(Icon) Sam Engineering - An Overlooked Semicon Play

Icon8888

Publish date: Tue, 22 Oct 2019, 10:35 AM

1. A Laggard ?

Many semiconductor stocks had been re-rated recently. In my opinion, Sam Engineering is one laggard that has been overlooked.

2. Historical Profitability

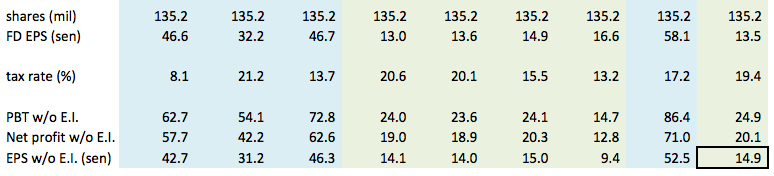

The following is Sam Engineering's recent few quarters' result :

Key observations :-

(a) Sam Engineering derived a significant amount of profit from semiconductor equipment manufacturing. In FY2019, out of segmental profit of RM97 mil, RM41 mil was attributable to semiconductor equipment manufacturing (42% of total profit). Aerospace division accounted for 58%.

(b) Same as many other companies, Sam's semiconductor equipment division did not perform well in March 2019 quarter. If not because of the gain on disposal of properties amounted to RM9.1 mil, segmental profit would be RM6 mil only, almost half of its normal profit of RM12 mil per quarter (please refer to thick line boxes).

(c) However, the worst should be over. In the June 2019 quarter, Sam reported strong core EPS of 14.9 sen. Its semiconductor equipment division's earning normalised to the usual RM10 mil range.

3. Strong Capex

The group has been spending heavily on capex in recent few years. This augurs well for future growth.

4. Concluding Remarks

Over the next few years, the aerospace division will be busy executing its massive RM3 bil contracts.

The semiconductor equipment division will benefit from the coming 5G super boom cycle.

At current price of RM8.00, the stock is trading at 13 times PER (based on 15 sen EPS annualised = 60 sen). Based on my exprience, as its EPS grows in the coming years, PE multiple will also expand as market gets excited about its prospects. I think Target Price of RM12.00 within two years is not impossible.

Buy at own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Look at this , 80% from Boeing order book belong to 737. what happen if 737 stop production?

737* 4,703

747 822

767 103

777 441

787 624

2019-10-22 14:27

Read this

https://www.sam-malaysia.com/wp-content/uploads/2019/09/SAMEE-25th-AGM-Presentation-Post-Discussion-As-at-21-August-2019-R.._.pdf

It said 737 max less than 10% revenue

2019-10-22 14:40

Boeing 737Max contributed <10% of SAMEE FY2019 Revenue

this was presented in 2019 presentation slides of SAM.

2019-10-22 14:43

Yes, it seem like conflict between their own wording.

How can 4703 Order book contributed less than 10% ?

2019-10-22 15:46

oh, if that is the case, then Sam is a good bet with recovery of semicon + aero CAGR 4% .

I'm in.

2019-10-22 17:19

I totally did not know they did semiconductor business. All this while when i visited their plant in penang I only thought they did fabrication of the hard disk drive pins and metal spring miniature steel fabs.

which part of semiconductors do they produce?

2019-10-23 19:27

If not mistaken, they only make machines for front end and back end semicon manufacturers

2019-10-29 08:18

LOL what do you mean ONLY ?

Front end and back end means cover everything already (they do make HDD components)

2019-10-29 12:31

"only" not necessary a bad thing. merely emphasize they are not making semicon end products. they "only" make the equipments which is a niche market but there are a few big players out there. from annual report 2018 onwards, can see SAM gaining momentum, widening scope with existing customer and winning new big customers.

2019-10-29 15:50

Op3rs

Sam have 2 legs, one leg is Aerospace and the other equipment (semiconductor & hdd)

Sales of aerospace parts will be further increased next year (2020) due to the followings

There will be an airshow site in December in dubai on november 17th-21st which in 2017, airbus recorded a total of 510 new air plane orders.

The need to start replacing older model airplanes, with the new fuel-efficiency airplanes throughout 2020-2030.

Increase in demand for hdds due to the adoption of 5g technology worldwide will boost its equipment segment's revenue.

With both legs running at high speed, god knows how fast it can go :)

2019-10-22 11:51