(Icon) Crest Builder (2) - 2017 Will Be An Interesting Year

Icon8888

Publish date: Thu, 11 Aug 2016, 12:06 AM

1. Introduction

I first wrote about Crest Builder in May 2014.

http://klse.i3investor.com/blogs/icon8888/50292.jsp

The stock recently caught my attention again because it secured RM438 mil new contract from Sime Darby. I did a quick study of the Group and found a few interesting points. There is a possibility that the stock could be re-rated in 2016 and take off in a big way in 2017. Please read on.

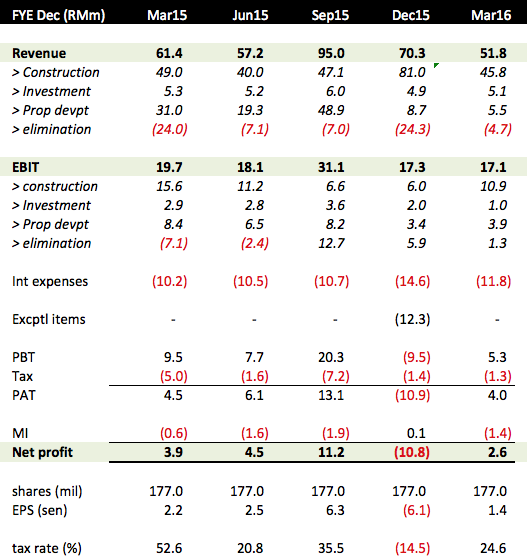

2. Background Financials

Crest Builder is principally involved in construction and property development. It also holds 51% equity interest in a 23 year government concession (ending 2034) to construct and maintain Universiti Teknologi Mara in Tapah, Perak.

Based on 177 mil shares and latest closing price of 92 sen, Crest Builder has market cap of RM163 mil.

In my opinion, the group is quite well run, as evidenced by its uninterrupted profitability since at least 2003.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-12-31 | 283,944 | 10,411 | 6.20 | 16.46 | 4.00 | 3.92 | 2.3000 |

| 2014-12-31 | 207,392 | 20,756 | 12.80 | 10.55 | 3.75 | 2.78 | 2.3500 |

| 2013-12-31 | 223,404 | 48,767 | 32.60 | 4.79 | 3.75 | 2.40 | 2.2900 |

| 2012-12-31 | 485,067 | 21,585 | 16.60 | 5.25 | 5.00 | 5.75 | 2.1800 |

| 2011-12-31 | 499,849 | 30,423 | 24.60 | 2.04 | 5.00 | 10.00 | 2.1600 |

| 2010-12-31 | 460,079 | 13,939 | 11.30 | 4.70 | 4.00 | 7.55 | 1.9400 |

| 2009-12-31 | 329,564 | 10,987 | 8.90 | 6.75 | 3.00 | 5.00 | 1.8600 |

| 2008-12-31 | 270,275 | 12,343 | 10.00 | 3.30 | 3.00 | 9.09 | 1.7900 |

| 2007-12-31 | 365,766 | 40,193 | 32.50 | 3.02 | 7.00 | 7.14 | 1.7500 |

| 2006-12-31 | 318,266 | 20,034 | 16.40 | 4.76 | 5.00 | 6.41 | 1.4600 |

| 2005-12-31 | 253,006 | 11,740 | 10.30 | 6.02 | 4.00 | 6.45 | 1.3400 |

| 2004-12-31 | 266,291 | 16,264 | 14.30 | 4.62 | 4.00 | 6.06 | 1.2800 |

| 2003-12-31 | 205,316 | 17,472 | 18.60 | 5.76 | 4.00 | 3.74 | 0.5141 |

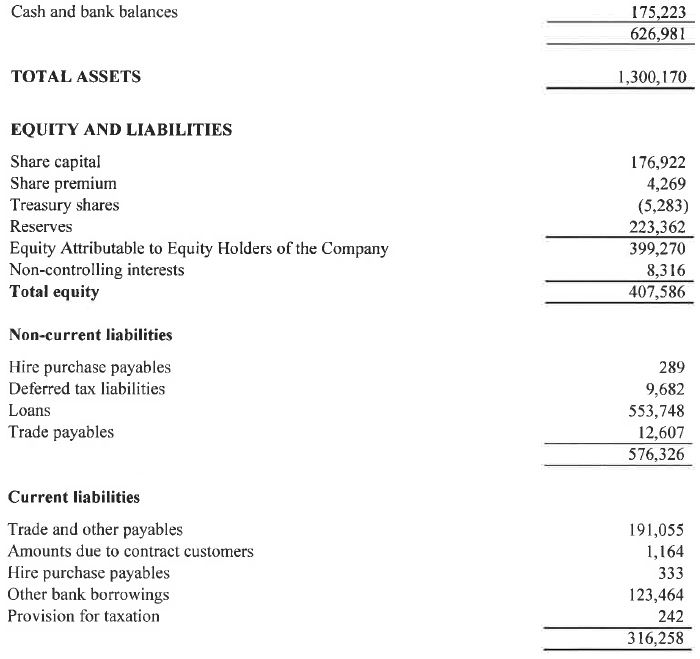

As at 31 March 2016, the group has net assets of RM399 mil and loans of RM677 mil. The actual gearing is not as alarming as it looked. Closed to RM500 mil of the borrowings are related to the Universiti Teknologi Mara concession. Actual borrowing is approximately RM177 mil, which translates into gearing of 0.44 times (I have been conservative by ignoring its cash holding of RM175 mil).

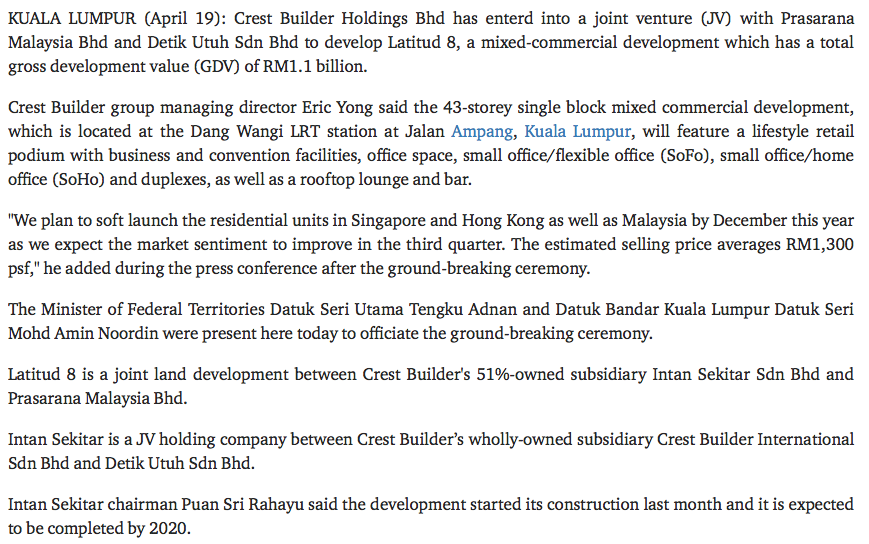

3. King Of TODs

TOD stands for "Transit Oriented Development". In Malaysia, it is a term used to describe property projects located within the compound of LRT stations. Prasarana, being the owner of the LRT station land, enters into joint venture with developers to construct commercial and/or residential properties on the site. In return, Prasarana will get certain percentage of the Gross Development Value by cash or payment in kind (property units).

Around 2012, Prasarana awarded several TODs to developers. Crest Builder managed to secure two : one at Dang Wangi LRT Station and the other one at Kelana Jaya LRT Station.

(Dang Wangi LRT Station, Jalan Ampang, KL)

(Kelana Jaya LRT Station, PJ)

However, the projects had been very slow to get off the ground. Prasarana needs to go through various government departments to secure the requisite approvals.

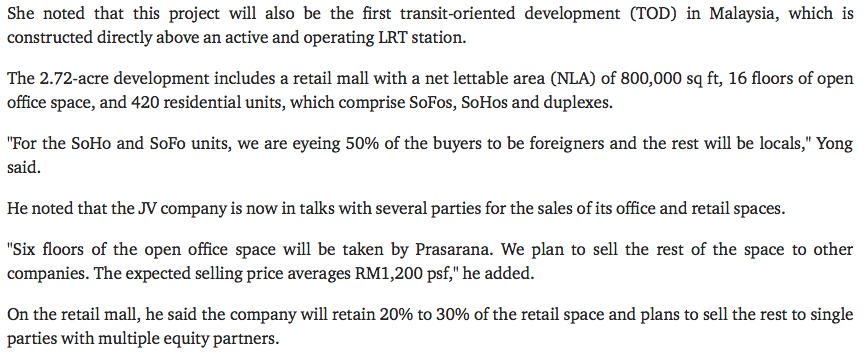

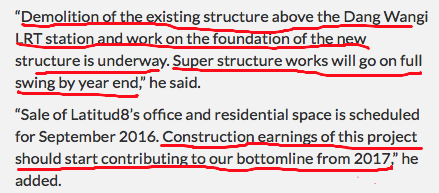

Finally, on 19 April 2016, Crest Builder and its partner Detik Utuh Sdn Bhd entered into formal agreement with Parasarana to finalise the Dang Wangi project (the Kelana Jaya JV yet to be finalised).

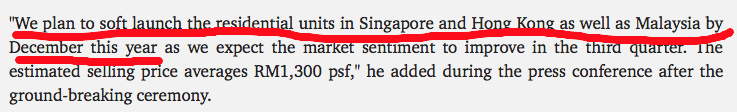

As mentioned in article above, they target to launch the residential units in Malaysia, Singapore and Hong Kong by December 2016.

THAT, actually is not sufficient to get me excited. If they launch the units by end 2016, it will easily take another one to two years before they can start booking in profit (progress billing). It is too early to buy this stock if you are aiming for development profit.

However, the article above also mentioned that they "have started construction last month". The story has now become much more interesting.

![]()

Crest Builder has a property development division. All this while, the construction works are all done in house (as disclosed in their financial statements). It turns out that it will also be the contractor for the Dang Wangi project.

(Source : New Straits Time 30 May 2016)

According to the Company, construction profit will start contributing to bottomline in 2017.

THIS IS POSITIVE POINT #1.

(Please note that the Dang Wangi project is not wholly-owned by Crest Builder. As such, the construction profit is real, not something to be eliminated upon consolidation).

4. Potential Disposal of Investment Property

After finalising the JV agreement in April 2016, the next step is to sort out financing for the construction works.

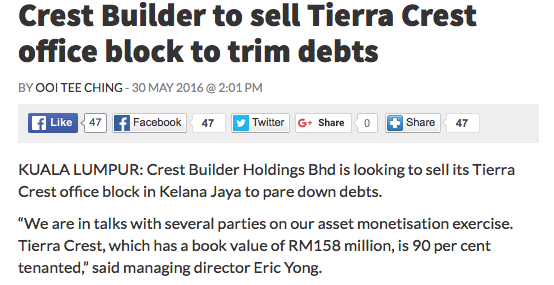

Crest Builder is currently in talks with investors to come in as equity partners for the Dang Wangi project. On top of that, it is also in discussions with potential buyers to dispose of its investment property Tierra Crest.

(Tierra Crest is located in Kelana Jaya. In 2012, Crest Builder secured a nine year tenancy agreement with Unitar International University)

(Source : New Straits Time)

I strongly believe that Crest Builder will dispose of the property as mentioned above. The group is currently in growth mode. It doesn't make sense to hold on to investment property for small amount of recurrent income. Apart from the Dang Wangi project, the group will be launching Galleria @ Jalan Ampang in 2017. It is a JV project with (again) Detih Utuh Sdn Bhd and Lembaga Getah Malaysia (more details below).

The disposal, if materialised (very likely over next few months), will trigger a re-rating.

THIS IS POSITIVE POINT #2.

5. Healthy Order Book

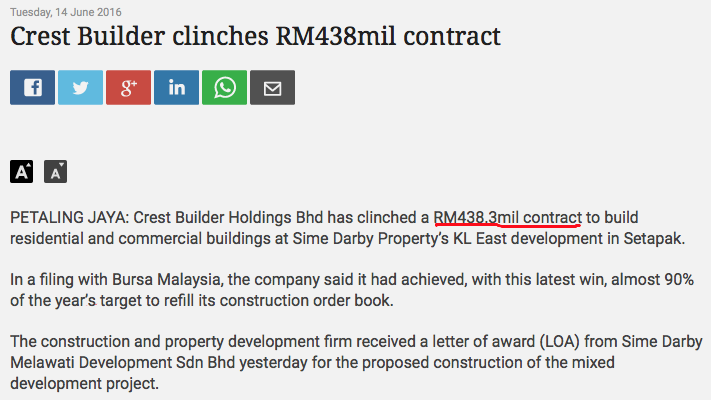

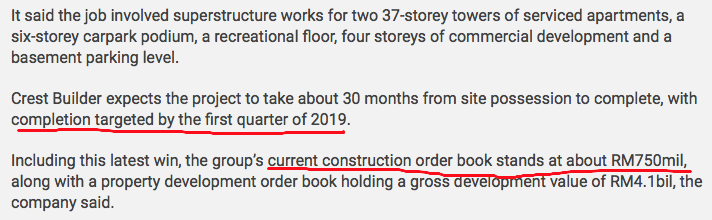

On 14 June 2016, Crest Builder announced that it has secured RM438 mil construction contract from Sime Darby. This boosted its order book to RM750 mil.

The size of the order book might not be big if compared to other major players. However, in FY2015, Crest Builder's construction revenue was only RM106 mil. As such, RM750 mil should be sufficient to last them at least two to three years (the group is currently tendering for RM4.5 billion contracts).

THIS IS POSITIVE POINT #3.

6. JV With Lembaga Getah Malaysia

(Galleria @ Jalan Ampang, to be launched in 2017 and has GDV of RM1.3 billion. The land is owned by Lembaga Getah Malaysia and is located opposite Great Eastern Mall at Jalan Ampang, near MRT station)

On 28 June 2012, Crest announced that its 51% subsidiary has entered into JV agreement with Lembaga Getah Malaysia to develop 5 acres of land at Jalan Ampang, opposite Great Eastern Mall and next to Gleneagles Hospital.

The proposed development will comprise three 28 storey Apartments and SOHO Towers, a 33 storey Corporate Tower and a 6 storey retail mall (note : details subject to changes).

GDV is estimated to be RM1.3 billion. LGM will be entitled to RM300 mil (22.5%), in cash and completed property.

Based on latest update, the Galleria is scheduled for launch sometime in 2017.

7. Other Development Projects

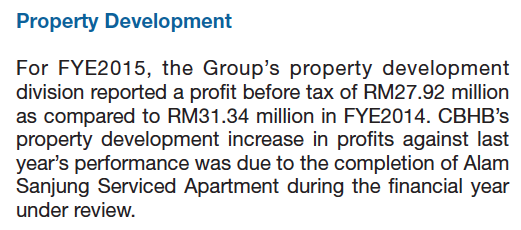

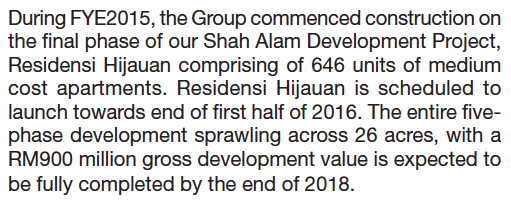

(Source : FY2015 annual report)

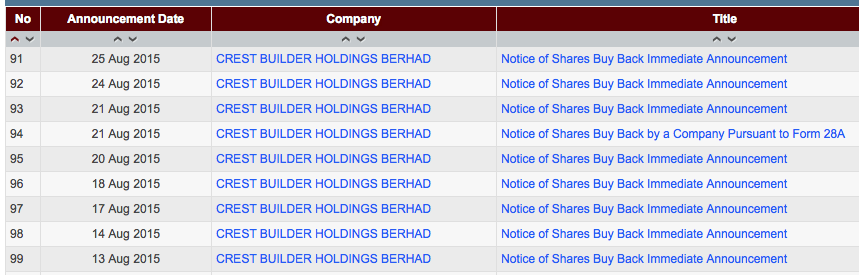

8. Shares Buy Back

Since August 2015, the company has been consistently buying back shares (6 mil shares so far).

This active support by the company gives me a lot of comfort, and is one of the main reasons I bought into the stock. I believe downside is limited, while there is potential upside as early as 2016 / 2017.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Hi Mr Icon, you have very wide range of stock selection, which one are you focusing now after Airasia?

2016-08-11 00:37

I am positioning myself big time in CIMB.

To make it more sexy, I match mother shares with C12 at 1 to 10 ratio.

For example : if I buy 10,000 mother shares, I will buy 100,000 Warrants C12

By doing that, I hope to generate high return for a bulky share like CIMB

2016-08-11 00:41

If C12 below water upon expiry in Mrach 2017 (very unlikely). I will inject cash to buy additional mother shares (at lower price) on 1 for 10 basis to extend the life of my C12 investment so as to make it a long term bet

2016-08-11 00:43

Thanks for the explanation & sharing, Mr Icon, it is still very long way to learn from you, hard to catch up leh (´ー`)

2016-08-11 00:56

KL East is located at "hill" and the construction is targeted to complete in 30 months, not bad! Nowadays in Klang Valley, the high rise project drag into 4 years completion, like recent Sunway Mont Kiara project.

Met one of the engineer of Crest Builder in the Latitude AGM one or two years ago, he mentioned the company performed so so.......however Icon pointed out now, die die have to find money to buy!

2016-08-11 07:03

Icon8888, another great piece of work put up - tq.

Kind of agree with moneySIFU that you are into a wide range of stock selections.

But the call warrant is a big "no" to me because of past experience. Good luck.

2016-08-11 07:32

Big thanks to sifu icon888 sharing ,will put in my watch list.i remember cold eye own this share before.

sifu , yours pocket is so deep , unlimited bullet ? printing money also can't chase u ... (^o^)

Anyway, do u still use margin ? what is the cash/margin ratio ?

2016-08-11 08:24

Sorry but no offense. My remarks are totally in the opposite way due to:

1) extremely high debts. too much uncertainty and risk to assume that most of the debts are backed by govrnment payment and is self liquidating.

2) from 2011-2015, revenue and net profit has been going south. Even though 2015 revenue is higher than 2014, net profit is still going down. Reason: company is not good at controlling their cost and too much impairment loss especially at Q4 of each year...

Guys, if someone bought this share in 2014 at around RM1.50... and has been "locked" for more than 2 years... you probably can understand now why this post is out in 2016... haha...

2016-08-11 16:21

If you had bought Bumi Armada at 4.80... What price is it today ????? If you had bought SKpetro at its high, what is the pre sent price??? If you have bought into Gtronic in the beginning of this year what is your present lost ????

2016-08-11 19:32

Bravo to the contributor of the above post and write up on Cresbld.... Fantastic extensive and reliable research ..... Cheers !!!!

2016-08-11 19:36

Are you referring to me ? If yes, then I am disappointed.

iloveshare128

Guys, if someone bought this share in 2014 at around RM1.50... and has been "locked" for more than 2 years... you probably can understand now why this post is out in 2016... haha...

2016-08-11 19:57

Why didn't you say , if you have bought Cresbulder a few months back when it was trading at 84 and 0.845 sen ??? Coupled with the 4 sen divident paid last month ?????

2016-08-12 07:38

no offense... i am just thinking that if the cost management of a company is poor, even if they won more contracts (more revenue), the bottom line (net profit) may still be poor. This is very likely the case for Crest Builder... Look at 2015 revenue, it was higher than 2014's but the net profit was way lower (only half of it)... I would rather opt for Gadang or HSL which have much better profit margins (much better in controlling/managing their cost). After all, order book at 750millions is not attractive enough due to the following reasons:

1) how much of the 750 millions order book are still outstanding and un-billed?

2) even if all 750 millions are not yet to be recognized, this revenue will be spread over 3-4 years so it is about 200-300millions of revenue per year (more or less same revenue as what Crest Builder has over the last 2 years).. and cost control is their main problem + high debt (with high uncertainties)... just my 2 cents...

2016-08-12 09:46

I am not saying your comments about Crest are wrong, Different people look at things differently.

I am referring to this

================

iloveshare128

Guys, if someone bought this share in 2014 at around RM1.50... and has been "locked" for more than 2 years... you probably can understand now why this post is out in 2016... haha...

2016-08-12 10:03

I bought a few months ago @ 84.5 sen and received dividend of 4 sen recently.

2016-08-12 14:36

Hi Icon8888, regarding the JV Project with Lembaga Getah Malaysia at Jalan Ampang, is that project similar with the JV Project between Lembaga Getah and Global Oreintal Berhad (GOB)?

Because I remember that GOB has the same JV project announced before, but no update since that.

2016-09-03 22:18

SuperMan 99

Hi Icon, another great job again!

Not need to go elsewhere to check or verify, everything in one place, well done!

2016-08-11 00:34