Party (which traditionally is the ruling party) is leading Labour by a huge margin. So, the risk of Jeremy Corbyn becoming PM is really not that high.

(Jeremy Corbyn, YTL Power's nemesis)

(c) In view of the foregoing, I have decided to add YTL Power to my portfolio. The coming quarter result might not be pretty as 60% owned Yes 4G's performance is expected to be horrible. But due to the expected 2020 APCO catalyst, any weakness will be opportunity for me to buy more, provided 12 December UK election result is ok.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

to be honest, I never check woh (will be surprise if YTL spend so much money without take or pay)

but the article did mention "Guaranteed by Jordan government"

: P

2019-11-25 11:32

Dear Icon8888,

Mind sharing is oil shale mining a profitable business? What is the expected or measured reserved for this oil shale? Able to mine for 30 years?

2019-11-25 11:45

sslee you have to learn NOT to micro manage

get the big picture right, and let go of the smaller issues

otherwise you won't be able to move

it is called Paralysis by Analysis

2019-11-25 11:49

Hahahaha Icon8888,

USA now only build combine cycle NG power plant. Just curosity why USA never built oil shale power plant.

2019-11-25 11:56

Dear Icon8888,

Below link on the power plant.

https://en.wikipedia.org/wiki/Oil_shale_in_Jordan

https://en.wikipedia.org/wiki/Attarat_Power_Plant

2019-11-25 12:31

I bought YTLP also bcoz this reason but my entry price is before dividend date.

2019-11-25 13:09

Dear Ion8888, maybe you miss out Indonesia plant and its profit potential...

2019-11-27 18:40

I also bought this share when it was 75 sen, after ex dividend, the price never move and i continue to buy below 70 sen. I merely bought because of attractive div yields and believe price bottomed. And lots of my friends are losing money and on the principle of be greedy when others are fearful. Hope my bet is correct in next 1 year...

2019-11-27 18:52

Thank you Icon8888 for good write up. Possible to include Indonesia power project? It will make YTL Power even more attractive in mid turn....

2019-11-27 23:48

Yes can buy

Limited downside as Jordan‘s Attarat Power alone will contribute RM200 mil net profit next year

2019-12-13 11:01

YTL Power shares fell 4.1% to close at RM1.39 on Friday following the UK referendum.

Tht time 2016.

Now price only Rm0.69

https://www.thestar.com.my/business/business-news/2016/06/28/ytl-power-unable-to-quantify-how-much-brexit-will-impact-the-group

2019-12-13 11:26

Balun this stock. Bottom uncovered. worst case we sit here to kutip dividen.

2019-12-13 12:44

DK66

Is the concession based on "take or pay" basis ?

2019-11-25 11:29