(Icon) Eco World International - Why I Am Adding More

Icon8888

Publish date: Mon, 16 Dec 2019, 11:08 AM

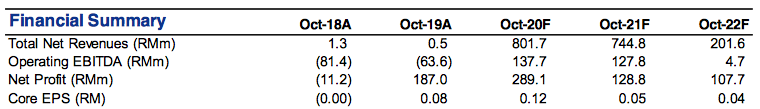

Lat week, there were two major developmets for Eco World International (Ewint). Firstly, the Tories won the UK election. Secondly, the company announced a very strong set of results. With market cap of RM2.4 bil and latest Q net profit of approximately RM110 mil, the group is trading at undemanding prospective PER of 5.5 times (based on annualised EPS).

However, share price has not moved much. Many investors took the opportunity to lock in profit and cash out instead. Even I myself have contemplated doing so (buy on rumours sell on facts). With 2.4 bil shares, the stock has market cap of RM2.4 bil. Everybody knows that its earning is based on the few property projects currently pending completion. It seems that at current price, the market has more or less factored in its earning potential. CIMB analyst, for example, forecasts that FY2020 earning will be extremely strong, but beyond that, EPS will drop to only 5 sen in FY2021. Hence the decision to downgrade to HOLD.

At first look, the analyst is correct as she is making her recommendation on the premise that earning will peak next year pursuant to completion of the projects in hand. A Good investor always acts one step ahead of others.

But if you think about it (Second Level Thinking), you will realise that her view is flawed. This is because Ewint is NOT a concession based company with finite lifespan. Instead, the recent resolution of UK political crisis through Conservative Party winning of majority is the beginning of a new boom cycle for Ewint. Upon reading this, many people will disagree with me (First Level Thinking again). They will argue that Brexit is far from being resolved, and there will be rocky roads ahead.

Well, if that is the case, they don't really understand the true risks posed by Brexit. Let me explain.

Many people have this impression that an unresolved Brexit will adversely affect Ewint's operation. Wrong.

It is true that Brexit will create certain uncertainties for businesses. But Brexit will have minimal impact on Ewint. If the UK exits Europe, Ewint is fine. If the UK does not exit, Ewint is also fine. If the UK fails to resolve Brexit and was stuck somewhere in the middle (like in past three years), Ewint will also be fine.

This is because the London housing market is facing severe supply shortage. Ewint has locked in substantial landbank over past two years (by capitalising on the Brexit panic). No matter what happens to Brexit in the next few years, Ewint's direction is clear : develope the landbank to tap the strong demand for housing in London. This can be done either through Built to Rent or though conventional property launches.

If that is the case, you may ask, then why did Ewint share price drop to as low as 60 sen in past few months ? Wasn't that proof that Brexit uncertainties can do a lot of harm ? And won't the same problem happen again in the future (knowing that Brexit is far from being resolved) ?

The all time low share price as described above was actually caused by two risk factors :

(a) the risk of No Deal Brexit; and

(b) the risk of Labour Party leader Jeremy Corbyn becoming Prime Minister.

Let us go though these two factors one by one.

No deal Brexit - In my opinion, it will never happen. The relationship between Europe and UK is very close. They are like a family, eventually things will be sorted out.

Jeremy Corbyn - This gentleman is dangerous because he is an unrepentant Communist. He threatened to impose high taxes on corporations, launch hundreds of thousands of affordable housing which will drastically cut down demand for residential products that developers such as Ewint relies on as bread and butter, and also force landlords to give tenants rights to buy over properties from them at discount, etc. With such hostile policies, who would dare to invest in UK properties ?

But fortunately, Jeremy Corbyn is out of the picture. He poses no more threat to Ewint and other developers as well as businesses in UK.

Concluding Remarks

Ewint is owned by two very strong shareholders : Tan Sri Liew Kee Sin and Tan Sri Quek Leng Chan. Ewint was listed in 2017 at RM1.20. It is very unlikely that the stock will have no further upside going forward. These two shareholders are famous for value creation. They do not commit their funds easily in business. For whatever they do, they will not rest until market cap has ballooned substantially to create wealth for them.

Of course, in business there is a limit to will power. You cannot get rich just because you have strong desire to do so. The market condition must be favorable. In Ewint's case, the market condition is INDEED favorable. There is plenty of room to grow further. Whoever that dismiss Ewint as fully valued just because FY2021 EPS is likely to experience a dip have not stretched their imagination far enough to factor in potential earning from future sales and projects.

If you are a speculator, you might want to cash out now. But if you are an investor, you should take the opportunity to buy more. The worst is over. The company is ready to go full throttle, targeting to grow its Built to Rent business multiple folds in coming years.

With a bit of patience, you will be amply rewarded.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Now its share price is too high. Wait for it to go down to a reasonable level to participate. This is to reduce the risk. Don't forget market is negative on property. So, no need to rush in to buy up.

2019-12-16 16:11

Cjcen on an interesting turnaround story.

When it first announced its planning to do fully auto-sorted courier-service, its share price hit Rm1.40 in 2016.

Now the said courier-service building already obtained CF and its auto-sorters started operation on October 2019, its share price hit Rm0.30 level due losses resulted from its start up cost.

Second level thinking (foresee what will take place in months to come) & control risk (buy at bottom). Virtually, risk free.

2019-12-16 16:18

Hahahaha,

Icon8888 second level thinking will trap him in EWINT for many years. Buy at the bottom but how to know it already bottom. I bought Bjland below its multiyear low of 19.5 cents hoping for MGO by TSVT also kena trap.

2019-12-16 20:07

To maintain winning streak in Bursa, it is a must to get “third-level thinking” deployed.

2019-12-16 20:12

Ass Ass Lee second level thinking think that Thong Kok Khee will actually declare dividend to him will trap him in INSAS for many years. Buy to enjoy dividend but how to know it will declare dividend or not.

2019-12-16 22:46

Buy more to get trap more? Already trapped in ABMB, YTL Power how to escape?

2019-12-17 07:22

Hi Connie555,

My first level thinking telling me Insas is a cheaper entry into Inari and I can enjoy the growth and dividend from Inari at cheaper cost to me.

My second level thinking telling me after Insas warrants and PA expired on 25th 2020 Insas can save 6m of PA interest payment and Insas price and dividend should start to move north.

My third level thinking telling me TSHS and Dato’ Wong will have better success if their take over Insas rather than Plus. https://www.theedgemarkets.com/article/newsbreak-halim-saad-ups-his-bid-plus-30

Thank you

2019-12-17 07:52

So called Multiple-level thinking is a pure guess formation aka speculation that you destroy you.

2019-12-17 07:58

Dear all,

The third level thinking will tell you after Brexit, services and manufacturing goods going to EU from UK will need to pay export tax to EU. Then Banks and manufacturers that depend on EU market will need to move base to EU. UK will lost its status as Europe Financial center and EU citizen who work in London will move back to EU, then what will happen to property market.

Thank you

2019-12-17 08:07

Dear abang_misai

Totally agree with you. And Benjamin Graham quote: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

So we only need first level thinking; this quarter earnings is better than last quarter and next quarter earnings will be better than this quarter to write 20 articles about it and earn RM 58 million within 9 months like Mr. Koon.

Please leave the second level thinking to 3iii and Philip; the market price will continues go north when companies can make stable, predictable and consistence revenue and earnings growth with PE from 25 to 50 to 100 and 150.

Also please don’t compete with calvintaneng with third level thinking of imagination and story-telling. He had contributed thousand articles to i3 and made so many chun-chun call.

For us if you want to make fast money please use your fist level thinking and your chart for stocks on "price and volume breakout"

Thank you

2019-12-17 09:05

This is good company but I think it is worth and less risk to get ECOWLD as it just break out and rise from the ground floor.....

2019-12-17 10:33

Actually SSlee also working hard on second level thinking with his MGO hopes for insas and bjland.

If you trap because of speculative activities, then it is not investing. Investing is about the business position first and foremost, MGO and goreng assumptions a far away third option.

Try to stay away from things like that and also calvin tan specialty: (ASS)ets. Just because you have a big castle doesn't mean bad management can't gamble it away...

Stick to profitable business first and foremost.

>>>>>>

Sslee Hahahaha,

Icon8888 second level thinking will trap him in EWINT for many years. Buy at the bottom but how to know it already bottom. I bought Bjland below its multiyear low of 19.5 cents hoping for MGO by TSVT also kena trap.

16/12/2019 8:07 PM

2019-12-17 12:48

Ass Ass Lee your Zero level thinking Bjland zero operating profit my Ewint a lot of operating profit

That is the difference

Don’t compare a retard with a PHD

2019-12-17 15:55

Hahahaha Icon8888,

Bjland is for betting/trading nothing to compare about. So please hold tight tight EWINT and must have conviction like philip to buy more during Pchem and Gkent discount day and hold for long term and no cut win please.

2019-12-17 17:54

HAHAHAHAHAHHAHA OMG CANT STOP LAUGHING THAT ICON ACTUALLY CALL ASS ASS LEE ASS ASS LEE.....anyway no offence Sslee, u still hv my respect unlike 2 the academian cum lecturer...

2019-12-17 18:40

Ipo rm1. 20? Wow, still negative return if don't think abt div? Ewint got div ah?

2019-12-17 18:58

Hi Connie555

Thank you for the respect.

Intelligent people compare idea.

Stupid people compare qualification: Primary school, SRP, SPM, “A” level, Diploma, Degree, Master, PHD.

Small people compare title: Dato’, Dato’ Sri, Tan Sri, Tun

And Rich people compare length of sausage.

To each his own.

Thank you

2019-12-17 20:05

And you have two Ass, Ass Ass Lee, so do you compare the two Ass?

And with the comparison, which catergory you fall into? intelligent,stupid,small or Rich?

2019-12-17 20:30

i mean choivo n ROCky Balboa (he no longer name ricky after he proposed his ROC idea for Nobel award, yet he fail but nvm we honor him with this name ROCky)

2019-12-17 20:32

Hahahaha Connie555,

We all have the capacity to be intelligent and rich or be stupid and small as long as we prepare to work hard and life long learning or be arrogant and think we already earned the PHD by reading some books.

2019-12-17 20:47

Hahahaha Icon8888,

We are not discussion Bjland in this article (Agreed Bjland is crap worth only half sen bet). Aren’t the discussions is about Brexit and your second level thinking “In Ewint's case, the market condition is INDEED favorable. There is plenty of room to grow further. Whoever that dismiss Ewint as fully valued just because FY2021 EPS is likely to experience a dip have not stretched their imagination far enough to factor in potential earning from future sales and projects”

Let’s start with Brexit consequences for the U.K

https://www.thebalance.com/brexit-consequences-4062999

1. The U.K. would no longer enjoy tariff-free trading with the EU, depending on the new trade agreement. Tariffs will raise prices of U.K. imports and costs of exports.

2. Brexit has already depressed growth in The City, the U.K.'s financial center. Growth was only 1.4% in 2018, and was close to zero in 2019. Brexit has diminished business investment by 11%. International companies would no longer use London as an English-speaking entry into the EU economy

3. Real estate: Lower economic growth could depress real estate prices.

4. Divorce bill: The U.K. would pay billions in euros for its “divorce bill.

5. Restricted labor movement: Constraints on immigration would hurt Britain’s labor force

6. Scotland voted against Brexit. The Scottish government believes that staying in the EU is the best for Scotland and the U.K. It has been pushing the U.K. government to allow for a second referendum

As of your so called second level thinking perhaps you can answer Philip’s second level thinking questions rather than questioning people have not stretched their imagination far enough to factor in potential earning from future sales and projects.

1. The main profit center for ewint is UK, where they are selling at 500-800 GBP per sqft. Now, how profitable is that versus acquisition costs and future expansions?

2. How much is the financial debt required to ride out a development phase, hoping to hit the sweet spot in home shortage and bring in the dough to pay out all the debt, all the while avoiding the danger of overexpansion and financial disaster?

3. How consistently can they mint money, and how long do we "invest" in the company before an eventual downturn, over commitment phase that seems to plague almost all developer companies?

Thank you

P/S: Please hold till FY2021, when EPS experience a dip to see whether people will talk about first level thinking or your so called second level thinking? Or run with their arms, legs or Ass? And since when stretching your imagination far enough is considered as second level thinking?

2019-12-18 07:36

This Ass Ass Lick talking until cow vome home but never earn any penny

2019-12-18 11:35

Ass Ass Lee now prepare question like hw he question BOD during agm oledi...asking for dividend....Icon better answer him like how Hengyuan director or Thong kok khee answer him......

*mic check, mic check*

Please ask slowly Mr.Ass , as the secretary need to note down the agm minute

2019-12-18 12:01

Hahahaha,

Icon8888 second level thinking will trap him in EWINT for many years. Buy at the bottom but how to know it already bottom. I bought Bjland below its multiyear low of 19.5 cents hoping for MGO by TSVT also kena trap.

.......

take private 15c.....

2019-12-18 12:04

What is the motive for the Author to tell all and sundry he is buying more?

2019-12-18 14:37

Dear all,

https://www.freemalaysiatoday.com/category/nation/2019/12/20/bailout-fears-unsettle-khazanah-amid-merger-plan-to-create-giant-property-firm/

Now you know who to blame in making house unaffordable.

Did anyone know in UK most shops closed after 5 and on Sunday? UK only entertainment is football and drinking in Pub and generally people hate big houses because of cooling and heating cost during summer and winter.

Thank you.

2019-12-20 11:55

Dear Icon8888,

May the Year of the Metal Rat bring you Good Luck, Good Health, Good Fortune, Plentiful of Laughter, Happiness, Success and at Peace with Oneself and Others. Happy Chinese New Year 2020

Thank you

P/S: https://klse.i3investor.com/blogs/Sslee_blog/2020-01-22-story-h1482896892-Let_s_celebrate_the_coming_CNY_2020_together_with_well_wishing_of_Unity.jsp

2020-01-22 21:05

until now, all good about EWINT become useless now

UK virus is widely spread

latest quarter result after the good result, is worse and bad

2020-04-18 15:20

sslee

Population reduction is only one of the issues

actually before Brexit, many multi-nationals already warned that they will shift Corporate HQ over to Europe. It has happened already

Panasonic (Moved its European headquarters from the UK to Amsterdam)

P&O (Shifted the registration of its UK vessels to Cyprus)

Sony (Moving European headquarters from the UK to the Netherlands)

AXA (Moved UK staff to Republic due to Brexit)

UBS (Moved €32 billion)

EBA (The European Banking Authority (EBA) closed its Canary Wharf office and will re-open in Paris, France)

Schaeffler (Closed two UK plants because of Brexit)

Flybmi (Went bust, cancelling all flights with immediate effect and blamed Brexit as the main cause of its collapse)

EMA (The European Medicines Agency has closed its doors in the UK with the loss of 900 jobs ahead of Brexit)

MoneyGram (Will move its European headquarters out of London to Brussels)

Nissan (Nissan has reversed plans to invest in new manufacturing capacity in the U.K., citing ‘continuing uncertainty’ around Brexit)

Toyota (Toyota has said that it could end U.K. production as early as 2023 if the country leaves the European Union without a deal)

Body Shop (Body Shop will be making staff redundant in the UK as they move some of their operations to Europe, ahead of Brexit)

Michelin (Michelin announced plans to close its factory in Dundee in 2020, nearly 50 years after it opened and where 845 people are employed)

Read more: https://metro.co.uk/2019/09/23/companies-collapsed-moved-abroad-since-brexit-10795029/?ito=cbshare

Twitter: https://twitter.com/MetroUK | Facebook: https://www.facebook.com/MetroUK/

2020-04-18 15:36

"..But if you are an investor, you should take the opportunity to buy more. The worst is over. The company is ready to go full throttle, targeting to grow its Built to Rent business multiple folds in coming years."

its not the internal factors tht matters now, its the unknown external factors, the last guy who proclaim "worst is over', was smart enough to cabut, to the green mountains, to fight again another day...

2020-04-18 16:01

Birmingham residents are spreading out to other areas

Possibly future premium reduction when UK benchmarks with Bangladesh, Afghanistan and Pakistan

2020-04-18 16:07

Philip ( buy what you understand)

The worst is over. The company is ready to go full throttle, targeting to grow its Built to Rent business multiple folds in coming years....

Famous last words.

2020-05-06 08:50

Posted by Philip ( buy what you understand) > May 6, 2020 8:50 AM | Report Abuse

Famous last words.

======

that means die already.....

2020-05-08 11:27

.png)

mmk79

I still holding tight tight, not even 1 share dispose.

2019-12-16 12:00